As a business owner, you're used to making big decisions. Securing funding is one of the biggest, and when a personal guarantee is on the table, the stakes feel even higher. It mixes the excitement of growth with the responsibility of putting your personal finances on the line.

At a glance

- A personal guarantee gives lenders the assurance they need to approve funding, but also puts your own assets and credit record at risk if the business cannot repay.

- To balance an opportunity against your personal risk, only borrow within your capacity, stress-test repayments against slower periods, and keep a cash buffer to manage your exposure.

- If a guarantee does not feel right, you may still qualify on business strength alone, or explore other funding structures like a business line of credit.

Understanding how guarantees work is the first step to protecting yourself and choosing the right path forward.

What is a personal guarantee on a business loan?

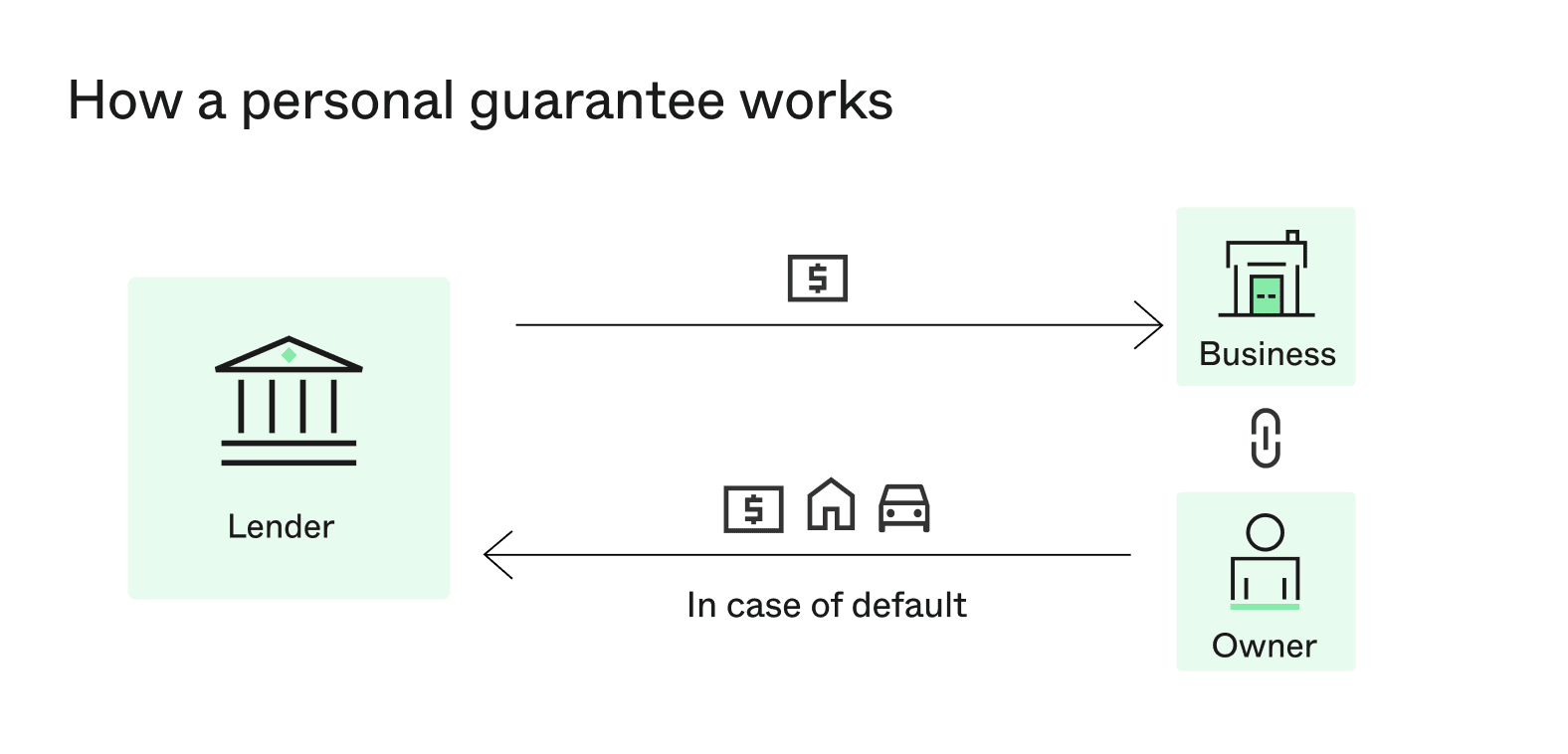

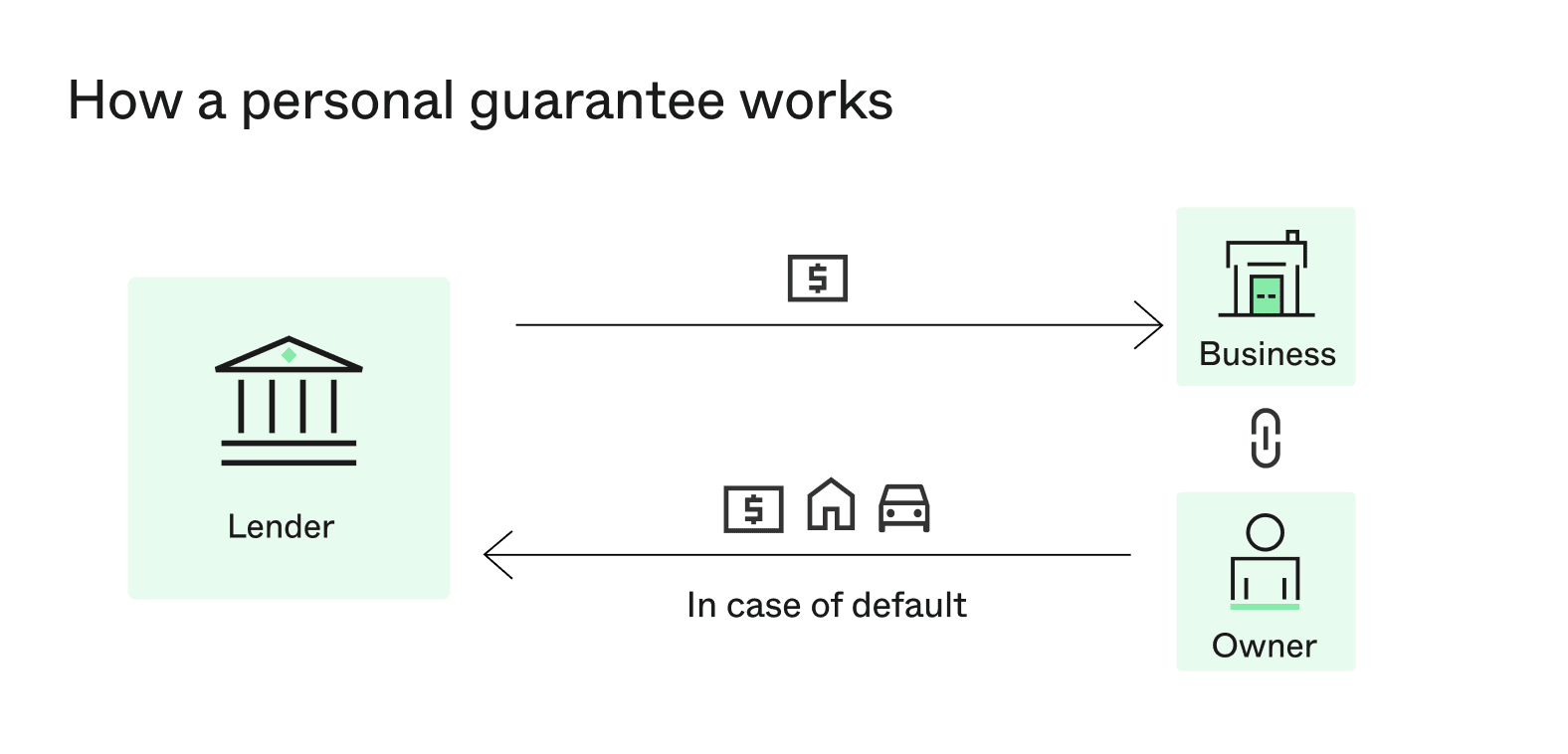

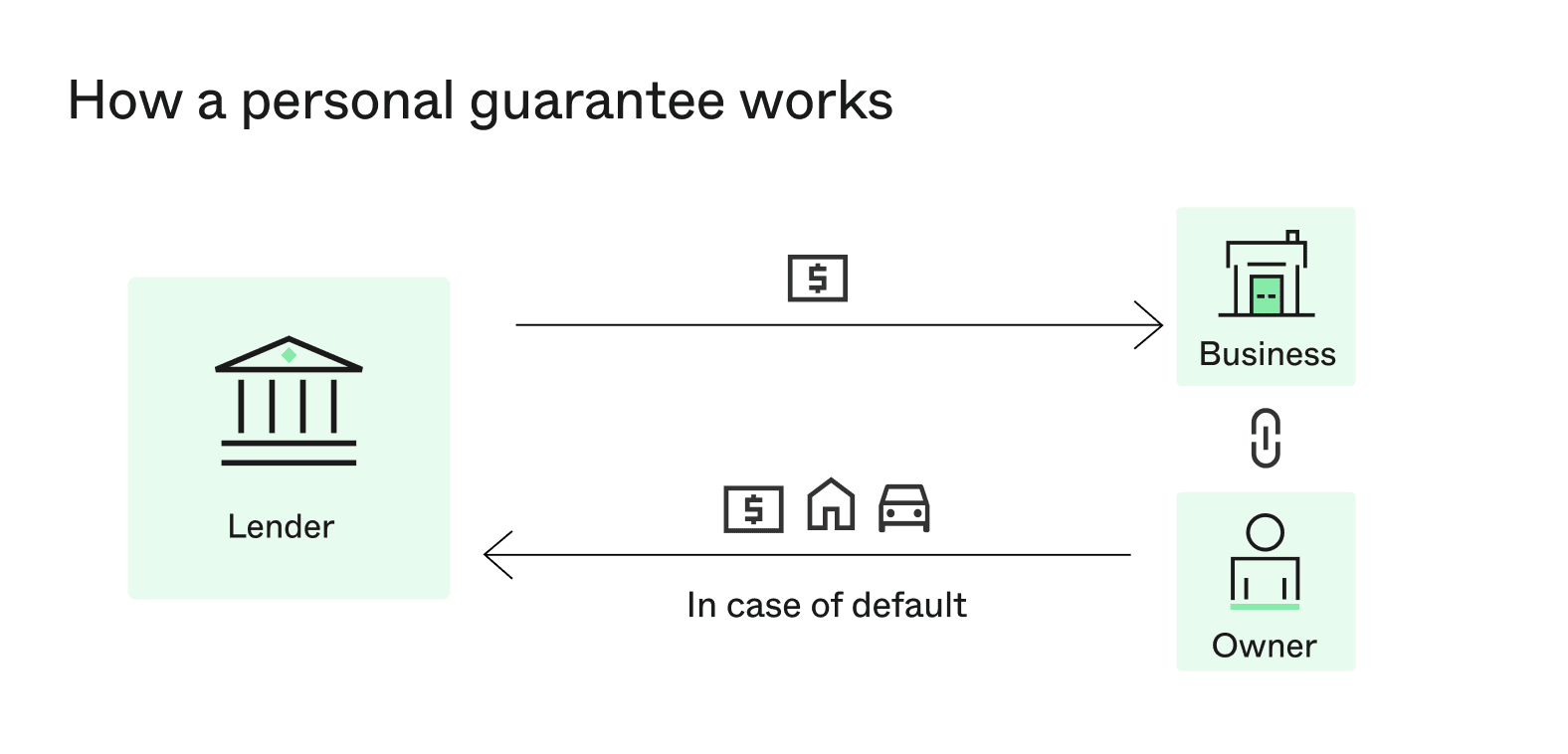

A personal guarantee makes an individual legally responsible for repaying a loan if the business cannot. In Australia, this usually takes the form of a director’s guarantee, rather than involving a family member or friend as a third-party guarantor.

In most cases it is unsecured, meaning no specific asset is listed as security. However, the agreement is still enforceable, so your personal assets and credit record may be at risk if repayments are missed.

Lenders often require a guarantee to show that you are committed to the business and confident in its ability to repay. It also helps them approve loans for businesses that may not have significant assets available as security.

For example, imagine you own a boutique fitness studio and apply for a $40,000 loan to refurbish your space and add new equipment. The lender approves the loan without asking for asset security, but requires you, as the director, to sign a personal guarantee.

If your business continues to meet repayments, nothing changes. However, if the studio falls behind and cannot repay, the lender can recover funds from you personally.

What are the risks of a personal guarantee?

Agreeing to a personal guarantee means putting your own finances on the line if your business cannot repay the loan. Even without a specific asset being secured, the lender can still pursue your property, vehicles, or savings to recover what is owed.

That responsibility can also add strain to your household budget. Covering both personal and business costs becomes harder if revenue dips or an unexpected bill lands.

There is also the potential impact on your credit history to consider. Missed payments on a guaranteed loan may be recorded against both you personally as well as the business, which could impact accessing finance in the future.

In the case of your fitness studio falling behind on repayments, the lender could ask you to cover the balance from personal income or savings. If that isn’t possible, they might take legal action, putting your home, car, or other assets at risk while also damaging your credit history.

What are the benefits of a personal guarantee on a loan?

While a personal guarantee introduces risk, it can also be the factor that gets your loan over the line. A guarantee gives lenders the necessary assurance to approve funding when securing assets is not an option or desired. This is common practice in Australia, where unsecured lending often relies on a director’s guarantee rather than property or equipment security.

By demonstrating your commitment to the business, you can help speed up loan approval and even access sharper pricing or flexible terms. For more on how rates and fees work, see our guide to the cost of borrowing.

How to decide if a personal guarantee is right for your business

Deciding whether to sign a personal guarantee comes down to weighing risk against opportunity. The loan may give your business the capital to grow, but it also ties your personal finances to the outcome.

Before you commit, use this checklist to be sure:

Your personal guarantee checklist

- Will this loan support long-term goals, or is it just filling a short-term gap?

- Is there a clear purpose for the loan?

- Am I confident it will deliver the expected return?

- Is the timing right for this commitment, or would waiting strengthen my position?

- Can my business comfortably manage the repayments, even if revenue dips for a few months?

- Do I have a cash buffer or contingency plan if the unexpected happens?

- Which of my assets could be exposed if things go wrong?

If you’re feeling confident after working through these questions, the next section on managing your exposure is for you. If you still have doubts, we’ll cover other funding options further on in the article.

How to manage your PG exposure

If you decide to proceed with a personal guarantee, there are steps you can take to keep the risk manageable:

- Borrow within your capacity and stress-test repayments against slower periods or reduced revenue.

- Keep a cash buffer so you don’t need to resort to multiple loans simultaneously.

- Ask your lender whether the guarantee can be capped or reviewed after a set period of on-time repayments.

- Stay up to date with BAS, tax obligations, and insurance, as lapses can quickly create further financial strain.

- Seek legal or accounting advice if you want added clarity before signing.

Getting a loan without a personal guarantee

If you’ve decided a personal guarantee isn’t the right fit, you still have several business financing options to explore. Lenders may not require a guarantee if their risk can be managed through other means.

See if you can qualify on business strength. If your business has a long and successful trading history, strong cash flow, and pristine financial records, you improve your chances of getting approved for an unsecured loan without a director’s guarantee. In some cases, it is possible to get a business loan without collateral or a guarantee based on the health of your business alone.

You could instead use a secured loan. By providing a specific asset, like a commercial property or high-value equipment, as security, you reduce the lender’s risk. This often removes the need for a personal guarantee entirely, as the asset itself backs the loan. Understanding the difference between secured vs unsecured business loans is important to decide if this path is right for you.

Finally, you can consider a different structure. Sometimes the solution isn’t the type of security but the type of product. A business line of credit, for example, offers more flexibility by letting you draw funds as needed. Depending on the lender and your business’s strength, the terms around guarantees may differ from a standard loan.