Business Line of Credit Funding your way

Keep your cash flowing. Access funds when you need, use what you want, but only pay interest on what you actually use.

Stock up, Pay Down, Stay Ahead.

Whether you’re stocking up, catching up, or just keeping things moving, our Business Line of Credit gives you the flexibility to manage your day-to-day with cash always at your fingertips – it’s funding your way.

up to $500K from day 1

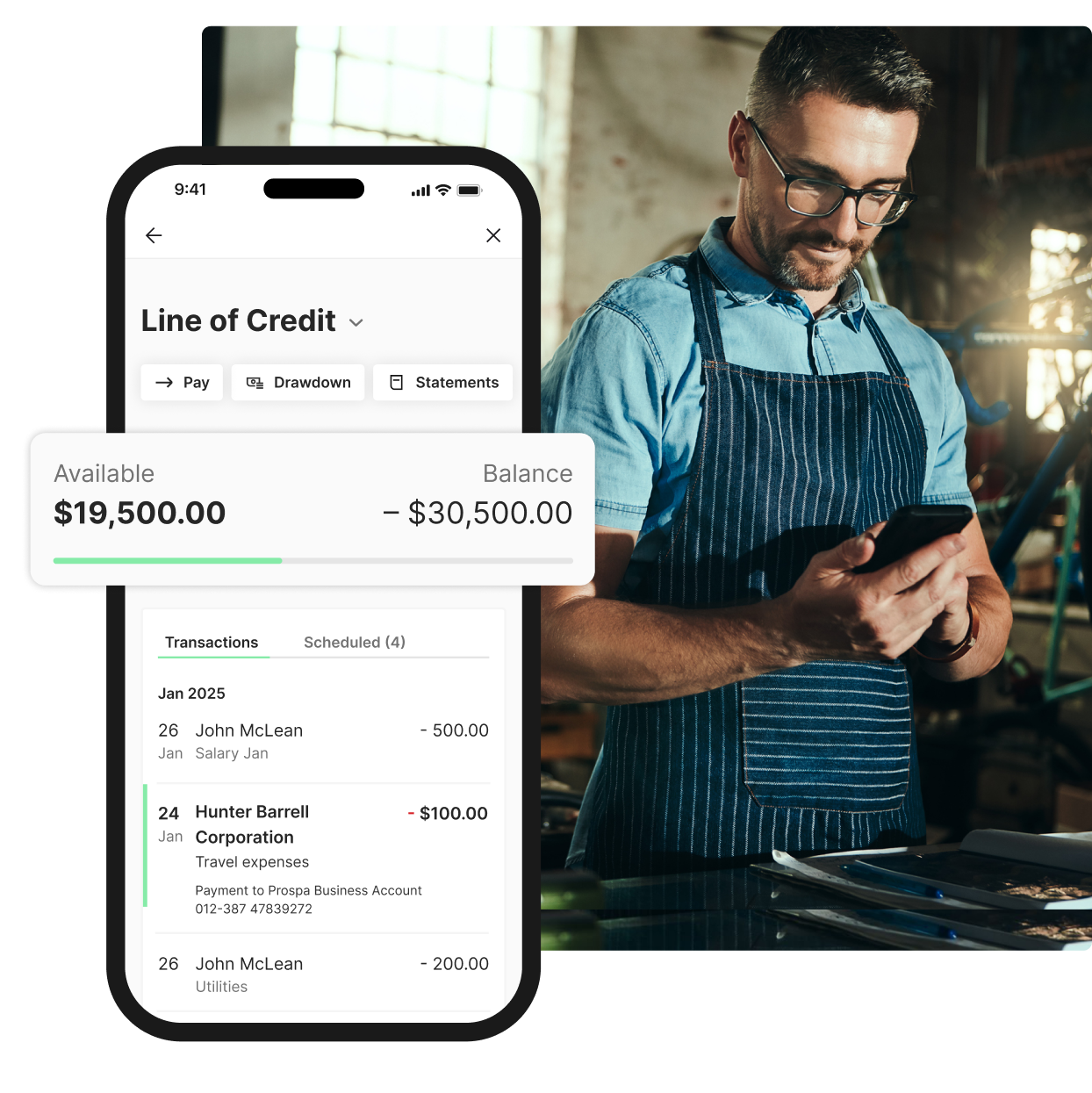

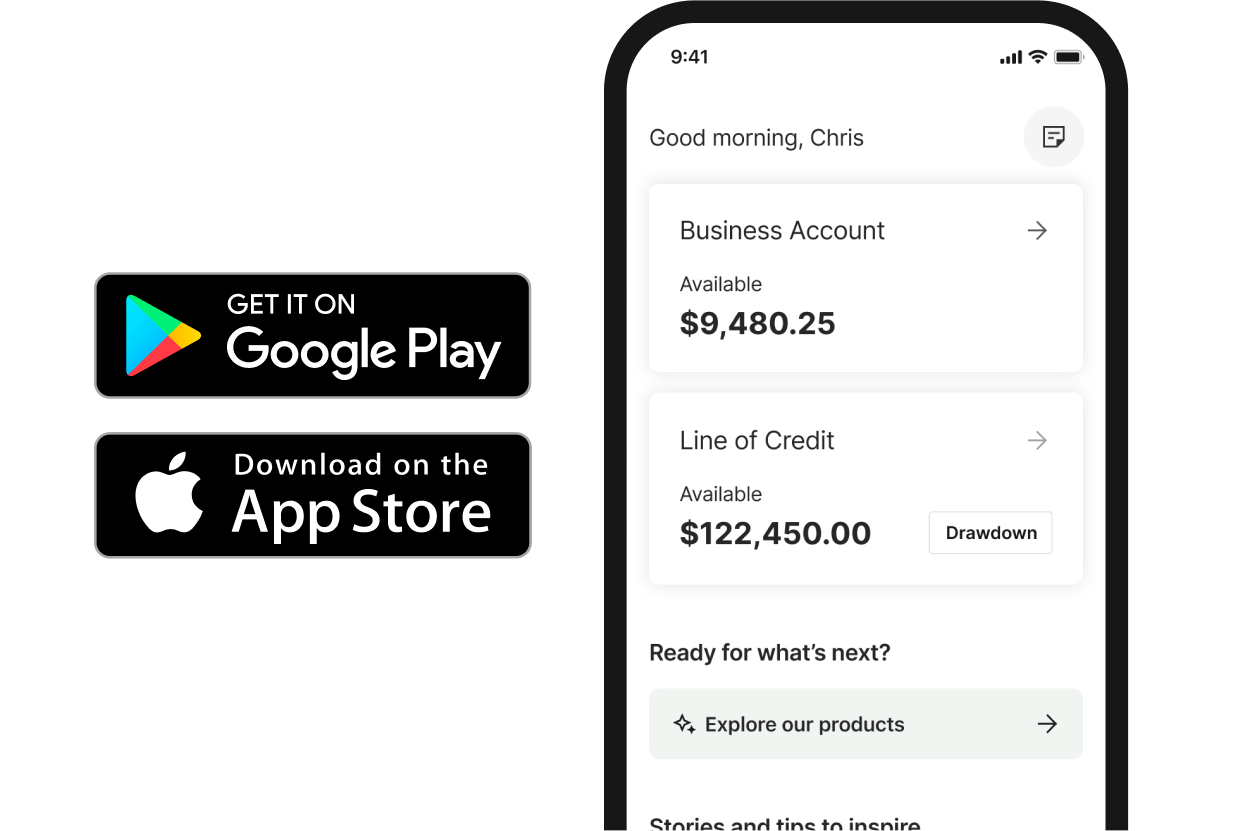

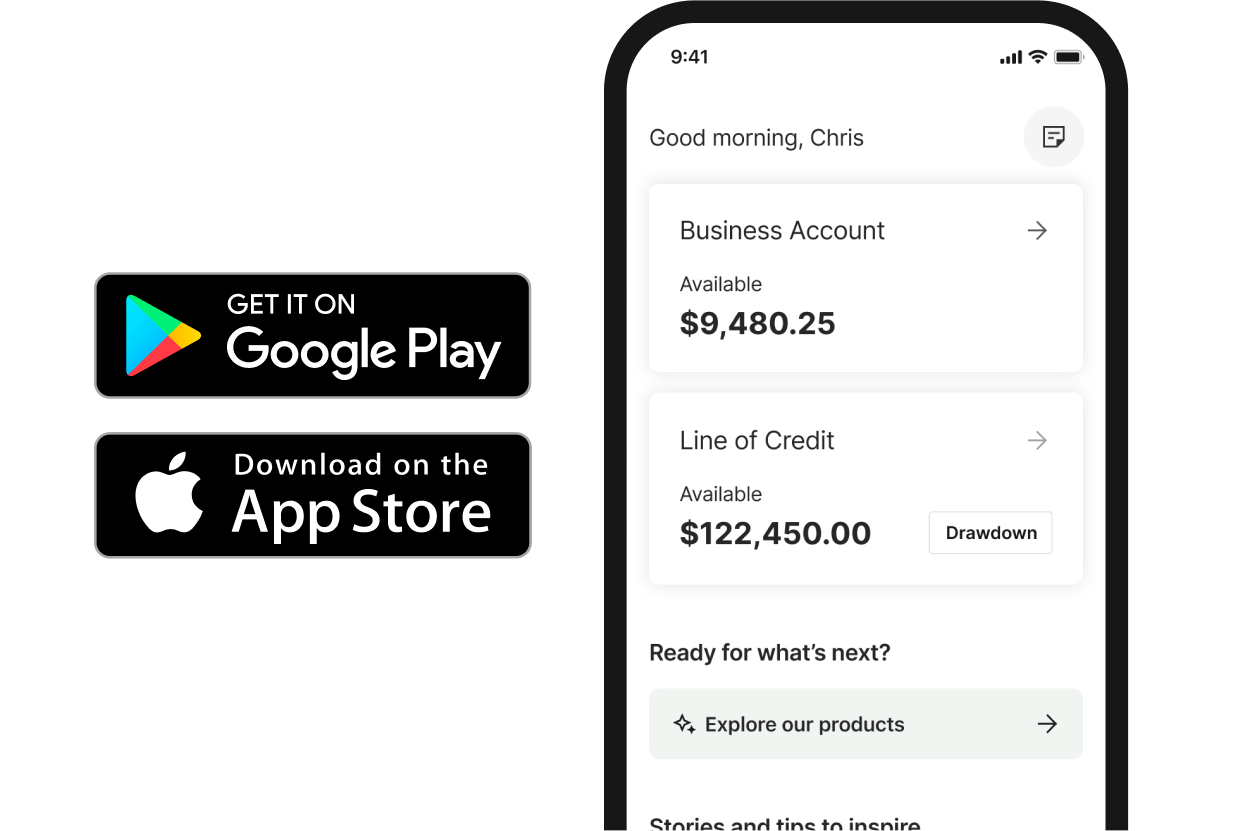

directly from the Prospa App

the amount you actually use

How we do credit, differently

| Prospa’s Line of Credit | Most other Lines of Credit | |

|---|---|---|

| Easy application | ||

| Funding in hours | ||

| Access up to your credit limit at anytime, for the entire term | ||

| Make payments directly from your Line of Credit | ||

| Lower your interest with unlimited extra repayments | ||

| Access funds 24/7 via the Prospa App | ||

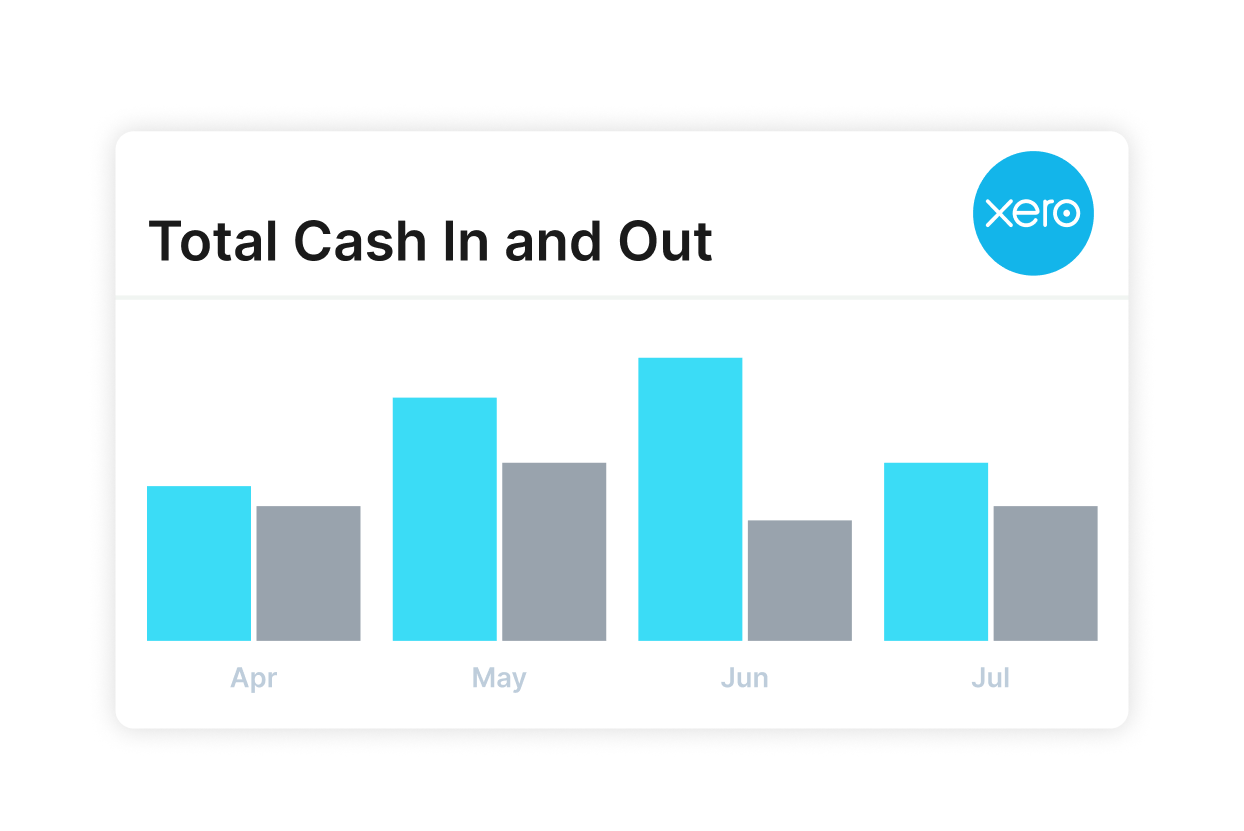

| Integrates with Xero for easy accounting |

Your cash flow, your choice

Our calculator will help you estimate how much you’ll pay per week

See full T&CPlease select a product

We’ll help simplify your admin too

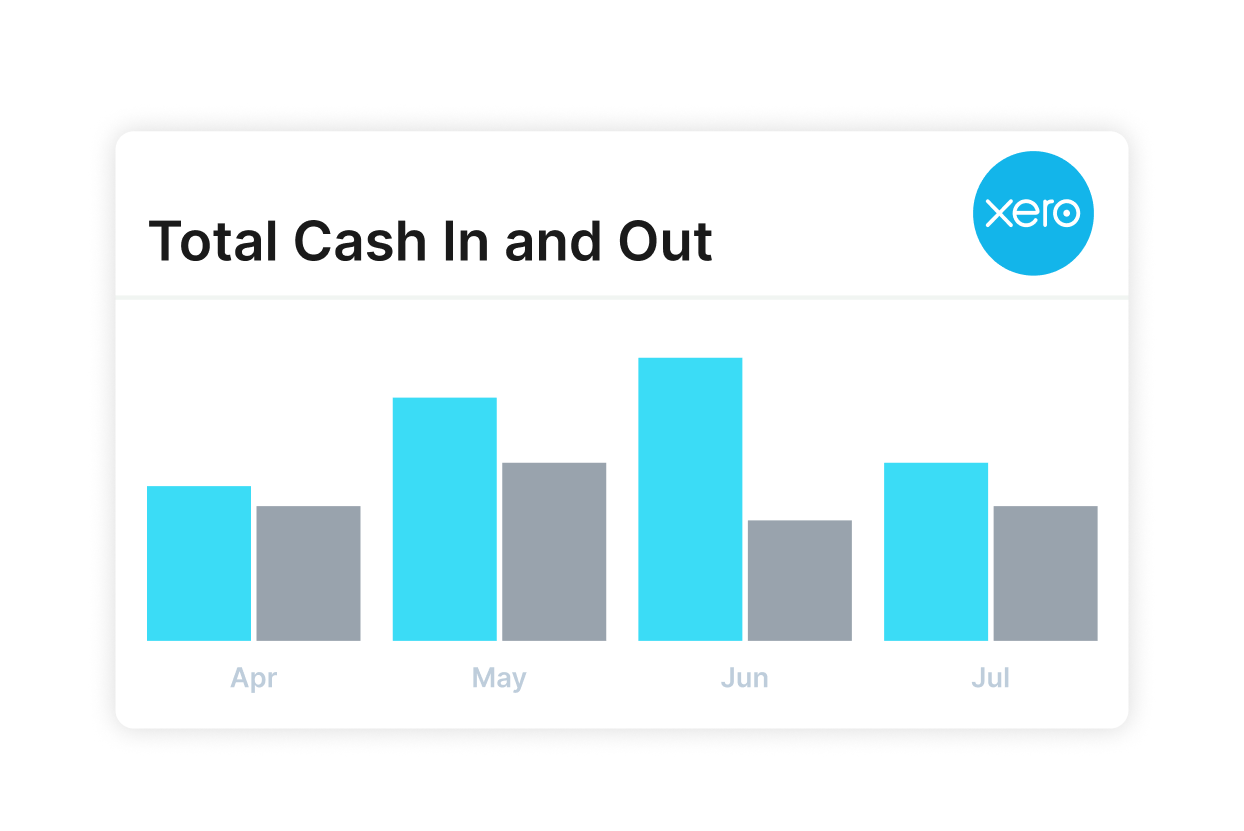

Let Xero do the heavy lifting

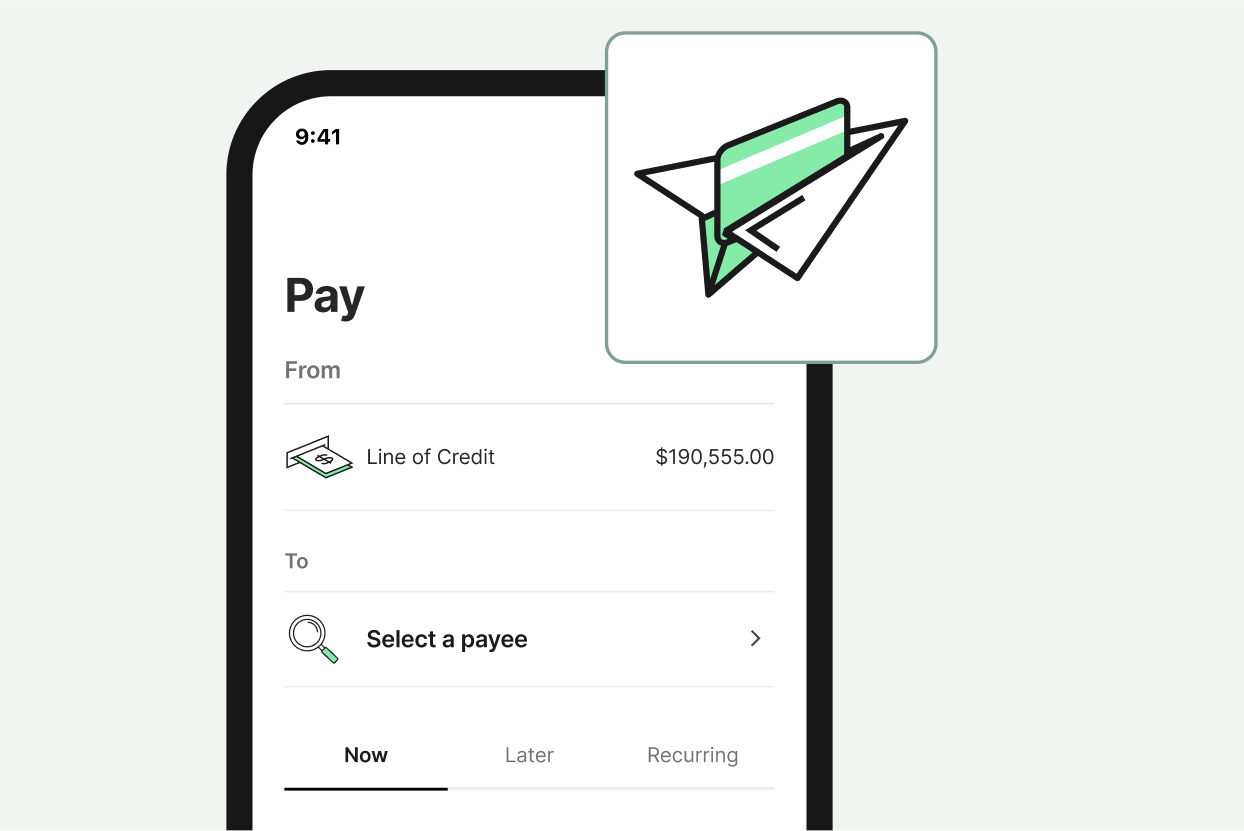

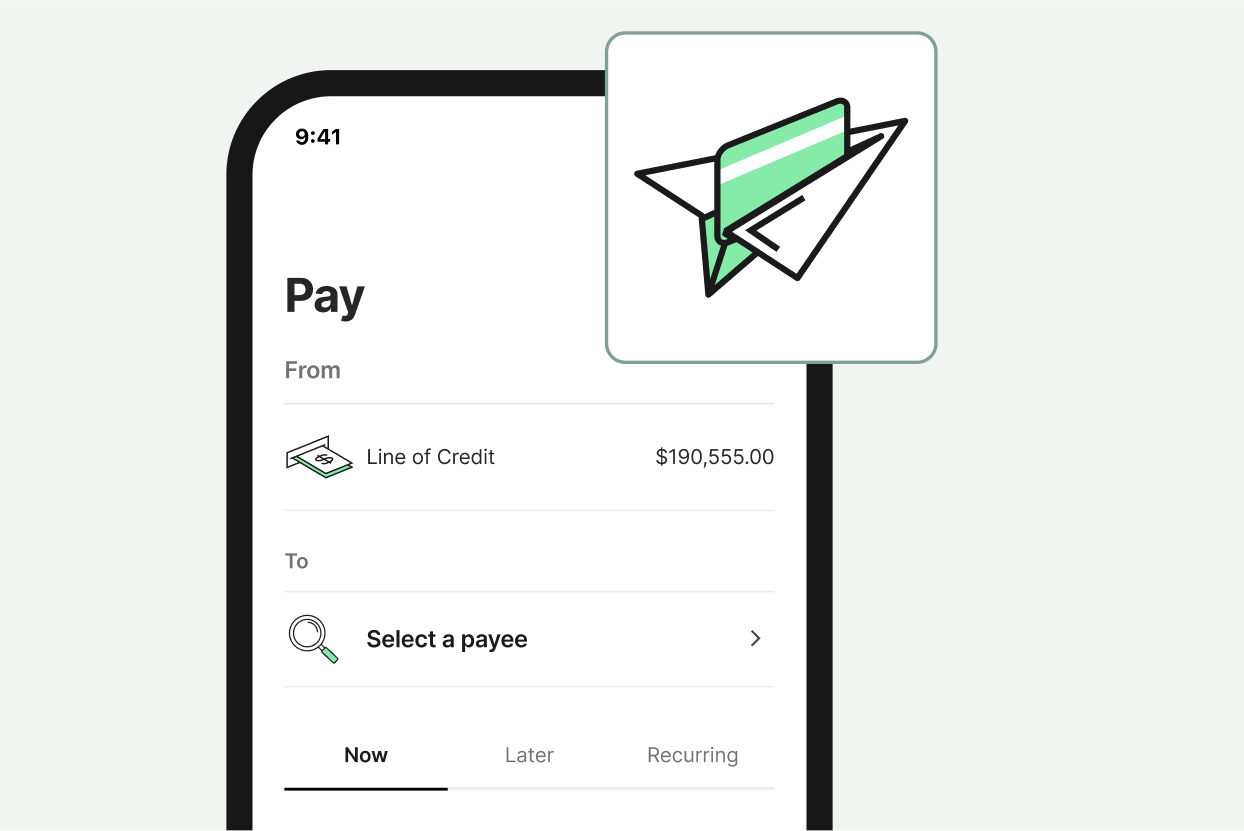

Easily make payments to vendors or suppliers

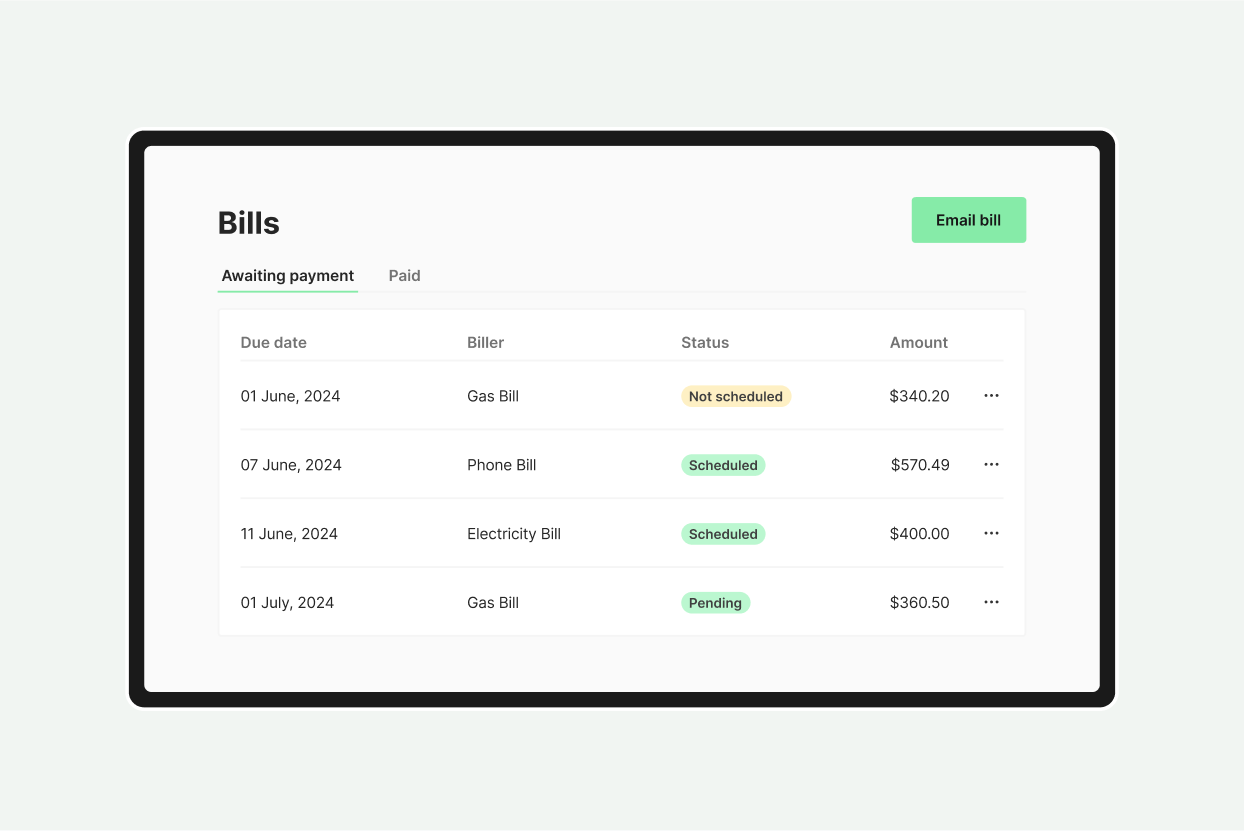

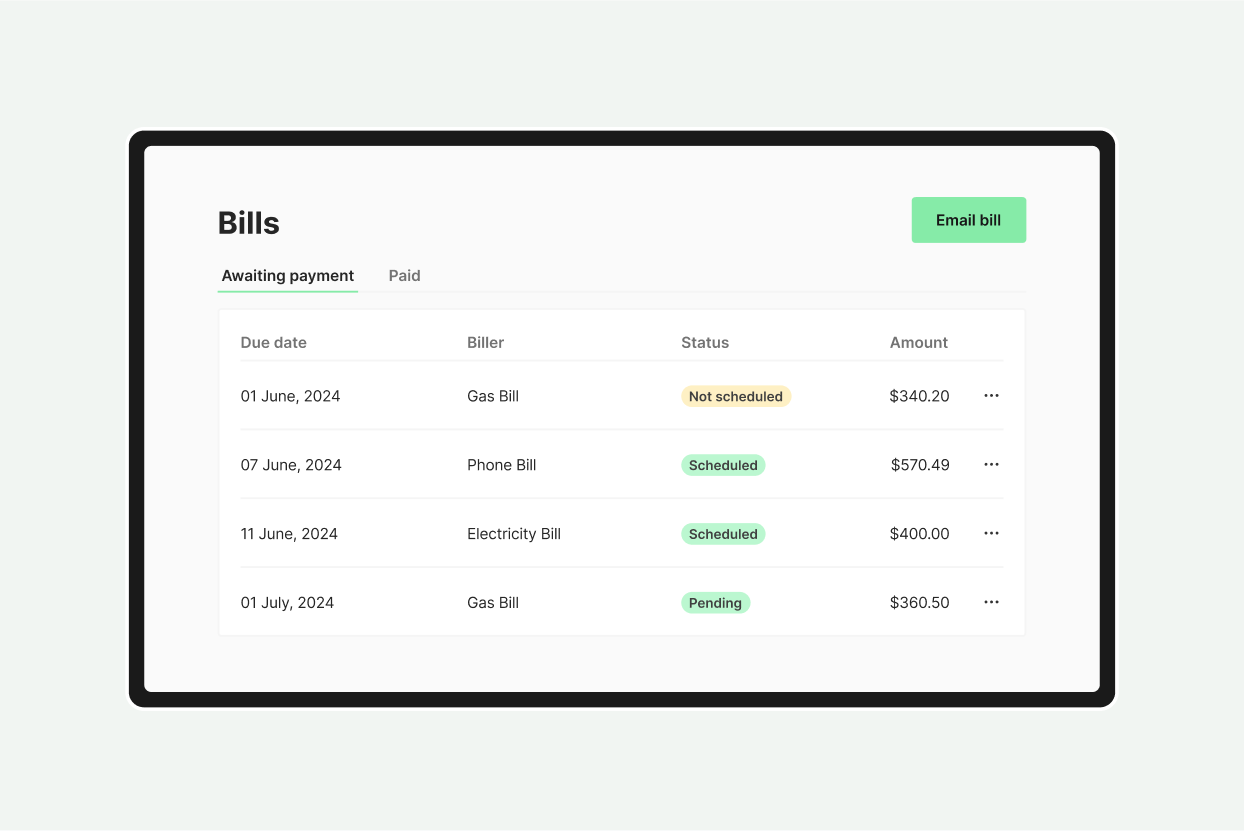

Simplify and automate your bills

Manage your cash flow, wherever your business takes you

Let Xero do the heavy lifting

Simplify and automate your bills

Easily make payments to vendors or suppliers

Manage your cash flow, wherever your business takes you

How to apply

01

Apply in minutes

02

Get a fast decision

03

Access your funds

Apply in minutes

Join the 50,000+ small businesses that we’ve helped today.

Customers making it happen with a Prospa loan

Read customer storiesFAQs

Common questions answered

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $250K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

For all Prospa funding:

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Small Business Loan up to $500K, you must also have:

- From 6 months trading history

- Monthly turnover of $6K

For a Business Line of Credit up to $500K, you must also have:

- Minimum 6+ months trading history

- Monthly turnover of $6K

- Property or asset ownership

For a Business Loan Plus from $500K up to $1M, you must also have:

- Minimum 3 years trading history

- Annual turnover of $2M

- Property or asset ownership

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

Often, you can have the funds in your account in as little as 1 hour after settlement.

We offer Business Loans up to $1M or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

Prospa considers the health of a business to determine creditworthiness. For Small Business Loans or Business Lines of Credit up to $150K, no asset security is required upfront to access. And provided you continue to meet your loan obligations (as detailed in your contract), asset security won’t be required.

For funding over $150K, or where your combined funding to our products exceeds $150K, property ownership required, and asset security may be required.

We do charge a small fee of 0.046% for ongoing access to funds. For a Business Line of Credit of $40K, this is less than $3 per day (the cost of a cup of coffee). We do not charge an origination or establishment fee.

Provided you continue to meet your contract obligations this will be the only Prospa fee you will pay.

For funding over $150K, a registration fee may apply if we register a caveat or mortgage over real property you own.

To apply for a Business Line of Credit we require 12 months bank statements.

ATO Tax Portal access and financial statements may also be required.

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of the loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 1300 882 867, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 1300 882 867.

With the Prospa Business Line of Credit you pay:

- A weekly service fee of 0.046%, charged weekly from the date of Settlement.

- Interest is only charged on the funds you use. It is charged weekly at a fixed rate, calculated daily based on your drawn balance (i.e. the amount that has been drawn down and not repaid. Your limit and your interest rate, will be based on our assessment of your business.

- For funding over $500K, a registration fee may apply if we register a caveat or mortgage over real property you own.

With a Business Line of Credit, you can get ongoing access to funds to simplify your cash flow, plus your only pay interest on what you use. You can draw down and pay back the funds as many times as you want throughout the term. It is a great way to ensure you always have cash in hand to pay wages, bills or suppliers.

A business line of credit provides ongoing access to funds for you to use, repay and reuse as needed, while a business loan gives you a fixed amount upfront with set repayments.

Your Line of Credit will be available to you to use and reuse for 2 years, with an option to extend. Once you have been approved and settled, these funds are committed for you to use, pay and reuse.

On or before the end of the 2 year term you can choose from the following options:

- you can apply to renew your Business Line of Credit for a further 2 years; or

- you can arrange to close your Business Line of Credit.

If you elect to renew your Business Line of Credit for a further 2 year term, we will need to complete a new assessment to check whether there have been any changes in your business. If you are approved, you can also review your limit based on your business’s current needs.

If you elect to close your Business Line of Credit at the end of the term, there are two possible options available to you to repay the outstanding balance:

- you can elect to repay the entire outstanding balance at the end of the term. This can be done in one lump sum payment via BPAY.

- if you are eligible, you may elect to repay your outstanding balance on a 104 week repayment plan. This repayment plan will commence immediately after your Line of Credit term finishes. At this time, your access to the facility will be suspended and the outstanding balance of your Line of Credit will be divided into 104 instalments. These instalments will be direct debited from your bank account each week along with that week’s accrued interest and Weekly Service Fee until your outstanding balance is paid down to $0. Interest will accrue on the outstanding balance throughout the 104 weeks at the same rate as your Line of Credit. To be eligible for the 104 week repayment plan you must not be in arrears at the end of your Line of Credit term.

If you do not select an option on or before the date on which the term ends or you apply for and are not approved for a term extension, your Business Line of Credit will be closed and, if eligible, you will be placed on the 104 week repayment plan.

We will set up an automatic repayment schedule with set weekly repayments over the 2 year term. The weekly repayment will comprise of the Weekly Service Fee, plus if you’ve drawn down on our Business Line of Credit, it will also include the interest and a portion of principal as well.

So that you don’t need to worry about missing a payment, these will be automatically debited from your nominated business bank account.

You can also choose to make additional payments at any time to reduce your drawn balance, thus reducing the amount of interest you pay. It’s up to you.

The best way to access your Business Line of Credit is through the Prospa App or Prospa Online.

Once you have logged in, you will be able to view transactions, draw down funds to your nominated business bank account, directly pay invoices and suppliers and much more.

A line of credit can be used for almost any business purpose – including activities that help you manage day-to-day cash flow. For example, it could be used for paying staff wages, covering unpaid invoices, buying urgent stock, managing seasonal fluctuations, paying suppliers and much more.

The weekly service fee of 0.046% is charged weekly. To help you avoid missing repayments we’ll automatically deducted your repayments from your nominated business account weekly.

If you have drawn down on your Business Line of Credit, your weekly repayments which will include the principal, interest as well as the weekly service fee will be charged weekly and automatically deducted from your nominated business account.

We know that life can get in the way, so if you miss one of your repayments, don’t worry.

To make up your missed repayment you can login to your Prospa App or Prospa Online where you will see a ‘missed repayment’ notification. Follow the prompts to complete the payment.

Alternatively, you can call 1300 882 867 to discuss your options with one of our Business Lending Specialists.

Please note that a small missed repayment fee is charged.

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of the loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 1300 882 867, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 1300 882 867.

Other questions?