Wondering if you can get a business loan in Australia without providing assets? Learn how unsecured loans work, what lenders look for, and how to apply.

At a glance

- An unsecured business loan provides fast access to funds without putting assets on the line, with approval based on your business’s financial health.

- Lenders review your trading history, recent bank activity, and credit profile to make sure your business can comfortably handle the repayments.

- Your rate and fees are set according to your business’s financial performance, the amount and term you choose, and how you plan to use the funds.

Yes, it is possible to get a business loan without putting your property or equipment on the line. For many Australian business owners, that really matters. The drive to grow is strong, but so is the instinct to protect the assets you have worked hard to build.

That’s the purpose of an unsecured business loan: to provide funding based on your business’s performance and potential, without tying the loan to what you own. In this guide, we will look at how unsecured business loans work, what lenders consider instead of collateral, and the steps to apply with confidence.

What is an unsecured business loan?

An unsecured business loan gives you a lump sum to fund growth without using property or equipment as collateral. You agree to a set term and make regular repayments, and approval is based on your business’s financial health rather than the value of an asset.

Although secured loans can offer larger amounts and lower interest rates, they take longer to arrange and can put your assets at risk if you cannot meet repayments. Unsecured loans offer faster access and greater flexibility because there is no need for the often lengthy process to assess the value of collateral.

How it works without putting assets on the line

With unsecured lending, approval is based on your business performance rather than the value of existing assets. Lenders look at recent trading and usually ask for a personal guarantee instead of physical security.

If your application is approved, the funds are provided as a lump sum and repaid in regular instalments over a set term. All without tying the loan to your personal or business assets. For you, the upside is speed and simplicity. No property valuation and less paperwork mean you can act on time-sensitive opportunities or cover planned investments without tying your assets to the loan itself.

Let’s imagine you run a catering business that has just secured a contract for a major event series worth $75,000 in revenue over three months. To deliver, you need two new commercial ovens and additional serving equipment costing around $18,000, and you have just four weeks before the first event. A business loan without collateral can have the funds in your account within 24 hours of approval, letting you lock in the equipment purchase and take on the exciting opportunity without the delays of an asset valuation.

What lenders look for instead of collateral

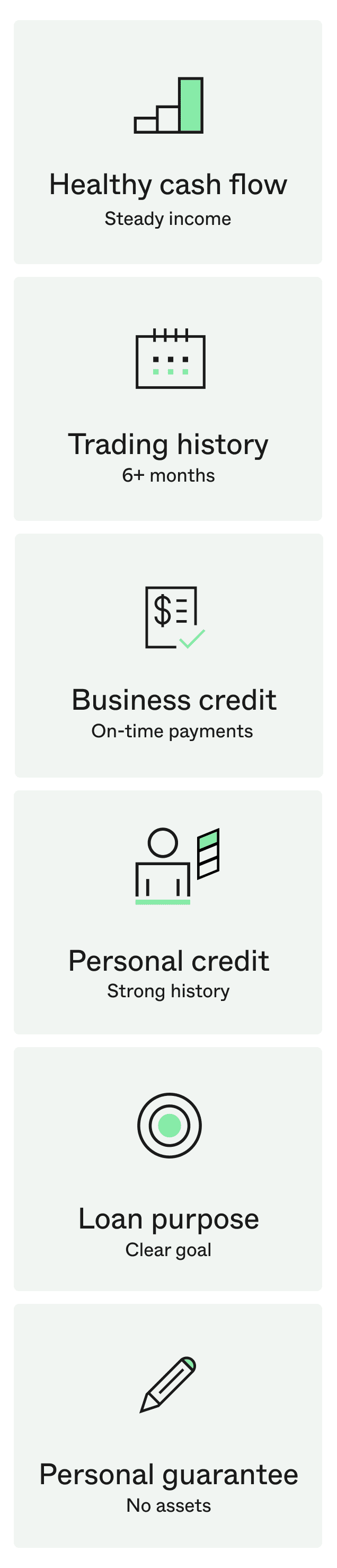

Without an asset to secure the loan, a lender’s focus shifts entirely to one question: can your business comfortably manage the repayments? They look for consistent trading, healthy cash flow, and a credit profile that shows you manage obligations on time.

Recent bank activity is reviewed to see how money moves through the business, including any signs of strain like frequent low balances or returned payments. Lenders also consider the purpose of the loan alongside your plan to repay it. Pricing and limits are then set against that risk picture rather than the value of an asset, so strong performance can open the door to more funding.

Your business’s cash flow and trading history

A strong, consistent revenue stream is one of the clearest signs that you can manage loan repayments. Lenders review recent bank statements to confirm sales coming in, expenses going out, and what’s left over. They will also look at seasonal trends, how dependent you are on a few customers, and how you have handled both busy and quiet periods.

The aim is to match the loan amount and terms to your cash flow so that repayments work for you.

Your business and personal credit profile

Credit scores help lenders judge risk. For your business, a history of paying suppliers and existing loans on time builds trust. On the personal side, most directors are asked for a personal guarantee, so your own credit history matters too.

Lenders look at your score range, any defaults or court judgments, and recent credit applications to see how you have managed debt over time. It doesn’t need to be perfect; however, stronger credit can mean faster approval and a better rate.

Who can qualify for an unsecured business loan?

Eligibility is about fit: the right product, a clear use of funds, and evidence that your business can comfortably handle repayments. Many established small and medium businesses meet these requirements. Newer operators can also be eligible once they can demonstrate consistent trading and healthy cash flow.

Established small and medium-sized businesses

The ideal candidate is a business with a proven trading record, predictable revenue, and a clear plan for the funds. Using our catering company example, a business with a steady client base might invest in additional ovens and serving equipment ahead of a busy events season.

Their bank statements show stable inflows with enough left over after expenses, and they have a solid credit history. Their loan term aligns with how quickly the investment will begin to pay for itself, making repayments fit comfortably within existing cash flow.

Newer businesses with a demonstrated trading history

A long history is not always required, but lenders need evidence that your business model works. Your catering business in its first year might already have regular bookings, consistent sales through a business account, and growing demand for its services.

At least six months of trading, clean and up-to-date bank data, and a clear purpose for the funds would help strengthen an application, as would a repayment plan that matches current revenue. As the business grows, eligibility and available limits can increase over time.

As an Australian citizen or permanent resident over 18, all you need to apply for a is six months trading history and a minimum monthly turnover of $6,000.

Note: If your primary need is to manage the ups and downs of cash flow, a business line of credit lets you draw funds as needed. See our business loan vs line of credit guide for a full comparison.

“Scaling the business was one of the hardest parts. I had to deal with the usual challenges — finding staff, sourcing equipment, and finance. That’s where Prospa came in. Without them, I would not have been able to scale as quickly or as smoothly.”

How are interest rates and fees determined?

Interest rates for unsecured business loans are risk-based, which means they are directly shaped by the same factors lenders review when assessing your application.

Strong cash flow, a steady trading history, and a good credit profile can reduce perceived risk and support a sharper rate. Conversely, irregular revenue or weaker credit can result in a higher rate to balance that risk.

Lenders also consider how long you have been in business, recent bank activity, the loan amount and term you request, the industry you operate in, and how you plan to use the funds.

The total cost of your loan includes the interest charged over the term, along with any establishment or account fees. Fees and rates can vary by product, so it is important to review the loan summary before you commit.

See estimated repayments for different amounts and terms with the Prospa Business Loan Calculator.

How to apply for an unsecured business loan online

Applying online for an unsecured business loan is designed to be fast, simple, and tailored to the way small businesses operate today. Instead of long forms and in-person meetings, you can complete the process in minutes and receive a decision quickly, so you can move forward without delay.

Take a look at the full range of options and details for unsecured business funding solutions.

The application process

The online application is built for speed and simplicity. You provide basic business details and the amount you are seeking, verify your identity, and securely connect your business bank statements so recent trading can be assessed.

With a Prospa Business Loan, you can apply for $5,000 to $500,000 with no upfront property required as security, and often receive a response the same day. Loan terms range from 3 months to 5 years, with fixed repayments for peace of mind and the option to pay out early and save on interest.

If approved, you review and sign your loan agreement electronically, and the lump sum is paid directly to your account. Compared with a traditional bank process involving branch visits, lengthy forms, and security documentation, the online path allows you to seize opportunities before they pass you by.

What documents you need

Documentation requirements for Prospa loans are minimal and designed to save you time. For most loans, all you’ll need is:

- Your ABN and basic business details

- A driver’s licence

- Your recent business bank statements. You can provide these by securely and conveniently connecting your bank account online or uploading PDFs

This simplified process means that for loans up to $500K, the documentation is typically lighter than with traditional lenders.

The next step for your business

Unsecured business loans give Australian small businesses fast, flexible funding without tying it to physical assets. You can apply quickly, use the funds for a range of business needs, and take the next step in growing your business while protecting what you have worked hard to build.

Ready to see what’s possible? Find out how much your business could borrow without providing assets as security.