Amid a high-interest rate environment, stress levels are increasing for small business owners – and many are considering loans to fund growth.

Small businesses are feeling the pinch of interest rate rises and expect this pressure to continue over the year ahead, with one in the four feeling highly stressed and one in three extremely stressed.*

The stress isn’t confined to finance; one in two (49%) are feeling overwhelmed by their increased workload during the Christmas holiday period, and almost two-thirds (63%) admit this personal stress adversely affects their job performance.

In an era of heightened interest rates, it’s natural to see a growing demand for funding. Almost three in five (58%) have taken out a loan, the highest level since late 2021.

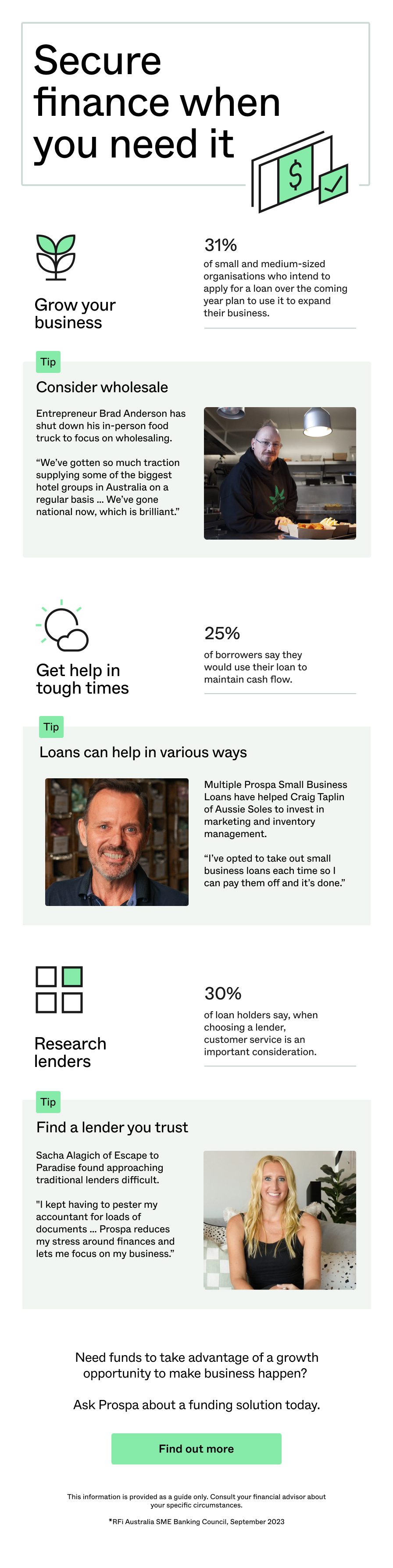

Projections show that one-third (34%) intend to seek a borrowing product over the next 12 months, with larger businesses more inclined to acquire a loan.

Businesses, primarily those with turnovers exceeding $500,000, are considering loans to fuel expansion, afford equipment, and maintain a steady cash flow. Of the businesses with existing loans, around one in four (24%) cited unplanned expenses as their reason for borrowing.

Selecting an alternative lender

When selecting a lender, businesses prioritise competitive interest rates, quick access to funds, flexible payment options, quality customer service, and a solid track record in business banking.

For the first time, alternative lenders like Prospa have overtaken business-oriented buy now pay later (BNPL) options in terms of popularity, with 20% being highly comfortable with the former compared to 19% with the latter.

Notably, sole traders are the most at ease borrowing from alternative lenders, with nearly one-third (31%) expressing high comfort levels with the process.

Here, small business owners share their experiences of securing finance and the reasons behind their decisions.

This information is provided as a guide only. Consult your financial advisor about your specific circumstances.

*RFI Australia SME Banking Council, September 2023