Business Loans Australia

Flexible business funding solutions to support your small business. Speak with Australia's #1 online lender to small business and get access to funds in hours.

- Borrow from $5K to $1M

- Fast decision and funding possible in 24 hours

- No upfront security required to access

Prospa funding up to $150K

Unlocking Opportunities with a Prospa Business Loan

In the ever-evolving landscape of Australian small businesses, securing adequate funding is crucial for growth and success.

At Prospa, we understand the unique challenges faced by entrepreneurs and offer flexible business loan solutions that empower businesses to thrive. We provide flexible lending options and quick loan processes to support your aspirations.

Discover how our business loans in Australia can fuel your entrepreneurial journey.

Prospa Small Business Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

Prospa Business Loan Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 60 months with fixed rates

- Dedicated Business Lending Specialist

- Upfront asset security required; charge over the applying business entity(ies)

- Minimum $2M annual turnover and 3 years trading to apply

Business Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

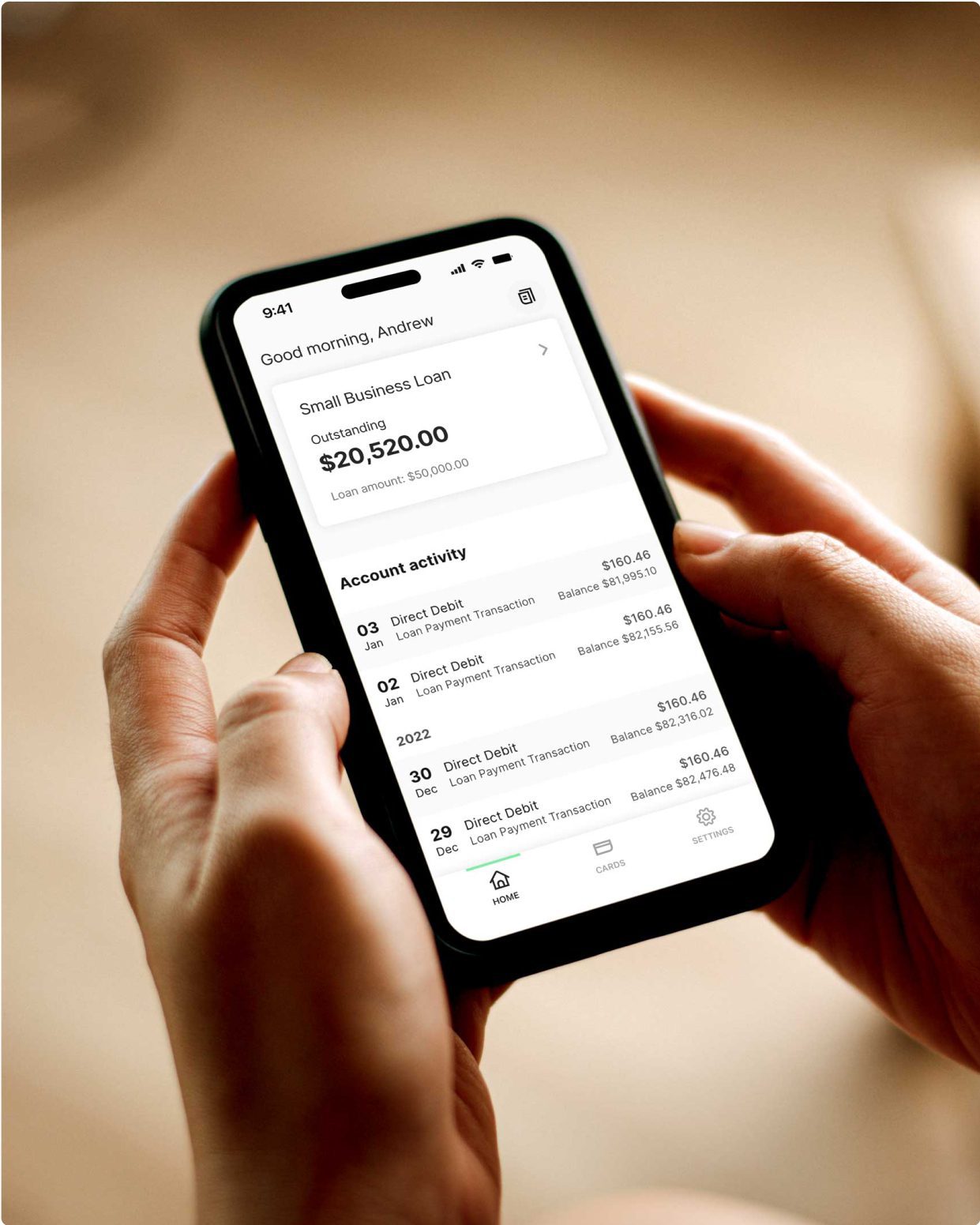

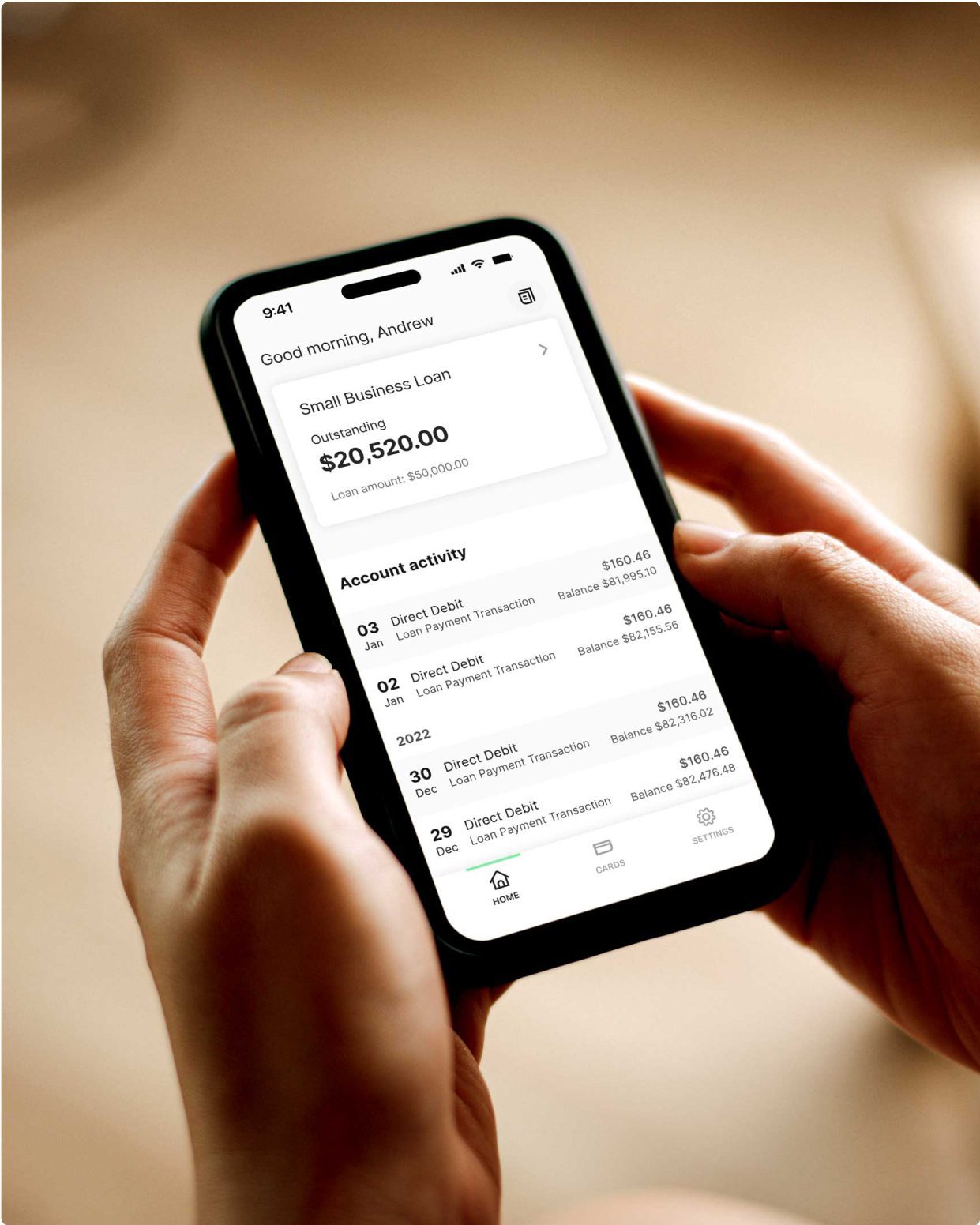

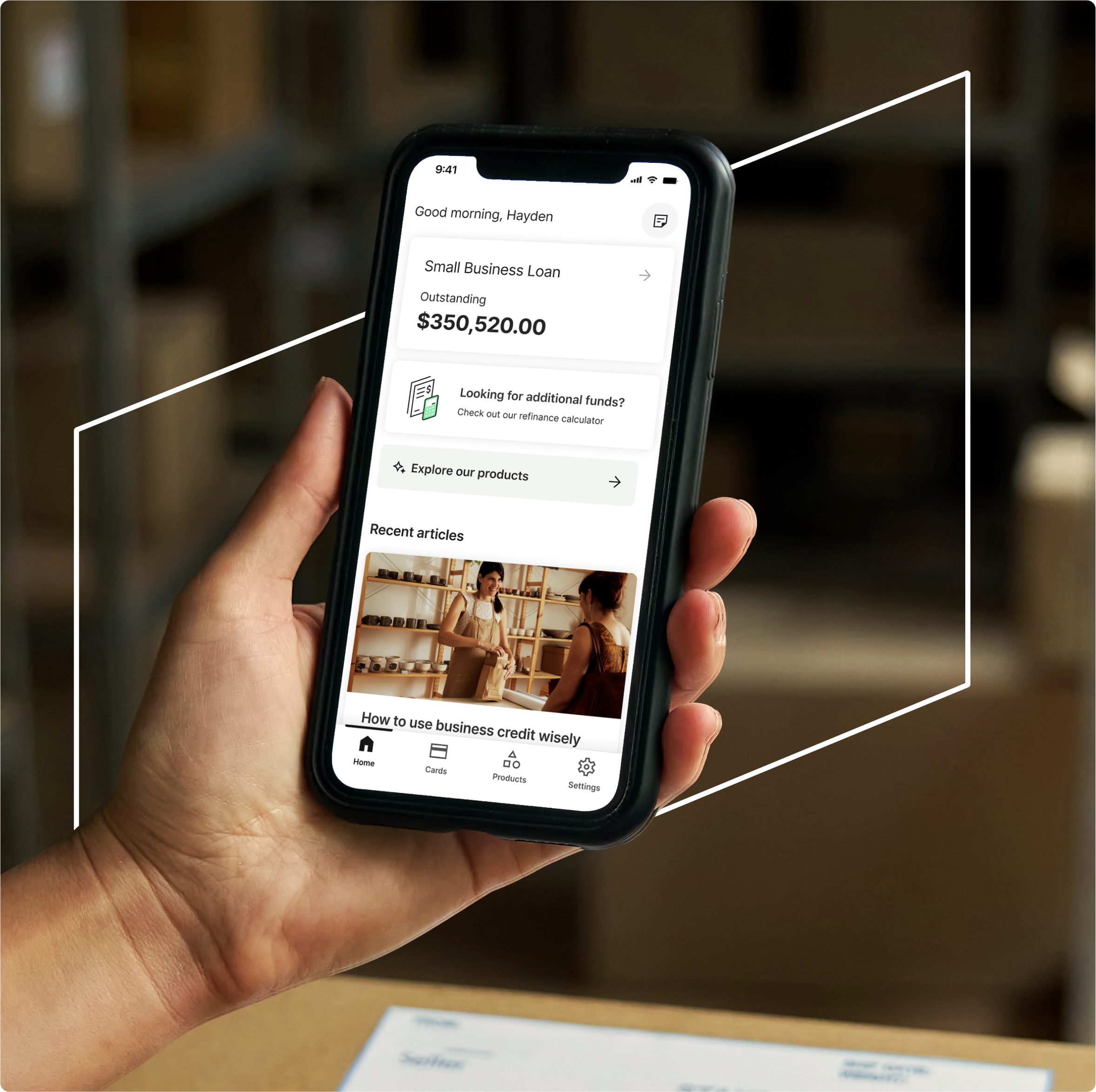

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Business Loans For Australian Small Businesses in 5 Simple Steps

Begin by assessing your financial requirements and determining the loan amount you need. Evaluate whether you meet the eligibility criteria. To apply with Prospa, for example, you need to be an Australian citizen or permanent resident aged over 18 years with a valid ABN/CAN and a minimum monthly turnover of $6K. For many lenders, you may also need to have business plan, revenue projections and credit history to understand your eligibility.

Submit a loan application online. Many financial services providers require lengthy forms but at Prospa the application takes under 10 minutes. You may need to provide financial statements, business details, and other relevant documents.

At Prospa, our team of business lending specialists will guide you through the application process and help you gather all the necessary information – including at a minimum your driver licence, ABN, BSB and account number.

Our team of experts will review your application promptly, considering various factors such as creditworthiness, business viability, and repayment capacity.

Once your loan application is approved, we’ll guide you through the terms and conditions, ensuring clarity and understanding before settling your loan.

Once your loan is approved, the funds are automatically transferred and could be in your account as soon as the next business day.

How to get a business loan?

To secure a business loan, start by reviewing your credit score and business financials. Apply online with lenders, provide necessary documents, and choose the best solution that suits your business needs. Learn more

How do business loans work?

Business loans provide capital for expenses or growth. Borrowers receive a lump sum amount or a credit line and repay it with interest over a set period. Learn more

How are business loan interest rates calculated?

Business loan interest rates are determined by the lender based on your creditworthiness, loan amount, term, and market conditions. Rates can be fixed or variable. Learn more

How to compare business loans

Compare business loans by evaluating interest rates, loan terms, fees, and repayment options. Use our comparison guide to assess which loan best fits your business’s financial needs and goals. Learn more

Are repayments tax-deductible?

In Australia, the tax deductibility of business loan repayments depends on the loan purpose. Generally, if the loan was used for business-related purposes, such as purchasing equipment, funding expansions, or working capital requirements, the interest paid on the loan may be tax-deductible. However, we strongly recommend consulting with a qualified tax professional to understand the specific implications for your business and ensure compliance with applicable tax laws.

Can I make a lump sum repayment?

A lump sum payment in the context of business loans refers to a single, large payment made to the lender that reduces the outstanding balance of the loan. This payment can be made in addition to the regular monthly or periodic loan payments.

When you make a lump sum payment, the lender applies it directly to the principal balance of the loan.

With the lump sum payment and any subsequent adjustments, you continue making regular payments until the loan is fully paid off.

Is there any early repayment fees?

There are no early payout fees. However, you will be required to pay a small percentage of the outstanding principal amount.

Business Loans Australia by state

Prospa offers tailored financing solutions across every state, ensuring that small businesses from have access to the funds they need to grow and succeed. Our state-specific loan options are designed to meet the unique challenges and opportunities of your region. With competitive rates, flexible terms, and a simple application process, we’re committed to supporting the diverse business landscapes across Australia.

Related Articles

Customers making it happen with a Prospa loan

Read customer storiesWhy Prospa is today's way to borrow

Securing quick financing for small businesses in Australia, especially startups, can be difficult. At Prospa, we are dedicated to supporting Australian businesses from various sectors to achieve consistent and solid growth.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $1M with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Stories to inspire you, tips to save you money

Eligibility and approval criteria, fees and charges and terms and conditions may apply to Prospa’s products and services.