At a glance

- Six key funding options for Australian SMEs include term loans, lines of credit, equipment finance, invoice finance, credit cards, and trade finance, each with distinct pros and cons.

- Asking the right questions about funding needs, repayment terms, and security requirements can help you choose the best option to support cash flow and long-term plans.

- Fast access to funds often depends on two factors: how quickly you can apply and how streamlined the lender’s approval process is.

Business loans. Lines of credit. Equipment financing. Banks. Fintechs. Alternative lenders. And the list goes on. Australian small businesses today have more funding options than ever before. But more choice brings complexity.

Working out which loan or financing option is right for you takes time, and as a business owner that’s a luxury you rarely have. When opportunities appear, hesitation or a drawn-out application process can mean watching them slip away.

That’s what nearly happened to Tony, owner of Hands from Heaven clinic in regional Queensland. When the opportunity to double his business’s floor space came along, he needed funding fast to secure the lease. But traditional finance options were slow, and the clock was ticking.

This guide is designed to help you avoid that scenario. It breaks down the most common business loans and financing options, outlines their pros and cons, and helps you choose the right fit — so when opportunity knocks, you’re ready to open the door.

Your business financing options explained

Many small business owners discover too late that not all loans are created equal. A product that works for buying equipment might not suit a short-term cash flow gap, and a traditional loan process can feel too slow when timing is critical.

Knowing your options upfront can save you time and help you act fast when the opportunity arises.

1. Term loans (secured and unsecured)

Term loans provide a lump sum upfront, repaid in fixed instalments over a set period. These loans are often used for larger, planned investments and can be secured against assets or unsecured depending on the lender.

Best for: Larger investments like renovations, equipment upgrades, or expansion.

Pros: Predictable repayments and access to higher loan amounts.

Cons: Traditional banks may require collateral, extensive documentation, and long approval timelines.

Good to know: If timing is critical and you lack assets to secure, consider unsecured term loans from alternative lenders like Prospa, which can fund up to $150K without tying up your assets.

In their words: Hands from Heaven clinic

Tony had been running his massage therapy clinic in Townsville for over a decade when the opportunity to double the business’s floor space came up. The expansion would mean more treatment rooms and a new laundry area to service his growing client base. But with only a short window to act, Tony couldn’t afford to get bogged down in paperwork or wait weeks for a decision.

“I did the application with Prospa and within 24 hours we had $20,000 in our bank account.” — Tony, Hands from Heaven clinic, Queensland

Want to improve your chances of approval? Read our guide: How to get approved for a small business loan: 5 tips to boost your chances

2. Business line of credit

A business line of credit gives you flexible access to funds up to a set limit, letting you draw and repay as needed. You only pay interest on what you use, making it a useful tool for managing cash flow gaps or covering unexpected expenses.

- Best for: Managing cash flow fluctuations, emergencies, or seizing time-sensitive opportunities.

- Pros: Reusable access to funds, interest charged only on drawn amounts.

- Cons: Traditional lenders often have stricter eligibility requirements and may charge fees on unused funds. Prospa’s Business Line of Credit offers ongoing access, anytime via the Prospa App.

Learn more: Differences between a business loan and a business line of credit.

3. Equipment financing

This option is designed for purchasing vehicles, machinery, or other high-cost assets. The loan is secured against the equipment itself, meaning the lender can repossess it if you default.

- Best for: Businesses needing to invest in expensive equipment without tying up other collateral.

- Pros: Designed for equipment purchases, helping businesses avoid large upfront costs and preserve cash flow for operations.

- Cons: Limited to equipment purchases only, and the asset may lose value over time (depreciation), which could affect future borrowing options.

Good to know: Prospa business loans can be used for any purpose, giving you flexibility beyond equipment-specific funding.

4. Invoice financing

Also known as debtor financing, this option lets businesses borrow against the value of unpaid invoices to improve cash flow without waiting for customer payments.

- Best for: Businesses with long customer payment cycles that need to smooth cash flow.

- Pros: Quick access to funds, ideal for bridging payment delays.

- Cons: Ongoing fees and may not suit businesses without consistent invoicing.

Good to know: Prospa’s business loans provide fast access to funds without tying them to your invoices.

5. Business credit cards

Business credit cards provide a revolving line of credit for day-to-day expenses, often with rewards programs or cashback benefits.

- Best for: Smaller, recurring purchases or emergency expenses.

- Pros: Quick access to credit, rewards on eligible spending.

- Cons: Higher interest rates, lower limits compared to term loans, and not ideal for larger funding needs.

Good to know: Prospa loans offer higher limits with structured repayments tailored to your business.

6. Trade finance

Trade finance supports businesses dealing in international trade by managing risks and cash flow challenges. It can involve letters of credit, bank guarantees, and other financial tools to facilitate import/export transactions.

- Best for: Businesses engaged in regular international trade or large import/export deals.

- Pros: Supports overseas transactions, reduces supplier risk.

- Cons: Complex, often requires collateral, and may not suit most small businesses.

| Option | Best For | Pros | Cons | Prospa Advantage |

|---|---|---|---|---|

| Term loan | Large, planned investments | Predictable repayments, larger sums | Slow approval, security required | Fast and no upfront security required up to $150K |

| Business line of credit | Planned or unplanned cash flow gaps | Flexible access, reusable funds | Harder to qualify, fees on unused funds | Easy ongoing access via Prospa app |

| Equipment financing | Buying vehicles, machinery | Avoids large upfront costs | Limited to equipment purchases only | Funds usable for any business need |

| Invoice financing | Bridging long payment cycles | Unlocks funds tied up in invoices | Ongoing fees, depends on invoicing | Quick funds without invoice tie-up |

| Business credit cards | Day-to-day expenses, small purchases | Quick access, rewards programs | Higher rates, lower limits | Higher limits, structured repayments |

| Trade finance | Regular import/export transactions | Supports international trade | Complex, may require collateral | Focuses on domestic businesses |

Start with your business needs

Once you understand the different business financing options, the next step is figuring out which one suits your situation. The right choice depends as much on your business’s goals and cash flow as it does on the products themselves.

Here are five questions to help narrow your choices:

- How much funding do you need? Is it a small cash flow buffer or a larger investment like a renovation or new equipment?

- How quickly do you need the funds? Some lenders can approve and disburse funds in as little as 24 hours, while others may take weeks.

- How long will you need to repay? A short repayment period can work for bridging gaps, but long-term investments may need extended terms.

- Do you prefer fixed repayments or flexibility? Fixed terms make budgeting easier, while a line of credit offers more control as your needs change.

- Do you have security to offer? Some lenders require collateral, while others provide unsecured loans that don’t tie up your assets.

Being clear on these points saves time when applying and helps you avoid settling for a financing option that doesn’t fit. If speed is critical, consider lenders who understand small businesses and can approve funds quickly.

Ever wondered how other businesses in your industry fund their growth? Get the insights in this small business guide.

Why thousands of SMEs choose Prospa

For many small business owners, speed and simplicity can make all the difference when it comes to securing funding. That’s where Prospa stands out. Designed specifically for SMEs, Prospa’s Business Loans and Line of Credit are built around the realities of running a small business.

Here’s why over 50,000 Australian businesses have chosen Prospa:

- Fast access to funds: Apply online in minutes, with funding available in hours.

- No upfront security required up to $150K: No need to tie up your home or business assets for most loans.

- Minimal paperwork: Skip the long forms and complicated requirements of traditional lenders.

- Tailored support: Work with a team that understands small business and can help you find the right solution.

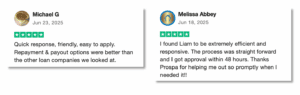

- Trusted by Australian SMEs: Prospa is rated Excellent on Trustpilot, with close to 8,000 positive reviews.

Find out how much you could borrow with Prospa’s business loan calculator — no obligations, no impact on your credit score.

Ready to act? What you need to apply with Prospa

Getting started with Prospa is simple. Unlike traditional lenders, you won’t need lengthy paperwork or a detailed business plan.

Here’s what’s required:

- Basic business details: Your ABN and how long you’ve been trading.

- Business bank account details: To get an instant snapshot of your recent bank statements and business’s cash flow.

- Funding amount and purpose: So Prospa can tailor the loan to your needs.

Once you’ve got these ready, you can apply online in minutes. Many business owners receive approval and funding the same day.

Have questions about funding? Speak to a Prospa specialist today to find the right solution for your business.