Why partner with Prospa?

Choose your experience

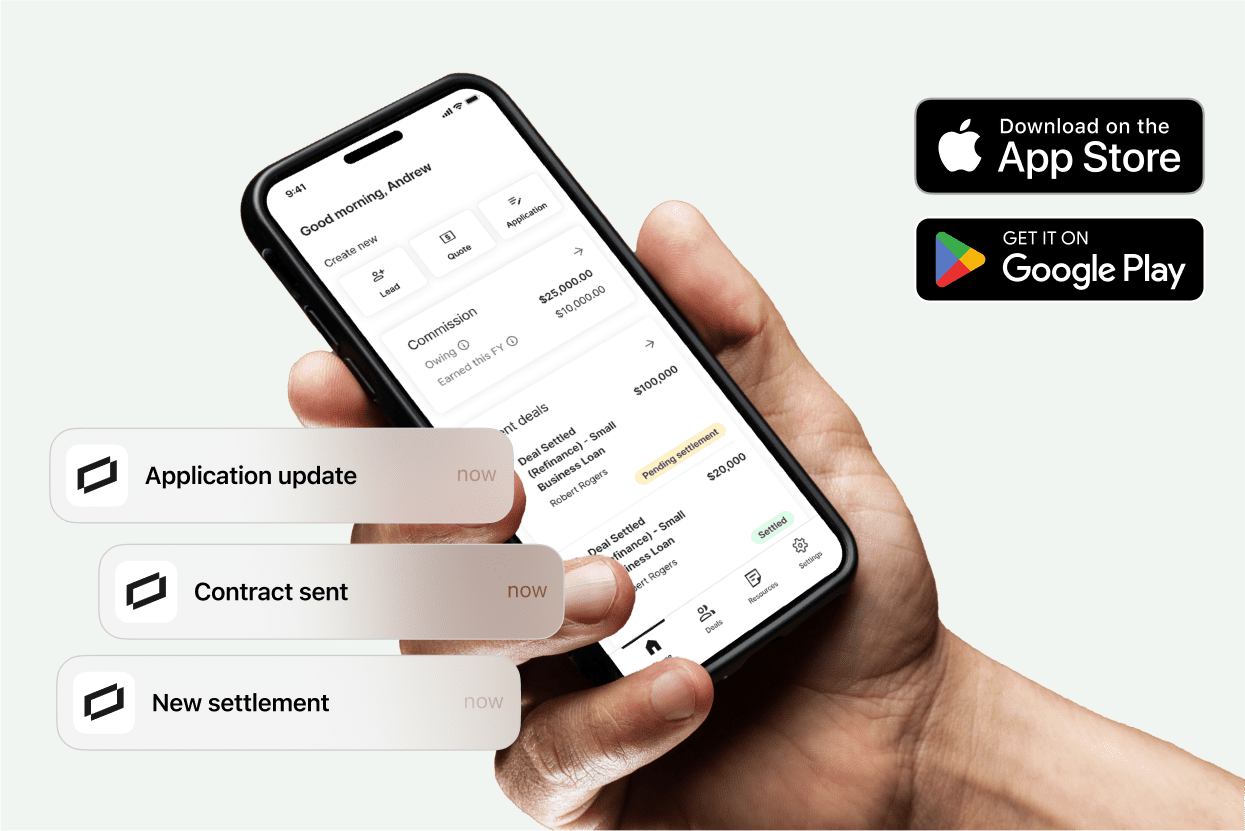

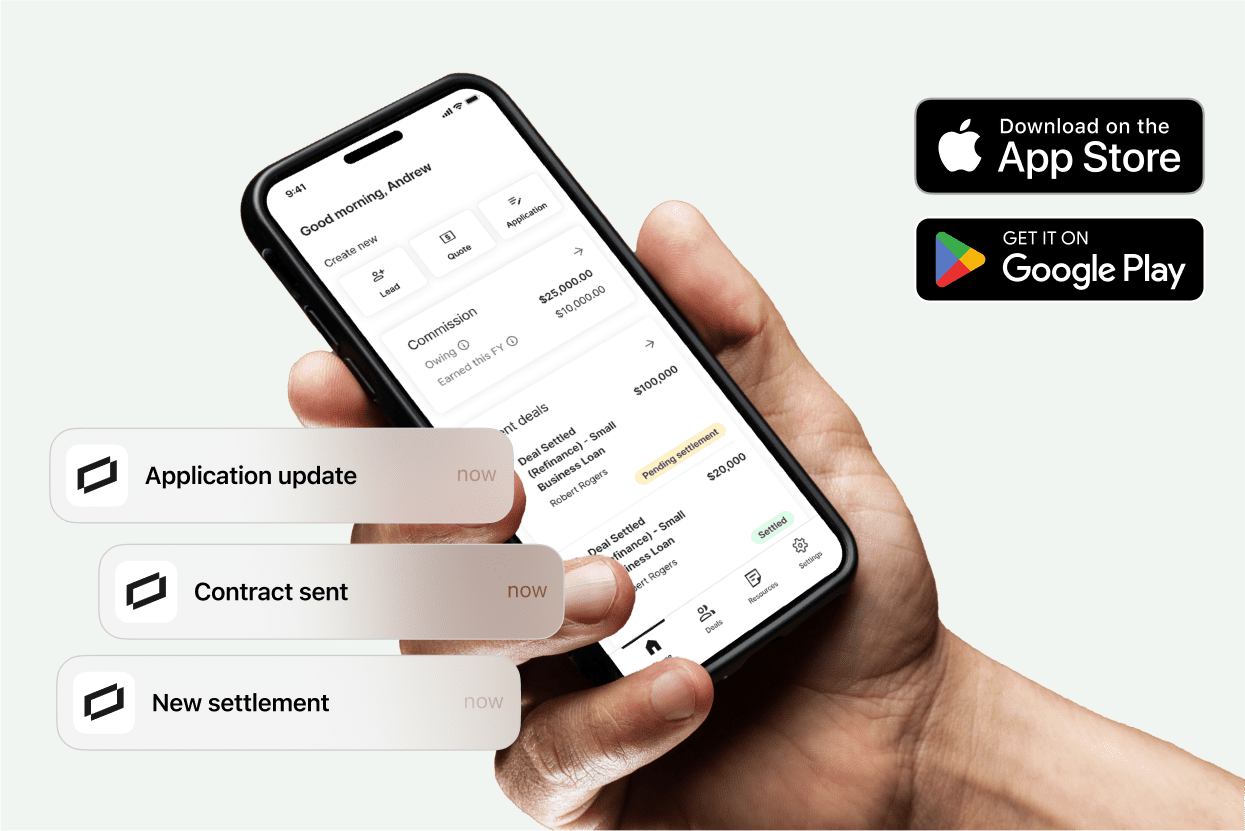

Everything you need in the Prospa App and Partner Portal

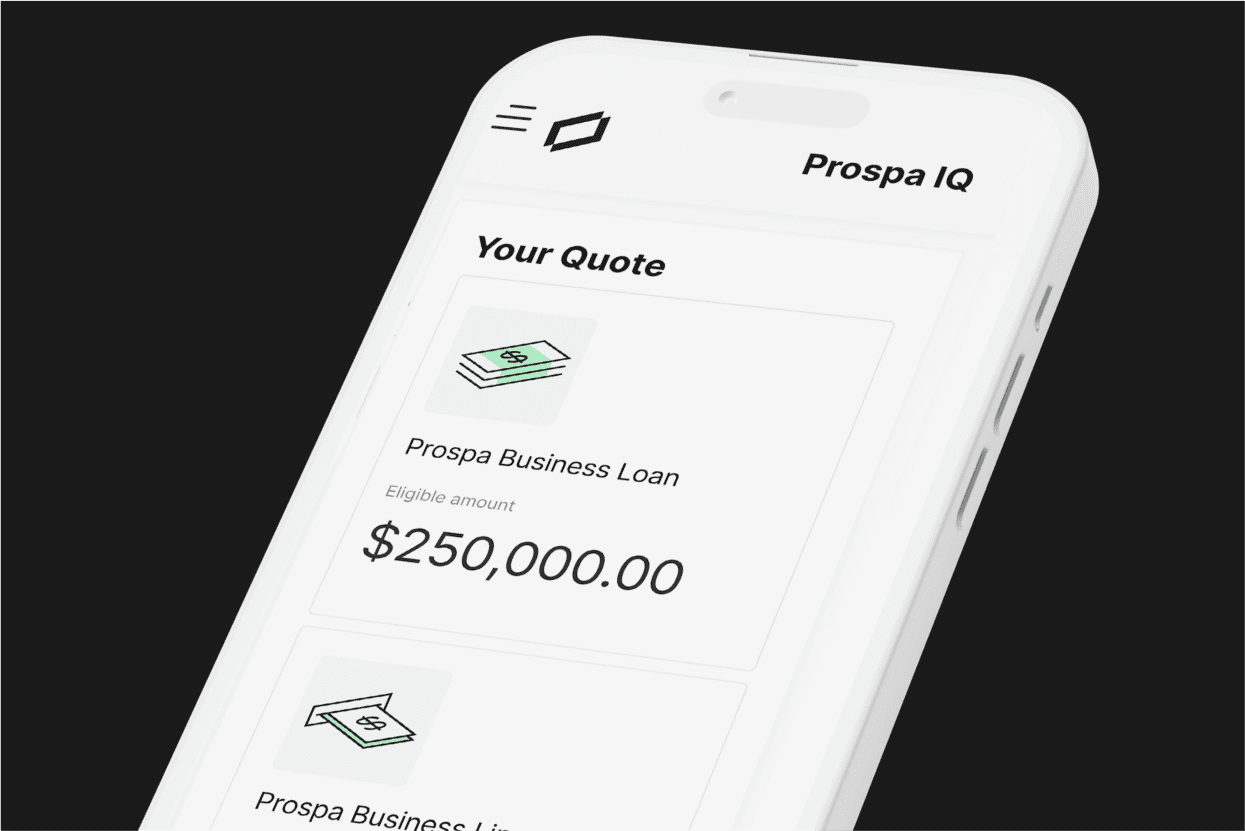

Get a quote with Prospa IQ

Locally focused BDMs

Choose your experience

Get a quote with Prospa IQ

Everything you need in the Prospa App and Partner Portal

Locally focused BDMs

Attractive commissions

Australia wide support

Education and Tools

"With Prospa IQ, we’re able to clearly understand what we can assist the client with."

Meet the Team

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |