Thinking about upgrading equipment? This guide explains the ATO’s instant asset write-off, how to claim it and what to check before you buy.

At a glance

- Eligible businesses can immediately deduct the full cost of qualifying assets costing less than $20,000 per item instead of depreciating them over time.

- To claim the deduction in the current financial year, you must ensure the asset is installed and ready for use by 30 June.

- Financing the purchase allows you to secure essential equipment now and manage cash flow while waiting for the tax benefit to flow through.

For many small business owners, the hard part often isn’t deciding what to buy – it’s knowing when to buy and what it means at tax time. The ATO’s instant asset write-off can make those decisions a little easier by allowing deductions sooner, so essential upgrades don’t need to be delayed for tax reasons.

This guide explains how asset write-offs work, what to watch out for, and how options like Prospa’s equipment financing can help you fund the assets you need, while reducing your tax liability.

Please note that this information is general in nature and does not constitute tax advice. You should consult your accountant or a qualified tax professional for advice specific to your circumstances.

What is the instant asset write-off?

The instant asset write-off allows eligible businesses to immediately deduct the full cost of qualifying assets from their taxable income. Instead of claiming the cost gradually over several years, you claim the full amount in the financial year the asset is first used or installed and ready for use.

As a general rule, you can claim the write-off if:

- You are a sole trader or small business with a turnover of less than $10 million.

- You are using the ATO’s simplified depreciation rules.

- The asset you buy meets the specific eligibility conditions.

What assets qualify for the write-off?

Most everyday business assets qualify, provided they are used for business purposes and cost less than the ATO threshold. While these limits have changed over time, since 1 July 2023, the threshold has been $20,000 per asset.

Best of all, this limit applies to each individual item. This means you can claim the immediate deduction for multiple purchases, as long as each asset costs less than $20,000.

Common examples include:

- Vehicles

- Tools and machinery

- Computers, laptops, and IT equipment

- Office furniture

Exceptions to watch for: Assets costing $20,000 or more generally cannot be written off immediately. Instead, they must be placed in your small business pool and depreciated over time. Capital works, such as buildings and structural improvements, are completely excluded from the write-off.

Tip: If you need to upgrade equipment but cash flow is tight, a business loan can help you spread the cost.

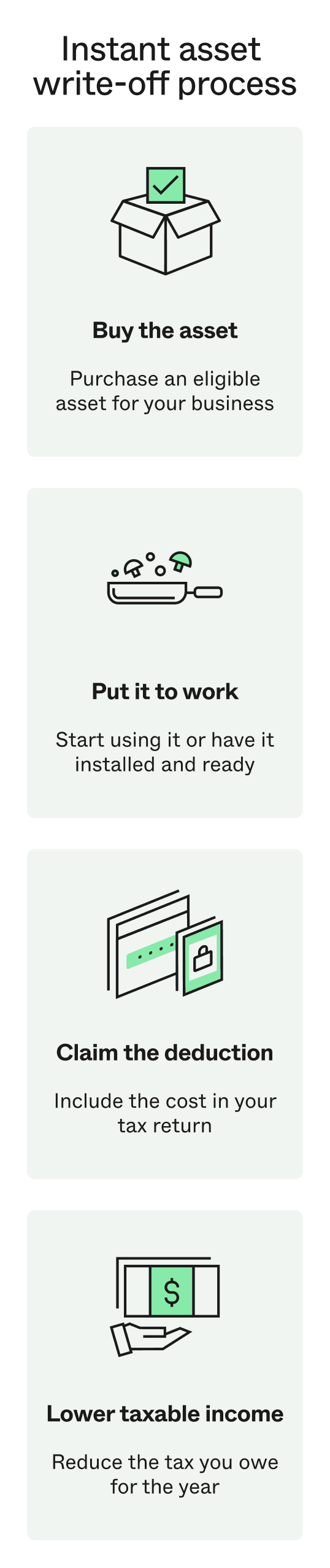

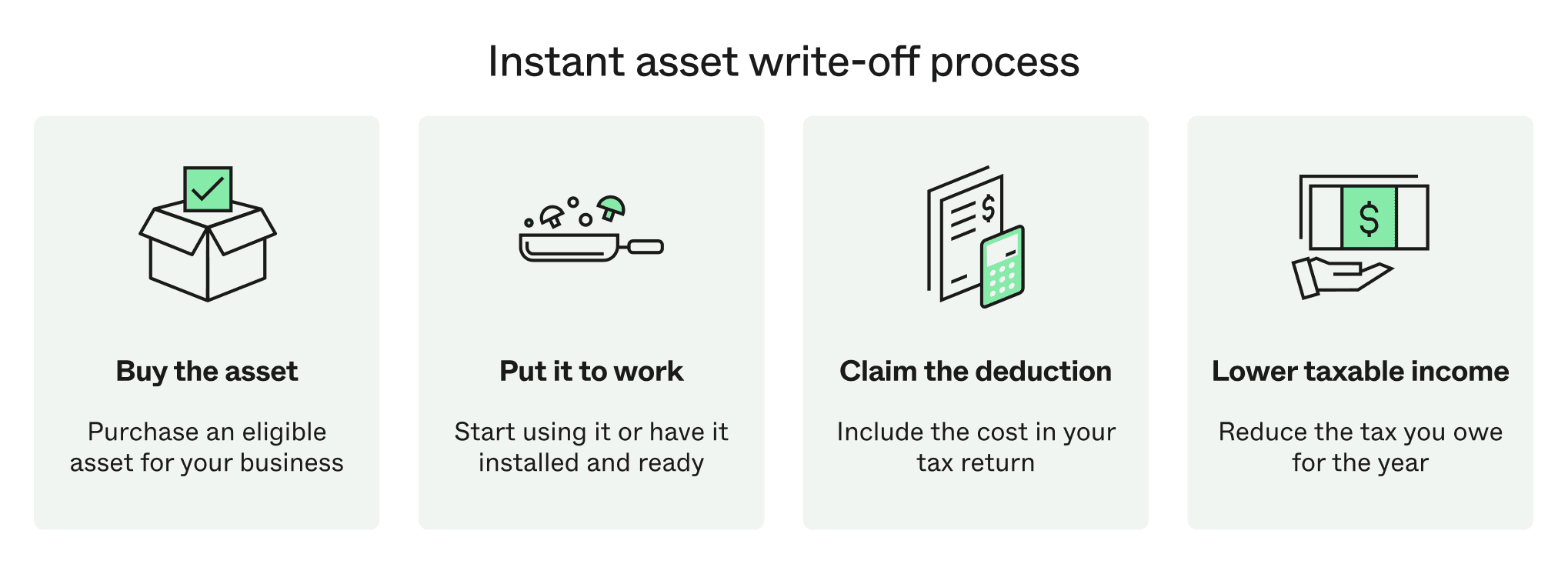

How does the instant asset write-off work?

The process is straightforward, but the order of steps matters. To claim the benefit, you generally follow these four steps:

- Buy the asset: Purchase an eligible asset for your business.

- Put it to work: The asset must be used or installed and ready for use in the financial year you claim it.

- Claim the deduction: Include the asset cost in that year’s tax return.

- Lower taxable income: The deduction reduces your taxable income, which lowers the tax you owe.

Say you run a restaurant and need to replace a failing refrigeration unit. In practice, the process looks like this:

- You purchase a new fridge for $15,000 on 30 January 2026.

- It is delivered, installed, and ready for use on 13 February 2026.

- Your business has taxable income of $200,000 for the financial year ending 30 June 2026.

- By claiming a deduction for the full $15,000, taxable income drops to $185,000.

Depending on your business structure, this reduction in taxable income could lower your final tax bill. For example, at a base rate entity company tax rate of 25%, the deduction would effectively reduce tax by $3,750. For individuals taxed at the top marginal rate of 47%, the saving would be $7,050.

As the tax benefit is only obtained once your return is finalised, a small business loan can help manage the upfront cost of the asset.

Things to watch out for

Before relying on the instant asset write-off, it’s worth keeping a few common pitfalls in mind.

Key risks to be aware of:

- Business use matters. Assets must be used for business purposes. If there is any private use, only the business-use portion can be claimed.

- Timing can trip you up. Ordering or paying for an asset before 30 June isn’t enough. The asset must be first used or installed and ready for use within the eligible period.

- GST treatment differs. If your business is registered for GST, the write-off generally applies to the asset’s cost excluding GST. Non-registered businesses usually claim the full amount.

- Excluded or higher-value assets. Some assets, such as buildings, are excluded entirely. Assets that exceed the instant asset write-off threshold don’t qualify and must be depreciated over time.

- Tax loss years change the outcome. If your business is operating at a loss, the deduction still applies, but it may not reduce tax payable in that year.

- Tied to simplified depreciation rules. You can opt out and use general depreciation rules for the year, but the choice applies to all assets and cannot be applied selectively.

Because the rules and conditions can vary depending on your circumstances, it’s a good idea to speak with your accountant to ensure the write-off is applied correctly.

Documentation checklist

Good records make it much easier to claim the write-off and respond to any ATO questions later. Make sure you keep:

- A valid invoice or receipt showing the purchase price and supplier details

- Proof of purchase date to confirm the asset falls within the eligible period

- Records showing when the asset was first used or installed and ready for use

- Evidence of business use, especially if the asset is partly private

- Any finance agreements or loan documents, if the asset was financed

If financing is involved, Prospa’s guide to small business loan costs can help you understand how interest and fees affect what you will really pay.

Benefits of the Instant Asset Write-Off

When used carefully, the instant asset write-off can support both short-term cash flow and longer-term business planning.

Key benefits include:

- Improving cash flow timing. Claiming a deduction sooner can reduce tax payable in the year an asset is put into use, rather than waiting years for deductions to flow through.

- Lowering taxable income. By deducting eligible asset costs upfront, taxable income for the year is reduced, which can ease the overall tax bill.

- Accelerating ROI. Bringing the deduction forward can help businesses realise the financial benefit of new equipment sooner, supporting reinvestment or upgrades.

- Simplifying purchase decisions. Knowing the tax treatment upfront can make it easier to plan equipment upgrades alongside cash flow, rather than delaying purchases purely for tax reasons.

- Supporting broader tax planning. The write-off can be combined with broader planning around depreciation choices, financing, and expected profitability, depending on your business structure and circumstances.

Bringing it together

The instant asset write-off is a useful tool for bringing your business plans forward. It’s about understanding how timing, tax, and cash flow interact, so necessary investments don’t become harder than they need to be.

If buying new equipment is on the horizon, Prospa’s business loans can help you plan the purchase without waiting on cash or tax timing.