Confused by "BAS excluded" transactions? Learn exactly what you don't need to report on your Business Activity Statement and how to avoid common lodging mistakes.

At a glance

- BAS excluded transactions sit outside the GST system and are not included in the GST reporting labels on your Business Activity Statement.

- While other transactions, such as GST-free and Input-taxed items, don't contain GST, they must still be reported to provide a complete picture of your business income.

- Correctly identifying excluded items helps ensure your lodgements are accurate and reduces the risk of compliance issues with the ATO.

BAS time is stressful enough without staring at your bank feed and wondering where to put that one random transfer between your accounts.

If you’re staring at a transaction and thinking, ‘Does this go in G1, G11, or nowhere?’ – you’re not alone. Getting these labels wrong can mess up your records, artificially inflate your turnover and trigger red flags with the ATO.

This guide, featuring practical insights from James Scott, Managing Director of JD Scott + Co Chartered Accountants, clears up what stays off your Business Activity Statement, so you can lodge with confidence and get back to business.

What does “BAS excluded” mean?

BAS excluded refers to transactions that don’t belong in the GST labels of your Business Activity Statement.

While most business activities need to be categorized for the ATO, these specific items are omitted because they are not considered taxable supplies or purchases. This means BAS excluded items:

- Don’t attract GST: No GST is charged on the sale or included in the purchase price.

- Don’t affect GST payable or refundable: Because there is no tax component, these items won’t increase or decrease your final GST balance.

- Are not reported in GST labels: They are completely omitted from the “G” labels on your form, such as G1 (Total Sales), G10 (Capital purchases), or G11 (Non-capital purchases).

| What does “BAS excluded” mean? |

|---|

| BAS excluded transactions are those that don’t belong in the GST labels of your Business Activity Statement (like G1, G10, or G11). |

| While most business activities need to be categorised for the ATO, these specific items are omitted from GST calculations because they are not considered taxable supplies. |

The ATO excludes these transactions because they are not part of the value-added chain of goods and services. Including them by mistake can make your business look like it’s turning over more than it actually is, potentially leading to an inflated tax bill or unnecessary ATO scrutiny.

| The accountant advice: Don’t confuse cash flow with revenue |

|---|

| “Money arriving in your bank account isn’t automatically ‘sales’ for BAS purposes,” says James Scott.

“Loans, owner contributions, and refunds are common examples of cash movements that shouldn’t be included in G1 (Total sales). If they’re coded as Sales, you’ll overstate your turnover. This can have unintended consequences, such as higher PAYG instalments or even issues with your eligibility for small business concessions.” |

Common BAS excluded transactions

A transaction is BAS excluded when it falls entirely outside of the GST system. These are typically internal movements of money or statutory payments where no taxable supply of a good or service has been made.

Here are the most common items you should leave off your GST labels:

- Wages and salaries: Gross payments are excluded from GST labels (G1, G10, G11), though they are still reported in the PAYG withholding section (W1).

- Superannuation: Contributions to employee super funds do not attract GST and are not reported in any BAS labels.

- Owner movements: Drawings or capital injections into or out of the business are equity transfers and stay off the form entirely.

- Loan principal: Receiving a loan – like a Prospa Small Business Loan – or paying back the principal is a capital move, not a taxable sale or purchase.

- Bank transfers: Shifting money between your own business accounts has zero GST impact and is not reported.

- Interest paid and dividends received: Interest you pay on a business loan is a financial cost that generally stays off the BAS. Likewise, dividends you receive are profit distributions, not sales, so they are excluded too. (Note: Interest you earn is different – see below).

- Government fees and taxes: Charges for income tax, ASIC fees, and fines are excluded because they are not considered a supply of goods or services.

- Private expenses: Personal costs unrelated to the business. That grocery run or family dinner you paid for with the business card? It has zero place on your BAS. Exclude it entirely.

BAS excluded vs GST-free vs Input-taxed

To most business owners, any transaction without GST may look the same. However, the ATO distinguishes between these three categories because they each have different reporting requirements and different impacts on your ability to claim credits:

- BAS excluded items are ignored for GST because they are not considered a taxable supply.

- GST-free items are within the system, but the rate is 0%. This allows you to still claim back the GST you paid on the expenses related to making those sales.

- Input-taxed items also have no GST, but unlike GST-free sales, you generally cannot claim back the GST on the costs associated with them.

Cheat Sheet: BAS Excluded vs. GST-Free vs. Input-Taxed

| Feature | BAS Excluded | GST-Free | Input-Taxed |

|---|---|---|---|

| Do you charge GST? | No | No (Rate is 0%) | No |

| Report on BAS? | No. Stays off the GST labels. | Yes. Reported at G1, G10, or G11. | Yes. Usually reported at G1 or G11. |

| Can you claim credits? | No GST to claim. | Yes. You can claim credits on related purchases. | No. You generally cannot claim credits for related costs. |

| Common Examples | Wages, loan principal, bank transfers. | Basic food (e.g., plain bread, milk, fruit), exports, and some health services. | Bank interest received, residential rent, and financial supplies. |

Note: This information is general in nature and does not constitute financial or tax advice. You should consult with a qualified tax professional regarding your specific business circumstances.

Common BAS reporting mistakes to avoid

It’s easy to autopilot your reconciliation, but that’s where the mistakes happen. Watch out for these common traps:

- Including wages in total sales: Wages should never be added to your “purchases” (G11). Including them here incorrectly inflates your expenses and leads to claiming GST credits you are not entitled to. Keep wages strictly in the PAYG section (W1).

- Reporting loan income as revenue: A loan is a capital injection, not business income. If you record it in your G1 (Total Sales) label, you are over-reporting your turnover, which may impact your tax obligations.

- Confusing GST-free with BAS excluded: GST-free sales (like basic food or exports) must still be reported at G1. If you treat them as “BAS excluded” and leave them off the form entirely, your reported turnover won’t match your actual business activity.

- Double-counting reimbursements: When paying back an employee for a business expense, the GST credit is claimed on the original supplier invoice, not the repayment. Coding the reimbursement as a GST purchase results in claiming the same credit twice.

| The accountant advice: Watch out for the “set and forget” trap |

|---|

| Modern accounting tools like Xero and MYOB use AI to predict your coding based on past behaviour. If you misclassify a transaction once – like coding a GST-free software subscription as taxable – the software may automatically repeat that error for every future payment.

“Don’t just click ‘OK’ on your bank feed,” warns James. “Coded transactions will continue to be miscoded going forward unless rectified by a human.” |

How to record BAS excluded items

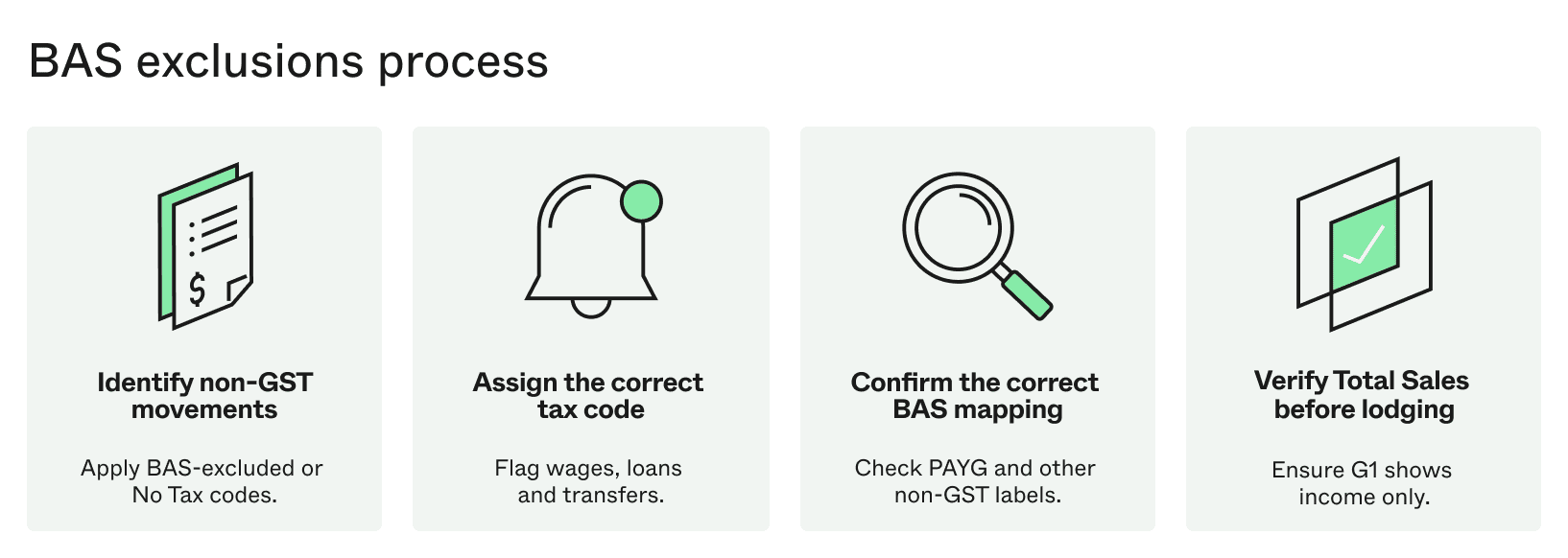

As part of your broader reconciliation process, use the steps below to correctly handle BAS-excluded and No Tax transactions. The goal is to keep non-GST movements out of your GST labels while ensuring they still land in the correct accounts.

- Step 1 – Identify non-GST movements: Flag transactions that are not part of trading activity, such as wages, loan movements, owner transfers, or internal bank transfers.

- Step 2 – Apply a BAS-excluded or No Tax code: Use the relevant code in your accounting software so the transaction bypasses GST calculations and does not flow to the G labels.

- Step 3 – Confirm correct BAS mapping: Verify that items like wages continue to populate the correct non-GST BAS sections, such as PAYG withholding at W1 and W2.

- Step 4 – Verify G1 before lodging: Ensure Total Sales reflects only genuine business income, with no capital injections, transfers, or other excluded items inflating the total.

| The accountant advice: Sanity-check your BAS before lodging |

|---|

| Before you lodge, compare your G1 (Total Sales) figure to the previous period. “Large swings should usually be explainable by seasonality or genuine sales changes,” says James.

“If the number jumps unexpectedly, it’s often a sign that non-sales items (like loans or transfers) have been coded incorrectly as Sales.” |

These steps ensure your GST reporting remains clean while maintaining an accurate representation of your business activity.

If you do your own bookkeeping, Scott recommends scheduling a brief periodic review with your accountant to confirm your GST codes and BAS mapping. A short check before can prevent expensive clean-ups later and give you confidence that what you lodge matches the reality of your business.

Bridge the gap at tax time

Sometimes, even a perfect BAS report can reveal a tax bill you weren’t expecting. If your cash is tied up in stock or unpaid invoices, you don’t need to stall your business just to pay the ATO.

A Prospa Line of Credit can act as a safety net, helping you clear your tax obligations on time while keeping your cash flow moving for the things that matter.