Not sure how to apply for a business loan?

We specialise in Australian small business loans between $5K and $1M with funding possible in just 24 hours. Terms range between 3 and 60 months and repayments are fixed either daily or weekly to work with your cash flow, there are also early repayment options that could save you interest.

Here, we have answered some common questions you might have about applying for a Prospa business loan – such as what are the credit criteria for a Prospa small business loan, how hard is it to qualify for a Prospa small business loan and do I need a business plan to get a Prospa small business loan. Hopefully this will stop you wondering: ‘Do I qualify for a business loan?’

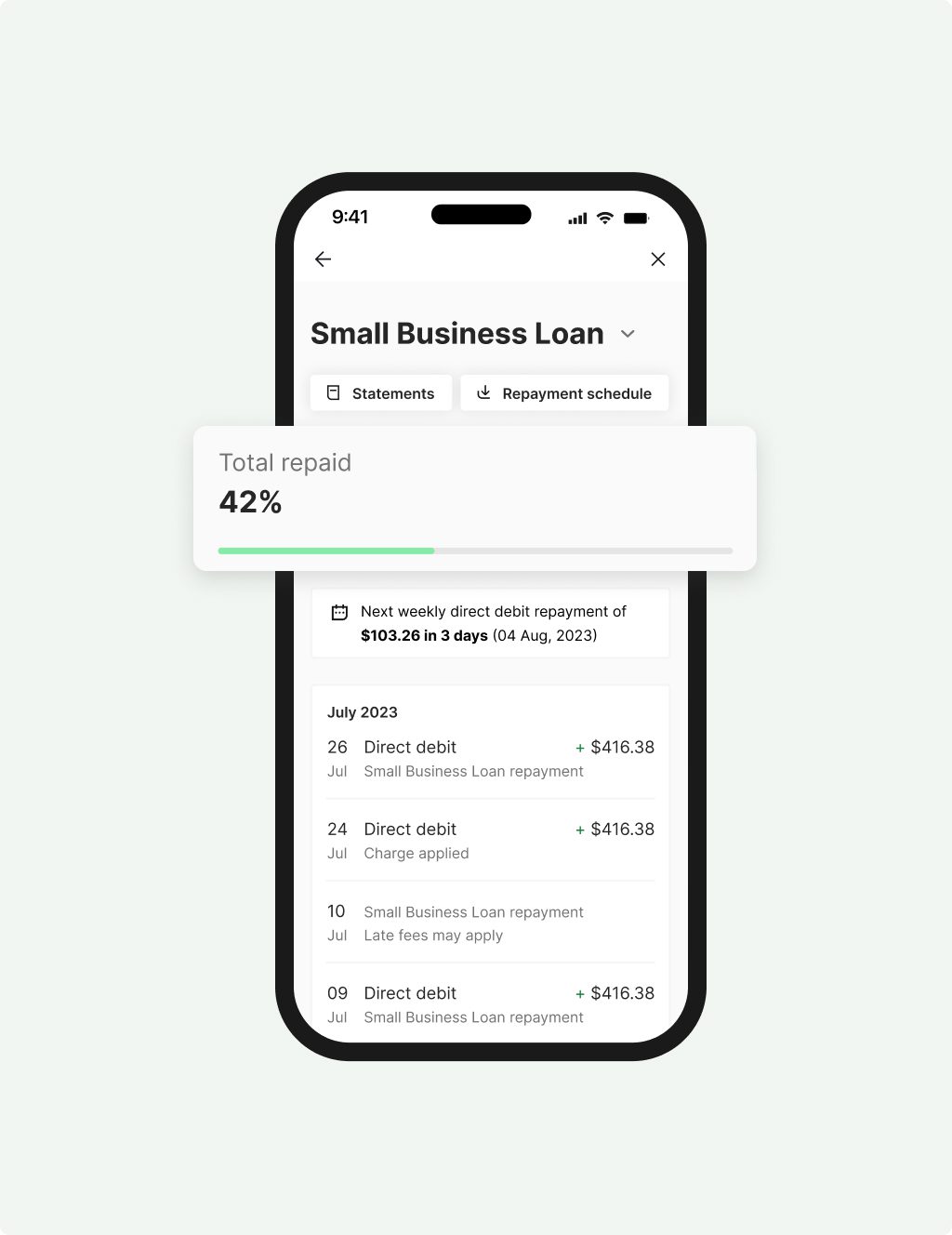

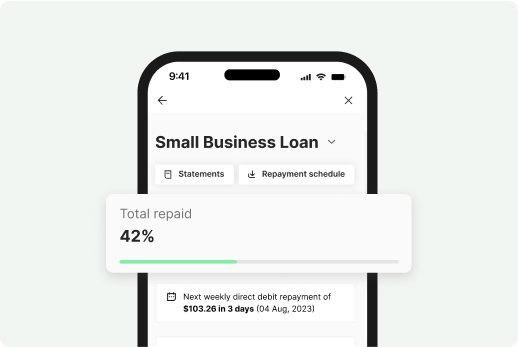

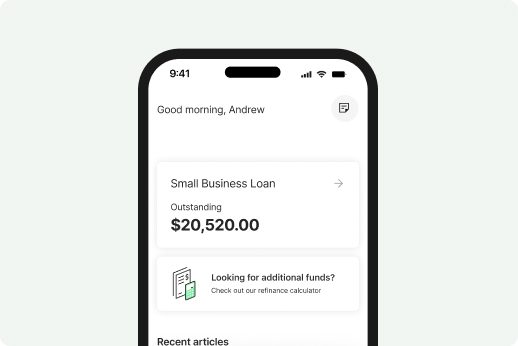

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

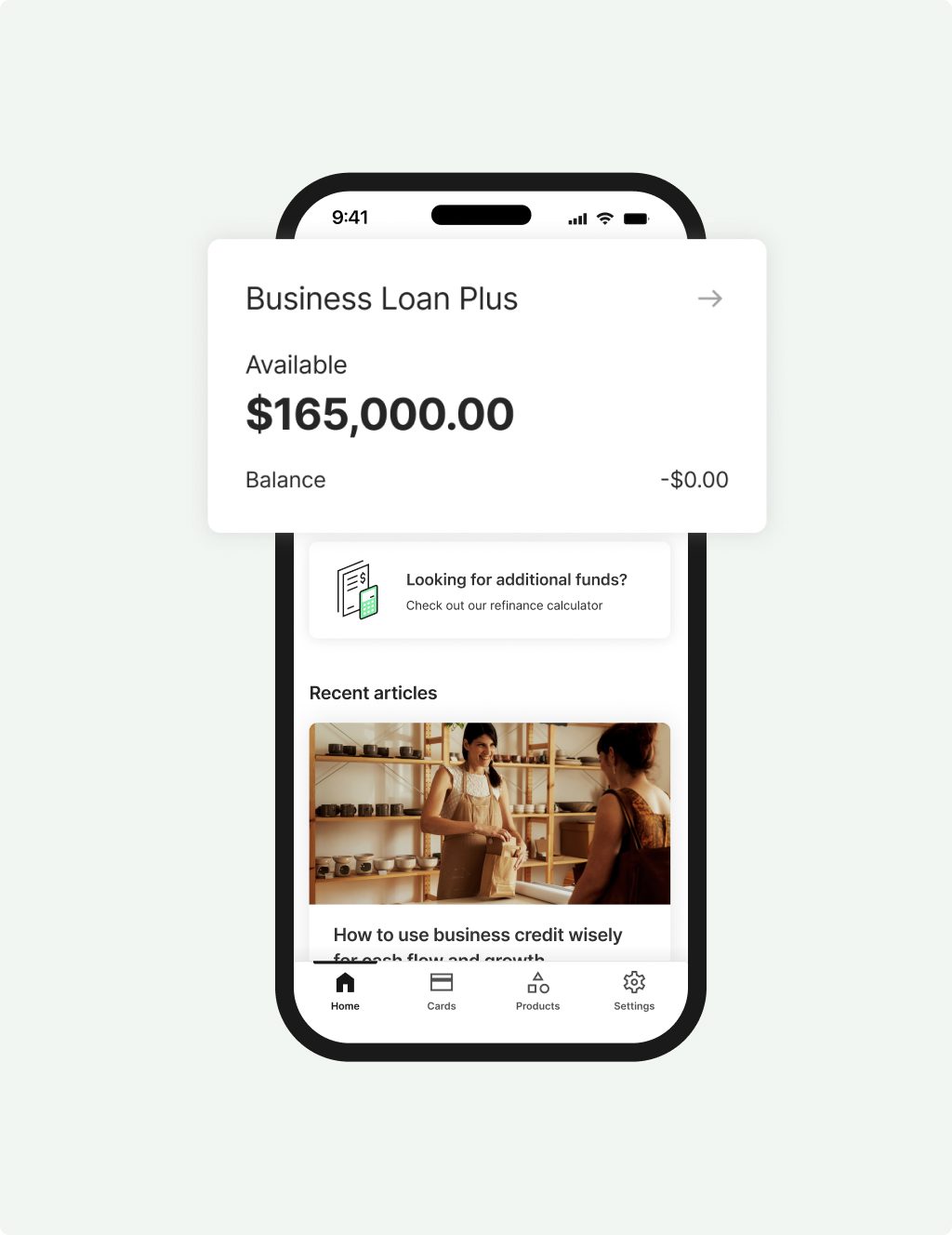

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

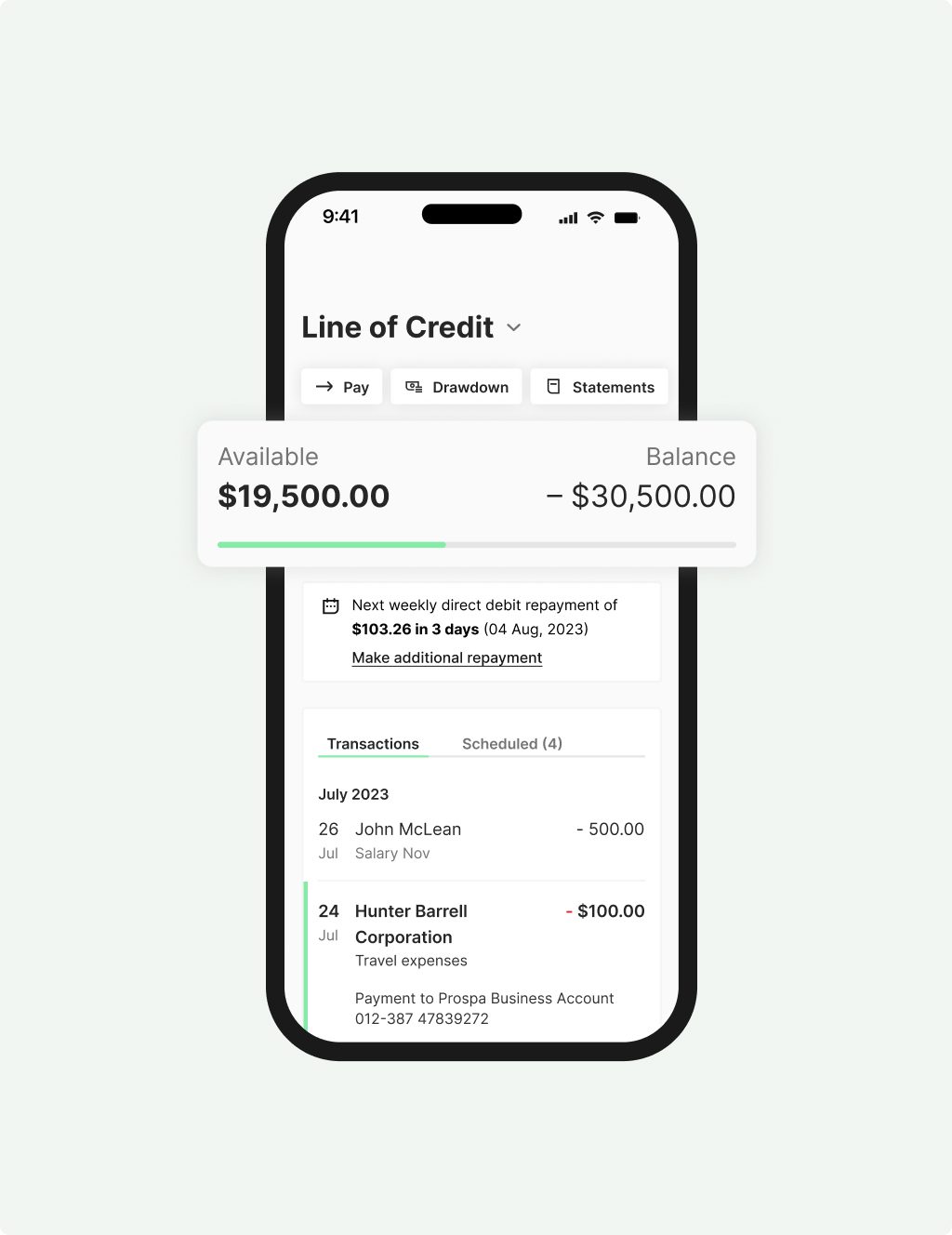

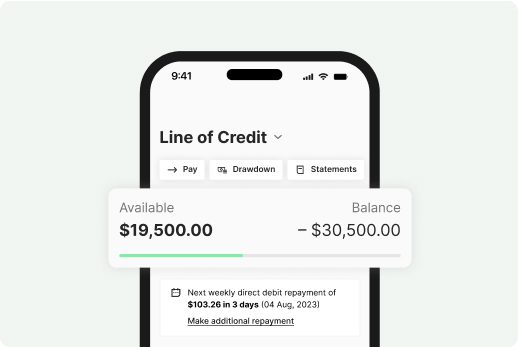

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

What are the criteria for a small business loan?

The lending criteria for a small business loan from Prospa include a minimum trading history as well as a minimum monthly turnover of $6K. For business loans of less than $150K, no upfront security is required. For amounts over $150K, your last 2 years financial reporting may be required. All applications require an active ABN and your business account details.

How hard is it to apply for a small business loan?

The application process including to find out whether you qualify for a business loan from Prospa is quick and easy. For starters, you need to be an Australian business with minimum trading history and a monthly turnover of no less than $6K. For amounts over $150K, your last 2 years financial reporting may be required. We’ll also ask you for some identification documentation, like your drivers licence and you’ll need to provide your ABN.

As a responsible business lender, we do a credit check at the time of your application. When you apply, we’ll talk to you about how business is going and what plans you have. Every application that we receive is carefully reviewed and all details relevant to the financial circumstances of your business are taken into consideration. We will only approve a loan if we believe you have the capacity to repay the loan and that the fixed repayments will work comfortably in your cash flow.

Do I need a business plan to get a small business loan?

Applying for funding from Prospa is quick and easy. We won’t ask you for a business plan at the time of your application. For amounts over $150K, your last 2 years financial reporting may be required.

How to get a business loan

Getting a business loan from Prospa can be a quick and hassle-free experience. Our online application form can be completed in less than 10 minutes and we specialise in fast decisions. If your application is approved, we will send you a loan contract. Once you have reviewed the loan contract and chosen to accept the offer, we then release the funds, sometimes almost immediately. In many cases, if all goes to plan funds can be received within just 24 hours or the next business day.

Talk to Australia’s #1 online lender to small business

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

FAQs

Frequently asked questions

A Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support business cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more.

Prospa considers the health of a business to determine creditworthiness. For Small Business Loans or Business Lines of Credit up to $150K, no asset security is required upfront to access. And provided you continue to meet your loan obligations (as detailed in your contract), asset security won’t be required.

For funding over $150K, or where your combined funding to our products exceeds $150K, property ownership required, and asset security may be required.

We offer Business Loans up to $1M or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

Other questions?

Awards, thanks to you

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |