Grow your business and manage cash flow with the right commercial loan. Discover different loan types, compare rates, and plan your funding strategy.

At a glance

- A commercial loan helps Australian businesses manage cash flow, fund upgrades, or expand without giving up ownership or equity.

- Options include secured and unsecured loans, with rates and terms determined by your business’s cash flow, credit profile, and loan purpose.

- Flexible repayment structures and fast online applications from lenders like Prospa make accessing funding simpler and more adaptable than ever.

You know what’s next: stocking up, hiring staff, or upgrading your space. The question is, which funding option gives you the flexibility and confidence to bring that plan to life?

A commercial loan is designed specifically for business use, helping you:

- Manage cash flow during busy or quiet periods

- Upgrade equipment or your workspace

- Refinance debt or fund new opportunities

According to Equifax, small business loan demand rose 3.9% year-over-year in Q1 2025, showing that more owners are turning to commercial finance to fund growth or maintain stability.

Understanding how commercial loans work and how to compare rates can help you make faster, smarter funding decisions for your business.

What is a commercial loan?

A commercial loan gives your business access to funds for bigger moves, whether that’s taking on a new fit-out, covering supplier costs, or investing in growth. It’s finance tailored to business operations, not personal use, and it’s often structured around your revenue and cash flow rather than just collateral.

For small businesses like cafés, salons, or tradies, this kind of funding can be the difference between missing out on a good opportunity and acting on it. The right loan can help you stay competitive, manage costs more smoothly, and keep momentum during times of change.

What are the types of commercial loans?

When your business needs extra capital, the type of commercial loan you choose can shape how flexible and cost-effective your financing will be.

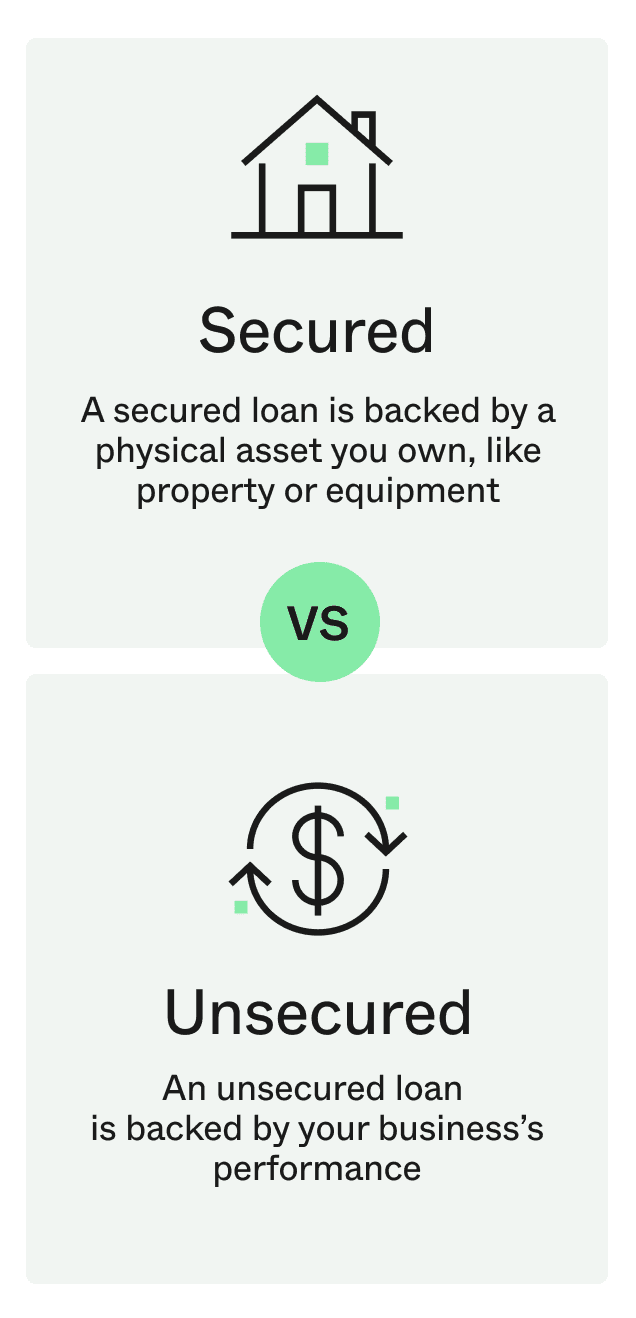

Secured loans: stability with lower costs

A secured loan uses business assets such as property, vehicles, or equipment as collateral. Because this lowers the lender’s risk, you’ll often get:

- Lower interest rates

- Higher borrowing limits

- Longer repayment terms

These are ideal when funding major investments like café fit-outs, salon renovations, or equipment upgrades. Just keep in mind that if repayments can’t be met, the lender may claim the asset used as security.

Unsecured loans: fast and flexible access

An unsecured loan doesn’t require collateral; approval depends on your business’s cash flow, trading history, and credit profile. This option is faster to secure and works well for short-term needs like stock orders, payroll, or marketing campaigns. Because there’s no security attached, interest rates tend to be slightly higher and loan sizes smaller.

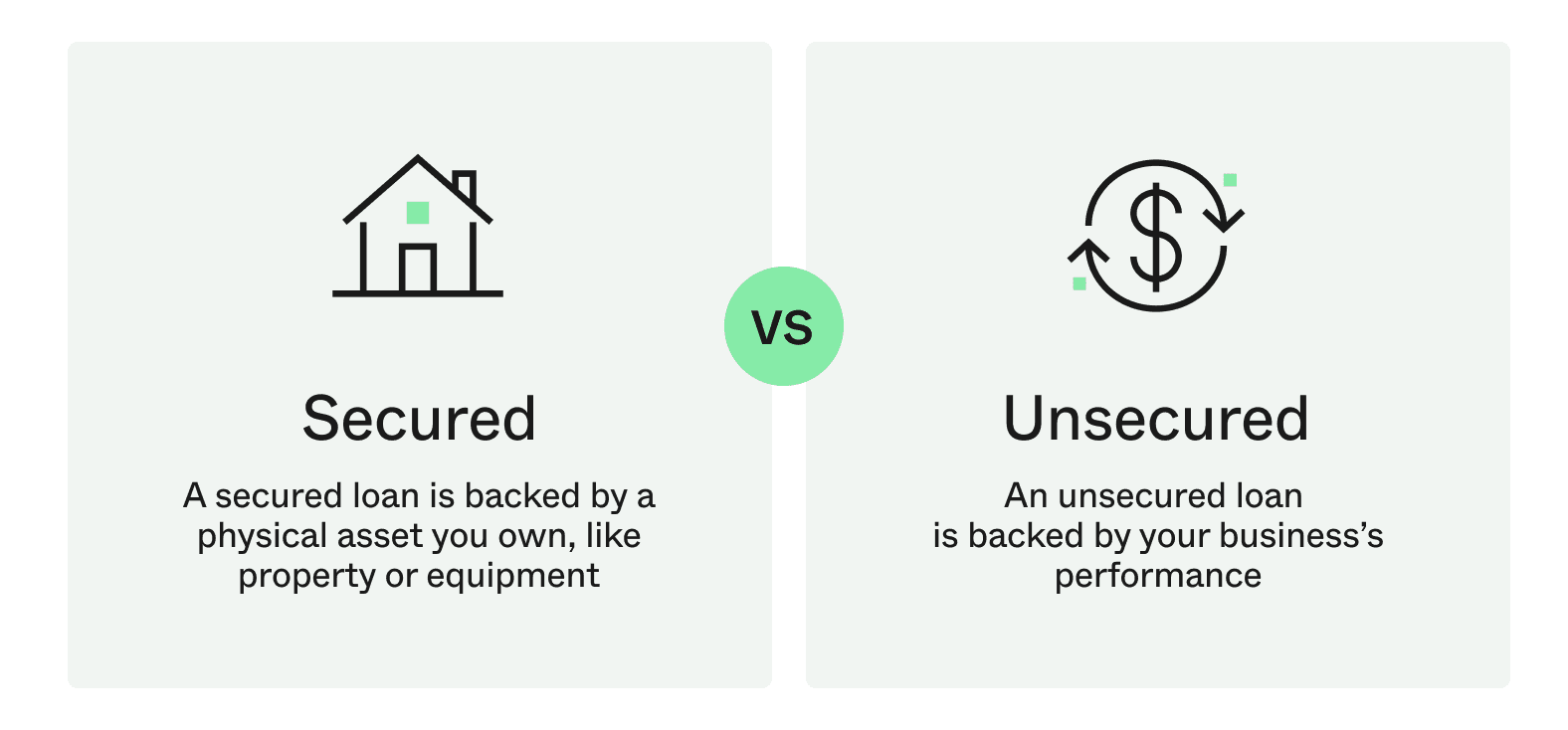

Comparing secured and unsecured business loans

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Required (assets) | Not required |

| Interest Rate | Lower | Higher |

| Loan Amount | Usually higher | Usually lower |

| Risk to Lender | Lower (collateral can be seized) | Higher |

| Approval Criteria | Focus on asset value | Focus on creditworthiness |

Equipment/Asset Finance

This is a type of secured loan used specifically to purchase a business asset, like a vehicle, machinery, or IT hardware. The loan is secured by the asset itself, which often means you can get lower rates.

Overdraft/Line of Credit

This isn’t a lump-sum loan, but a flexible credit line. It gives your business access to funds up to a set limit, and you only pay interest on the amount you actually use. It’s ideal for managing short-term cash flow gaps.

Choosing what fits best: For small businesses, it’s about matching the right loan to your goals. A secured loan can unlock bigger opportunities at a lower cost, while an unsecured loan gives you speed for urgent needs. Equipment finance is ideal for purchasing a specific asset, and a line of credit offers flexibility for managing day-to-day cash flow.

Commercial loan rates

Commercial loan rates are shaped by several key factors. First is the loan term (shorter terms can mean lower total interest but higher monthly repayments) and your business risk (lenders may offer higher rates to businesses with irregular cash flow or limited financial history).

Here are the most common loan types:

- Secured loans (backed by assets) typically range from 11.95%–20% p.a. Because collateral lowers risk, these loans usually offer better rates and longer repayment terms.

- Unsecured loans (no collateral) can range anywhere between 14.95%–45% p.a. They’re faster to access but carry slightly higher costs due to increased lender risk.

- Equipment/asset finance: These loans are secured by the asset you’re buying (like a vehicle or machine). This specific security means rates are often lower.

- Overdraft/line of credit: This gives you flexible access to funds up to a set limit. You only pay interest on what you use.

- Bad credit business loans: For businesses with poor credit history, these loans present a higher risk to lenders, which is reflected in higher rates.

Typical 2025 commercial loan rate ranges

| Loan Type | Starting Range | Typical Range |

|---|---|---|

| Secured business loan | 11.95% | 11.95%-24% p.a. |

| Unsecured business loan | 14.95% | 14.95%-45% p.a. |

Always check the RBA’s official rate data and the latest from major lenders for a reliable, unbiased comparison.

The headline rate is only one part of the cost. To find the most cost-effective option, you must also consider one-off origination fees and the Annual Percentage Rate (APR), which combines interest and fees into a single figure for comparison. Even a small difference in the APR can mean thousands in savings over a loan’s lifetime.

It’s also important to know how the interest is calculated. Most standard loans use a p.a. (per annum) rate calculated on the reducing balance of the loan, while other lenders may use a simple interest rate calculated on the original loan amount.

To stay competitive and keep innovating sustainably, Craig Taplin of Aussie Soles used several Prospa Small Business Loans to fund research into eco-friendly materials, boost marketing, and manage cash flow through seasonal peaks—all without putting his assets on the line.

“The application process with Prospa was so easy, and they gave me a really good deal right from the beginning. The loans have given me the ability to expand the range, as I’ve wanted to add in new products, and it’s given me the ability to order larger quantities through my pre-season orders.” |

|---|

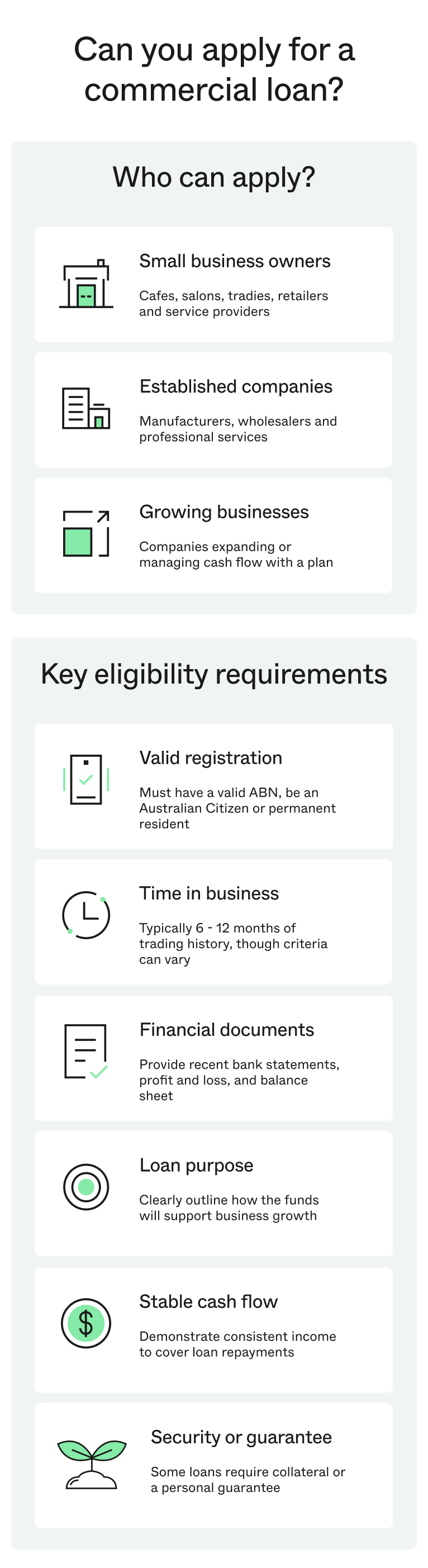

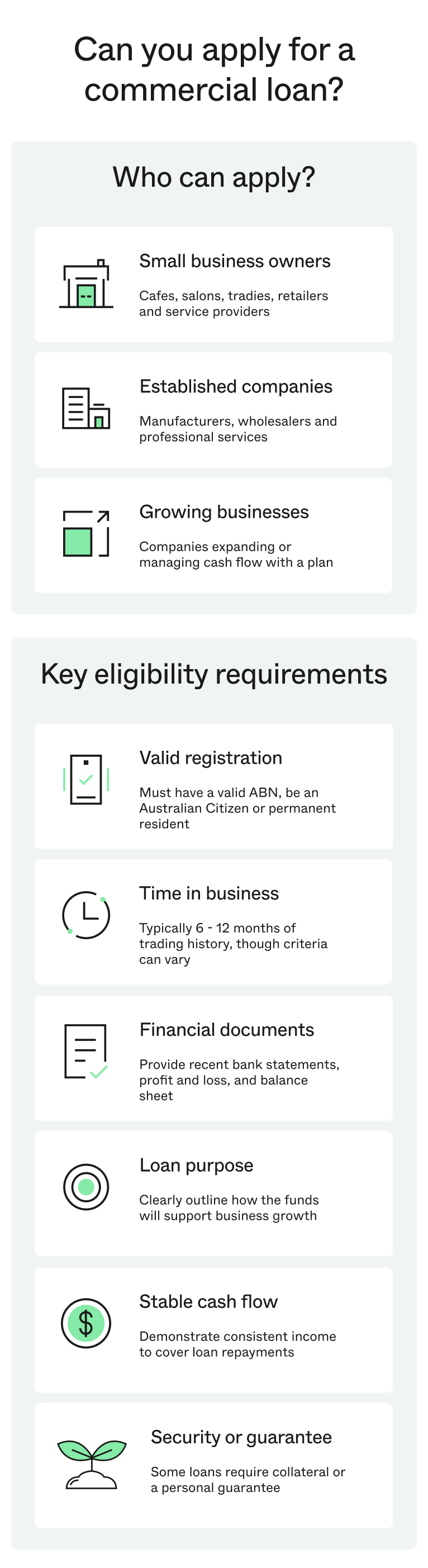

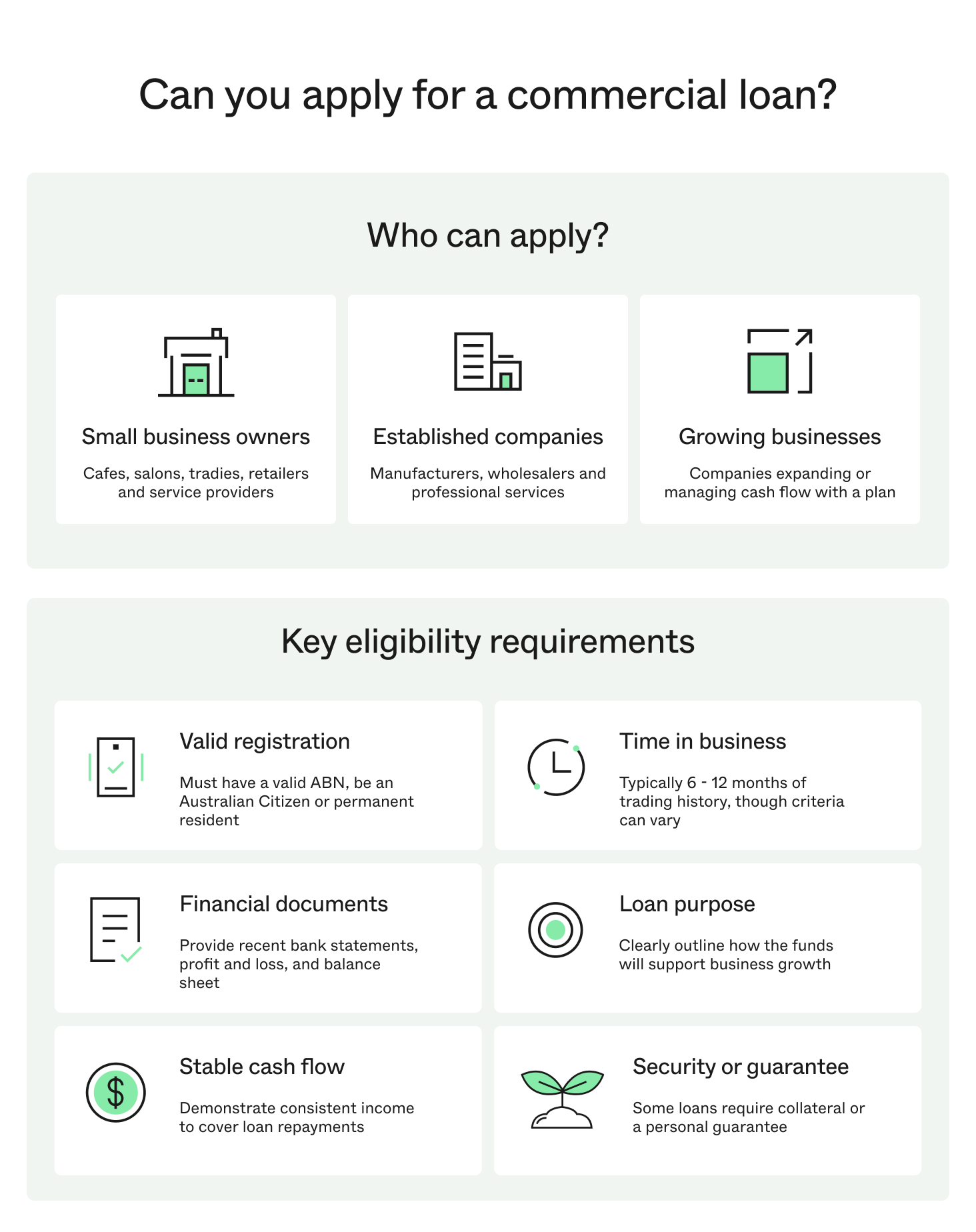

Who can apply for a commercial loan?

Almost any business in Australia, from small local cafés to established companies, can apply for a commercial loan, provided they meet a few key criteria. Eligible applicants include sole traders, partnerships, companies (Pty Ltd), and trusts, as long as the business is legally registered and trading.

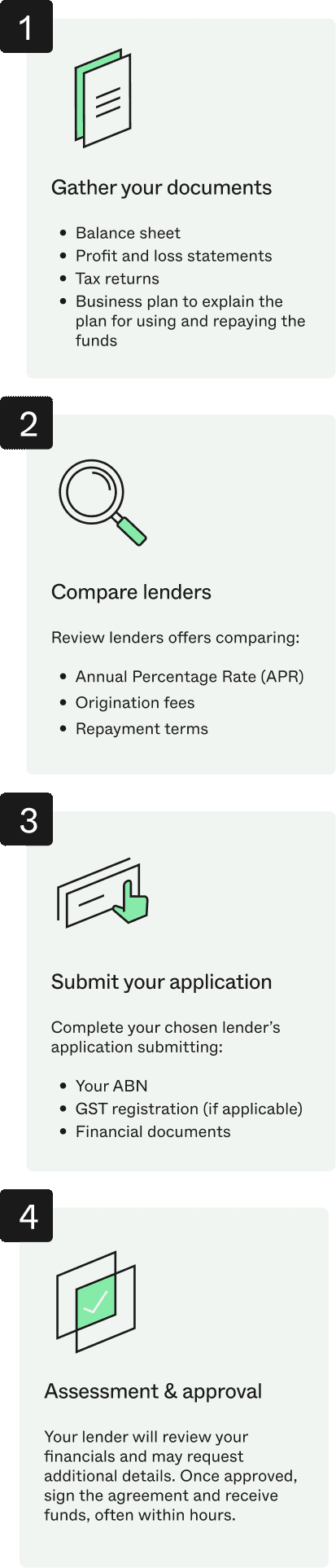

How do you apply for a commercial loan?

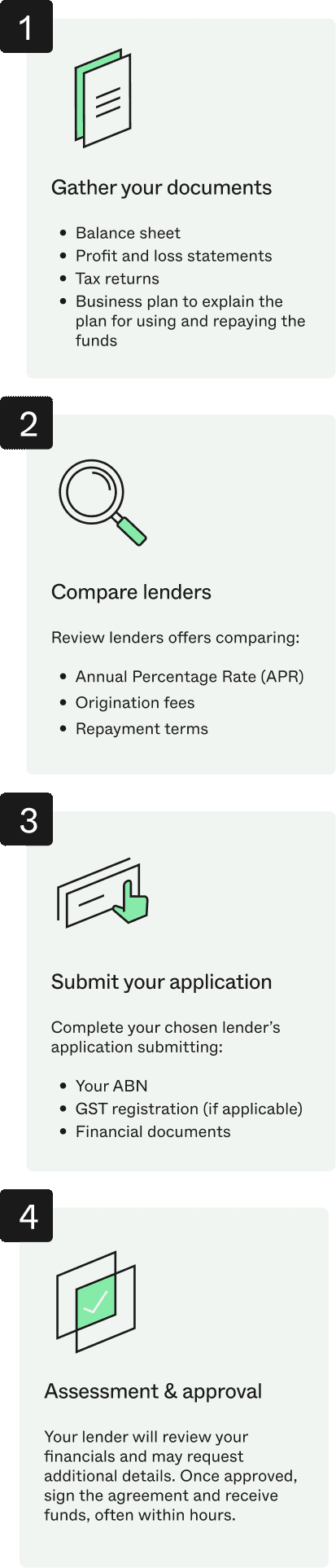

Applying for a commercial loan doesn’t have to feel complicated. Follow these key steps to streamline your application and boost your approval chances.

- Step 1: Gather your financial documents. Prepare a recent balance sheet, profit and loss statements, tax returns, and a simple business plan that explains how you’ll use the funds and repay them.

- Step 2: Compare lenders and total cost. Review offers from trusted finance providers and banks. Look beyond the headline interest rate and compare the Annual Percentage Rate (APR), origination fees, and repayment terms to find the true cost and secure the best deal for your business.

- Step 3: Submit your application. Complete your chosen lender’s online or in-person application. Have your ABN, GST registration (if applicable), and financial documents ready.

- Step 4: Assessment and approval. Your lender will review your financials and may request additional details. Once approved, sign the agreement and receive funds, often within 24 hours, for alternative commercial loan lenders like Prospa.

Use the Prospa Commercial Loan Calculator to estimate repayments and explore flexible funding options tailored to your small business.

How to apply for a commercial loan

How commercial loans help you grow without losing control

Commercial loans give businesses the freedom to fund growth, from hiring staff and upgrading equipment to opening new locations without giving up ownership or equity. Unlike investors, lenders don’t take a share in your company. You receive the funds you need upfront, repay them over time, and retain full control over every decision and future profit.

Why it matters: Once your loan is repaid, your obligations end and your business remains entirely yours. That’s the power of non-dilutive funding.

Flexible repayment options that fit your business

Commercial loans are designed to adapt to your cash flow, not the other way around. Lenders often offer tailored repayment structures, such as:

- Interest-only periods to free up cash during slower months

- Seasonal or variable schedules that align with your revenue cycles

- Hybrid interest rates combine fixed and variable options for flexibility

- Redraw and payment holiday features on certain products

- Negotiable loan terms that match your growth plans

These features allow small businesses to borrow safely, plan sustainably, and continue investing in what matters most, all while maintaining ownership and control.

Ready to fund your big plan? Apply online in 10 minutes and get a fast decision.