Commercial Loan

Discover Prospa's range of commercial lending solutions and get quick access to capital for all your business needs. You've got a plan, let's make it happen.

- Commercial funding options up to $1M

- Fast decision and funding possible in 24 hours

- No upfront security required to access

Prospa funding up to $150K - Apply online in just 10 minutes

Grow your business with a commercial loan

Apply for a commercial loan from Australia’s #1 online lender to small business and receive not only the funds you need to grow your business, but also dedicated care and support from a commercial loan broker who specialises in helping Aussie businesses to never miss an opportunity.

Prospa is more than just your average lender. Our commercial loans have already helped tens of thousands of local Australian businesses to maintain their cash flow and concentrate on building their opportunities for growth and long-term stability.

Commercial finance options for:

- Managing staff during peak periods

- Expansion or renovations

- Capital purchases

- Payroll support

- Marketing campaign or rebrand

We will help you assess your business potential

Our Business Lending Specialists are available Monday to Saturday, providing ongoing support. We’ll offer finance solutions to help you reach important milestones and develop long-term, sustainable growth.

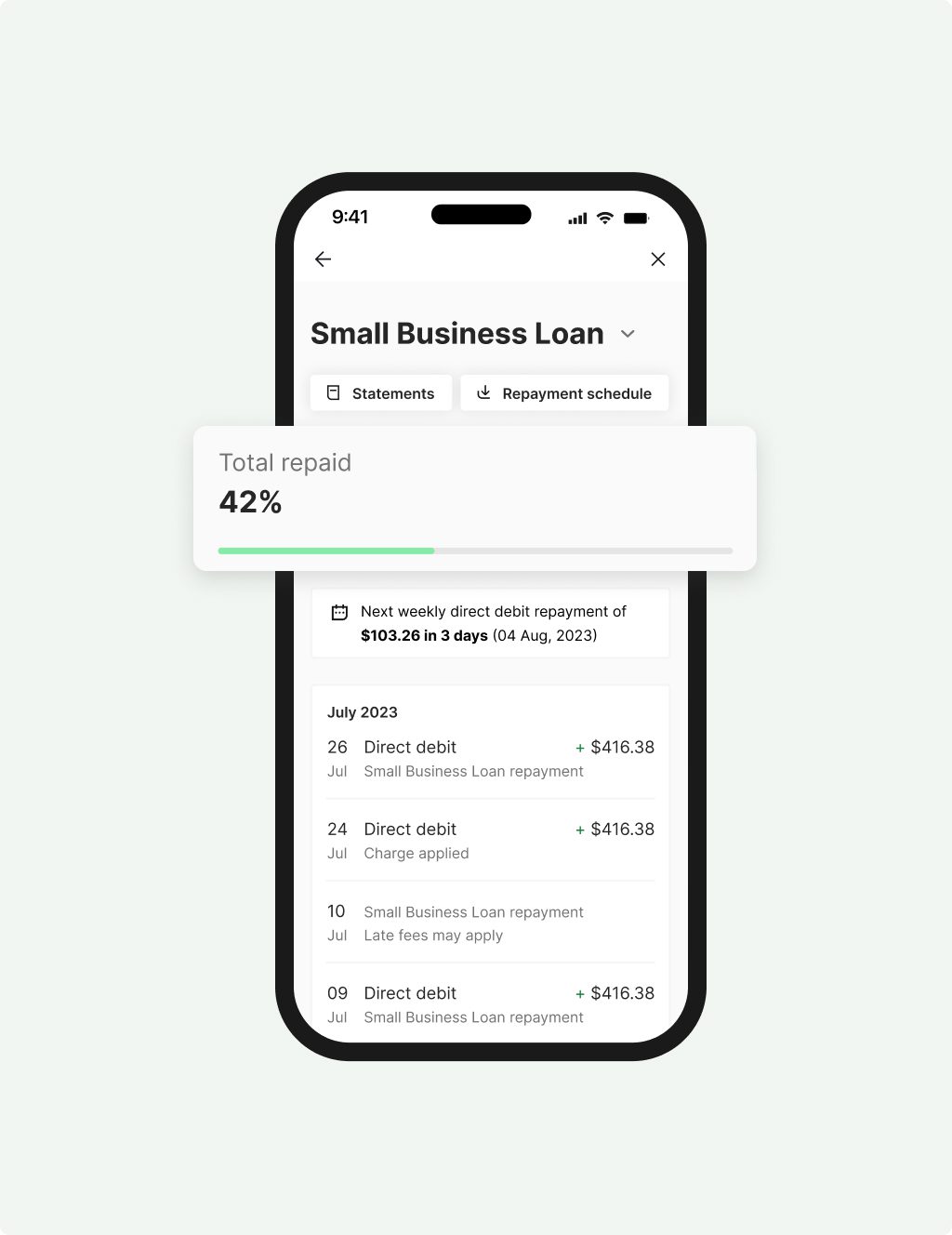

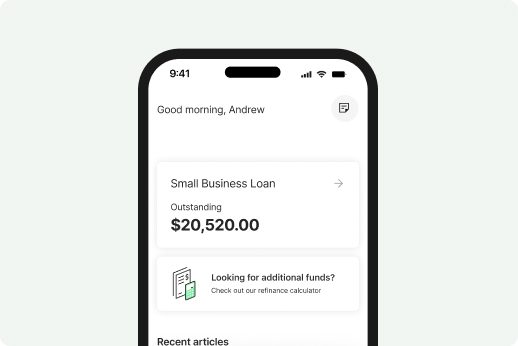

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

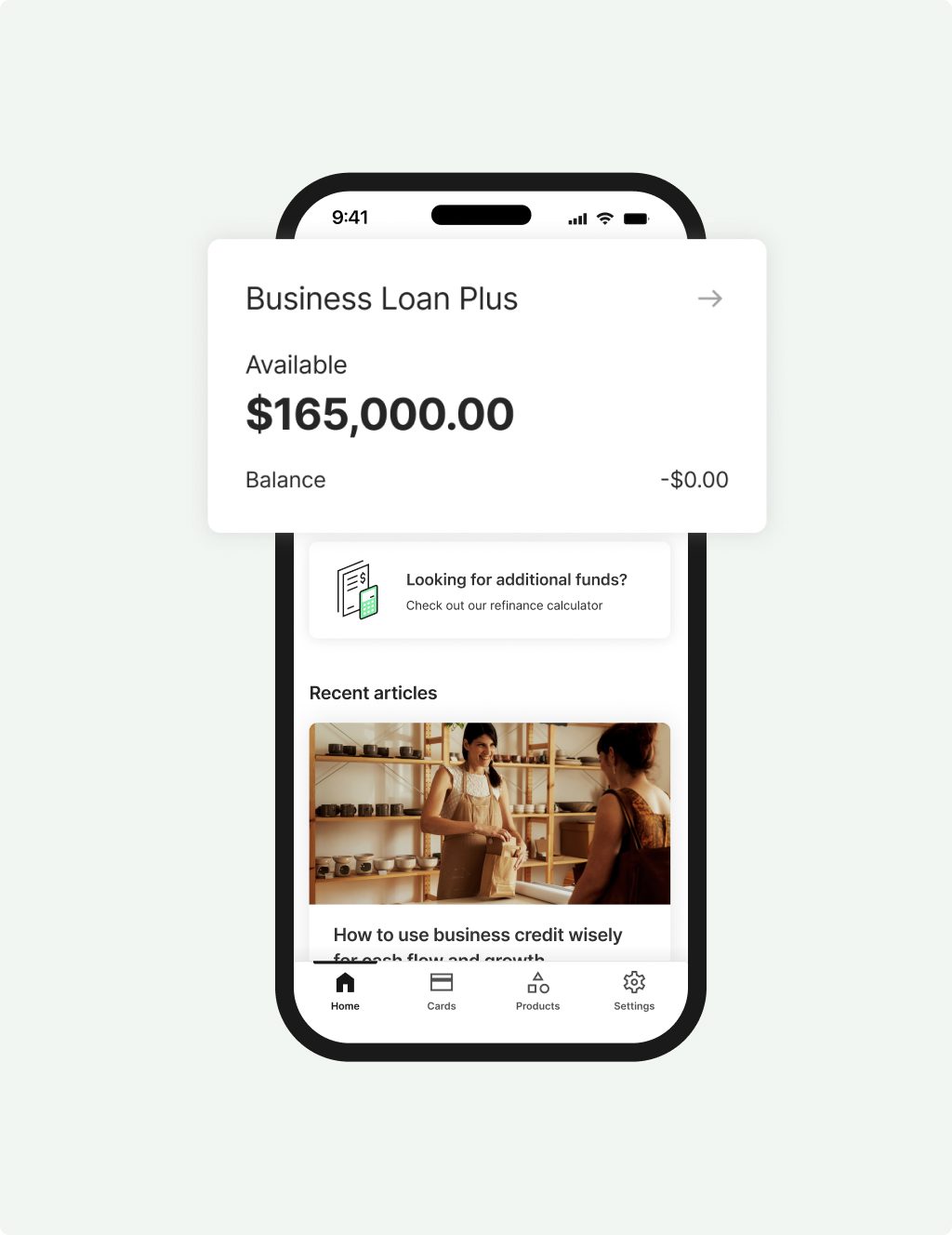

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

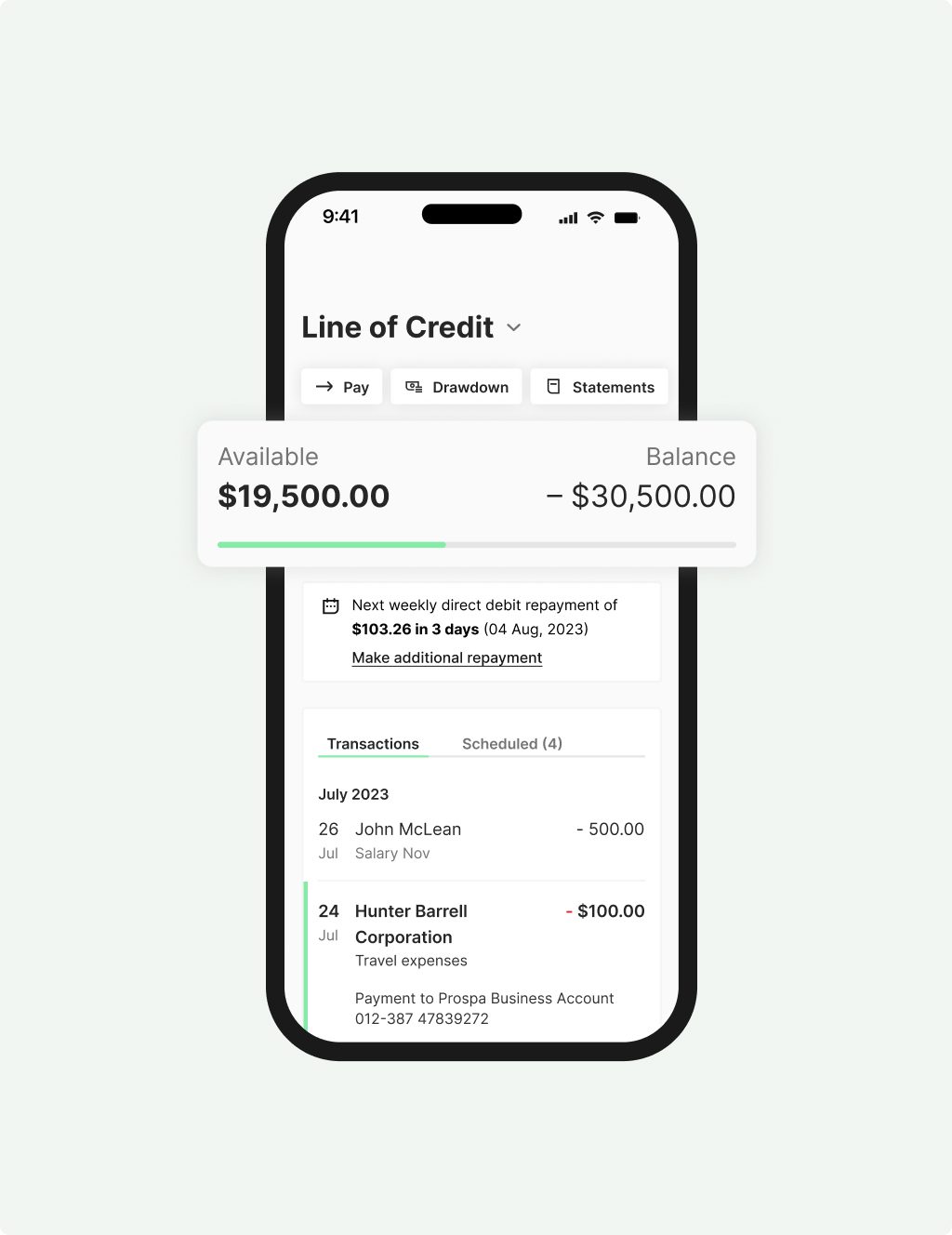

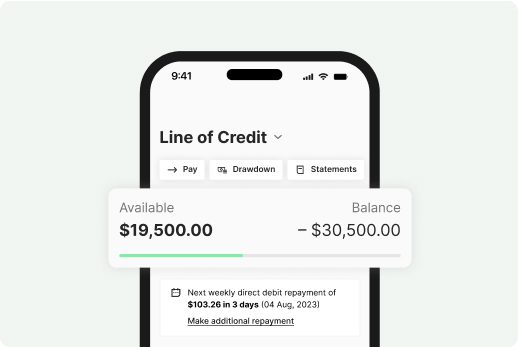

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

01

Apply online in under 10 minutes

02

Get a same-day decision

03

Access your funds

01

Apply online in under 10 minutes

02

Get a same-day decision

03

Access your funds

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

Customers making it happen with a Prospa loan

Read Customer StoriesFAQs

Frequently asked questions

A Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support business cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more.

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

Often, you can have the funds in your account in as little as 1 hour after settlement.