What’s not to love about a public holiday? Sleep-ins, traffic-free roads and the warm glow of relaxation – unless you happen to be a small business owner.

In that case, it’s hard to forget about the fact that a shorter week of trading doesn’t mean that rent and other expenses also get trimmed.

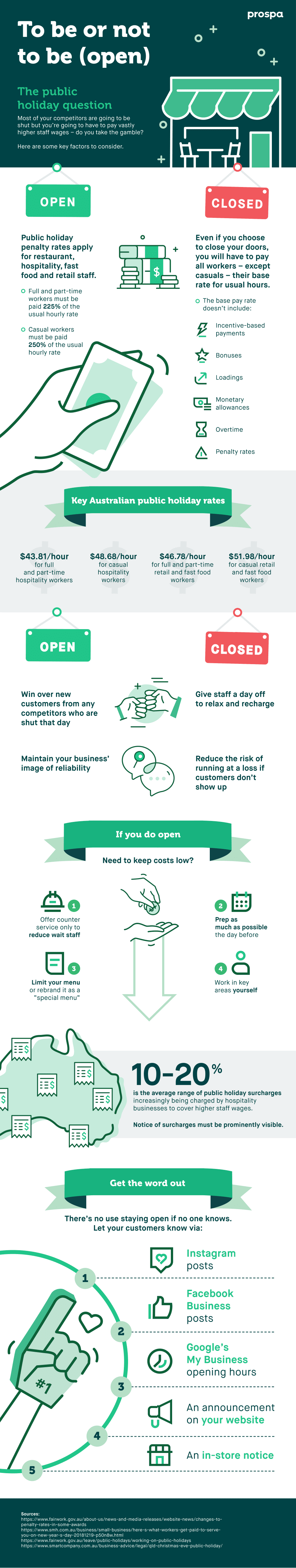

The decision of whether to open your doors or not on a public holiday can be a fraught one – opening often means paying higher penalty rates, but foot traffic can be unpredictable. Yet, staying shut means losing a day of trading, putting pressure on cash flow.

Every business (and every public holiday) is different, so there’s no magic formula for determining whether it’s worth your while to forgo the lure of a backyard barbecue in favour of opening up shop, but there are some key considerations that need to be factored into your decision.

If you need a little financial help to tide you over during the quiet holiday period, talk to Prospa about how a business line of credit might be able to help support cash flow.