The sentiment of small business owners right now, and the techniques some are adopting to foster growth as we enter the new year.

While long-term confidence among small and medium-sized business owners remains shaky, their short-term outlook is brighter, with many planning to broaden their ventures and invest in growth strategies.

In a recent poll on their future outlook, 43% of small business owners and decision-makers expressed confidence about the next 12 months. This marks an increase from 39% in March and is nearly aligned with the 44% seen during the latter half of 2022.*

The picture is much more rosy than the second half of 2020, with a mere 23% of owners optimistic about the upcoming year that September.

Looking further down the line, long-term confidence has remained relatively consistent. Right now, just 35% of business owners are hopeful about their business’s trajectory over a span of five years, slipping from 39% in June and 38% from a year ago.

However, sentiment varies based on business size and sector. Larger enterprises displayed greater optimism for the coming 12 months. A modest 36% of small businesses with turnovers below $100,000 showed high confidence. This contrasts with 48% of businesses generating between $100,000 and $2.5 million, and 46% of entities surpassing the $2.5 million mark.

Businesses rooted in secondary industries were most optimistic about the upcoming year, with 49% of owners highly confident about the future, while those in consumer services and transport-dependent domains lagged in confidence (with 39% and 37% feeling highly confident respectively).

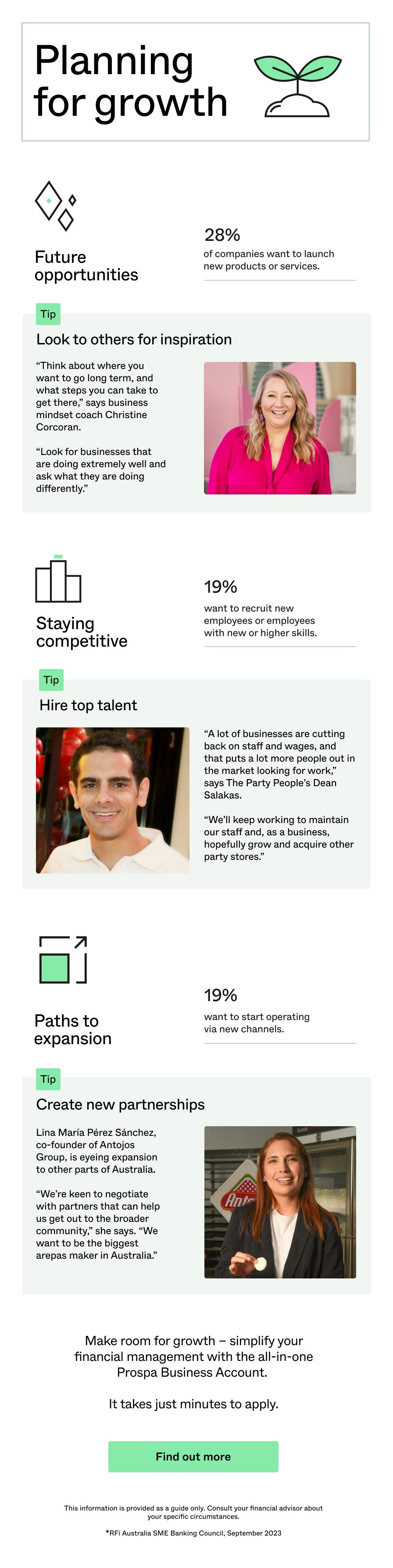

With an eye on a brighter horizon in the forthcoming year, small and medium businesses are gearing up for growth-driven investment: 43% aim to boost their revenue, 39% are set on refining efficiency, and 35% plan to bolster their savings.

Here, small business owners share how they’re feeling in the second half of this year and what they’re doing to boost growth, with tips from an expert.

This information is provided as a guide only. Consult your financial advisor about your specific circumstances.

*RFI Australia SME Banking Council, September 2023