Don't let a slow loan approval hold your business back. Discover the key factors that determine funding speed and get actionable tips for a fast decision.

At a glance

- Business loan approval times typically range from two to six weeks with traditional banks, while online lenders can often approve and fund within hours.

- Your loan size, application quality, and trading history directly impact how quickly you can get approved.

- Being prepared with your ID, ABN, recent bank statements, and a clear funding purpose generally helps secure faster approval.

When opportunity knocks or an unexpected cost lands, business owners often need funds quickly. A supplier offers a discount on bulk stock. Equipment breaks down when you need it most. Payroll deadlines loom. In these moments, timing is everything.

Approval times for business loans can range from just a few hours to several weeks. The right lender can mean the difference between taking action or watching an opportunity slip away. This guide shows how long business loans take in 2025, what affects the timeline, and what you can do to speed things up.

Understanding business loan approval timelines

When cash flow is tight, waiting weeks for an answer just isn’t an option. That’s why it pays to understand what different lenders mean by “fast.”

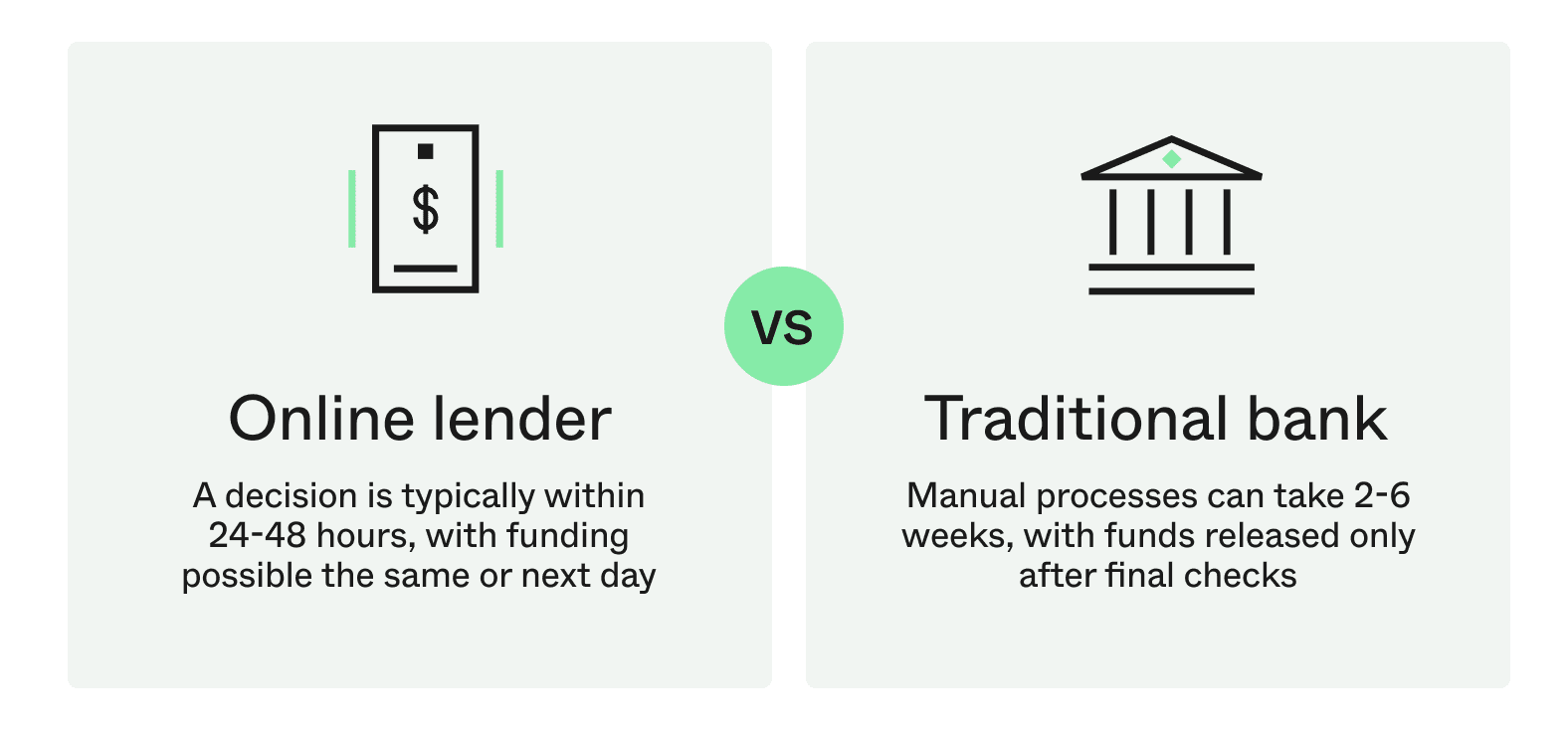

With a traditional bank, you can expect multiple forms, credit checks, and sometimes property valuations. This process relies on manual assessments and paperwork, so timelines often stretch anywhere from two to six weeks before funds are released.

Online lenders use technology to fast-track the process. Thanks to automated data checks and digital applications, they can typically turn around a decision within 24 to 48 hours, with funds following shortly after. In some cases, approval and funding can happen in as little as one hour.

How fast is ‘fast’?

Many lenders promote “instant approval” or “same-day funding.” These terms sound simple, but it helps to know what they really mean.

- Instant approval usually refers to an automated check to confirm you meet basic criteria. It’s not final approval, and funds are only released once verification is complete.

- Same-day or 24-hour funding can be realistic, but only if the application is complete, all requirements are met, and it’s submitted before the lender’s daily cut-off.

Let’s say you run a retail store and need $25,000 to lock in discounted Christmas stock. You apply at 9 a.m. with your ABN, driver’s licence, and recent bank statements. Because everything is ready, an online lender can approve within hours and transfer funds the same day. With a bank, the same request could take weeks, and by then the deal could be gone.

Need funding to cover expenses or seize an opportunity? Check your eligibility today.

Key factors that influence your loan approval speed

Every business is different, and so is every loan application. The time it takes for a lender to make a decision usually comes down to how easily they can confirm the health of your business and the level of risk involved. The main factors include:

The type of lender you choose

Online lenders use automated checks to speed things up. Some can respond in as little as one hour if you link your bank data through secure verification.

Traditional banks rely on manual assessments and extra paperwork, which means approval can take much longer.

The quality and completeness of your application

The fastest approvals happen when everything a lender needs is ready to go. Missing or unclear information is the most common cause of delays. Using instant bank verification instead of uploading documents can save valuable time. If you upload copies of bank statements, it may take a little longer.

Your business’s health and trading history

A business with consistent cash flow and a clear trading record is simpler to assess. It shows you can comfortably handle repayments, which reduces the need for extra checks.

For younger businesses or those with variable income, the lender may need more time to understand the risk. Even with a less-than-perfect credit history, you can access fast business funding if you can show steady trading and reliable cash flow.

Donna Skavlos, who runs Donna’s Beauty Cottage, a home-based beauty therapy business in Sydney, used a Prospa Small Business Loan to cover Christmas inventory and keep her shelves stocked for the busiest time of year.

“I spend around $15,000 at this time of year on stock, and most of that isn’t in my account, so it can be stressful finding the funds to pay for it,” says Donna. “I found getting loans as a sole trader was a nightmare. Traditional lenders want you to give them a kidney! It was such a headache. But it was the easiest process I’ve ever experienced. I uploaded my bank statements, and the money was there within 24 hours. It was so quick and easy.”

Need funding to cover expenses or seize an opportunity? Check your eligibility today.

Does the type of business loan affect approval times?

Yes. The loan type you choose can have a big impact on how quickly funds are approved.

Unsecured options like a small business loan are usually the fastest. With no property valuations or complex security required, lenders can make decisions quickly and release funds within hours. In contrast, large-scale asset finance or property-backed loans involve additional checks and paperwork. These can add weeks to the approval process.

If your priority is fast working capital to cover expenses, buy stock, or smooth cash flow, an unsecured solution is often the most practical path.

How to prepare for a faster business loan approval

The fastest approvals happen when you make it easy for a lender to say yes. That means having the right information on hand and being clear about what the funds are for. A little preparation can save hours, sometimes days.

1. Have your documents ready before you apply

With only a few essentials needed, some business loans are easy to get approved quickly, provided your information is ready to go. Online lenders don’t ask for endless paperwork, but they do need a few essentials:

- Driver’s licence or another form of ID

- Australian Business Number (ABN)

- Access to recent business bank statements

2. Know your numbers and your reason for funding

Lenders want to see that you understand your business. Having a clear picture of your revenue, expenses, and cash flow makes the assessment smoother.

It also helps to be specific about your purpose for funding. Are you covering a tax bill, ordering extra stock ahead of peak season, or hiring staff for a new contract? The clearer your plan, the easier it is for a lender to approve the right amount quickly.

What Prospa’s application and approval process looks like

If you’re ready to apply, the process is simple and built for speed. Here’s how it works:

- Complete the online application. The form takes less than 10 minutes. For funding up to $500K, you will need to have your driver’s licence number, ABN, bank login details or bank statements ready.

- Link your bank statements. The fastest option is Prospa’s secure bank verification system. This gives instant access to recent business bank statements and can mean a response in as little as one hour. You can also upload your bank statements manually, though it may take longer.

- Get a fast decision. Many applications receive an answer on the same business day. For straightforward requests, a decision may come within hours.

- Funds in your account. Once approved, settlement is quick. In many cases, funds are available in your account within hours, sometimes as soon as one hour after settlement.

Because the process is digital and streamlined, there is no need for long meetings, lengthy paperwork, or waiting weeks for an outcome. That means you can focus on running your business while the funding is processed in the background.

The bottom line

Fast business loan approvals come down to two things: being prepared and choosing a lender built for speed. With both in place, you can act quickly and keep your business moving forward.

Need funding fast? Start your 10-minute online application today and see how quickly you could access the support your business needs.