At a glance

- A $10K loan can give small businesses the momentum to grow, adjust, or strengthen their operations.

- Business loan ideas that deliver the most impact are equipment upgrades, tech improvements or building financial resilience.

- Targeted funding can help improve efficiency, reduce stress and create space for long-term planning.

A $10,000 loan might not seem like a huge amount, but in the right hands, it can unlock the kind of momentum that leads to long-term growth. Deciding how to make it count is often the harder part.

Across Australia, small business owners are using modest loans to take strategic steps forward. Some are trialling new revenue streams, others are investing in equipment or creating a buffer in their cash flow. In many cases, these funding decisions are helping them stay agile, competitive, and focused on what matters most.

This article explores seven business loan ideas to show how $10K can be put to work. Because sometimes, small funding can kick off big moves.

Refresh your space to attract more customers

If your physical space isn’t working for you, chances are it’s quietly working against you. Customers notice more than we think. A cramped layout, limited signage, or purely functional setup might be holding your business back in ways that aren’t immediately obvious. It can affect how customers move through your space, how long they stay, and whether they choose to come back.

A small upgrade can improve how your business operates day-to-day, open the door to more sales, or make your brand feel more polished and professional. And with $10K in small business funding, you can make those changes without putting pressure on your day-to-day cash flow.

What could $10K cover?

If you’re running a small retail space (say, 50–80 square metres), a loan of this size could go toward:

- New signage and exterior paint: $2,000–$4,000

- Fresh furniture or display shelving: $1,500–$3,000

- Lighting upgrades: $1,000–$2,000

- Layout redesign or light partitioning: $1,500–$2,500

Real-world example:

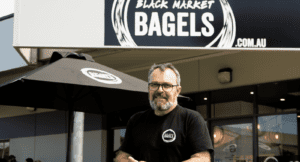

Black Market Bagels began in a commercial kitchen with no shopfront and no direct customer interaction. While their product was gaining traction, growth was capped by their limited visibility. With funding from Prospa, they moved into a retail space in Elsternwick. The new location allowed them to increase production, welcome walk-ins, and connect more deeply with their local community.

Expand delivery or mobile reach

When growth is your goal, opening a second location can feel like the obvious next step. But for many small business owners, the cost and commitment involved make that feel out of reach. Expanding your delivery range or adding a mobile service arm can be a more flexible way to grow, without the overhead of a new lease or additional staff.

A delivery van or mobile setup gives you access to new customers, reduces friction for existing ones, and builds brand visibility in new areas. It’s also a way to test demand before committing to larger investments.

What could $10K cover?

Depending on your industry and location, $10K in small business funding could help you:

- Purchase or upgrade a used delivery van: $6,000–$9,000

- Fit out a mobile treatment or service station: $1,500–$3,000

- Set up a booking or POS system you can use on the go: $500–$1,000

- Promote your new service area with local marketing: $500–$1,000

Real-world example

Tita’s Cakes began as a home-based cake business with big demand and limited delivery capacity. With a Small Business Loan from Prospa, Angelli was able to buy a used delivery van and extend her service range. That extra reach meant more orders, more customer referrals, and a growing reputation well beyond her local area. It also gave her the confidence to plan for her next step, a physical storefront.

Trial a new revenue stream with low risk

A $10K small business loan can give you the breathing room to test a new product or service without drawing from your main cash flow. If it works, it becomes a new arm of your business. If it doesn’t, you’ve learned something without putting everything on the line.

The key is to keep the trial small, focused, and easy to measure. That way, you can make an informed decision about whether to expand, refine, or walk away.

What could $10K cover?

Depending on your industry, a test run could include:

- Equipment or supplies for a limited product run: $2,000–$5,000

- A short-term social media campaign to promote the new offer: $500–$1,000

- Extra casual staff for fulfilment or delivery: $1,000–$2,000

- Website or online store updates to support the trial: $500–$1,000

Real-world example

When lockdowns halted tourism, Manly Bikes saw its core revenue stream vanish almost overnight. Instead of waiting it out, owner Francisco Furman used a Small Business Loan from Prospa to pivot. He expanded the repair side of the business, added online parts and accessories sales, and shifted focus from short-term hires to longer rentals for locals. These changes helped stabilise income and laid the groundwork for a more resilient business model.

Buy equipment that boosts productivity

When you’re already at capacity, adding more hours to your day won’t solve the problem. The right equipment can save time, reduce errors, and help you take on more work without stretching your team too thin. If you’re relying heavily on manual processes or saying no to new jobs, a business expansion loan could unlock capacity you didn’t know you had.

What could $10K cover?

Depending on your setup, small business funding could help you:

- Buy specialised kitchen or café equipment: $3,000–$8,000

- Upgrade to commercial-grade tools or machinery: $4,000–$9,000

- Automate a manual admin process: $1,000–$3,000

- Train staff to use new systems safely and efficiently: $500–$1,000

Real-world example

Antojos Group built their reputation on traditional Colombian street food, but hand-making every arepa was slowing them down. Demand was growing, but capacity wasn’t. With a Prospa Small Business Loan, they bought an arepa machine that preserved the quality customers loved while significantly increasing output. The new equipment let them accept more orders, reduce pressure on the team, and scale the business at the right pace.

Fix the tech bottlenecks holding you back

If admin tasks are taking up your best hours, or you’re juggling too many disconnected systems, it’s time to upgrade your tech. The right digital tools can free you up to focus on growth, improve your customer experience, and make it easier to bring on help when you need it.

Often you don’t need a full rebuild, but just the final push to connect the dots: automating bookings, streamlining payments, or getting clearer data to make faster decisions.

What could $10K cover?

Depending on your needs, small business funding could help you:

- Upgrade your scheduling, CRM or inventory platform: $2,000–$5,000

- Integrate payments and invoicing tools: $1,000–$3,000

- Improve your website or customer portal: $2,000–$4,000

- Set up basic analytics and reporting dashboards: $500–$1,500

Real-world example

An online tutoring business was growing quickly, but their manual systems couldn’t keep up. Missed bookings, inconsistent payments, and customer frustration were slowing things down. They used a $10K loan to invest in an all-in-one scheduling and payments platform. Within six months, they’d tripled their client base and were able to onboard new tutors without added admin stress.

Build inventory ahead of peak demand

If you’ve ever run out of stock at the wrong time, you know how costly it can be. Delays frustrate customers, disrupt your workflow, and leave money on the table. A short-term cash injection can help you prepare for peak periods without putting pressure on your day-to-day operations.

Having what you need ahead of time can give you breathing room and unlock supplier discounts. It can also help you avoid express shipping costs and maintain consistent service during your busiest weeks.

What could $10K cover?

Depending on your business, small business funding could help you:

- Purchase extra stock or seasonal inventory: $5,000–$9,000

- Bulk buy key supplies at a discounted rate: $2,000–$6,000

- Order packaging, labels or marketing materials in advance: $500–$1,500

- Cover upfront supplier payments to avoid delays: $1,000–$3,000

Real-world example

At Donna’s Beauty Cottage, the lead-up to the holiday season is always the busiest time of year. To prepare, Donna used a Business Line of Credit from Prospa to purchase additional stock and supplies ahead of time. This meant she could meet customer demand without last-minute stress, maintain the quality of her services, and focus on her clients rather than chasing deliveries.

Create breathing room with a cash-flow buffer

Beyond expansion, a well-timed loan can also give your business more stability and flexibility, especially when income is uneven or you’re planning a shift in how you operate. Building a short-term cash buffer can help you cover essentials without stress, so you can focus on making better decisions instead of reacting to the next cash crunch.

This approach can be especially useful if you’re switching to a new model or taking time to improve systems or train staff. It can also reduce the temptation to take on work that isn’t the right fit just to keep cash coming in.

What could $10K cover?

Small business funding could support:

- Creating a three-month buffer for fixed costs: Rent, insurance, subscriptions

- Offsetting slower months during a seasonal dip

- Bridging income gaps when shifting pricing or service models

- Covering payroll or contractor costs during a growth phase

Real-world example

A boutique branding studio was transitioning from one-off jobs to retainer-based work. The gap between projects and recurring revenue made it difficult to plan ahead. They used a $10K loan to build a three-month cash buffer, which gave them time to restructure their workflow and focus on landing longer-term clients. That breathing room helped them stabilise their income and grow more intentionally.

Ready to put $10K to work?

If you’re considering funding to support your next move, it helps to have a plan. Discover how you can use business credit wisely for cash flow and growth.

And if you’re ready to take action, explore Prospa’s small business funding options to see what’s possible.