Business loans interest rates in Australia

A comprehensive guide for Australian Small Business Owner

When it comes to funding your small business in Australia, understanding the ins and outs of business loans interest rates is crucial. Choosing the right loan with favourable interest rates can make a significant difference in the financial health and success of your business.

In this guide, we will delve into the world of business loan interest rates, explaining how they are calculated, whether they are fixed, the understanding of Annual Percentage Rate (APR), additional fees and charges, and the differences between small business loans and lines of credit.

Many businesses rely on loans to fund growth and expansion. However, it’s important to consider the role that interest rates play in selecting the right financing option. These rates can significantly affect the overall cost of a loan, impacting your company’s cash flow and financial planning. Your business’s interest rate will depend on the lender’s criteria and your level of risk. To ensure you get the most favourable rate, talk to a Specialist at Prospa.

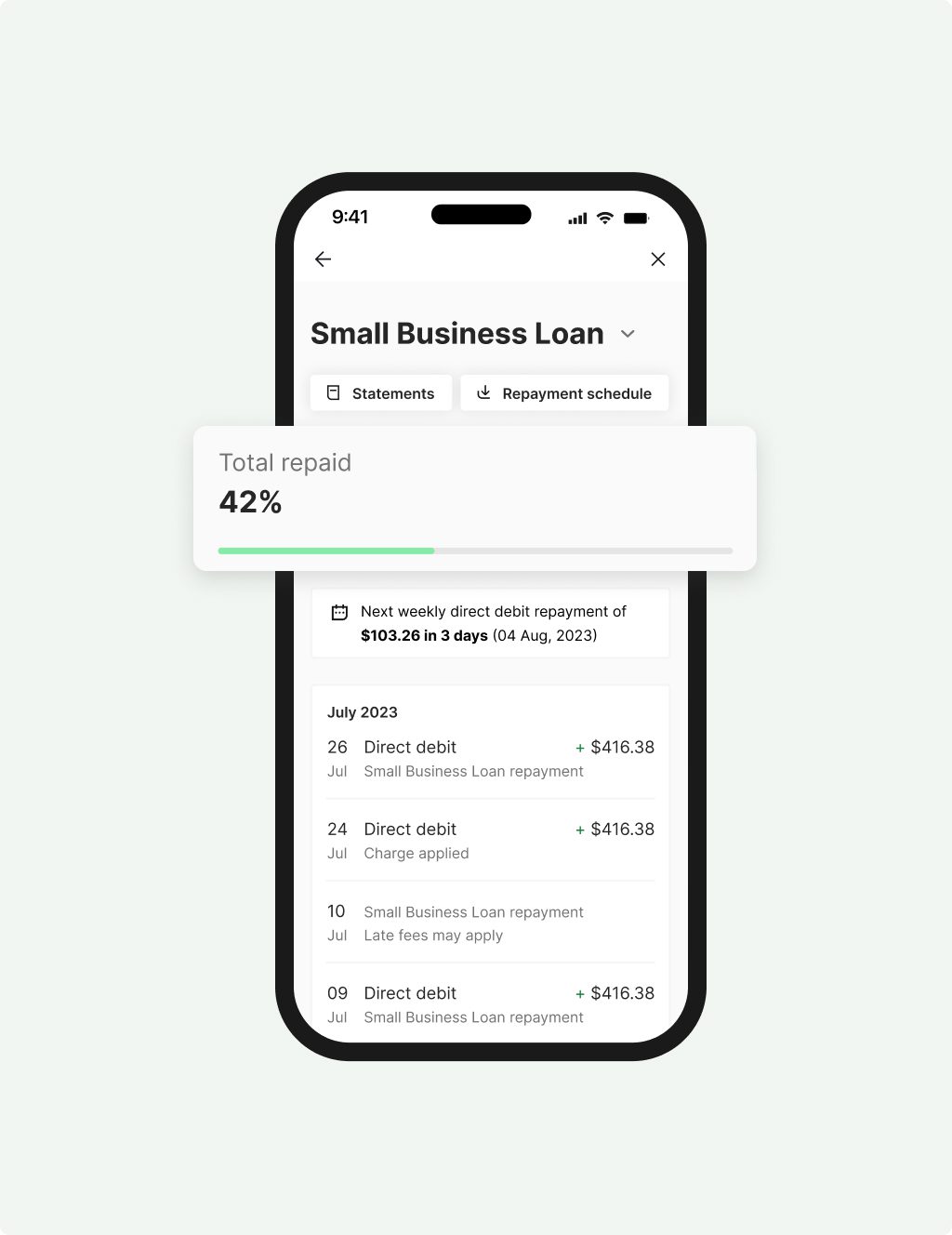

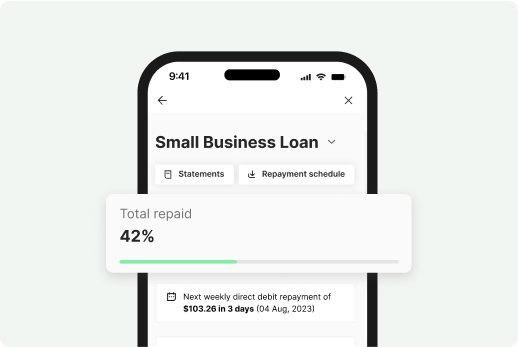

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

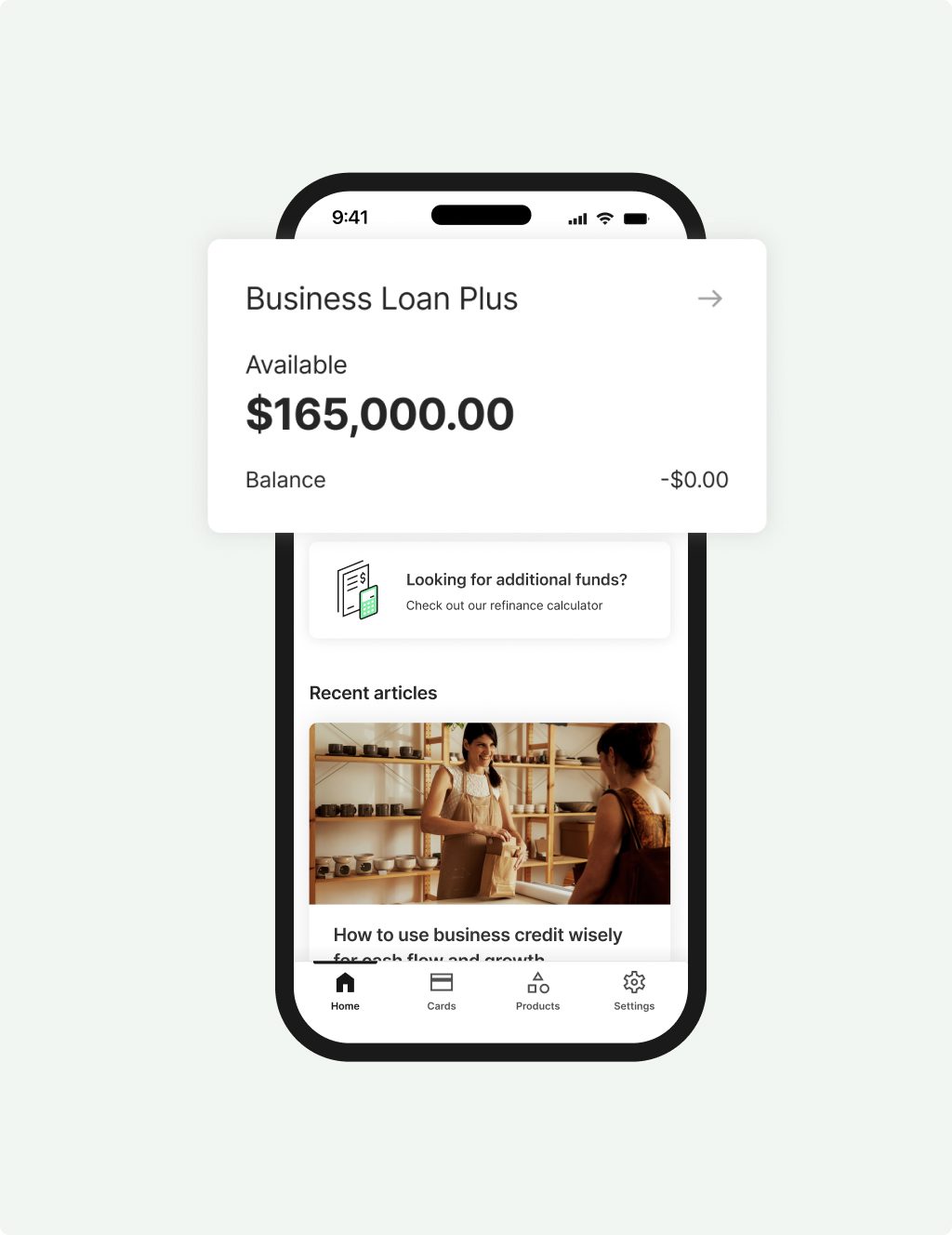

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

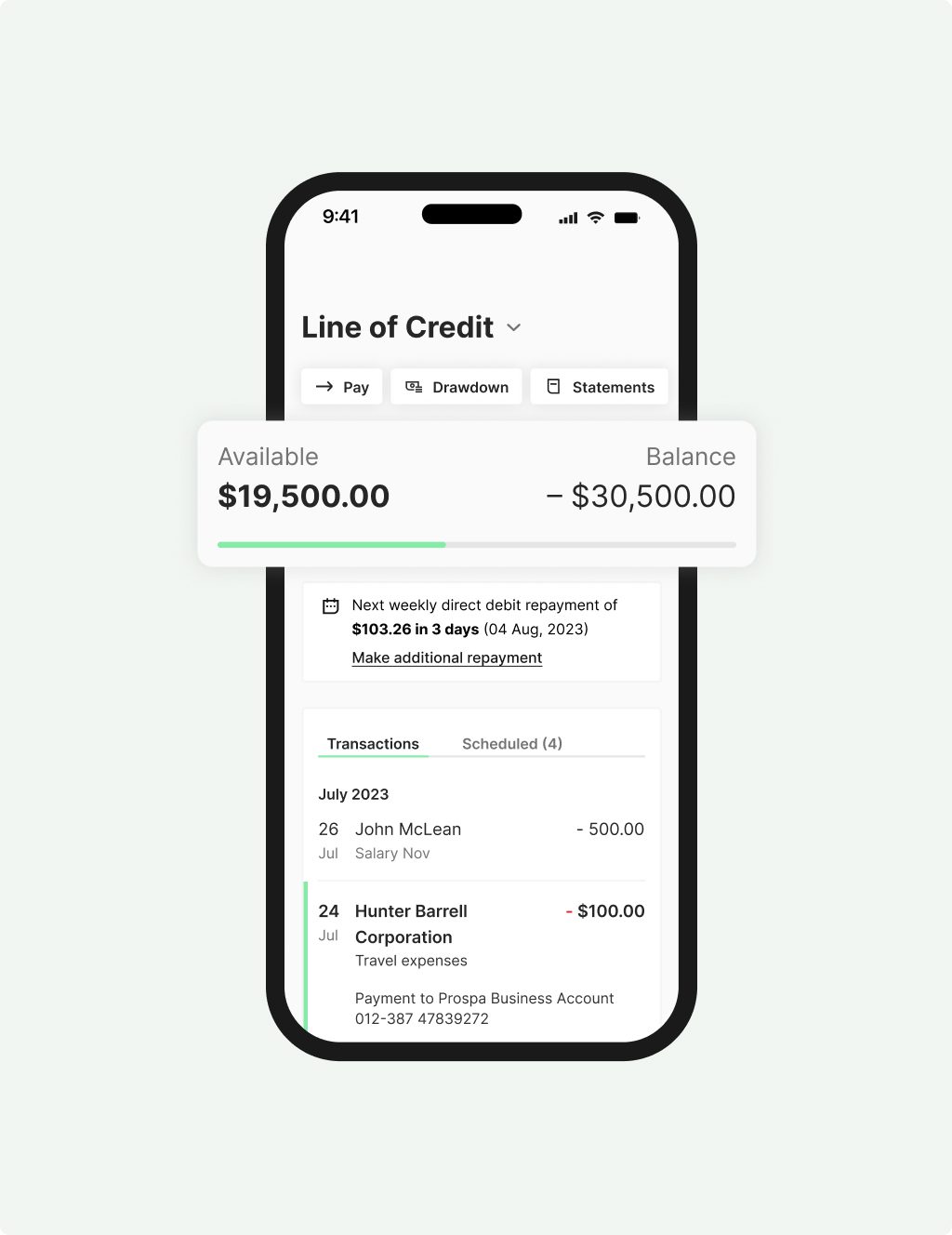

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

How are interest rates calculated?

At Prospa, business loan interest rates can vary depending on a range of factors, the industry you operate in, the length of time your business has been established, and the financial health of your business.

Understanding Annual Percentage Rate (APR)

Business Loan Interest rates are often presented as an Annual Percentage Rate (APR). So, what does this mean?

APR is a standard way of calculating the total interest payment on a business loan as a reducing balance over the total length of the loan (including all fees and charges).

How is APR different from simple interest rate?

When shopping around for a business loan you might also hear the term ‘simple interest rate’. So how does this differ to APR and what does this mean for you?

The simple interest rate focuses solely on the cost of borrowing the principal amount, for example if you borrow $10K at a 2.72% interest rate for 1 year the total interest you pay on the loan is $272.

Simple Interest rate = (Loan amount x interest rate x loan term) / 100

Comparatively, if you express the same example as an APR, which is calculated on a reducing balance, if you borrow $10K, and the total interest on the loan is $272, your APR interest rate would be expressed as 5%.

ASR = ((Interest + Fees/ Loan amount) / Loan term) x 365 x 100

An APR will appear high for short-term loans but low for long-term loans, which may be confusing, which is why your loan may be quoted in simple interest rate terms.

If you’re interested to find out more about the difference between APR and simple interest rate read this article on our blog for a simple explanation and examples.

Other fees and charges

Apart from interest rates, it’s crucial to be aware of other fees and charges that may be associated with a business loan. While these fees may vary between lenders, here are some common ones you may encounter:

- Application Fee: Charged for processing your loan application.

- Origination Fee: Covers the administrative costs of setting up the loan.

- Ongoing Fees: Monthly or annual fees for maintaining the loan account.

- Early Repayment Fee: Charged if you repay the loan before the agreed-upon term.

- Late Payment Fee: Imposed for missed or delayed loan repayments.

- Security Fees: Applicable if you provide collateral to secure the loan.

Before finalising a business loan agreement, carefully review the loan terms and conditions to identify any potential fees and charges. Factor these costs into your financial projections to ensure they align with your business’s cash flow capabilities.

Difference between funding options

Small business loans and lines of credit are two common types of funding options for Australian businesses – and Prospa offers both to small business customers. While both serve the purpose of providing funding, they differ in how interest rates are calculated and utilised:

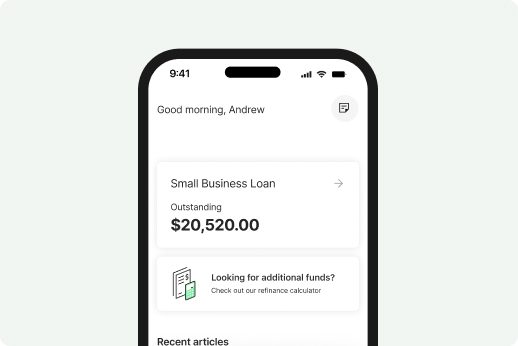

Small Business Loans: Prospa offers small business loan up to $1M, the interest rate is typically calculated based on factors such as your business’s financial health, creditworthiness, industry, and time in business. The loan is disbursed as a lump sum, and you pay interest on the entire loan amount from the beginning. Small business loans are ideal for one-time expenses, such as purchasing equipment, expanding operations, or launching a marketing campaign.

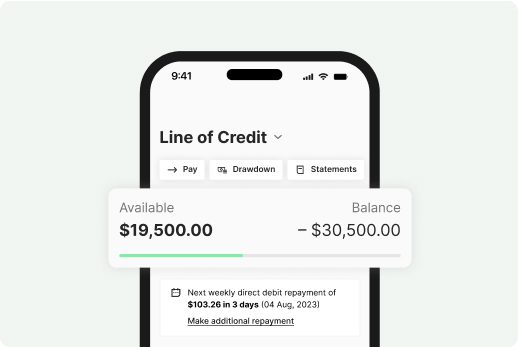

Lines of Credit: Prospa offers line of credit facility limits up to $500K, interest rates are usually calculated only on the amount you borrow. Instead of receiving a lump sum, you have access to a predetermined credit limit. You can withdraw funds as needed, and interest is charged only on the outstanding balance. Lines of credit provide flexibility and are suitable for managing ongoing expenses, covering unexpected costs, or bridging cash flow gaps.

Understanding the differences between small business loans and lines of credit can help you determine which option aligns best with your specific funding needs and repayment preferences.

If you’d like to find out more about the differences between a line of credit and a business loan, read this article from the Prospa blog.

How to get the right funding for your business needs

Business loan interest rates can play a significant role in shaping the financial viability of your small business. By understanding how interest rates are calculated, the distinction between fixed and variable rates, the concept of APR, and the presence of additional fees and charges, you can make informed decisions when choosing business funding.

Consider consulting with lenders, exploring different loan options, and comparing offers to find the most suitable financing solution for your Australian small business. Remember, thorough research and due diligence are key to securing the right form of finance for your business needs, and ultimately achieving financial success.

What are the different types of interest rates?

When you apply for a loan, all you really want to find out is: ‘What will this cost me?’ But before you enter into a loan agreement, it is important to understand the different types of business loan interest rates and how interest is calculated so you can make an informed decision about your money without overcommitting.

Interest – Interest is the main cost of borrowing the money, normally shown as a percentage. The interest is added to your loan amount along with any fees, so when you make repayments you’ll be paying back the loan amount and the amount it costs you to borrow the money.

Fixed Rate Interest – This is a set percentage of the loan amount that has to be repaid during the loan term. Fixed rates tend to be slightly higher than variable rates, but this is balanced by the fact that your repayments will not change for the life of the loan.

Variable Rate Interest – This lets the borrower take advantage of market conditions as the loan interest rate varies according to the market. It allows you to benefit from future drops in interest rates, but can also mean you have to weather increases in market rates in Australia.

APR – The Annual Percentage Rate is the rate that can be used to calculate the cost of the loan. It takes into account the reducing balance of the loan amount, expressed as an annual rate, and may include fees and charges. APR is used as a common comparison for all loans in Australia. Read more about APR.

Simple Interest – This is the most basic way to express interest and is calculated on the total interest amount divided by the total principal amount of the loan.

Compound interest – This is calculated on the principal amount of the loan but also on the interest accumulated (but unpaid) from previous periods. It’s like paying interest on your interest, and can be common with credit cards.

With Prospa everything is crystal clear, we offer fixed rates on our business loans – so you’ll know up front exactly how much you owe over the loan term.

Success story

Quick turnaround on a Prospa small business loan helped Australian business PUPSTYLE restock products to fulfil an unexpected influx of orders and triple the business’s revenue in a year.

FAQs

Common questions answered

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $250K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

We offer Business Loans up to $1M or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.