Slow-paying clients hurting your cash flow? Before you choose invoice financing, read our complete guide on the pros, cons, and more flexible funding alternatives.

At a glance

- Invoice financing provides immediate cash flow by allowing you to borrow against your outstanding invoices, typically receiving up to 85% of their value upfront.

- While it offers fast access to funds, invoice financing can be expensive, with a higher equivalent APR than direct lending, and the involvement of a third party may complicate customer relationships.

- This funding option is best suited for specific business models, such as rapidly growing B2B companies or those with long payment terms.

As a business owner, you know the feeling. Your work is complete, your invoices are issued, but a glance at the accounting app is enough to see your cash reserves running low. As the pressure mounts, you begin the search for a quick financial fix.

Invoice financing often emerges as a popular option, promising to unlock the value in your accounts receivable almost instantly. To determine if it’s the right fit, you need to weigh the convenience against the real world costs and commitments.

What is invoice financing and how does it work?

Invoice financing is a way for businesses to improve their working capital by borrowing against their accounts receivable (your outstanding invoices). Rather than waiting weeks or months for clients to pay, you can work with a finance provider to get an immediate advance on the money you are owed. In effect, it closes the gap between invoicing for your work and having the cash available in your bank account.

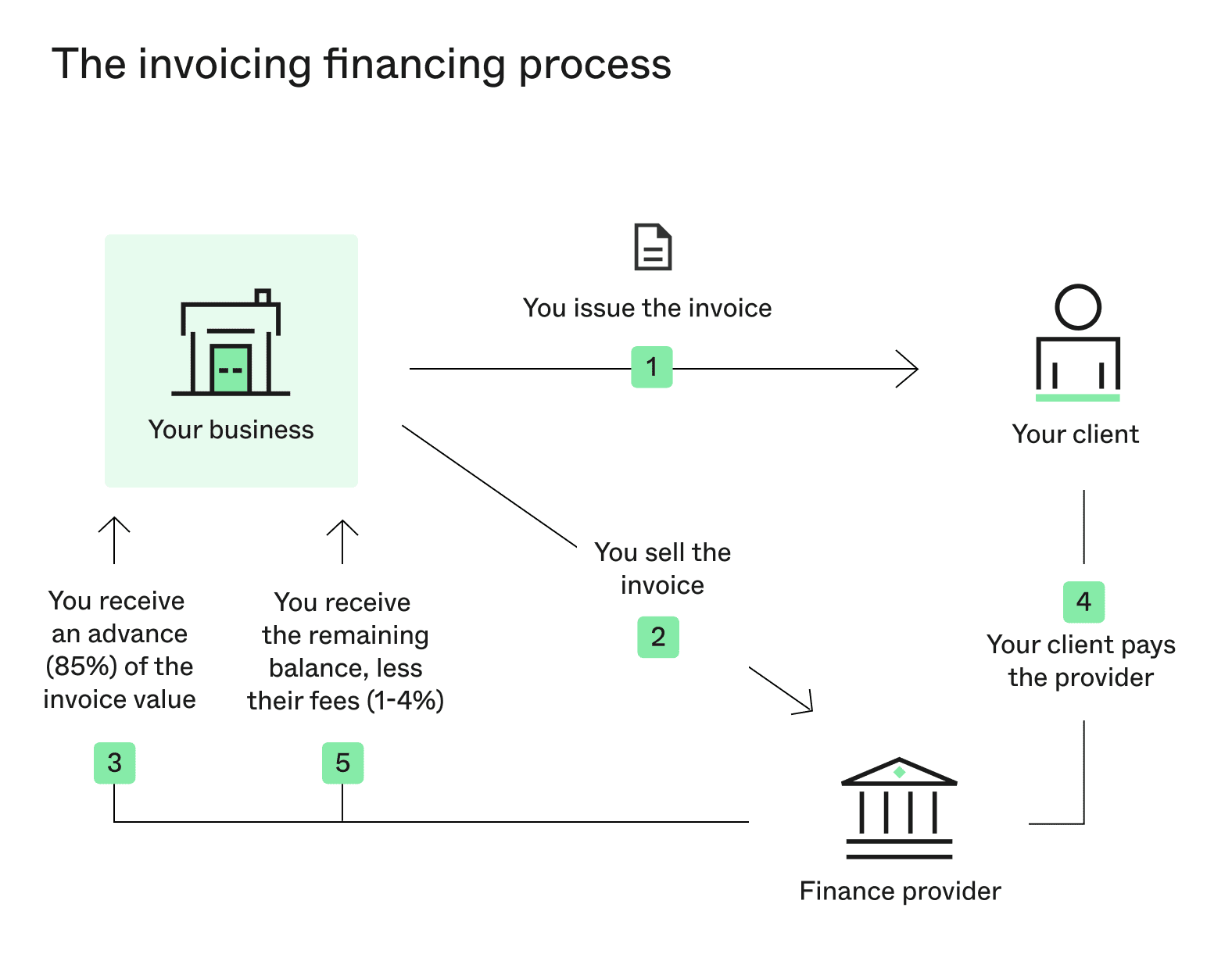

- You issue the invoice. After you deliver your product or service, you send an invoice to your client with the agreed-upon payment terms, just as you normally would.

- You sell the invoice. You then provide a copy of this unpaid invoice to your chosen finance provider.

- You receive an advance. The provider verifies the invoice and advances you a significant portion of its value, typically up to 85%, often within 24 hours.

- Your client pays the provider. Once the payment term is up, your client pays the full invoice amount directly to the finance provider.

- You receive the remaining balance. After receiving the full payment, the provider sends you the rest of the money, having deducted their agreed-upon fees for the service.

Example: Imagine you’re an electrician and have just completed a $10,000 commercial office fit-out. The client’s payment terms are 30 days, but you need cash now to cover upfront costs for your next major contract. Following the steps above, you could receive an $8,500 (85%) advance this week.

Example: Imagine you’re an electrician and have just completed a $10,000 commercial office fit-out. The client’s payment terms are 30 days, but you need cash now to cover upfront costs for your next major contract. Following the steps above, you could receive an $8,500 (85%) advance this week.

Thirty days later, when your client pays, the provider would transfer the final $1,500 to you, less their fee. This fee often ranges from 1% to 4% of the invoice value per month, so for this $10,000 invoice, the cost to you would be between $100 and $400.

What is the difference between invoice financing, factoring and discounting?

The world of business finance is full of similar-sounding terms. When it comes to unlocking cash from invoices, you’ll often see ‘financing’, ‘factoring’, and ‘discounting’ used, sometimes interchangeably. While they all aim to solve the same cash flow problem, the way they work can be quite different, particularly when it comes to your customers.

The main difference usually comes down to two simple questions: Is the arrangement confidential? And who is responsible for collecting the payment?

Invoice Financing

This is the process we described in the previous section. It generally operates as a confidential arrangement between you and the finance provider. You remain in full control of your sales ledger and are still responsible for chasing the payment from your client. Your client is often completely unaware that a third party is involved.

Invoice Factoring

This is typically a more hands-on service. With factoring, you sell your invoices to a third-party company (a factor), which then often takes over the responsibility of collecting payment directly from your customers. Because the factor is managing the collection, this arrangement is usually disclosed, meaning your client will know you are using a finance service.

Invoice Discounting

In Australia, the term ‘invoice discounting’ is often used as another name for invoice financing. It typically refers to the same confidential process where you maintain control over your customer relationships and collections, simply using your invoices as security for a loan.

Here’s how they compare side-by-side.

Financing / Discounting vs. Factoring

| Feature | Invoice Financing / Discounting | Invoice Factoring |

| Confidentiality | Usually confidential. Your client is not aware. | Usually disclosed. Your client pays the factor directly. |

| Collections | You manage your sales ledger and collect payment. | The factor often manages collections on your behalf. |

| Best For | Businesses that want to maintain full control of their customer relationships. | Businesses that want a full-service option and are prepared for the typically higher cost. |

What are the pros and cons of invoice financing?

Like any financial product, invoice financing comes with a distinct set of advantages and potential drawbacks. Understanding both sides will help you decide if this tool truly suits your circumstances.

The pros of invoice financing

- Improves cash flow immediately. This is the primary benefit. It gives you fast access to cash that is otherwise tied up in your accounts receivable, allowing you to cover expenses and seize new opportunities without waiting on client payments.

- Funding grows with your sales. Unlike a fixed loan, an invoice financing facility can scale with your business. As you generate more sales and issue larger invoices, your access to potential funding increases accordingly.

- No upfront security is usually required. The invoice itself acts as the asset securing the funds. This means you typically don’t need to use property or other significant business assets as collateral, which can be a major advantage for many businesses.

The potential cons

- It can be expensive. While the monthly fees may seem small, they can result in a high equivalent Annual Percentage Rate (APR) when calculated over a full year. As seen in our electrician example, a fee of 1-4% per month can quickly erode your profit margins.

- It can complicate customer relationships. If you use factoring, a third party will be contacting your clients to collect payment, which can affect the relationship you’ve built. Even with confidential financing, the pressure to ensure your clients pay on time to satisfy the lender can add a new layer of stress.

- The process can be admin-intensive. Managing the facility requires ongoing administration, from submitting invoices and tracking payments to reconciling the final balances. This can add to your workload, especially if you don’t have a dedicated finance team.

- It only solves one specific problem. Invoice financing is designed solely to bridge the gap from a specific unpaid invoice. It isn’t a flexible source of capital that you can use for broader business investments, such as buying a major asset, funding a marketing campaign, or managing unexpected expenses.

Pros vs. Cons at a glance

| Pros | Cons |

| Immediate access to cash flow | Can be expensive with high equivalent Annual Percentage Rate (APR) |

| Funding scales as your sales grow | Can complicate or damage customer relationships |

| No upfront security typically required | Creates an ongoing administrative workload |

| Only solves for unpaid invoices, lacks flexibility |

How much does invoice financing cost?

Understanding the true cost of invoice financing can be complex, as beyond the headline rate, there is the combination of fees that providers typically charge. To get a clear picture, you need to look at all the components that make up the final price.

The total cost is usually a blend of two main parts:

- The discount rate: This is the primary fee, charged as a percentage of the invoice value. It often falls within a 1% to 4% range for every 30 days an invoice is outstanding.

- Service or administration fees: Many providers also charge ongoing monthly or annual fees simply for having the facility active.

On top of these, it’s important to ask any provider about other potential charges, such as setup fees, monthly minimums, and bank transfer fees.

Example: Let’s apply this to our electrician’s $10,000 invoice with a 30-day payment term, who needs to bridge an $8,500 cash gap for one month. With a typical invoice financing facility, the cost might look like this: a 2.5% discount rate for the 30-day period ($250) plus a $100 monthly service fee. This brings the total cost, excluding the principal, to $350.

Now, let’s compare that to a more direct funding solution. With a $8,500 Prospa Line of Credit, you could draw down the exact $8,500 you need. Based on Prospa’s Loan calculator, the total cost for using those funds for the first month, excluding the principal, would be around $215*, made up of the interest paid and the weekly service fees.

In this scenario, the cost (excluding the principal repayments) to solve the exact same 30-day cash flow problem is clearly different:

- Invoice Financing: $350

- Prospa Line of Credit: ~$215

In our electrician’s case, paying $350 to access $8,500 for one month equates to a monthly interest rate of over 4%. When annualised, this can result in an equivalent APR of over 40%. That’s why, to understand the true long-term cost, you need to ask for the APR of all options you’re comparing.

*Calculations are for illustrative purposes only and do not constitute an offer of credit or financial advice. To calculate repayments, this calculator uses a fixed annual percentage rate (APR) of 31% as the interest rate and a weekly service fee of 0.046% of the facility limit. Calculated repayments include principal, interest, and fees. Repayments are calculated based on the first drawdown amount and do not consider the facility limit. The calculated repayments may not be sufficient to repay the total loan amount. At the end of the term, any outstanding balance must be repaid in full or over an additional two-year payment plan. Terms and conditions, standard credit criteria, and applicable fees apply to Prospa products.

Is your small business eligible for invoice financing?

Unlike a traditional business loan where the focus is almost entirely on your business’s financial health and history, eligibility for invoice financing works a little differently. Because the unpaid invoice itself is the asset, lenders are often just as interested in the reliability of your clients as they are in your own business.

While every provider has its own criteria, you’ll generally need to meet a few key requirements:

- You must be a B2B business. Invoice financing is designed for businesses that sell goods or services to other businesses, not directly to consumers (B2C). Your invoices need to be issued to commercial clients.

- Your clients need to have a good credit history. Lenders will often assess the creditworthiness of the clients on the invoices you want to finance. Your application will be much stronger if your clients are well-established businesses with a proven record of paying on time.

- You need a clear invoicing process. You must have clear, verifiable invoices for completed work, with established payment terms. Ambiguous or milestone-based payment schedules can be more difficult to finance.

What about “no credit check” financing?

You may see offers for “no credit check” invoice financing. It’s important to understand what this usually means. While the lender might place less emphasis on your personal or business credit score, they will still perform due diligence, focusing heavily on the credit risk of your clients. It’s not a complete absence of checks, but rather a shift in focus from your creditworthiness to that of your customers.

When could invoice financing be a good fit?

Despite its potential drawbacks, invoice financing can be the right choice for certain businesses in specific situations.

Invoice financing often makes the most sense for:

- Rapidly growing B2B companies. For businesses that are scaling quickly, the fact that invoice financing grows with sales can be a major advantage. As your accounts receivable ledger expands, so does your potential access to funding, providing a scalable source of working capital.

- Businesses with a dedicated finance team. The administrative work involved in managing an invoice financing facility can be significant. A business with an accounts manager or department has the internal resources to handle the required reporting and reconciliation, mitigating one of the key drawbacks.

- Industries with very long payment terms. In some sectors, such as manufacturing, wholesale, or for those dealing with government contracts, payment terms of 60, 90, or even 120 days are standard. For these businesses, invoice financing is often a necessary, built-in tool for survival.

- Businesses unable to secure other finance. Because approval often depends more on the creditworthiness of your clients than on your own business’s history or assets, it can be an accessible option for companies that may not yet qualify for a traditional business loan.

If these situations don’t describe your business, then a more direct form of finance may be more suitable for your needs.

Are there simpler alternatives for managing cash flow?

For many business owners who want to avoid the complexities of selling invoices and involving third parties in their customer relationships, the alternative is a direct funding solution. This is where a lender provides capital directly to your business without tying it to individual invoices, an approach that is often simpler and provides greater flexibility.

The two primary options in this category are the small business loan and the business line of credit.

- A small business loan provides you with a lump sum of capital upfront for a specific purpose. You then repay the loan with regular, predictable repayments over a fixed term. This is often ideal for planned investments, such as purchasing equipment or funding a strategic expansion.

- A business line of credit gives you access to a flexible, revolving credit facility up to an approved limit. You can draw down funds as you need them, and you only pay interest on the money you use. It’s designed to help you bridge cash flow shortfalls, handle sudden expenses, and act quickly when a business opportunity emerges.

Both of these solutions offer a more direct relationship between you and your lender, and for many businesses, they provide a more versatile and streamlined way to access funding.

Why a business loan or line of credit could be a better fit

So, what makes these direct funding solutions a better fit for many small businesses? The advantages often come down to four key factors: simplicity, confidentiality, flexibility, and control.

- Greater simplicity. The process is typically much simpler, beginning with one application for an approved facility or loan amount. Once approved, the funds are available to you without any connection to individual invoices. This removes the ongoing administrative task of submitting sales documents and reconciling balances that is required for invoice financing.

- Complete confidentiality. Your financing remains a private arrangement between you and your lender. Your customers are never contacted by a third party for payment, allowing you to protect the important relationships you’ve worked hard to build. You maintain full control over your client communications.

- Total flexibility. The capital you receive is not tied to the value of a specific invoice. You can use the funds for any business purpose you see fit, whether it’s to cover a temporary cash flow gap, purchase a new piece of equipment, invest in marketing, or manage unexpected expenses. This gives you far greater freedom in running your business.

- Full control. Perhaps most importantly, you retain complete ownership of your sales ledger. The responsibility for chasing payments remains with you, on your own terms. This means you control the entire customer experience without the intervention of a finance provider.

The choice often comes down to what your business needs most: a way to unlock cash from work you’ve already completed, or a simple, flexible source of capital to power what you do next. If you’re focused on growth and maintaining control over your future, a Prospa Business Loan or Business Line of Credit will offer you a clearer path.