Business Loans NSW

Compare our products

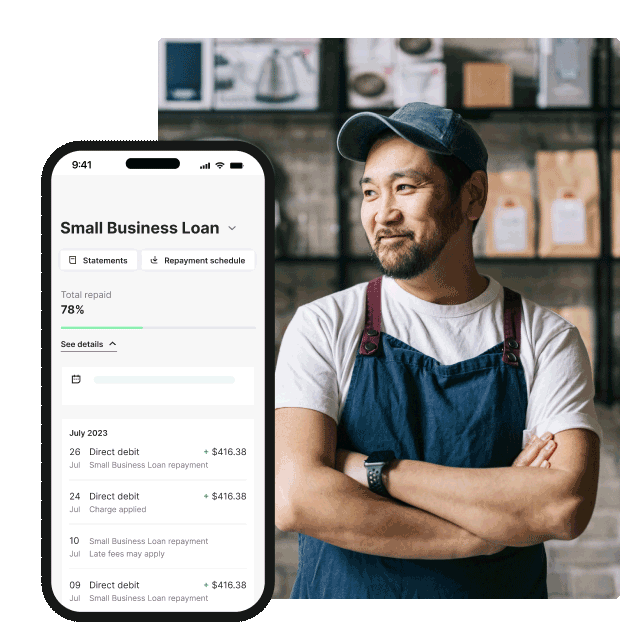

Small Business Loan

Fast access to keep business moving

- From $5K - $500K

- Funding possible in 24 hours

- Up to 5 year terms

- No upfront security up to $150K

Business Loan Plus

A larger lump sum to invest in longer term plans

- From $500K - $1M

- Sharper rates when secured against your property

- Up to 5 year terms

- Upfront property security required

Business Line of Credit

Ongoing access to funds to simplify cash flow

- From $2K - $500K

- Access funds anytime via the Prospa App

- Only pay interest on what you use

- No upfront security up to $150K

Funding possible within hours

Make unlimited extra repayments to save on interest and pay off your loan faster

No lengthy forms or stressful processes, so you can get back to running your business

Once we have all your necessary application details, we can provide a decision in as little as one business day.

Manage cash flow on the go with the Prospa App or Prospa Online.

Apply online in under 10 minutes, with no credit checks to see if you’re eligible.

Calculate your repayments

Our calculator will help you estimate how much you’ll pay per week based on the amount you borrow for a Business Loan or Line of Credit.

See full T&CsPlease select a product

Why Prospa?

Access fast, easy, and flexible business funding in NSW that keeps your cash flow steady. With no upfront security required for loans up to $150K and business finance options up to $1M, we have a business lending solution for you.

Apply online today and give your business the confidence to grow.

How it works

Apply in minutes

Get a fast decision

Access your funds

Why a NSW Business Loan?

Looking to upgrade your workspace, invest in new equipment, or hire extra staff to meet growing demand? A small business loan can help you access the funds you need within hours. With quick approvals and flexible repayment options, our business loans are ideal for any business looking to manage cash flow.