Learn how asset finance works, compare your funding options, and see how to secure essential equipment without a large upfront cost.

At a glance

- Asset finance lets you secure essential equipment or vehicles while preserving your working capital, allowing you to spread repayments over time while keeping your business moving.

- Hire purchase, operating leases, and finance leases offer different levels of ownership, flexibility, and upgrade options, which can influence repayments, asset life, and even tax treatment.

- With so many options available, speaking with a finance or tax professional can give you clarity on timing, affordability, and which structure best fits your next purchase.

To stay competitive, you need the right tools – but purchasing expensive machinery or vehicles outright can put a dangerous squeeze on your cash flow. Asset finance offers a smarter way to secure what you need to grow, without emptying your business savings.

Whether you are scaling up operations or replacing an old workhorse, understanding your funding options is the first step toward making a purchase that supports your bottom line.

What is Asset Finance?

Asset finance is a funding solution that lets you acquire essential business tools immediately, without the heavy capital outlay. Instead of paying the full purchase price upfront, you spread the cost over a set term.

Whether you require specific equipment financing for heavy machinery or funding for a new work vehicle, the asset itself typically acts as security. This structure allows you to put the equipment to work straight away while preserving your working capital for day-to-day operations.

Imagine you run a cleaning business and demand is growing nicely, but you are at capacity and need a $28,000 commercial van to take on more clients. Asset finance can help you secure it without a huge initial commitment. Instead, you can manage modest repayments of only a few hundred dollars a week, while the van starts generating income straight away.

You can use Prospa’s loan calculator to get a quick sense of what repayments might look like for your business.

What are the different types of asset finance?

Depending on whether you want to own an asset or simply use it for a set period, asset finance can be structured in different ways. The main options are:

Hire purchase: You get access to the asset straight away while paying it off in instalments. Once the final payment is made, ownership transfers to you. This can work well for major investments such as vehicles or machinery that you plan to keep long-term.

Leasing: If owning the asset is not essential, leasing gives you access to the equipment you need with predictable costs and the flexibility to upgrade sooner. Depending on the type of lease, you may also have the option to buy the asset later. The two common forms are:

- Operating lease: You rent the asset for a set period and return it at the end. Ownership stays with the lender, and maintenance is sometimes included. This can suit businesses that upgrade equipment regularly or do not need it for its full working life.

- Finance lease: You use the asset and make regular payments over a fixed term. While ownership stays with the lender during the term, you often have the option to buy the asset at the end. This can work well if you want flexibility now but may want to keep the equipment long term.

Which asset finance option fits your business?

| If your goal is to: | And your priority is: | Consider this option |

|---|---|---|

| Own the asset once the payments are finished | Building equity with fixed repayments | Hire Purchase |

| Upgrade regularly to the latest models or tech | Easy transitions and predictable costs | Operating Lease |

| Use it now but decide later if you want to keep it | Flexibility to offer to buy or return the asset | Finance Lease |

For your cleaning business, if you are the type who keeps a vehicle running for as long as possible, a hire purchase may be the better fit because you end up owning it. If you prefer to upgrade often and stay ahead of wear and tear, an operating lease keeps things simple by trading ownership for predictable costs and easier transitions to newer models. A finance lease can offer flexibility in between, with the option to buy the van later if it earns its keep.

To get started, lenders usually need recent business bank statements, identification, and basic financial information, such as 6 months of trading history. As with most small business loans, the documents and security required may depend on the amount and purpose.

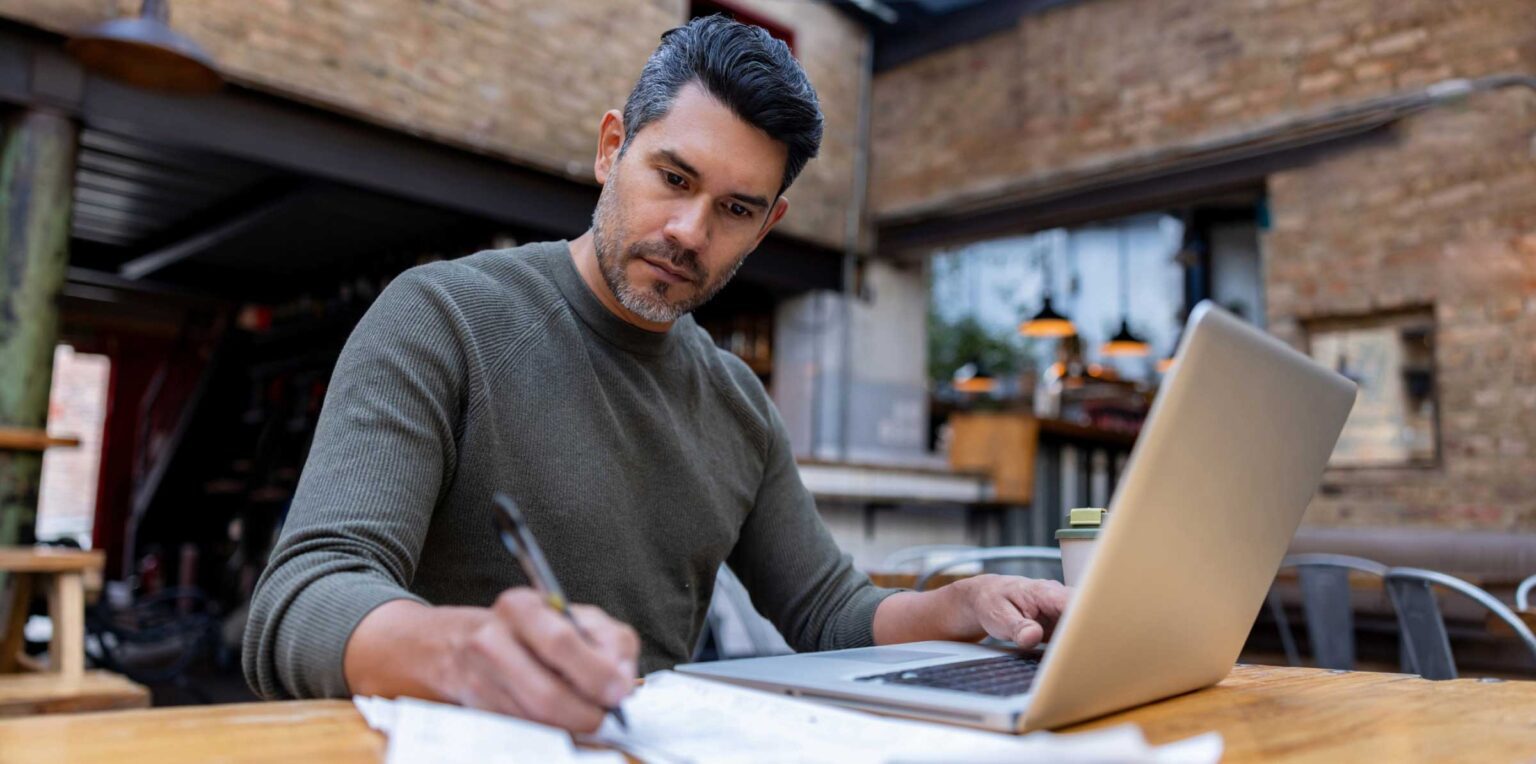

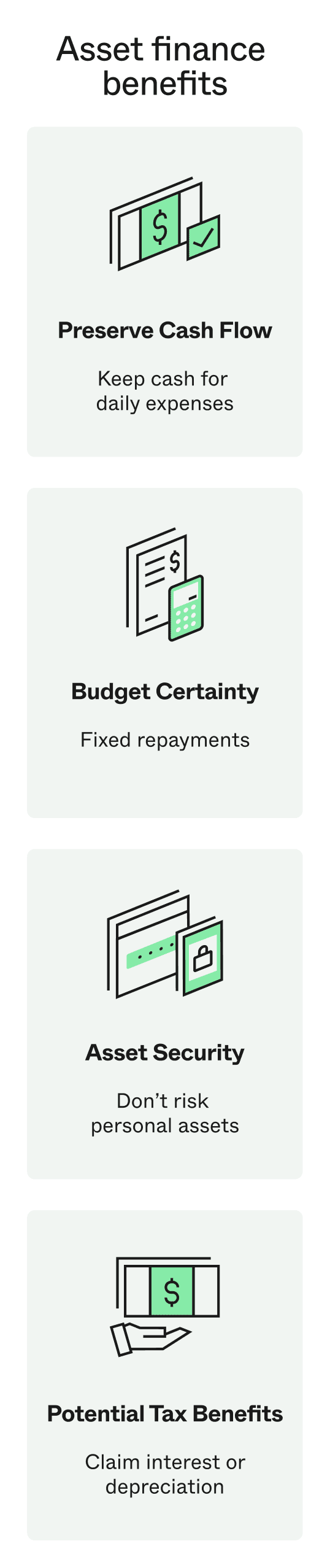

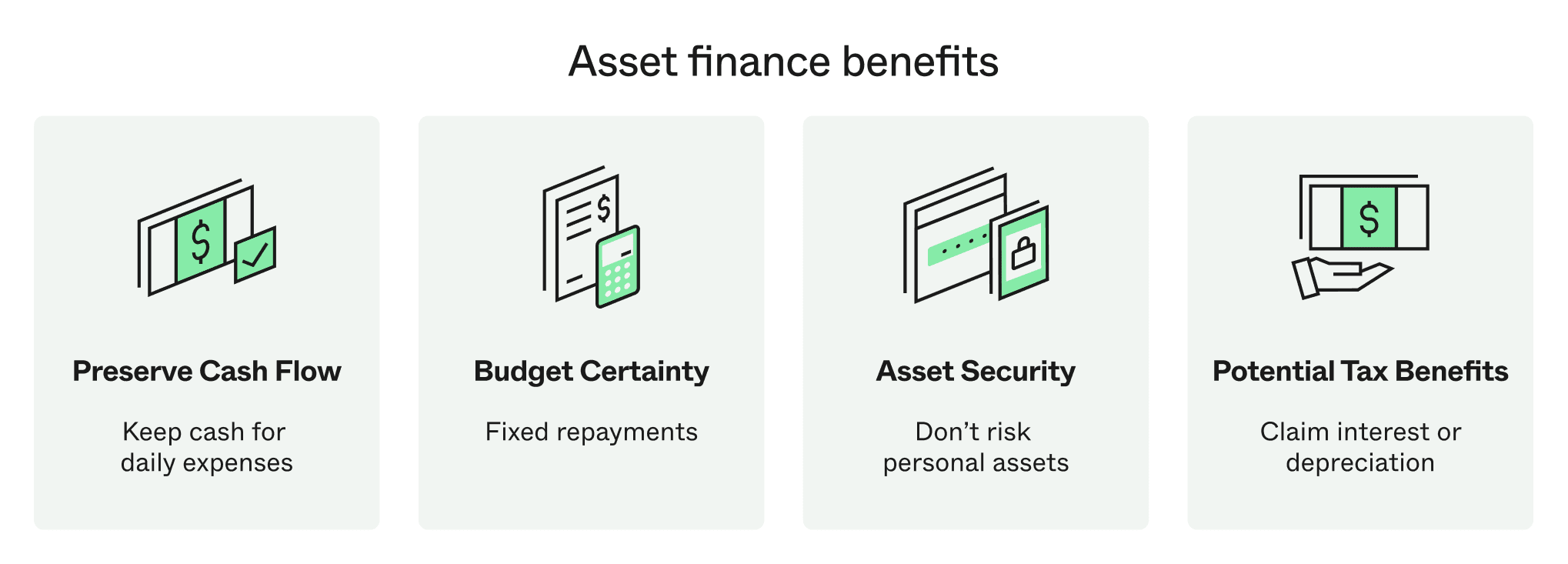

What are the benefits of asset finance?

When opportunities arise or equipment breaks down, you need to act fast. However, taking a large chunk of cash out of the business to pay for it can leave you vulnerable.

Asset finance allows you to secure the tools you need to grow without putting a strain on your day-to-day operations. Here is why it is a popular choice for savvy business owners:

- Preserve your working capital: By spreading the cost over time, you keep your cash reserves available for staff wages, marketing, or unexpected costs, rather than sinking it all into a depreciating asset.

- Access the latest technology: You do not have to wait until you have saved the full amount to upgrade. This allows you to bid for bigger jobs or work more efficiently immediately.

- Budget with confidence: With fixed interest rates and regular repayment terms, you know exactly what is coming out of your account each month, making cash flow forecasting simple.

- Protect personal assets: Because the finance is typically secured by the asset itself (like the vehicle or machine), you generally do not need to use your family home as collateral.

- Tax efficiency: The finance structure you choose directly impacts your tax position. You may be able to claim interest payments or depreciation as tax deductions, or claim input tax credits on the GST.

How does asset finance affect taxes?

Given the differences between hire purchase, operating leases, and finance leases, many business owners run into confusion at tax time. Legal ownership and tax ownership do not always line up. You can use an asset every day without legally owning it; however, the ATO may still treat it as yours.

The finance structure you choose directly impacts which tax deductions you can claim. This may include depreciation, interest, or GST credits, and even whether you qualify for instant asset write-offs. Because each option is treated differently for tax purposes, it might be helpful (and profitable!) to speak with your accountant about the best fit for your situation.

Having your recent tax returns or notices of assessment handy can make those conversations easier.

Explore your asset funding options

Asset finance is not the only way to fund a new purchase. You can also explore using a Business Loan. The final outcome is often the same, except:

- You own the asset from day one (no leasing or residual structures).

- No security is required upfront for loans up to $150,000.

- You can also use the funds to cover not just the purchase price, but also installation, training, and delivery costs.

If you aren’t sure which funding structure fits your goals, our team can help you compare your options. Talk to one of our specialists today.