Stop relying on 30-day-old data. Learn how SMEs use AI to predict cash flow gaps, optimise inventory and protect margins. Includes free DIY prompts to start today.

At a glance

- AI tools can predict cash flow gaps weeks in advance by analysing historical client payment behaviour instead of relying on standard invoice due dates.

- Sales forecasting algorithms help you avoid dead stock by assessing multiple data points to align your inventory orders with actual customer demand.

- You can improve net margins without increasing total revenue by using AI to identify and target client segments that offer the highest actual profitability.

The difference between surviving and scaling often comes down to the speed of your decisions. Yet, many business owners rely on monthly P&L statements that only tell them what happened 30 days ago. In a fast-moving economy, relying on historical data is a risk.

This is where Artificial Intelligence (AI) delivers real value. Beyond the hype, savvy SMEs are taking a pragmatic approach to AI to process their business data and predict future outcomes. It is as if they have hired an always-on “Virtual CFO” that spots cash flow gaps and margin erosion before they appear in their bank account.

Here is how they are using AI to identify future revenue patterns and secure margins. We have also included the exact tools and copy-paste prompts you can use to do this yourself today.

Spotting cash flow gaps with predictive analytics

Cash flow kills more businesses than a lack of profit. Traditionally, you might not know you are heading for a cash crunch until the bank account looks low. AI changes this dynamic by looking at behaviour, not just due dates.

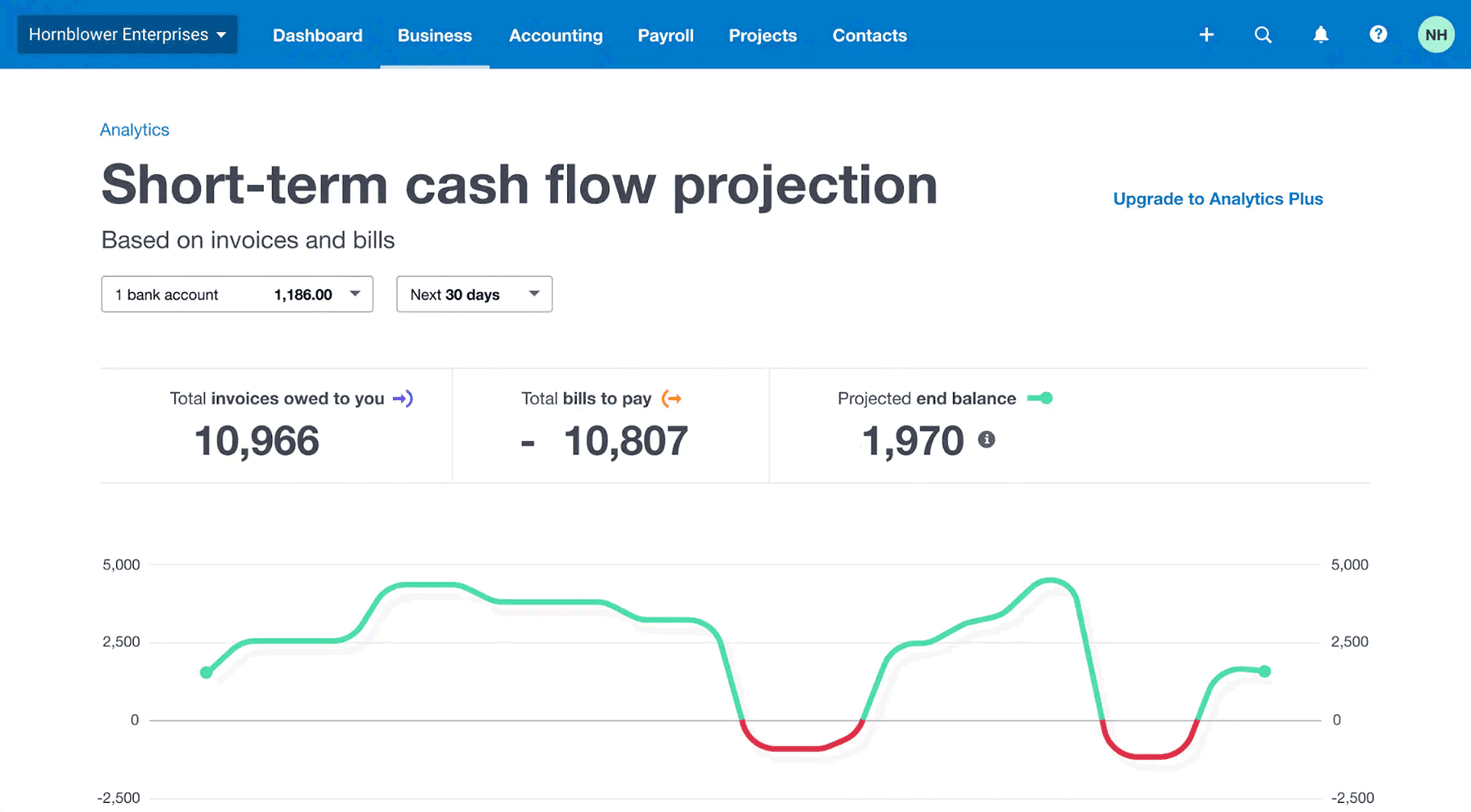

Consider a digital agency with a $50,000 payroll run due on the 15th. Their spreadsheet says they have $60,000 coming in on the 10th. Safe, right? An AI tool scans the payers and flags a risk: Two of those clients average 9 days late on payments. The AI predicts the actual cash balance on the 15th will be only $42,000 – an $8,000 shortfall. Knowing this 3 weeks in advance allows the owner to chase the invoice early or secure a bridge loan, avoiding a payroll drama.

If you are looking for a tool to automate this, Xero Analytics Plus is the easiest place to start for many SMEs. It uses AI to generate a short-term cash flow projection that visually plots your future bank balance based on recurring bills and likely payment dates. It is a great way to see exactly where your cash flow stands over the next 30 to 90 days.

Alternatively, you can do this yourself right now using a free LLM like ChatGPT or Claude. Simply export your transaction data to CSV, anonymize it (remove client names), and paste it into the chat with this prompt:

“Act as a CFO for a small business. I have pasted my transaction data below. Please analyse the payment dates of my top 10 clients over the last 6 months. Identify any patterns in late payments and predict which invoices due next month are at highest risk of being paid late.”

Avoiding dead stock with sales forecasting

Have you ever walked into your warehouse and noticed stock gathering dust, while your best-sellers are constantly sold out? Every dollar trapped in slow-moving stock is a dollar you cannot use to drive growth. AI solves this by moving you away from gut feel and evaluating multiple data points – from seasonality to local weather – to predict exactly what your customers will want.

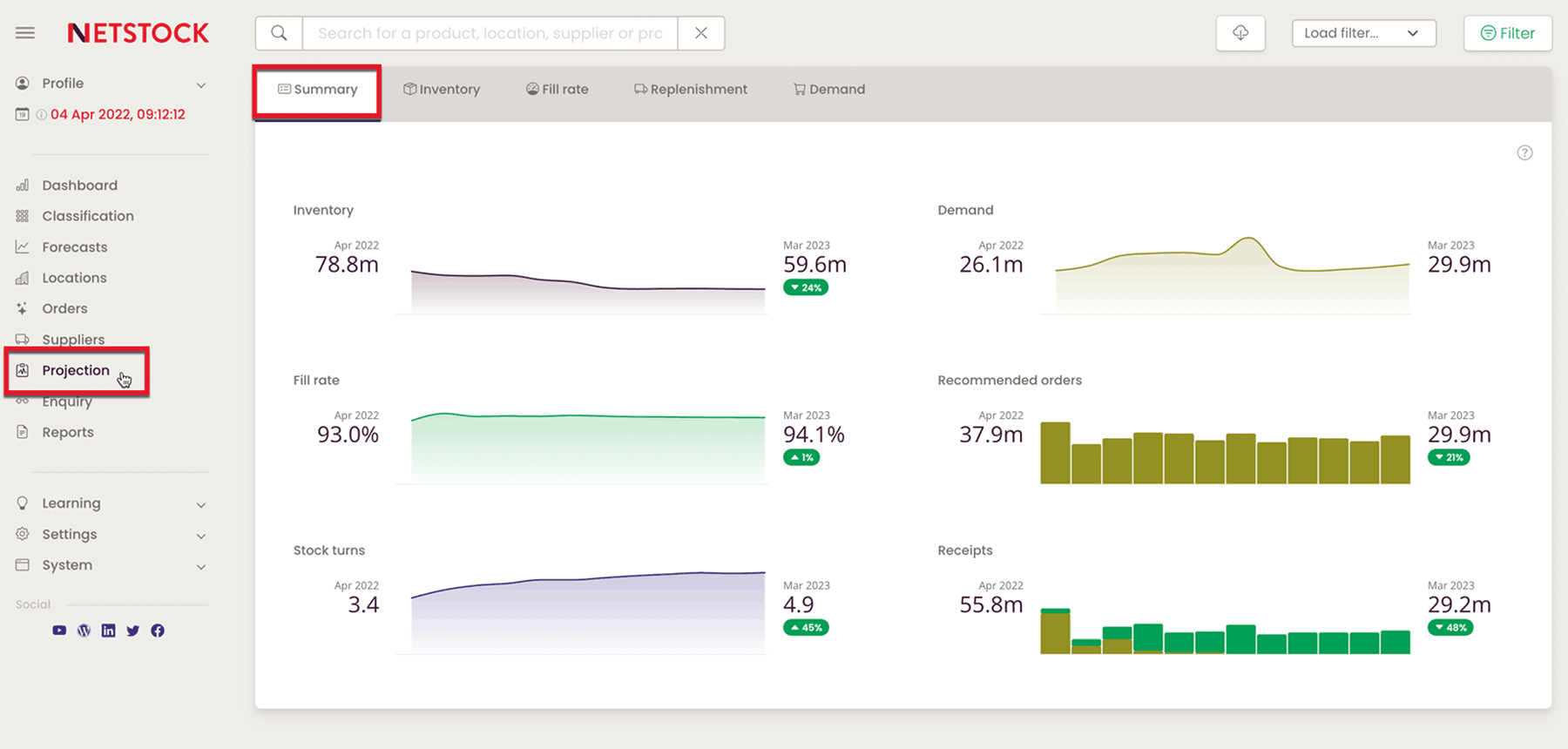

Take a boutique retailer who stocks up on winter apparel in March. AI analysis of their historical sell-through rate reveals that 20% of that stock (100 units) usually sits unsold until the August clearance sale, eroding margin. By adjusting the order down to 400 units based on the forecast, the business frees up $5,000 in cash flow that would otherwise be frozen on a shelf for five months.

For businesses managing significant inventory, Netstock is a sophisticated tool. It integrates with common ERPs (like Unleashed or MYOB) to classify every item in your warehouse, telling you exactly what to order and when. It is particularly useful for retailers and wholesalers with hundreds of SKUs who need to spot potential stockouts before they happen.

You can also run a basic version of this analysis using a free chatbot. Export your sales history to a CSV file and paste it into Gemini or Microsoft Copilot with this prompt:

“I have pasted my sales data from the last 12 months. Please identify my top 3 ‘Seasonally Sensitive’ products – items that spike in sales during specific months – and recommend a date by which I should re-order them to ensure I do not run out of stock during peak demand.”

Focusing on profit with customer segmentation

Chasing turnover without measuring profitability is a common growth trap. Some clients are highly profitable and low-touch; others require significant resources that erode your margins. AI excels at calculating the true “Cost to Serve,” helping you maximise customer value by identifying who your VIPs really are.

Imagine a landscaping firm that uses AI to audit their client list. They discover that while commercial strata clients bring in 40% of revenue, they consume 60% of labour hours due to site complexities. Meanwhile, residential renovations have a 25% higher profit margin. The business pivots their marketing spend to target only residential clients, increasing their net profit margin by 15% over the next quarter without increasing total revenue.

Dedicated reporting platforms like Fathom were built for this. It pulls data from your accounting software to create visual management reports. Its analysis tools can help segment customers and track non-financial KPIs, giving you a clear view of which business units or customer groups are actually driving profit.

If you want to start analysing this today for free, you can use a chatbot. First, export your sales or invoice data to CSV. For each customer, add a simple column called “Effort Score” (1 = Easy, 5 = Difficult) and give them a ranking. Then, paste the data into your preferred LLM with this prompt:

“I have pasted my sales data below, including an ‘Effort Score’ for each client. Please analyse this data and segment my customers into three groups:

- ‘Gold Tier’ (High Revenue / Low Effort)

- ‘Review Tier’ (Low Revenue / High Effort)

- ‘Growth Tier’ (High Revenue / High Effort)

For the ‘Review Tier’, calculate how much revenue they contribute vs. the effort score, and suggest a strategy to improve their profitability (e.g. price increase or service reduction).”

Start small to minimise risk

The biggest mistake SMEs make is trying to overhaul their entire tech stack at once. The best approach is to start small with data projects to validate AI recommendations before scaling.

Audit your current stack: You likely do not need new software. Platforms like Xero, QuickBooks, Shopify, and Salesforce already have built-in AI features for forecasting and analytics. Turn them on and learn to interpret them first.

And if you are looking to upgrade, check out our guide on the best cashflow management software for small business. Pick one metric: Focus on solving one problem first – such as reducing late payments or optimising one category of stock.

AI gives you the foresight to spot a cash flow gap, but you need the funds to bridge it. Talk to a Prospa specialist today about a Line of Credit or Business Loan to keep your business moving.