Understand the key differences between online, non-bank lenders and traditional banks in speed, products, and application process.

At a glance

- Online lenders focus on speed and flexibility for working capital, while traditional banks are better suited for large, long-term loans secured by property.

- The application process with an online lender is typically a fast, digital experience, whereas banks often require detailed paperwork and in-person meetings.

- Your business's recent cash flow is the main factor for online lenders, while banks focus more on your long-term trading history and available assets.

Familiar or fast? For many Australian business owners seeking funding, this simple question gets to the heart of a complex decision.

On one side, you have traditional banks, a trusted name, but a process known for its long waits and stacks of paperwork. On the other side are modern online lenders, offering impressive speed and simplicity that might have you asking if it’s the right choice for your business. In this guide, we break down those differences across speed, flexibility, and the application experience, so you can decide which option best fits your business.

How online lenders and traditional banks differ

A quick comparison shows the main differences:

| Feature | Online Lenders | Traditional Banks |

|---|---|---|

| Speed | Approvals in hours, funds possible in 24 hours | Applications may take weeks or months |

| Flexibility | Focus on short to medium-term loans, unsecured options available | Larger loans, often tied to property as security |

| Customer Support | Digital and phone-based, available quickly | Business banker support, usually slower and in-branch |

| Typical Borrower | SMEs looking for fast access to working capital | Established businesses needing large, asset-backed loans |

Online (non-bank) lenders take a technology-first approach that draws on business data such as cash flow and transaction history. This allows faster assessments and tailored solutions for growing businesses that need working capital quickly.

Banks rely on established, often manual processes that focus on assets and long-term trading history. This approach can suit larger or well-established companies, but it usually involves more paperwork and longer approval times.

Customer support also differs. Banks typically offer a dedicated business banker and in-person branch service, which can provide continuity but may slow things down. Online lenders are built around fast, accessible digital and phone support, designed to match the pace of small businesses.

Comparing loan approval speed and time to funding

When your business needs funding, timing can make all the difference. Online lenders are built for speed. Automated checks and digital applications mean approvals and funding can happen within hours. Banks place more emphasis on security and detailed checks. This reliance on manual assessments, credit history checks, and asset valuations means approvals can stretch into weeks before money is released.

The difference comes down to process. Technology streamlines the experience with online lenders, while banks continue to rely on slower, more manual reviews. For a detailed breakdown of what influences these timelines, see our complete guide on how fast you can get a business loan.

Imagine you run a café and spot a commercial coffee machine on clearance for $18,000. An online lender could approve the loan the same day and transfer funds before the deal is gone. With a bank, the process could still be underway long after the machine has been sold.

Got a time-sensitive opportunity? Check your estimated repayments with Prospa Business Loan Calculator.

What funding products can you access?

Small businesses need funding that adapts to their pace. From a short-term boost to cover payroll to a flexible facility to manage cash flow swings. This is another area where online lenders and banks diverge.

Online lenders focus on products designed for working capital, such as unsecured small business loans and flexible business lines of credit, with limits that can reach up to $1,000,000. With these products, security is often not required for smaller amounts, though it may be requested for facilities over $150,000.

To decide which of these options is right for you, see our guide comparing a line of credit vs. a business loan.

Let’s say your café has the chance to run a pop-up at a week-long festival. A $60,000 unsecured loan could cover fit out, staff, and supplies, giving you the flexibility to act quickly without tying the loan to property.

Banks, by contrast, specialise in larger loans secured against property or other assets, often structured over longer terms. This suits businesses funding major projects, but it can be less practical for owners who need fast, flexible support.

Understanding the costs and loan terms

How costs and repayments are structured is another major difference between online lenders and banks. Online lenders provide a clear, upfront total cost, giving you certainty on repayments from day one, without layers of fees. Many also allow early repayment without penalty, so if cash flow improves, you can clear the loan and save on interest.

Banks tend to have more complex fee schedules. Application fees, establishment charges, and ongoing account fees are common. On top of that, you can be penalised with heavy ‘break costs’ for paying your loan off early, creating uncertainty even when your business is doing well.

Continuing the café example, if the festival pop-up performs better than expected and you want to repay early, an online loan gives you that flexibility. With a bank loan, the same move could end up costing more.

For a full breakdown of fees and total repayable, see What a small business loan really costs.

Comparing the business loan application process

With an online lender, a “low doc” business loan application can be completed in less than 10 minutes with minimal documentation. Thanks to the Australian government-regulated Consumer Data Right (CDR), also known as Open Banking, you can securely share your transaction history in seconds, giving lenders accurate, real-time insights without piles of paperwork. For you, that means a quicker, simpler application and more time to focus on growth.

Banks still ask for detailed business plans, several years of financial records, asset documentation, and often multiple in-person appointments. The process provides a thorough review, but for many small businesses it can stretch timelines well beyond what is practical.

How lenders assess your eligibility

What a lender prioritises during assessment shapes both your chances of approval and how quickly you can access funds.

| Factor | Online (non-bank) lenders | Traditional banks |

|---|---|---|

| What they weigh most | Recent trading performance and cash flow patterns from bank data | Multi-year financials, profitability, and available security |

| Serviceability view | Can repayments be covered from current cash flow with headroom | Can repayments be covered over the long term with security in place |

| Security posture | Often unsecured at lower limits, personal guarantee common | Often secured against property or assets |

| Decision speed | Data-driven, typically faster once data is connected | Manual reviews, valuations and committee steps can extend timelines |

Regardless of the lender, certain financial habits can improve your chances of a fast approval, while others can slow things down.

Signals that tend to improve your odds:

- Consistent monthly revenue with a clear buffer after expenses

- Clean recent bank activity with few or no dishonours

- A specific, credible use of funds tied to business outcomes

- A solid business and personal credit profile

- Awareness of existing obligations and how the new repayment fits

Things that often slow or reduce approvals:

- Frequent overdrawn balances or returned payments

- Heavy seasonality without a plan to manage quiet months

- Tax arrears or outstanding compliance issues

- Reliance on a single customer for most revenue

- Mismatched loan type and purpose

It’s also worth noting that many online lenders use a ‘soft’ credit check for initial eligibility, which doesn’t impact your credit score.

Sacha Alagich, founder of Escape to Paradise, runs a homewares brand that brings the beauty of island living into homes. She turned to Prospa after finding traditional lenders too slow and rigid to support her growth.

“When I tried to get a loan from the bank, I kept having to pester my accountant for loads of documents. And it can take a year to get an overdraft approved — by then the opportunity’s passed. With Prospa, I filled out a questionnaire and uploaded my financials online securely. It was so easy, and I had the funds within a day or two.”

Sacha also valued the flexibility. “I had a cash flow gap between when our invoices were paid from our overseas department stores, so we found that being able to pay the loan off earlier is an amazing option.”

For the full list of documents and criteria, see our Business loan requirements guide.

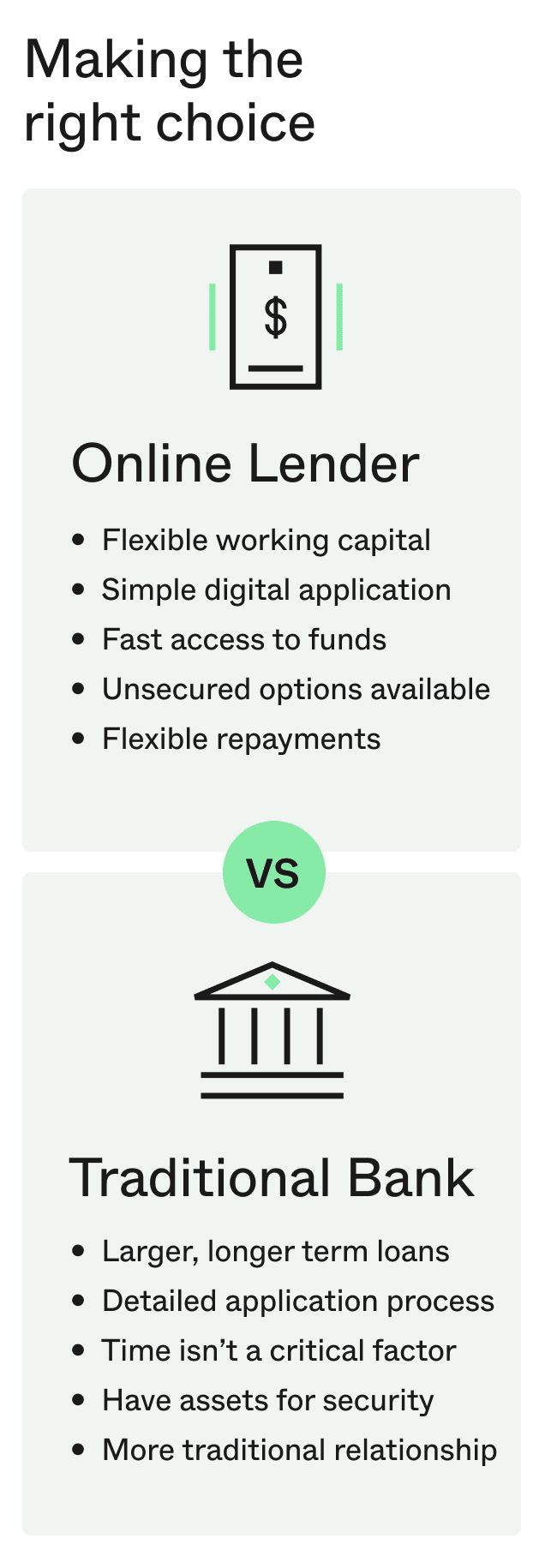

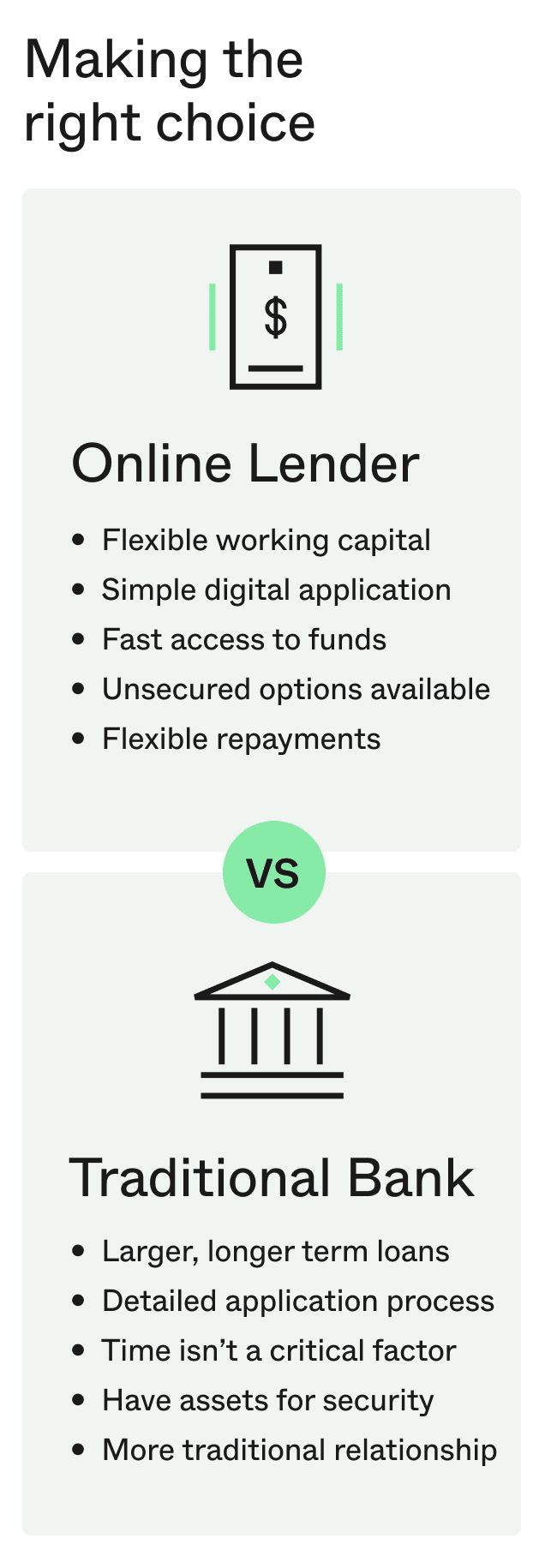

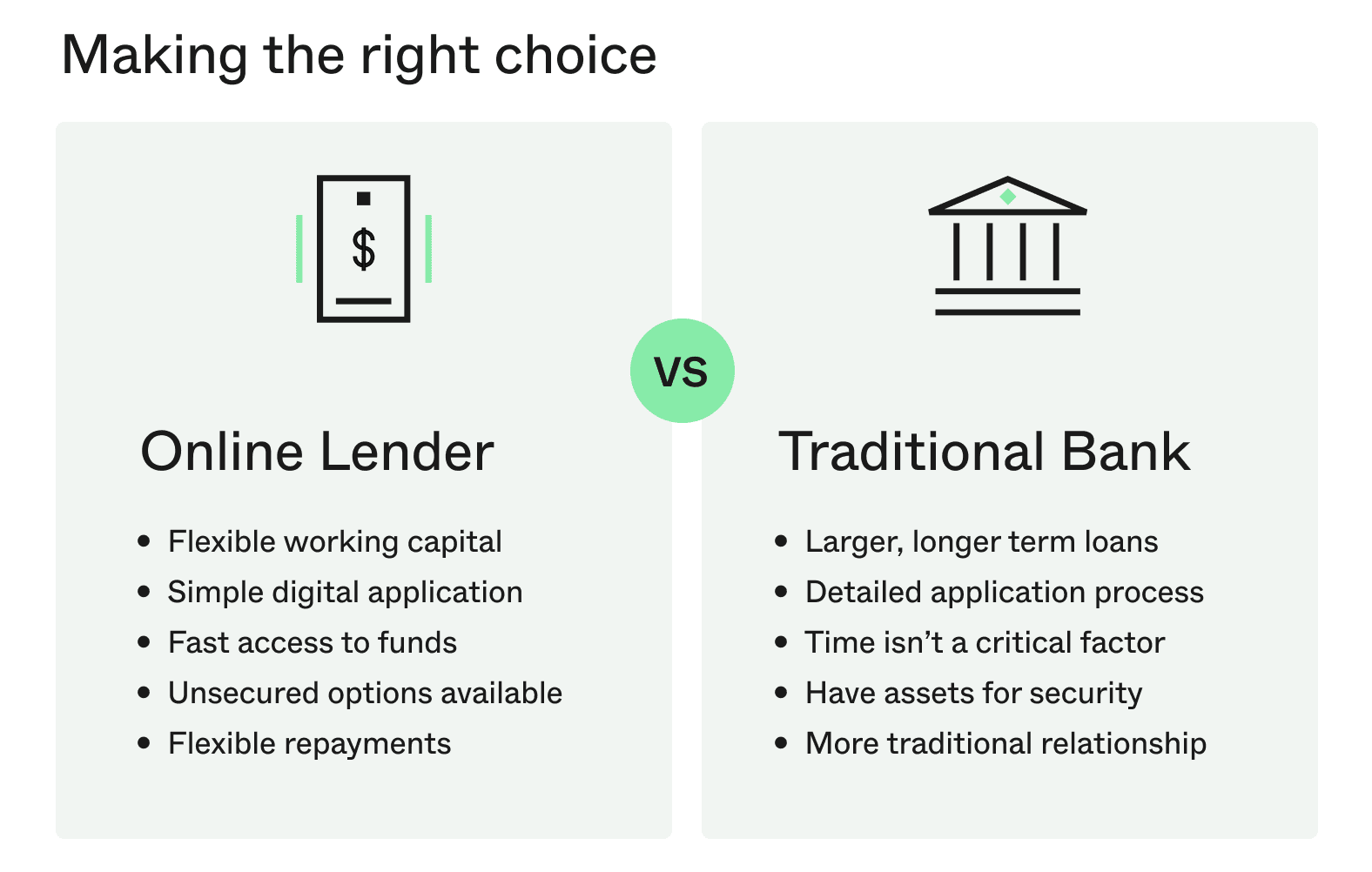

Making the right choice for your business

The best lender for you comes down to what your business needs most. Use this simple framework to guide your decision:

An online lender is likely your best fit if you:

- Need fast access to funds to act on opportunities

- Prefer a simple digital application process

- Don’t want to secure the loan against property

- Value flexible terms, like the option to repay early without penalty

A traditional bank could be an option if you:

- Can accommodate a slower approval process in exchange for a traditional relationship model

- Are comfortable with a detailed, in-person application process

- Have significant property or assets to use as security

- Require a very large or complex loan over a long term

For most modern small businesses, online lenders like Prospa are designed to deliver the speed and flexibility it takes to grow with confidence.

Ready for a faster, simpler funding experience? Apply online in 10 minutes.