At a glance

- More than half of Australian small businesses operate without a budget, increasing their risk of cash flow issues.

- A business budget is a flexible planning tool, not a business plan or a fixed set of rules.

- Follow six practical steps and use our checklist and budget template to build a budget that works and stays relevant.

Each month, more than 2,000 Australian small business owners head online in search of one thing: how to create a business budget. That tells you something.

Budgeting might seem like admin best left to accountants, but more business owners are taking an interest — and for good reason. In a tough economic climate, knowing where your money is going is no longer a nice-to-have. A budget gives structure to your decisions, adds clarity to your plans, and helps you run your business with confidence.

Whether you’re new to budgeting or looking to improve your current setup, this guide offers straightforward steps to help you build a small business budget that works for you.

Why a small business budget matters more than you think

In a 2024 survey of 180 Australian SMEs, 55% said they operate without a documented budget. Of those, 70% eventually experienced cash flow issues.

Take a café owner who sees strong weekend trade but forgets to factor in quarterly BAS payments and rising supplier costs. On paper, the business is doing well. But when a quiet month hits or a piece of equipment breaks, there’s no buffer. A budget would have flagged the cash flow gap before it became a scramble.

Even profitable businesses can end up short on cash or caught off guard by expenses. These cash flow mistakes often play a role, but many can be prevented with a clear, flexible budget.

What a business budget is — and isn’t

It’s easy to confuse a business budget with a business plan or to assume it’s only useful once your business reaches a certain size.

Here’s what a business budget really is:

| A business budget is… | A business budget isn’t… |

|---|---|

| A working plan to guide financial decisions | A business plan or investor pitch |

| A tool to monitor income and expenses in real time | A one-off document that stays in a drawer |

| Useful for any size business | Something only large or complex businesses need |

| Flexible and responsive to change | A rigid set of rules you’re locked into |

| A way to catch problems early and reduce financial stress | Just another layer of admin |

A good budget adapts with your business. It doesn’t have to be complex — it just needs to be useful.

How to create a small business budget

The goal of any business budget is simple: make sure your income consistently covers your expenses and leaves room to grow. By identifying your biggest costs and revenue sources, you can plan ahead instead of reacting. It’s generally a good idea to build in a safety margin of 10% to 20% around projected income, giving you room to adjust when costs rise or sales fall short.

These practical business budgeting tips for small business owners will help you get started.

1. Review your income

Start with all income sources over the past 6 to 12 months. Include sales, services, project work, and recurring contracts. If your revenue fluctuates across the year, look at patterns month by month. Averages alone can hide the leaner periods.

2. List your fixed and variable expenses

Fixed costs stay the same each month. Think rent, insurance, salaries, and subscriptions. Variable costs fluctuate based on activity and might include inventory, utilities, marketing, or contractor fees. Understanding how these behave in busy or quiet periods helps you spot where you can adjust if needed.

3. Plan for one-off and occasional expenses

These often slip through the cracks. Include things like tax payments, equipment upgrades, emergency repairs, or annual fees. They may not appear often, but when they do, they can throw off your cash flow if you haven’t planned for them.

4. Set financial goals

Use your budget to direct your decisions. That might mean building a cash buffer, paying off debt, or setting aside funds for new hires or equipment. When your goals are clear, your budget becomes a tool to help you act on them.

5. Use tools to stay on track

Spreadsheets can work, but tools like Xero Expenses, MYOB Capture & Expenses, or Frollo act as a business expense tracker, helping you monitor spending and stay accurate in real time. They give you a clear picture of what’s coming in and going out, and flag issues before they become problems. For more on what to use, discover 4 must-have financial tools for small business owners in 2025.

6. Review and adjust regularly

No budget gets everything right the first time. Check in monthly or quarterly to see how your numbers compare with reality. If expenses are creeping up or revenue isn’t matching expectations, update the plan so it keeps working for you.

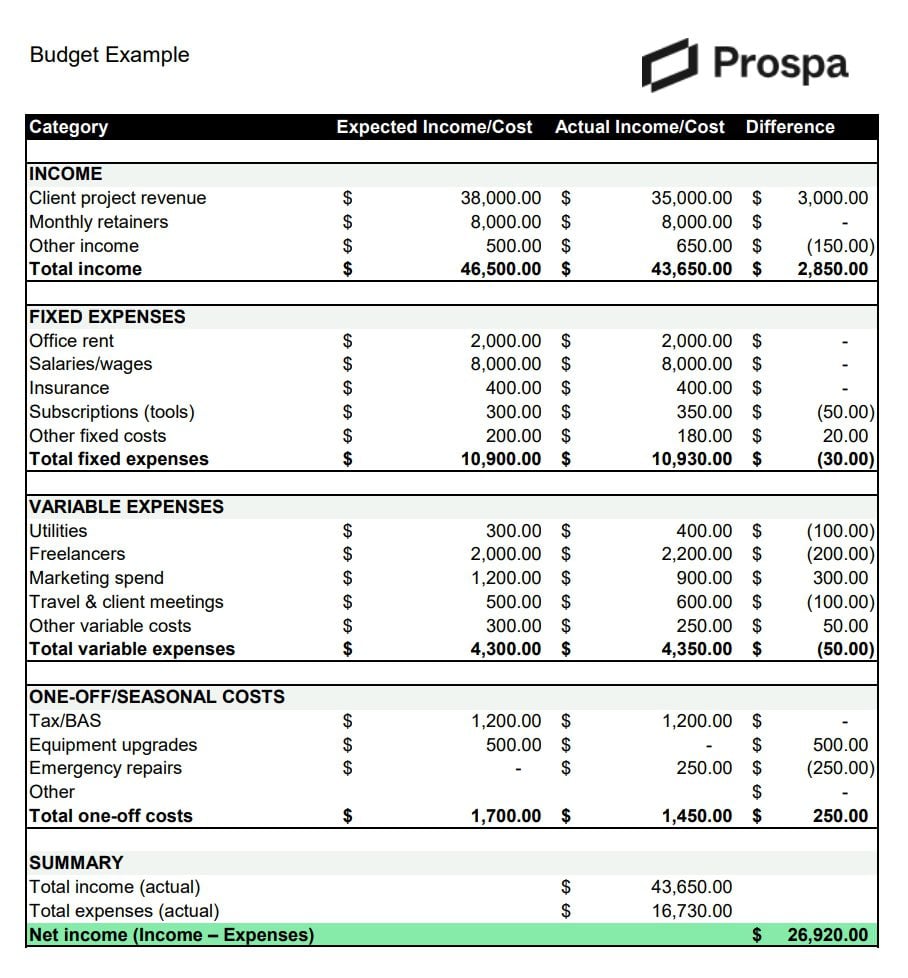

Not sure where to start? We’ve included a free small business budget template you can download and adapt. It also includes an example tab pre-filled with realistic figures to give you a head start.

Is your budget hitting the mark?

When you review your budget, keep these small business budgeting tips in mind.

- All your expenses are covered

You’ve accounted for fixed, variable, and one-off costs like tax, subscriptions, and emergency repairs. - You’ve planned for seasonal changes

Your forecast adjusts for slower months, not just yearly averages. - Your goals are grounded in real numbers

You’re working toward targets based on past performance, with enough stretch to stay ambitious. - You’ve included a buffer

You’ve built in a 10% to 20% margin around income to give your business flexibility when things shift. - You’re reviewing it regularly

You check your budget monthly or quarterly to keep it relevant and useful.

If a few of these didn’t get a tick, now’s a good time to make some updates. They’ll pay off when your business needs to move fast.

Final thought

You don’t need a perfect budget. You just need one that reflects how your business actually runs and gives you the tools to adjust when things change. Start simple, keep it useful, and check in regularly. The more you use it, the more confident your decisions will become.

Need flexible funds to cover gaps or invest in growth? A Prospa Line of Credit could give you the breathing room your budget can’t always guarantee.