In a normal financial year, it pays to be organised when it comes to preparing your end-of-financial-year tax obligations. But this year, with the global coronavirus pandemic at large, it's particularly important.

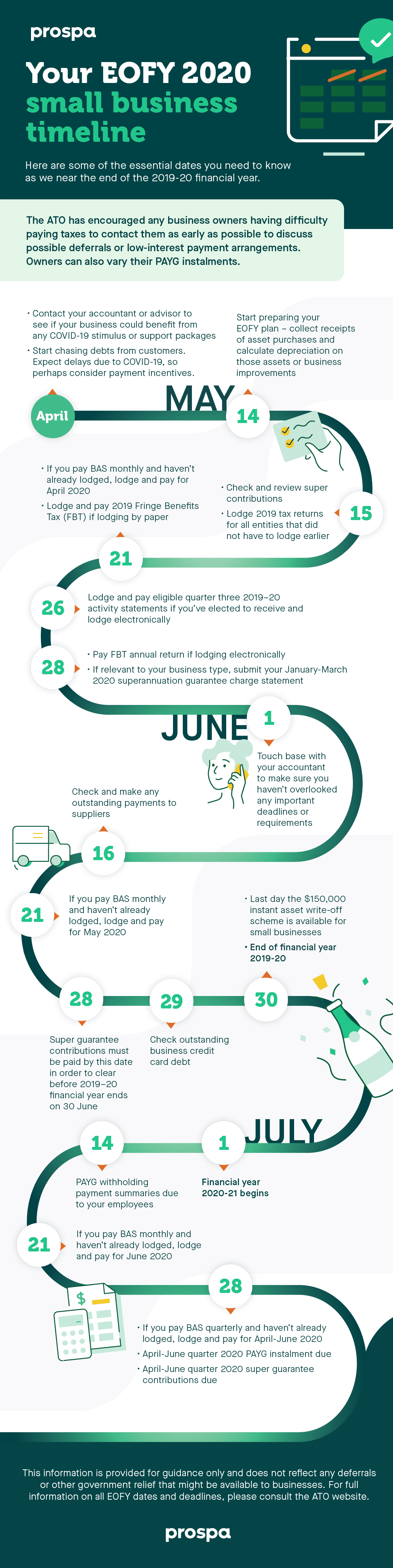

Here’s a checklist of some important reminders and deadlines for small business owners to mark in their calendar as 30 June 2020 approaches and the new financial year begins:

By getting organised early, your small business may be able to take advantage of key initiatives – including those announced in the Federal Government’s COVID-19 economic stimulus package – before the 2019-20 financial year ends.

For example, chartered accountant Rod Fay, Director at Seacombe Services, says businesses could consider making the most of the $150,000 instant asset write-off expansion (up from $30,000), or the 100% cashback on PAYG withholding, up to $100,000 in total.

“The dollar values involved are considerable but you need to make sure you’re organised and lodge on time,” says Fay.

Fay also urges small business owners to start chasing outstanding debts from clients sooner than usual this financial year due to the strain that coronavirus is putting on many businesses.

“You may also need to think smarter about how you can encourage quick payment. You could offer a 5% discount, for example, if they pay you within 14 days,” adds Fay.

Another key EOFY deadline consideration is superannuation, adds Fay, which must be paid and clear by 30 June to count for this financial year.

“Normally with your staff you pay their super in the month after their payroll,” explains Fay, “but you won’t get a tax deduction for that 28th of July payment in the current financial year unless you have paid it prior to 30 June.”