Things you need to know when applying for a business loan

If you’re applying for a business loan, then the first question you’re likely to ask yourself is: how do business loans work? Prospa is Australia’s #1 online lender to small business, and we support local Australian businesses with easy and hassle-free application on small business loans with a quick decision on loan amounts of between $5K and $1M. Terms range between 3 and 60 months and repayments are fixed either daily or weekly to work with your cash flow, plus early repayment options are available.

Here we’ll take you through some basic information regarding our application process, plus answer some of the questions you might have about how business loans work – such as what you need to provide when applying, what your business can do with a loan if you are approved and what loan amounts and terms might be available. We’ll also cover what you might expect when you apply for business finance options in Australia.

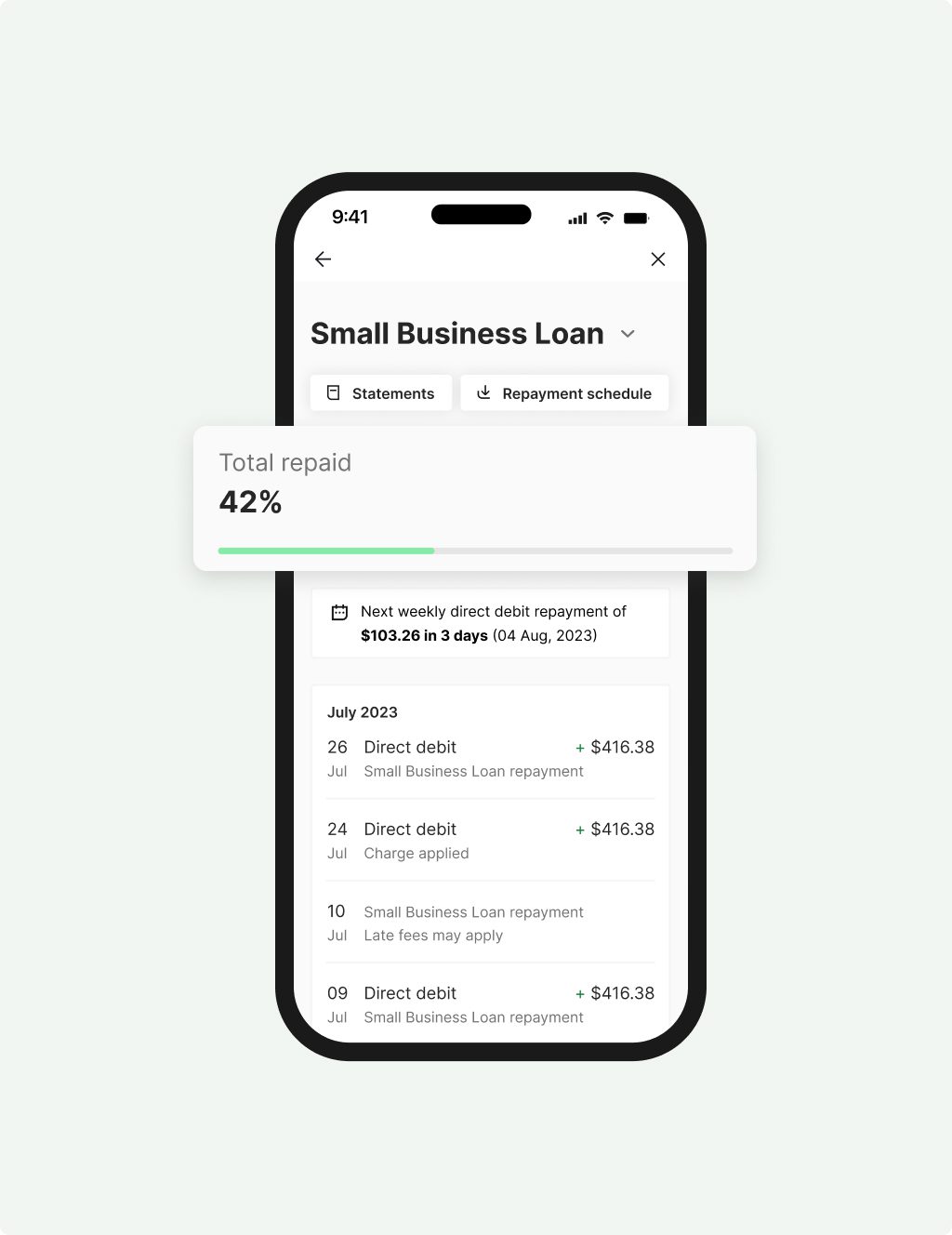

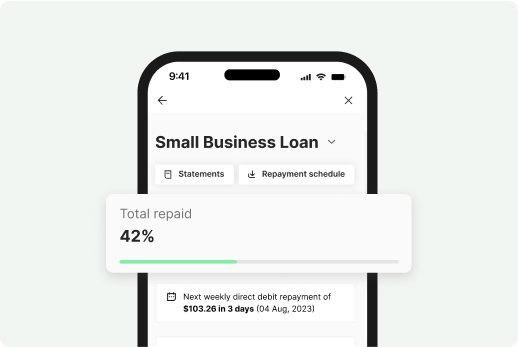

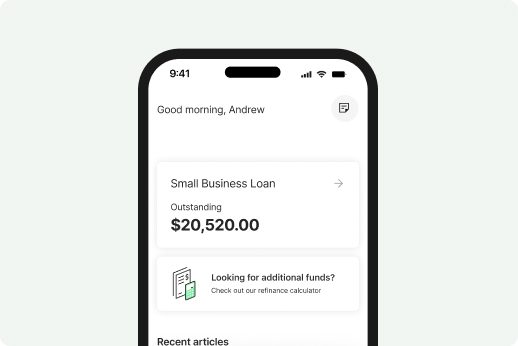

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

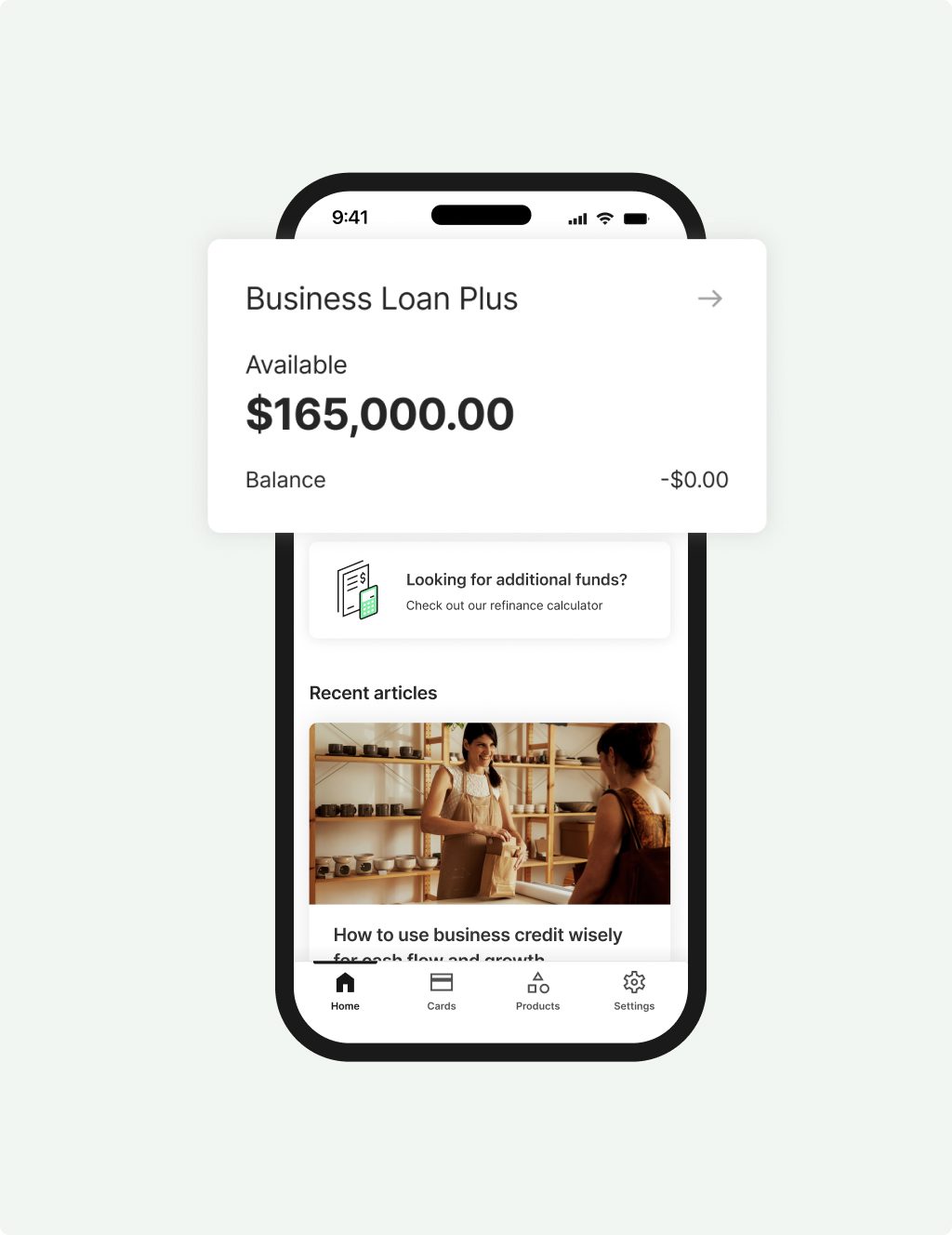

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

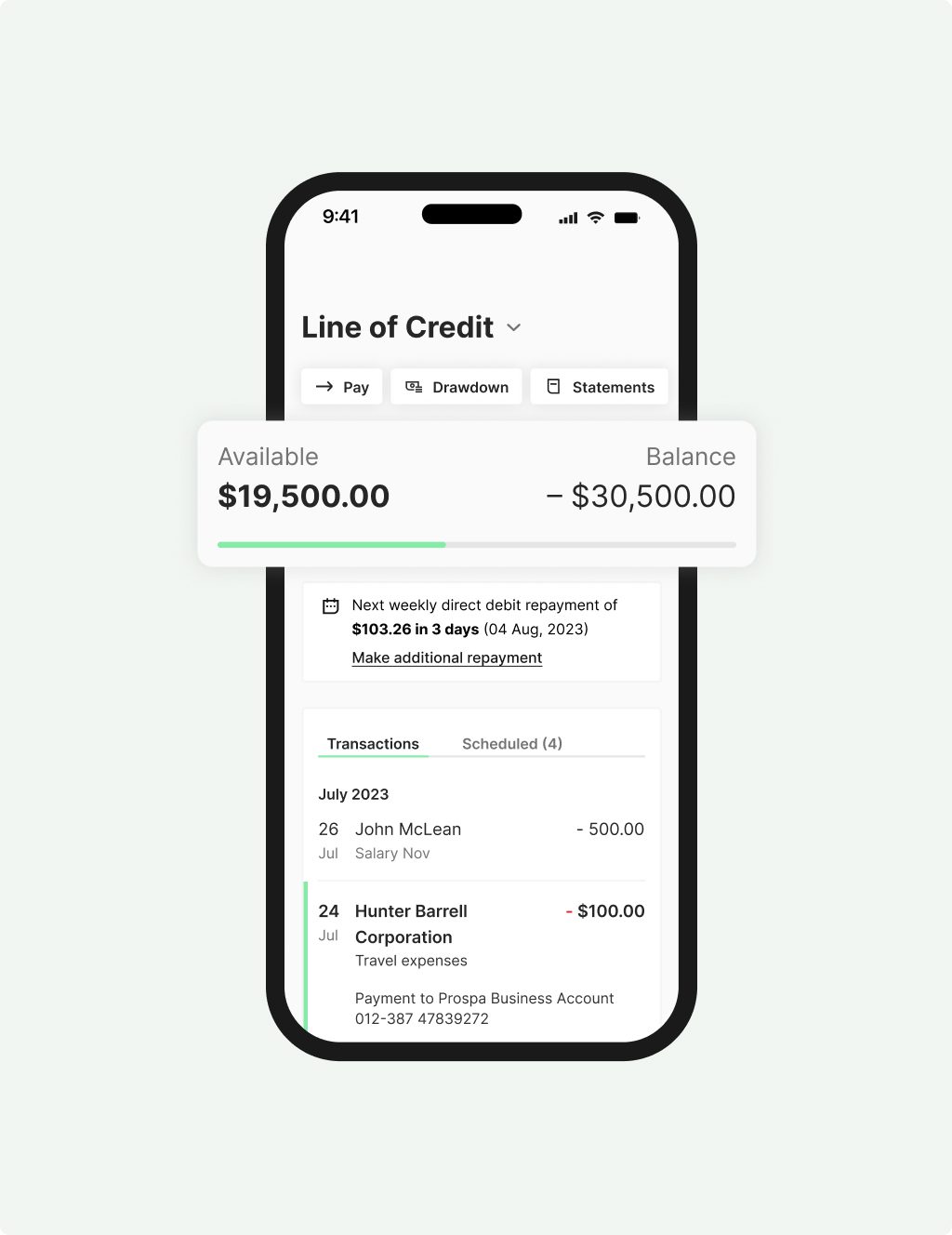

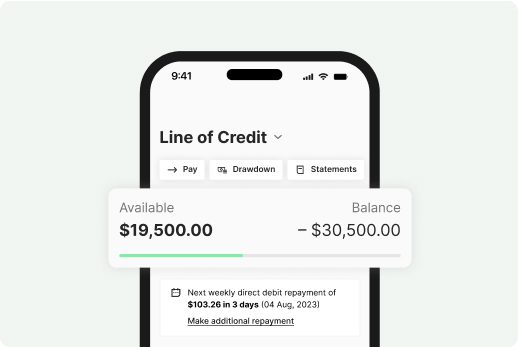

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

How to get a business loan

When you choose Prospa to help your business to grow over the short term or long term, you can look forward to a fast application process and friendly business loan specialists to support your business. There are early payout options, and we offer cash flow friendly repayments to work with small businesses, so we can do our best to support growing success.

Prospa continues to meet the changing needs of small businesses. We have already helped thousands of Australian and New Zealand businesses with business loan funding and we’re proudly committed to maintaining our 4.5/5 TrustScore rating.

To begin an application for a business loan of $250,000 or less you will need:

- Your driver’s licence number

- Your ABN

- Your BSB and bank account number

For loan applications requesting more than $250,000 you will also need basic financial statements such as your Profit & Loss and cash flow.

Applications take just 10 minutes to complete online and we do our best to get back to you with a decision quickly – in fact when you apply within standard business hours you could receive a response within the hour. If your application is approved before 4pm on a business day, it is possible to receive your new funds into your business account the very next business day.

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $1M with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

FAQs

Frequently asked questions

A Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support business cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more.

You can choose to repay the entire amount of your loan early at any time.

If you decide to do this please speak to our friendly business loan specialists on 1300 882 867. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

There are a number of options you can explore when you want to compare business financing options. Here are some to think about:

Line of Credit: If you are looking for a better way to streamline or fill cash flow gaps, a Line of Credit may be the right funding solution for you. With a Business Line of Credit, you can get ongoing access to funds and only pay interest on what you use. We offer a Business Line of Credit $500K, with a renewable 2 year term.

Equipment financing: Equipment loans are a way to finance purchases of equipment for your business. This type of finance is usually secured against the value of the business asset you wish to purchase. This can sometimes help to secure a low rate, although this isn’t always the case. So, if you need to purchase business machinery, IT equipment, tools, or even work vehicles, a Prospa Business Loan could be a good alternative to equipment finance.

Vehicle finance, Business car loan, Machinery finance: This can be a handy way of updating your fleet vehicles or to cover the cost of large assets like harvesters, excavators or commercial cookers. A Prospa Business Loan may be able to cover these items, talk to us today to find out more.

Business overdraft: This handy type of finance can help small businesses cover short-term cash flow gaps. It is often used to cover bills like payroll which can fluctuate if you employ seasonal casuals. It’s also useful to pay suppliers on time if you’re waiting for your own invoices to be paid by your customers. See you can use Prospa’s Line of Credit in a similar way.

Other questions?

Awards , thanks to you

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |