At a glance

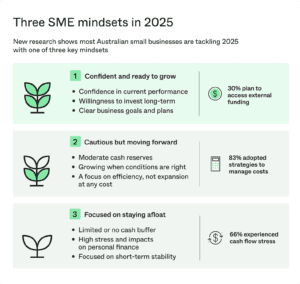

- New research shows most Australian SMEs are navigating 2025 with one of three distinct mindsets: growing, cautiously adapting, or working to stay afloat.

- Business owners are reviewing funding, pricing and cash flow strategies to match their position and build resilience.

- Being clear on your mindset can help you make better choices and move forward with purpose.

Rising costs and a tough economic climate are putting pressure on Australian small businesses. But most business owners are determined to adapt.

According to the April 2025 YouGov SME Sentiment Report, commissioned by Prospa, 74% of business owners rate their business health as good, a 7% improvement from late last year. At the same time, many are making trade-offs to stay on track. One in five say they have less than a month’s worth of cash reserves. A third have used personal funds to cover business expenses. And 43% say the stress is affecting their wellbeing.

It’s a mixed picture, but three clear mindsets are emerging. Some business owners are ready to invest and grow. Others are cautiously adjusting to conditions as they go. And many are focused on simply getting through the year.

This article explores each mindset in more detail and offers practical tips to help you move forward, wherever your business is right now.

1. Confident and ready to grow

Some business owners are taking action this year, not just holding steady. 30% of SMEs plan to access external funding in the next 12 months, with many directing it toward expansion (35%), marketing (35%) and equipment upgrades (32%).

This group is focused on opportunity. They’re weighing the risks, but still moving ahead with plans to build capacity, improve visibility or upgrade systems.

What this mindset looks like:

- Confidence in current performance

- Willingness to invest in long-term growth

- Clear business goals and plans to act on them

What to consider next:

- Choose a funding option that aligns with your plans. The right business loan depends on how and where you’re planning to invest. Ask yourself: which business loan is right for my industry?

- Smaller business loans can still create momentum. A $10K boost can cover targeted improvements or unlock working capital to help fund growth. Here are 7 clever ideas for how to use a $10K business loan.

- Understand the terms before you commit. Knowing how different loan features work helps you make more informed decisions. From APR to working capital, find out what the most common business loan terms mean.

2. Cautious but still moving forward

Many business owners are taking a measured approach in 2025. They’re adjusting to economic pressures while continuing to look for safe, sustainable ways to grow. 83% say they’ve adopted or are likely to adopt strategies to manage rising costs, including reducing non-essential expenses (46%) and increasing prices (37%).

This group is focused on staying in control. Decisions are considered, budgets are closely watched, and growth is only pursued when the conditions are right.

What this mindset looks like:

- Moderate cash reserves

- Looking to grow, but only when the timing feels right

- A focus on efficiency, not expansion at any cost

What to consider next:

- Find the funding option that’s right for you. A business line of credit gives you access to funds when needed, without the commitment of a fixed loan. You can cover costs or act on opportunities without drawing more than necessary.

- Give yourself the best shot when applying. Lenders look for certain indicators when assessing applications. These tips will help you feel more confident and boost your chances of getting approved.

- Find small ways to improve your margins. Improving your pricing strategy can be one of the most effective ways to protect your profits without cutting quality. Here’s how to rethink your pricing model in a way that supports both cash flow and customer value.

3. Focused on staying afloat

For some business owners, the main priority this year is keeping the business going. 13% say they have no cash reserves. Another 20% report having less than a month’s buffer. In the past 12 months, 66% have experienced cash flow stress, and 43% say it’s affecting their wellbeing.

This group is showing resilience under pressure. They’re continuing to serve their customers, manage day-to-day operations and hold things together, even with limited resources.

What this mindset looks like:

- Limited or no cash buffer

- High levels of stress and personal financial impact

- Focused on short-term stability over long-term plans

What to consider next:

- Look into fast, simple ways to access funding. If you’re short on time or energy, you don’t need to navigate a long, complex application process. Here’s how to apply for finance quickly and easily.

- Pinpoint areas in your cash flow that need improvement. These six tactics can help you stop unnecessary losses, hold onto more of your income and build stability.

- Start building a small reserve, even gradually. Setting money aside may feel difficult, but even a small buffer can provide breathing room. Learn how to build a cash reserve in a way that works for your business.

EOFY: some grow, some pause

The end of the financial year means different things to different businesses. According to the YouGov research, 54% of business owners see EOFY as an opportunity to grow. For others, it’s a valuable checkpoint to pause and reassess.

Whatever mindset you’re in, this is a good time to review your cash flow and think ahead. If you’re considering funding to support the year ahead, this guide breaks down the pros and cons of borrowing before or after 30 June, depending on your goals and financial position.

Speak with the Prospa team to find the right funding for where you’re at.