Commercial Lending

In the initial years of operation, many businesses need funds to keep moving. Financial expenses might include working capital, office rental, product or service development, marketing, and daily operations, to name a few. To keep up the momentum, some businesses may need commercial lending to sustain their operations while others may need commercial loan funding to expand their business.

When it comes to commercial business loans, the challenge lies in choosing the right lender to borrow money from. Depending on how reliable and flexible the business loan you get is, you will either be able to achieve your business goals or risk being less financially stable as you try to run your business day to day. Prospa has helped thousands of Australian businesses with their commercial lending needs, and we can also help transform how you run your business.

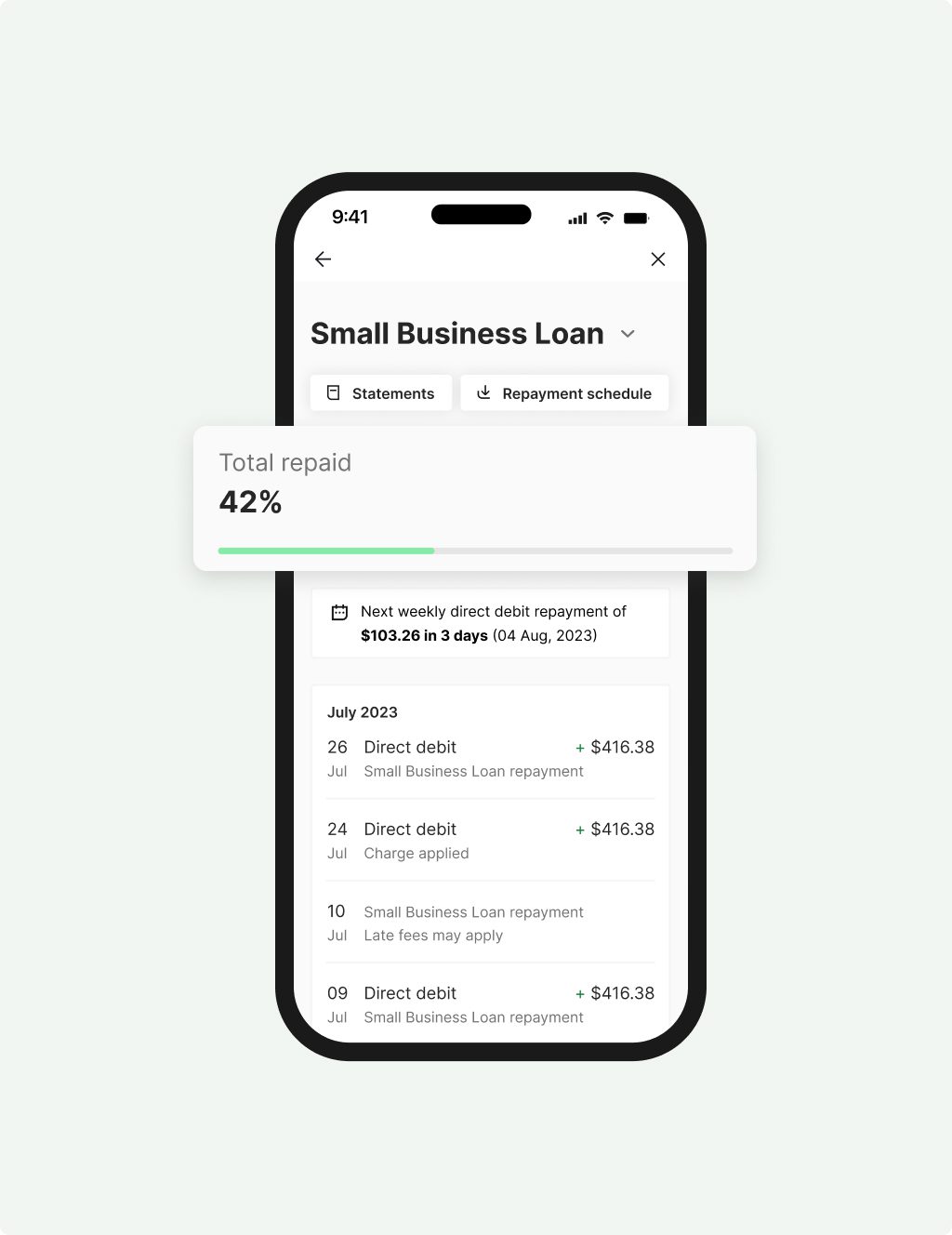

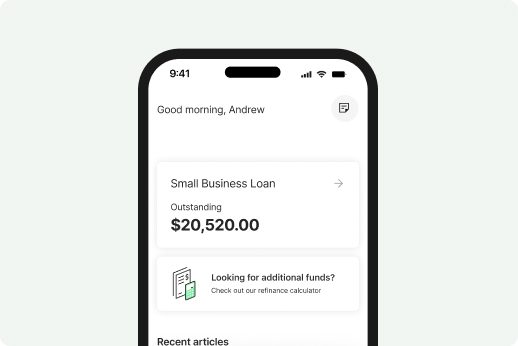

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

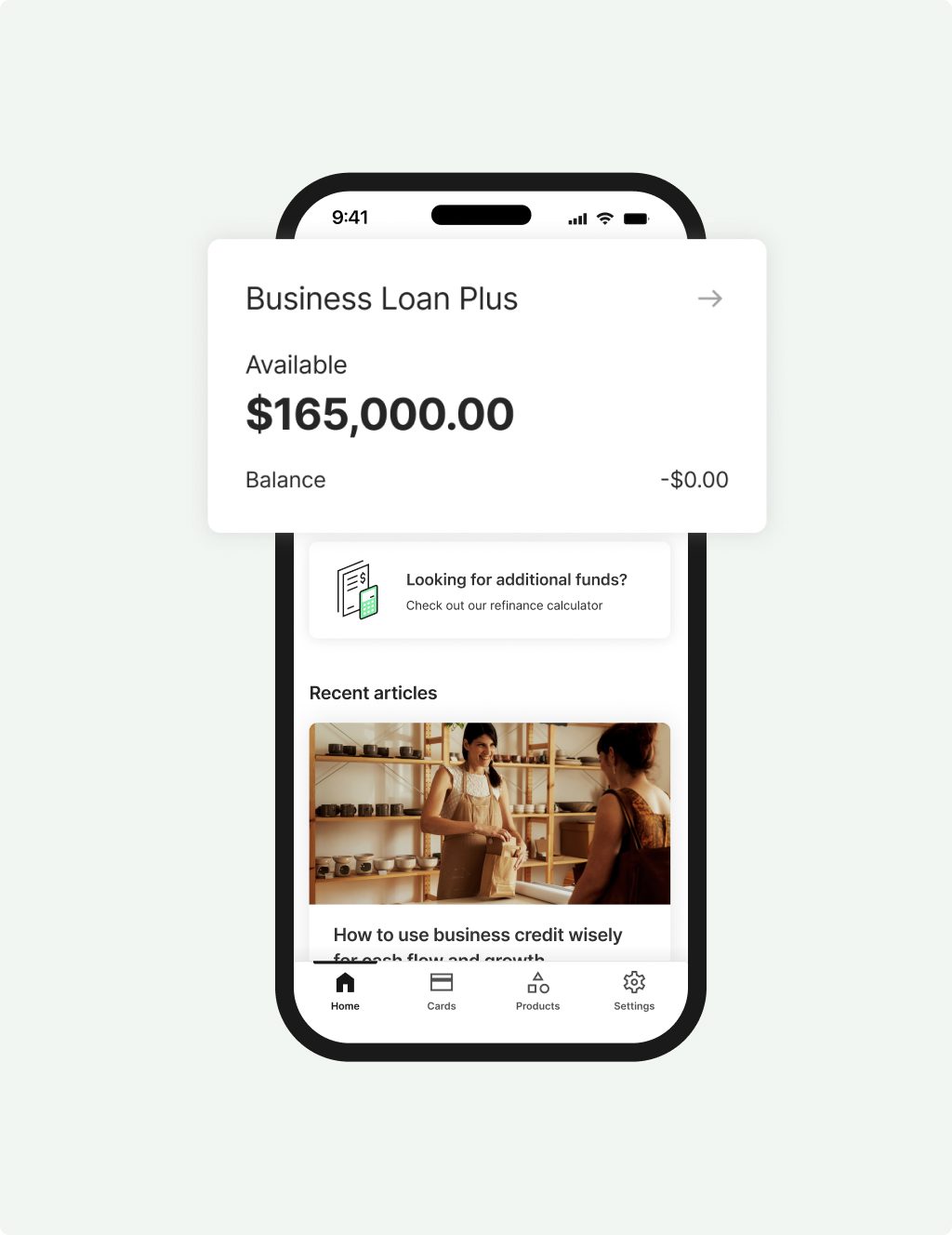

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

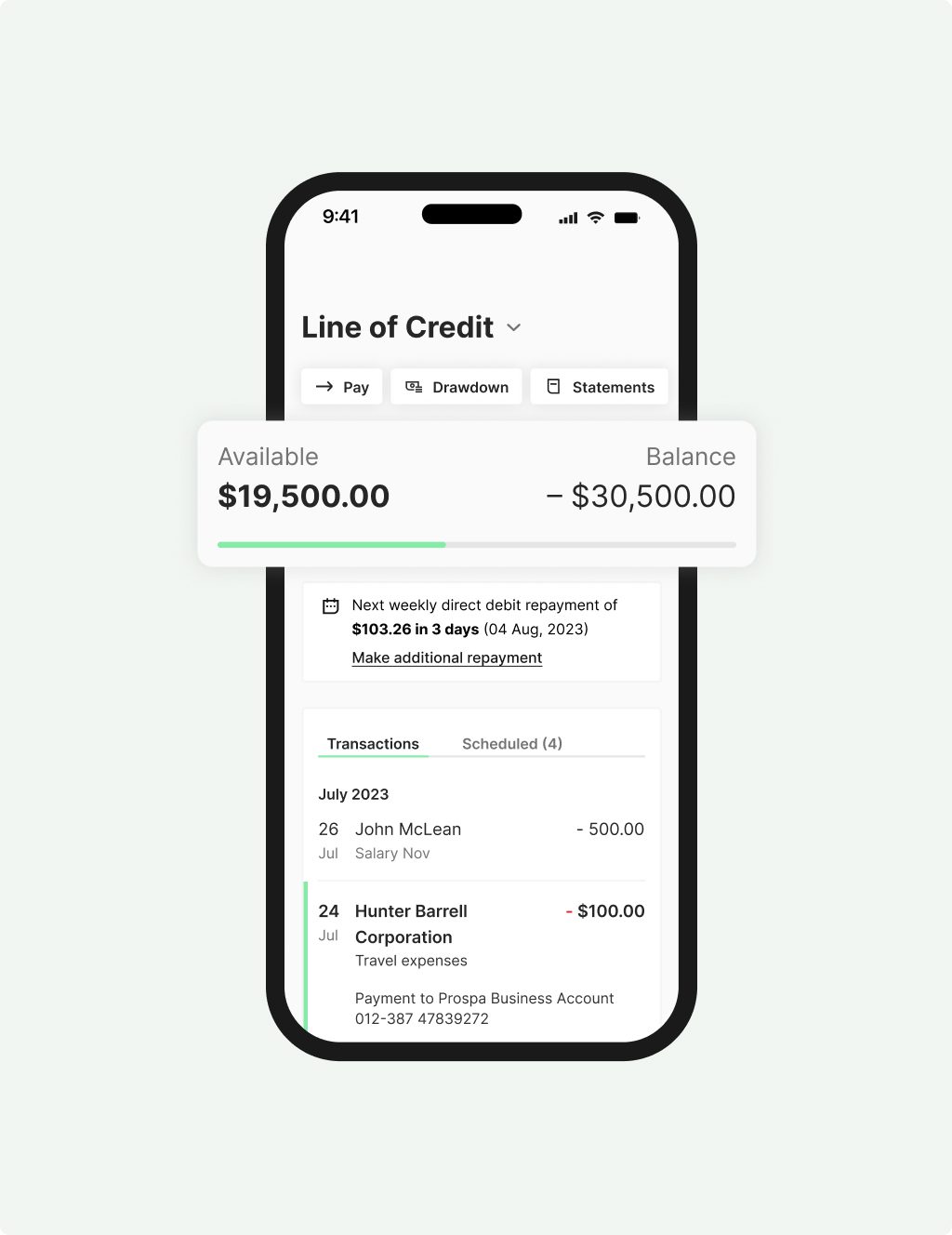

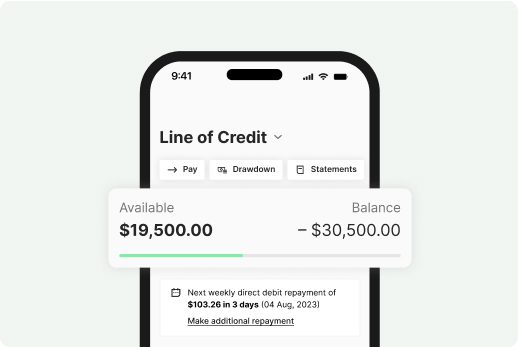

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Hassle-free commercial lending with Prospa

When you apply for business funding with Prospa for your commercial lending needs, the process is quick and easy. Our technology is designed to enable small businesses eligible for commercial lending to get access to their funds in as little as one business day. Prospa has partnered with local Australian businesses for over a decade, and we are proud to be Australia’s #1 online lender for small businesses. Prospa has ranked top in non-bank finance companies in Australia and New Zealand and has over 6,000 positive reviews on Trustpilot as well. All these are reflections of the exceptional service Prospa has provided its customers.

Taking advantage of growth opportunities with Prospa loans

When small business owners of PUPSTYLE needed funding to restock their in-demand pet products, they turned to Prospa for help. Thanks to the small business loan, they were able to restock items quickly to cope with and meet the sudden influx of orders. Today, PUPSTYLE continues to move forward, with its staff members working hard to make their company the leading choice for pooch lovers worldwide.

“The funds came through at the perfect time and that wouldn’t have happened if we’d gone to a bank, because the application and approval process would have taken too long. Prospa helped us to take advantage of a huge growth opportunity.” – Tatum Ioannidis, owner of PUPSTYLE

Prospa commercial lending service features

Prospa gives you full control over your commercial business loans. Our 10-minute application process, fixed terms, and flexible repayment options empower you to focus on growing your business. Currently, we offer:

- Business loans ranging from $5K to $1M over fixed terms of 3 to 60 months

- A Business line of credit with limits between $2K and $500K over 24 month term with an option to renew

- No upfront security needed to access Prospa funding up to $150K

- Hassle-free application process with funding possible in 24 hours

- Fixed rates and set repayments

How can commercial lending help your business

When you apply for commercial lending through a digital lending platform like Prospa, you can look forward to faster and more efficient application experience than with most traditional lenders that offer commercial loans. Commercial loan products from Prospa can be used for almost any business purpose including expanding your business, investing in a business opportunity, and freeing up your cash flow. Here’s how else a loan can help your business:

- Acquiring new business assets

- Hiring more employees

- Upskilling your team

- Running marketing campaigns

- Boosting your online presence

- Renovating your old business premises or moving to a new one

- Purchasing more stocks or materials

- Catering to more customer demands

How to know if you are eligible for Prospa commercial lending

‘How do business loans work’, ‘how to get a business loan’, and ‘do I qualify for a small business loan’ are just some of the many questions that small businesses have when it comes to getting a commercial loan. You can apply for commercial lending at Prospa if you meet the following criteria:

- Be an Australian citizen or a permanent resident of Australia

- Be at least 18 years old

- Own an Australian business with a valid ABN/ACN

- Minimum trading history applies

If you are applying for $250K or less, your driver’s licence number, ABN, and proof of identity, as well as your BSB and account number are the only requirements. You’ll need fundamental financial records, such as a P&L and cash flow, for loans over $250K. Applying for a Prospa loan is quick and simple; click the button below and fill out the online form in as little as 10 minutes.

How do companies raise capital?

Typically, working capital reflects the assets available to a company to be used to generate future revenue or support organisational growth. Working capital can be in the form of either debt or equity. Taking out a small business loan can be one way of raising a company’s capital.

It’s important to remember that both the initial working capital growth and the subsequent impact of that investment must be measured on an ongoing basis in order to maintain an accurate record of the company’s current capital value and avoid financial penalty.

Flexibility

Support

Confidence

Customers making it happen with a Prospa loan

Read customer storiesFAQs

FAQs

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

For all Prospa funding:

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Small Business Loan up to $500K, you must also have:

- From 6 months trading history

- Monthly turnover of $6K

For a Business Line of Credit up to $500K, you must also have:

- Minimum 6+ months trading history

- Monthly turnover of $6K

- Property or asset ownership

For a Business Loan Plus from $500K up to $1M, you must also have:

- Minimum 3 years trading history

- Annual turnover of $2M

- Property or asset ownership

To apply for a Small Business Loan:

For amounts up to $250K we require:

- 6 months bank statements

- ATO Tax Portal access (For amounts >$100K)

For amounts above $250K we require:

- 12 months bank statements

- ATO Tax Portal access

- Financial statements

Use our loan calculator to see how much you can afford to borrow.