Despite a challenging few months due to harsh lockdowns in Victoria, Matt Fraser’s home-based clinic Northern Sports & Remedial Myotherapy has bounced back.

At a glance

With the funds from a Prospa Line of Credit, Matt has been able to:

- Buy new equipment and stock

- Invest in advertising

- Grow the business beyond his expectations

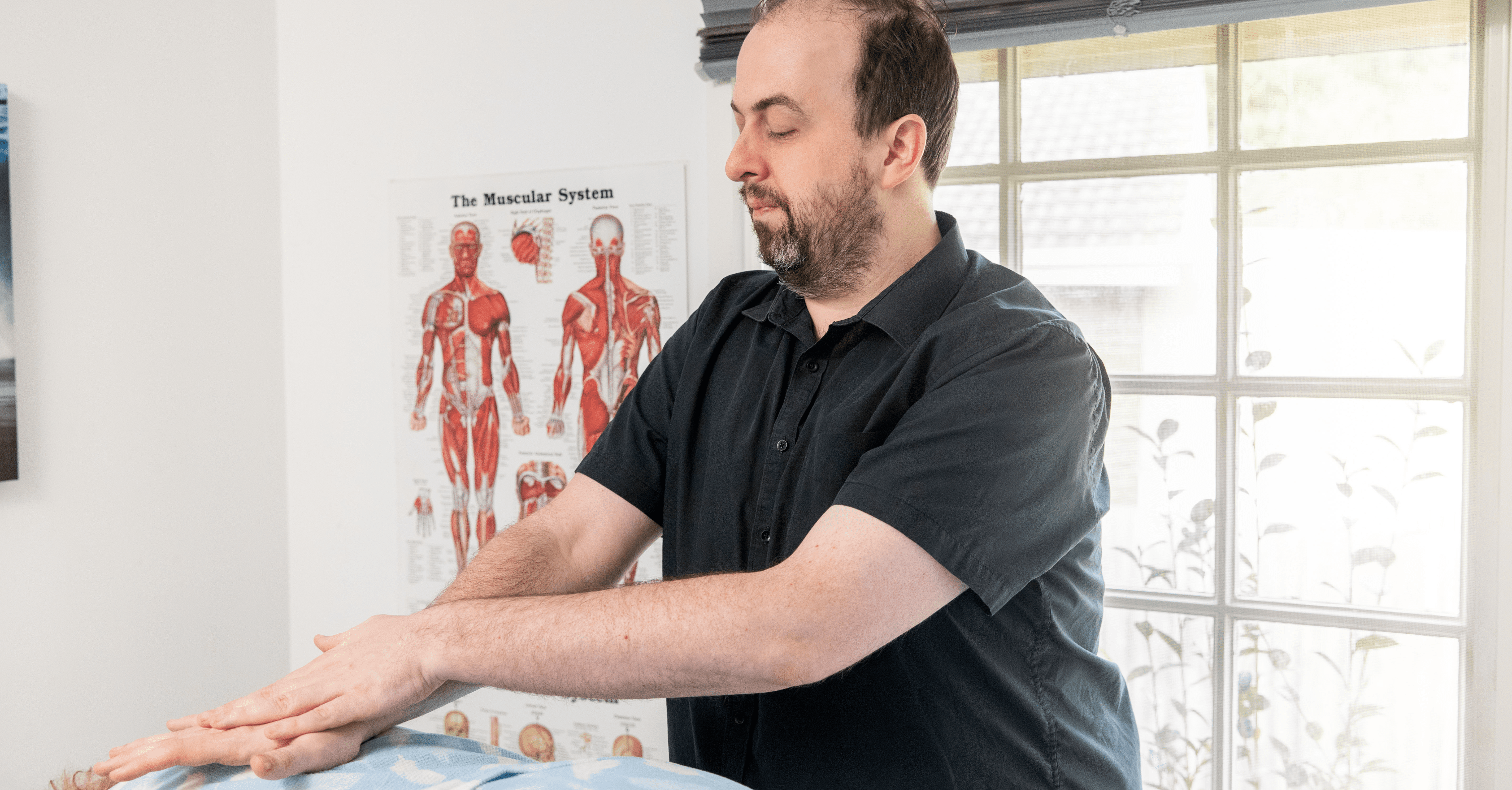

Most people enjoy receiving massages, but Matt Fraser loves giving them.

After attending a weekend workshop, he found his new career path as a massage and myotherapy specialist. “I completely fell in love with myotherapy and haven’t stopped since,” says Matt.

Myotherapy is the assessment and treatment of musculoskeletal pain. “Along with physical pressure on the muscles, we also use different modalities including dry needling and cupping to figure out what’s going on and get the person in a better shape,” explains Matt.

Matt qualified in 2016 and worked at a series of osteopathy, chiropractic, Pilates and naturopathy clinics before launching Northern Sports & Remedial Myotherapy in Bundoora, Victoria a year later.

He runs his business as a solo practitioner and runs everything – from marketing to taking bookings – in his home-based clinic.

Bouncing back after challenges

Bouncing back after challenges

At the height of the pandemic the business was forced to close for around eight months.

During this time Matt only managed to keep it ticking over with government grants. “It just kept the lights on and allowed me to pay my utility bills,” he says. “It was a rough time.”

But since the state opened back up, business has boomed. “My phone barely stops ringing,” says Matt. “At the moment I’m booked out three to four weeks ahead on a constant basis.”

This uptick in clients is a result of Matt taking out a line of credit with Prospa, which he used to invest in advertising.

Matt discovered Prospa after seeing TV, radio and Facebooks ads and was impressed with the positive reviews from other small business owners. He was determined to steer clear of banks and credit cards.

“There’s a lot more interest with credit cards and the repayments are not flexible like a line of credit is,” he explains.

His experience with Prospa was different. “I liked how they treat people with respect,” he says. “They actually go out of their way to get more of an understanding of what you do and help you in any way they can. The application process was seamless and straightforward and within a day I had funds in my account.”

Matt took out a line of credit in March this year and topped it up in May. He chose this option over a small business loan because of its flexibility.

“It’s a lot more beneficial because I can put money into it and then redraw if I need to,” says Matt. “That helps with a lot of cash flow issues I may have from time to time.”

Investing in advertising reaps rewards

Using the funds to invest in Facebook, Instagram and Google Ads has reaped rewards for the clinic.

“Coming out of the pandemic, I didn’t have the budget to do much advertising,” says Matt. “So this allowed me to grow the business. It’s brought customers from not just the local area but surrounding suburbs and the Melbourne CBD too. Without the line of credit, this wouldn’t have happened.”

Word of mouth referrals are important for a business and this has been the case for Matt, who bends over backwards to give clients the best service.

To this end, he also used the line of credit to upgrade his massage table and other equipment, supplies and sales stock.

“I always get the medical grade stuff,” says Matt. “I don’t supply anything that I wouldn’t use myself.”

Investing in advertising and equipment has allowed Northern Sports & Remedial Myotherapy to grow by 30% over the past year.

“Prospa’s line of credit has been a life saver for me and helped give my business the ability to thrive beyond what I was expecting,” says Matt.

Building slowly and enjoying the journey

Building slowly and enjoying the journey

In fact Matt has been so successful that other clinics have tried to hire him to work for them. But it’s not something he’s interested in as one of the main reasons he loves running his own business is not having to answer to a boss.

“I love being able to make decisions whenever I need to,” he says. “If a patient needs a particular piece of equipment and they can’t find it, I contact my supplier and get it within a couple of days.”

As for the future, Matt’s taking it slowly. “I’ve thought about growing the business a bit more, such as putting an external clinic outside my property or renting a commercial place, but I’m not sure if I’m going to go down that alley yet. I’m quite happy with how I’m running things now.”

For anyone aspiring to start their own business, Matt says it’s challenging but can also be prosperous. “If you stick it out, and especially if you love what you do, you can’t go wrong.”

Need funds to take advantage of a growth opportunity? Ask Prospa about a funding solution that keeps your small business moving.