Flexible Funding Solutions for Retail Growth

Fuel Your Retail Growth with Prospa's Flexible Cash Flow Solutions

Flexible business funding to get you where you need to be

When you’re thinking ‘growth’, don’t let a lack of funds stop you in your tracks. We’ve helped hundreds of retail businesses make their next brave move with our flexible range of cash flow solutions.

Whether you want to build an online empire, invest in next-level POS tech, promote a massive sale, or just enjoy a bit of cash flow backup – talk to Prospa. It takes just 10 minutes to apply online for funds up to $1M, and approved funding is possible in just 24 hours. What are you waiting for?

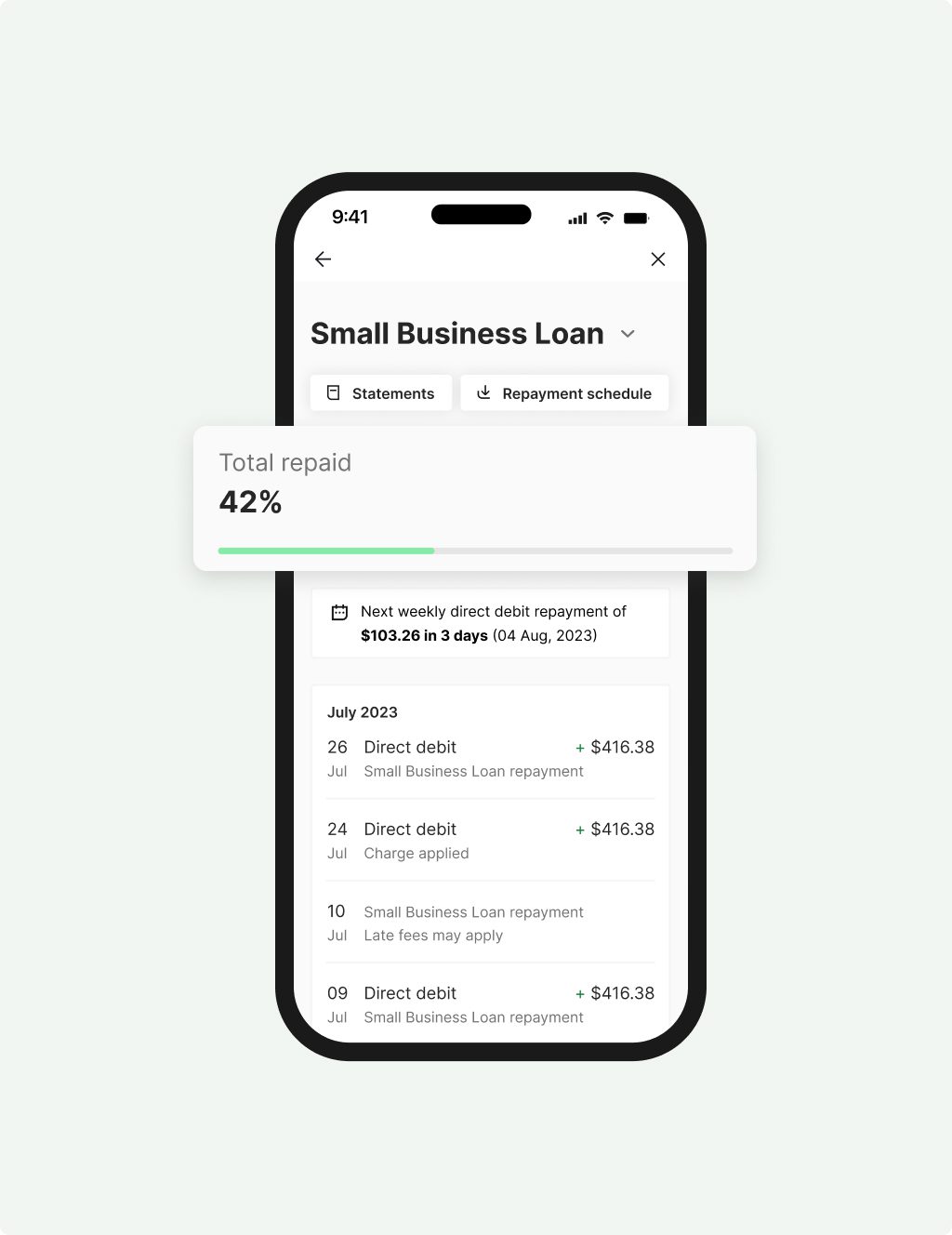

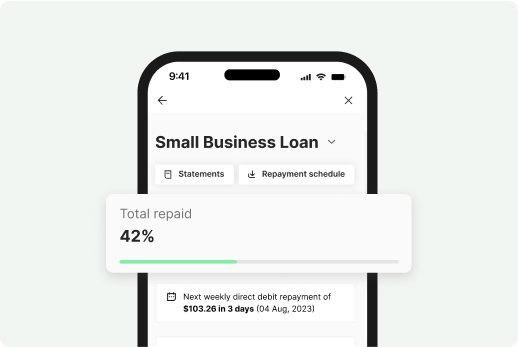

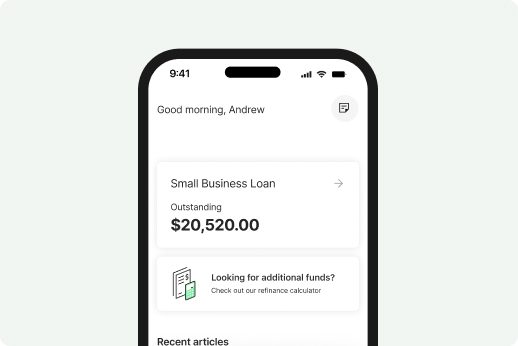

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

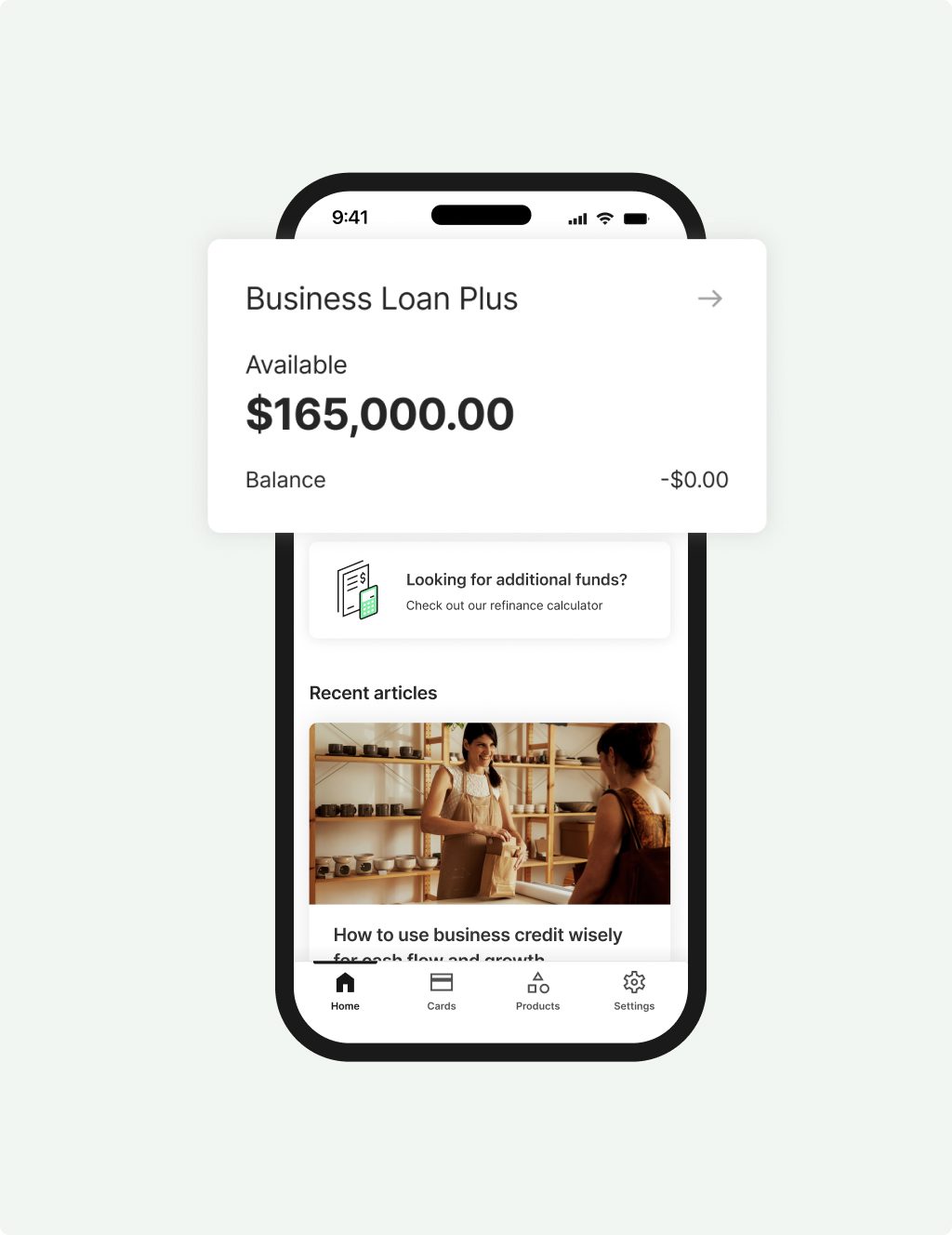

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

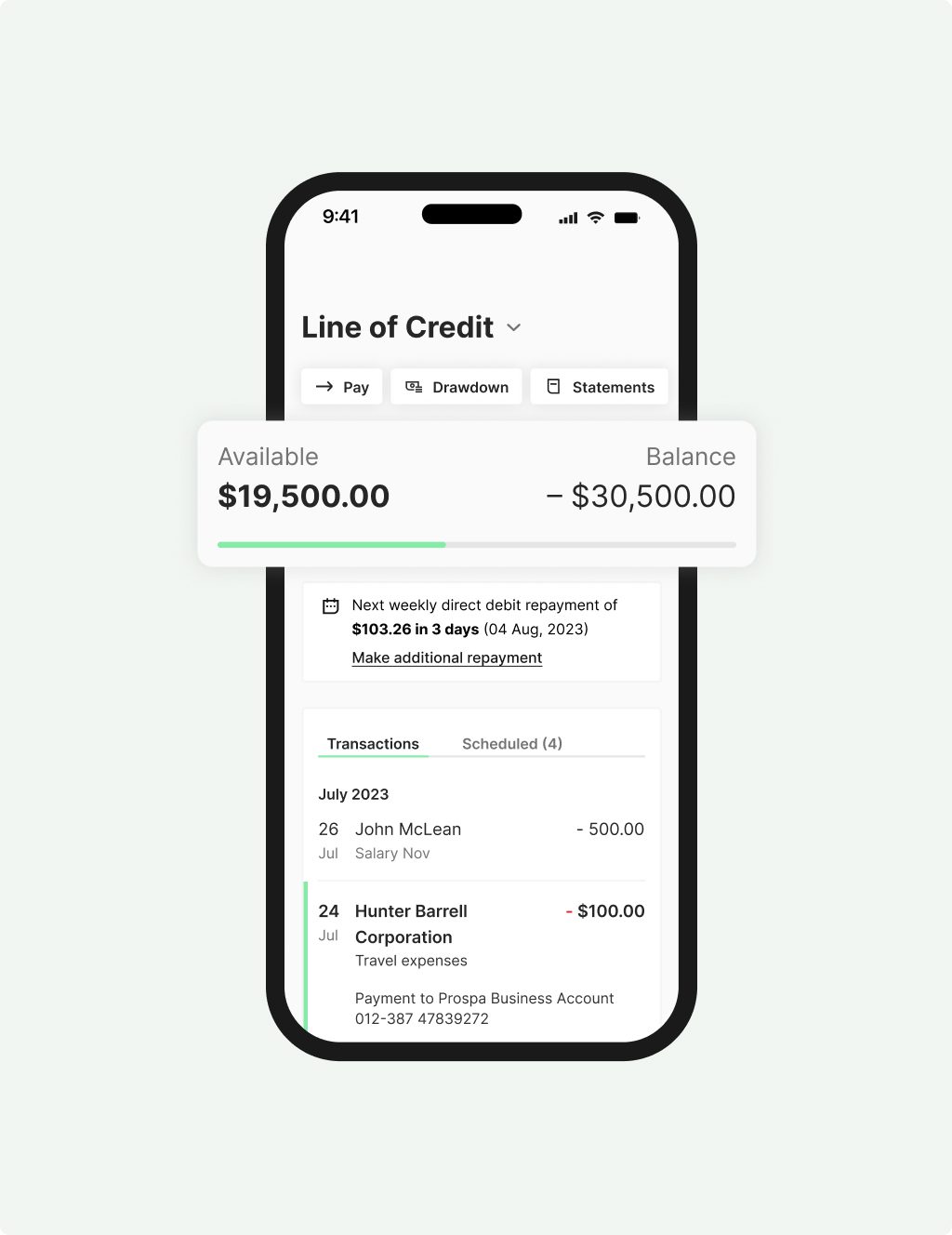

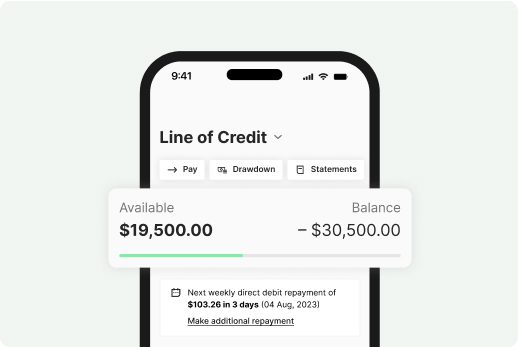

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

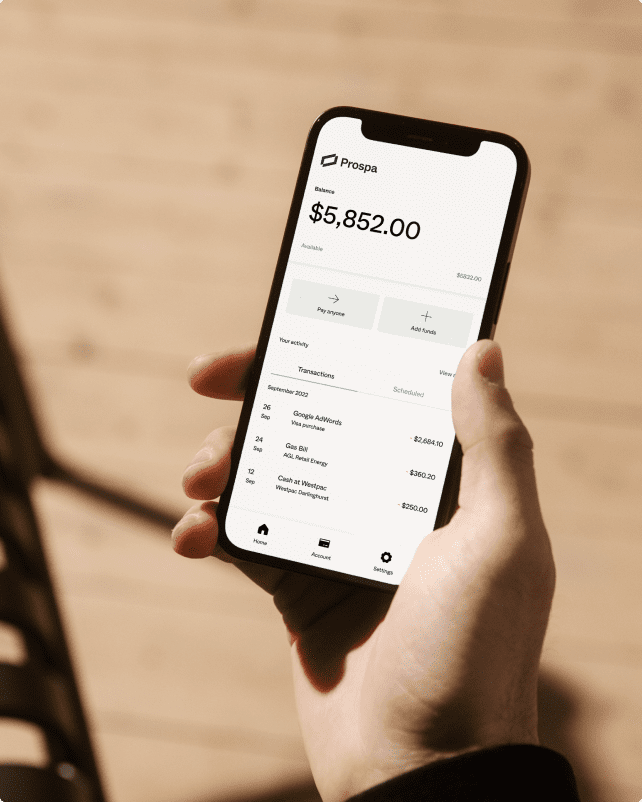

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Cashflow or Growth. We help retailers with both!

As a business owner operating in the retail industry, you know that cash flow can play a vital role in your business’s day-to-day. Plus, there are times when you might need funds to invest in your business to take it to the next level. Talk to Prospa – we can help you apply for a flexible funding solution for your retail business’s needs – whatever they may be.

Stock

Improvements

Staff

eCommerce

Marketing

And more

Recent articles

Stories to inspire you, tips to save you time

Why Prospa? Because we believe in small business.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

How our customers have put their funds to work

Read Customer StoriesAwards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |