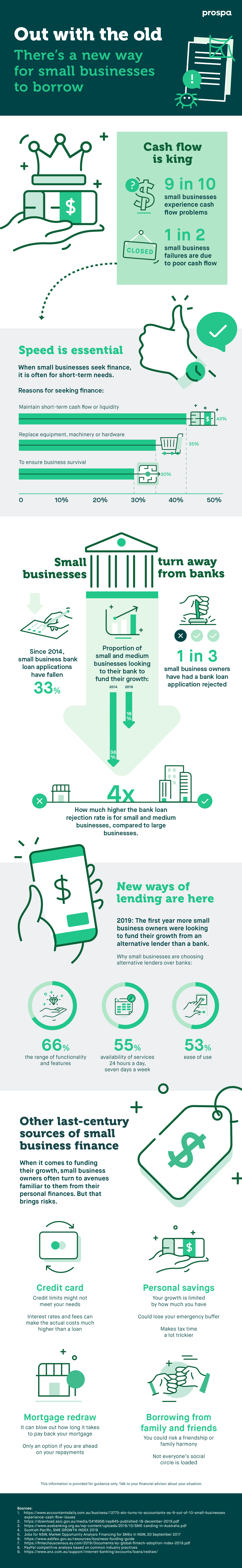

Cash flow and capital are the lifeblood of a small business. And for decades, banks have been a go-to for small business owners who needed finance. But in recent years the number of small businesses applying for bank loans has been on the decline – we look at the reasons why.

The Australian Small Business and Family Enterprise Ombudsman, Kate Carnell, says historically 83% of small businesses have relied on major banks for their funding requirements but that is changing.

“About a third of small business owners have had their applications for bank loans rejected,” she says.

“Many more have not bothered to apply as they have been told that unless they have significant equity in real estate their application will fail.”

Meanwhile, Reserve Bank of Australia research has found that entrepreneurs and small business owners are finding the loan application process “lengthy and onerous”.

“When they apply, they have to provide a large amount of information and documentation,” their research found.

“The banks then take a long time to decide whether to extend the loan. This can be particularly problematic if the business opportunity is time sensitive.”

Jamie Davison, the co-founder of Carbon Group, says small business finance is being shaken up across the globe.

He says the dwindling number of bank loan applications is a straightforward matter of supply and demand.

“On the supply side, the big banks have never been overly eager to lend to small businesses and have become even more cautious following the Royal Commission,” he says.

“On the demand side, there’s a growing awareness that many of the new alternative lenders are focused on small business loans and have invested in cutting-edge tech to make the application process as painless as possible.”

Want to find out more about today’s way to borrow? Talk to a Prospa business lending specialist on 1300 882 867 or learn more.