- Loan originations for FY18 were $367 million (70% pcp growth), up 9% on prospectus forecasts with strong momentum in the fourth quarter.

- Prospa has now delivered over $750 million in loans to over 15,000 Australian small businesses.

- A continuing focus on improving access to finance for small businesses has seen Prospa achieve a 400bps decrease in weighted average APR for the portfolio to 37%, with lower funding costs being passed on to customers.

- Customer satisfaction remains consistently high, with Prospa’s annual average Net Promoter Score in excess of +77. A rating of 9.8/10 on independent review platform TrustPilot makes Prospa the #1 Money company in Australia ranked by TrustScore.

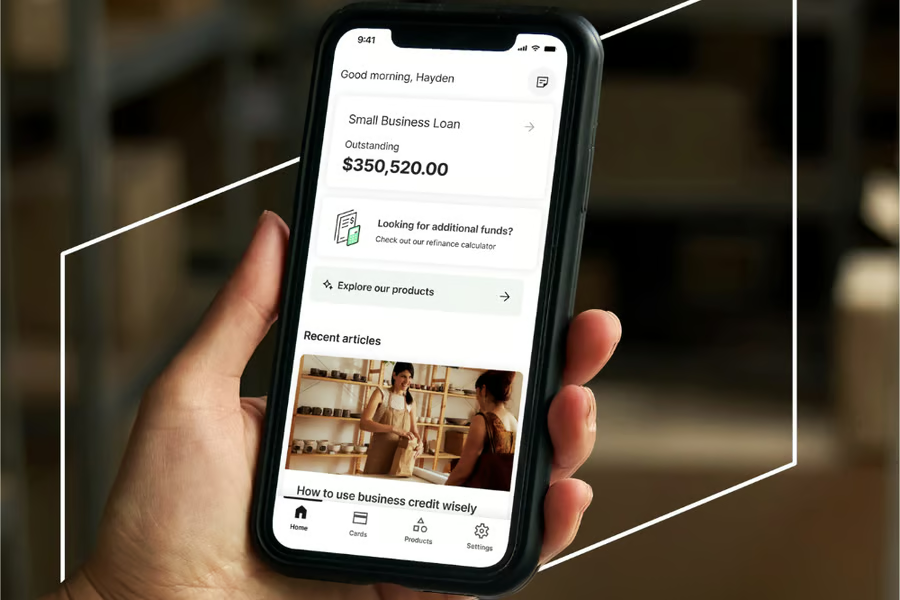

- Business expansion has continued, with originations in New Zealand reaching NZ$1million in the first 30 days, and a line of credit product in beta trials in Australia.

Business trading exceeds prospectus forecasts

Prospa, Australia’s number one online lender to small business, is pleased to announce its results for the year ended 30 June 2018 (FY 2018).

Total loan originations for the FY18 were $367 million, up 9% on prospectus forecasts and up 70% on the prior year (FY17: $216 million).

Total loan originations for the six months ended 30 June 2018 (H2 FY18) totalled $211 million, up 16% on prospectus forecasts (forecast: $181 million) and up 61% on the previous corresponding period (H2 FY17: $131 million).

Prospa’s total loan originations have now surpassed $750 million loans delivered to over 15,000 small businesses as demand continues to grow.

Greg Moshal, co-founder and joint CEO of Prospa, said: “Our continued growth demonstrates Prospa is going from strength to strength by supporting access to finance for an underserved market. Our growth is driven by small businesses’ need for quick and easy access to finance so they can manage cash flow and seize opportunities to grow. The increasing demand for our product shows we deliver a much-needed service that is highly valued by our customers, both existing and new.”

Beau Bertoli, co-founder and joint CEO of Prospa, said: “I am incredibly proud of what we have achieved in the past six years. We had a great year in our core product, the small business loan, which delivered 70% growth year on year. And I am really excited about our expansion into New Zealand and our line of credit product.”

Continued focus on improving access to funding for small business

Small businesses are a major contributor to the economy, with 2.2 million small businesses in Australia employing 44 per cent of Australia’s private sector workforce and generating 35 per cent of Australia’s GDP. These small businesses have been underserved by the traditional banking system, and are increasingly turning to online, unsecured lending to support their growth.

During the financial year, Prospa achieved a 400bps decrease in weighted average APR for the portfolio to 37%, with lower funding costs being passed on to customers. Prospa’s interest rates range between 8.5% and 29.9%.

Beau Bertoli, co-founder and joint CEO of Prospa, said: “Prospa is committed to improving access to finance for small businesses. Our objective is always to bring the cost of borrowing down. There are a number of factors that determine our rates – including the cost of capital, which, if you’re a non-bank lender is much higher than the banks. Another factor is risk, and our rates are risk adjusted to the borrower. Pricing appropriately for risk allows us to have a sustainable business so we can achieve our objective of supporting as many small businesses as we can.”

Prospa’s customer satisfaction remains consistently high with an annual average Net Promoter Score in excess of +77. Prospa also scores 9.8/10 on independent review platform TrustPilot, making Prospa the #1 Money company in Australia ranked by TrustScore.

During FY18, strong partner recognition saw Prospa named ‘2018 Fintech Lender of the Year’ at the MFAA National Awards after a clean sweep of the MFAA State Excellence awards, winning in all five States.

Greg Moshal, co-founder and joint CEO of Prospa, said: “When Beau and I started this business six years ago there was nowhere a small business could turn to if they had a great idea, and needed funds to make it happen. The system was failing them, and we thought there had to be a better way.

“From that moment we have always put the customer at the heart of everything we do. We designed an application process that was simple, taking the hassle out of finance. We engineered our processes to deliver fast, accurate decisions, so our small business customers could get certainty and move on with doing business. We then built lasting relationships with those customers, investing the time to understand them and help them to take advantage of the next opportunity when it comes along”.

Continued investment in team

Prospa was awarded Best Employer status by AON Hewitt for the second year in a row on 30 July 2018 and ranked #6 in the LinkedIn best places to work in Australia.

Several senior and highly experienced specialist team members joined Prospa in FY18 to support business expansion, product development and lower funding costs particularly in the areas of engineering, design, group capital management and customer acquisition.

New leadership hires include:

- Ted Tencza (Head of Engineering) – Ted brings with him a wealth of technological experience from previous roles at Finder.com.au, BigCommerce and Atlassian;

- Emma Robinson (Director of Marketing) – Emma previously headed up Marketing at ANZ for their Business & Private Banking team; and

- Raj Bhat (Head of Group Capital Management) – as announced, Raj joined Prospa from KPMG where he was Debt Partner

Focus in FY19 and beyond

Prospa sees a substantial market opportunity and estimates there is an addressable market for small business lending in Australia of more than $20bn per annum. In FY19 Prospa is focused on continued growth via its core loan product in Australia and New Zealand and the launch of a line of credit product. Prospa has originated more than $1 million in loans in its first month of operation in New Zealand, exceeding expectations.

ENDS

For further information contact:

Anna Fitzgerald +61 410 447 922

Lauren Thompson +61 438 954 729

About Prospa

- Prospa has originated over $750 million in loans to date

- Prospa has over 15,000 unique small business customers

- These customers have a strong track record of repeatability (approximately 69% of eligible customers take a repeat loan)

- Prospa’s distribution channel includes 7,000+ partner firms

- Prospa is an AON Hewitt Employer of Choice in 2017 and 2018

- Prospa’s Net Promoter Score is +77

Prospa recently achieved a clean sweep of the MFAA Excellence awards for Fintech Lender of the Year, winning the award in all five States in Australia.