What really sets small businesses apart from large corporates? This guide breaks down the practical differences in structure, speed, and strategy to help you plan your growth.

At a glance

- Competing with large corporates can feel daunting for smaller businesses facing fewer resources, tighter margins, and faster-moving challenges.

- SMEs can turn size into strength by staying agile, making quick decisions, and building close relationships that big organisations struggle to match.

- Leveraging this agility and having the right support in place helps business owners make confident choices when new opportunities appear.

For many Australian business owners, large corporations hold tremendous advantages that are out of reach. They have scale, teams for every task, and resources that smaller businesses can only dream of.

Yet those same advantages often make them slower to react and less able to change direction. Smaller businesses have the edge when it comes to flexibility and focus. The ability to move fast, adapt, and make decisions quickly is what keeps SMEs growing in competitive markets.

With an enormous 99.8 percent of Australian businesses classified as small or medium-sized, you are not alone in working hard to plan, grow, and compete with bigger players. This guide highlights what sets SMEs apart and how to use those strengths to your advantage.

What are SMEs?

SMEs make up the backbone of the Australian economy, from local retailers and cafés to growing tech startups and professional services firms.

In Australia, a small business generally has fewer than 20 employees, while medium-sized businesses employ up to 199. Annual revenue and structure can vary, but employee numbers form the main definition used by the Australian Bureau of Statistics.

These businesses are independently managed and close to their customers, which helps them adapt quickly to change and new opportunities. This hands-on approach means they are constantly making real-time decisions that balance daily operations with long-term growth.

What are large enterprises?

By comparison, large corporates employ more than 200 people and often generate higher revenues across multiple locations or markets. They are structured with formal governance processes and dedicated departments for each function, from finance to marketing and operations.

This size brings clear advantages in capital access, stability, and brand recognition. Yet it can also slow decision-making. Change requires coordination across teams and systems, making large organisations less agile than smaller businesses.

Where SMEs rely on adaptability and close customer relationships, large enterprises focus on efficiency, consistency, and managing risk.

Key differences between SMEs and large enterprises in practice

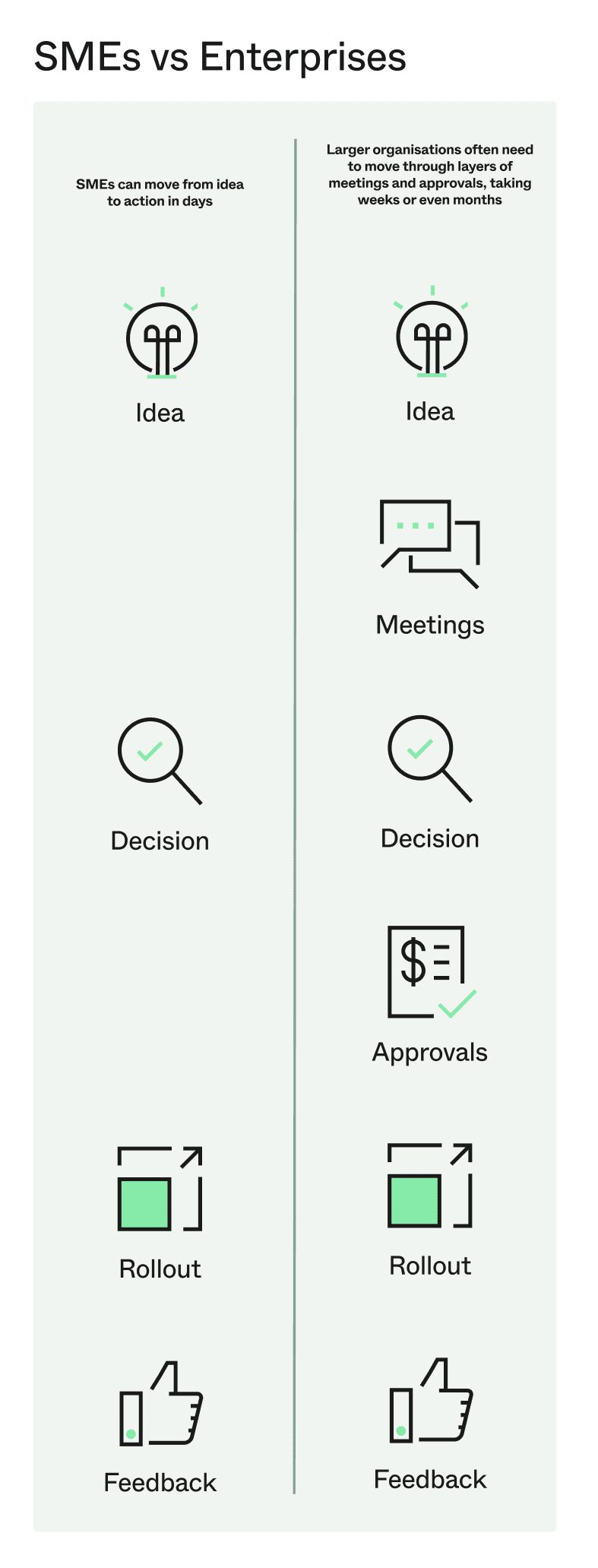

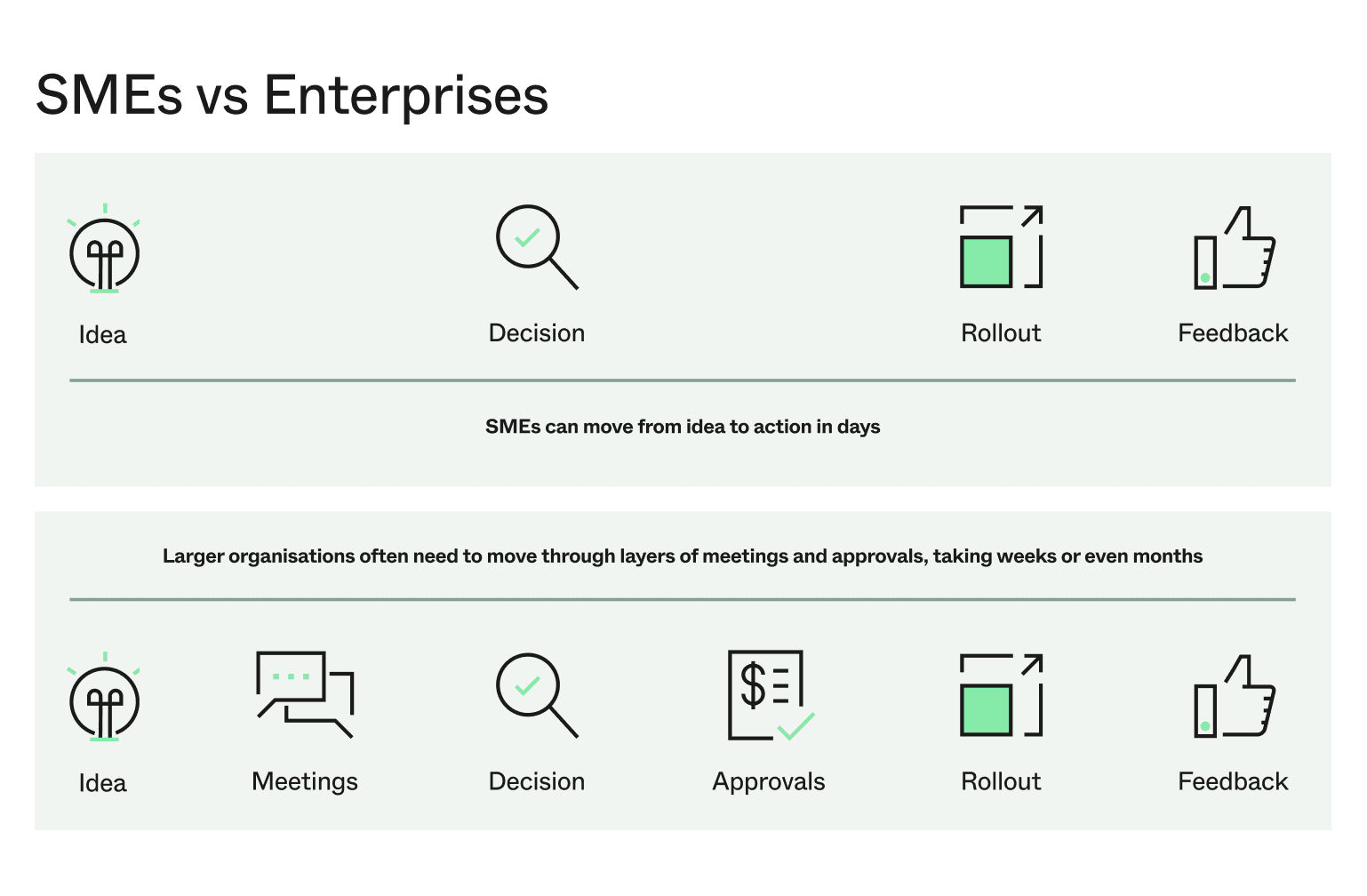

For small business owners, the differences between SMEs and large enterprises are most obvious in how things get done. SMEs often move from idea to action in days, while larger organisations move through layers of meetings, approvals, and reports before anything changes.

Imagine you run a family-owned café. You notice customers asking for more dairy-free options, so you trial a new almond milk flat white the next morning. In a large coffee chain, that same idea would need to pass through product development, supply contracts, and marketing approval before reaching a single cup.

Managing people and resources also looks very different. In large enterprises, specialist teams in each department manage budgets and guide decisions according to long-term plans. In smaller businesses, every dollar matters, so owners often take on multiple roles, overseeing finances and procurement one minute and serving customers the next, which keeps them connected to every part of the business.

What might appear to be limitations at first are often your biggest advantages. Smaller businesses can spot opportunities faster, adjust when conditions change, and build closer relationships with customers.

Differences between SMEs and large enterprises

| Feature | SME | Large Enterprise |

|---|---|---|

| Decision-Making | Decisions in days. Owners can act on opportunities immediately. |

Approvals in weeks. Decisions pass through multiple layers. |

| Innovation | Test ideas instantly. Adapt based on direct customer feedback. |

Systematic R&D. Innovation follows a formal, structured process. |

| Customer Focus | Direct and personal. Owners build close customer relationships. |

Managed by departments. Customer relations are handled by dedicated teams. |

| Resources | Hands-on and flexible. Owners wear multiple hats to manage resources. |

Specialist teams and budgets. Resources are allocated based on long-term plans. |

| Growth Capital | Fast, flexible funding. Access capital like business loans to seize opportunities. |

Structured, long-term finance. Relies on shareholders, bonds, and corporate credit. |

Focusing on those strengths helps you grow on your own terms, without trying to match the scale of larger competitors. Having access to quick, flexible funding, such as a small business loan, can make all the difference when the right opportunity comes along.

Why it matters for your business or research

Knowing how your business compares to larger organisations helps you plan with clarity. It shows where to focus your time, what to prioritise, and how to grow without losing the agility that gives you an edge.

For small business owners, this awareness shapes smarter decisions, from when to hire to how to manage funding and compete for customers.

For consultants and researchers, these distinctions provide valuable insight into how strategy and structure influence outcomes. Understanding the practical differences between SMEs and large enterprises helps build more realistic business models, market analyses, and growth frameworks that reflect how companies actually operate.

How SMEs and enterprises fund growth

Both small and large businesses require capital to grow, but how they access it couldn’t be more different. Large enterprises often operate on a scale that allows them to raise funds by issuing corporate bonds or leveraging complex credit facilities with major banks. Their financial strategy is built around long-term, structured growth.

SMEs, however, thrive on agility. Your growth is often tied to seizing immediate opportunities: hiring staff, stocking up for a seasonal rush, or investing in new equipment at the right moment. This is why SMEs don’t turn to venture capital, but adopt dynamic solutions like business loans and lines of credit that are built for real-world business needs.

When your business is ready for its next stage of growth, Prospa offers several small business loan solutions that can help you plan, expand, and compete on your own terms.