Small business funding

Small business funding is a great way to simply pay for unexpected costs or invest in opportunities to grow your business. Your small business funding can be used in a variety of ways:

- improve your working capital

- finance new projects and renovations

- invest in equipment and research

- expand your market reach

- cover unexpected expenses

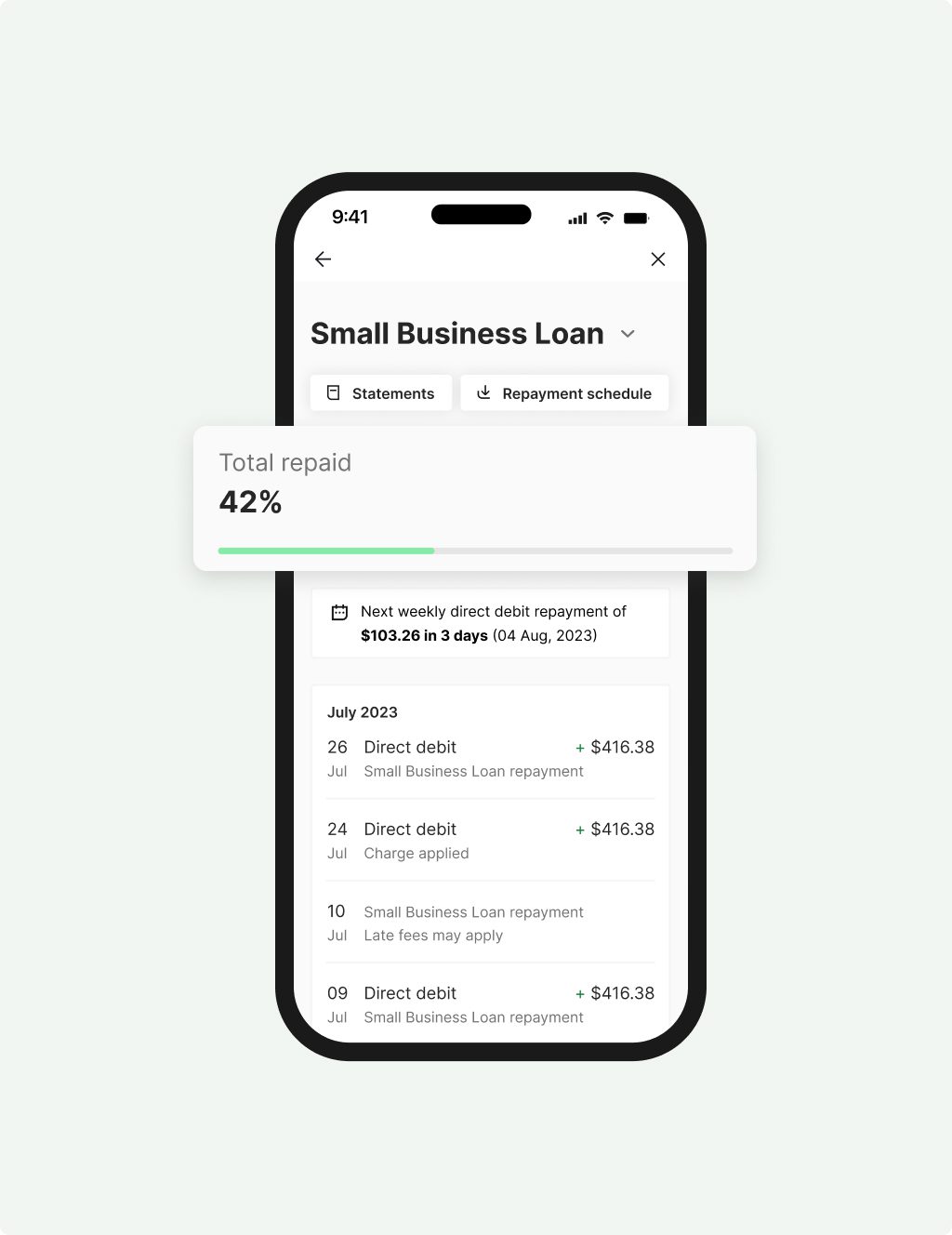

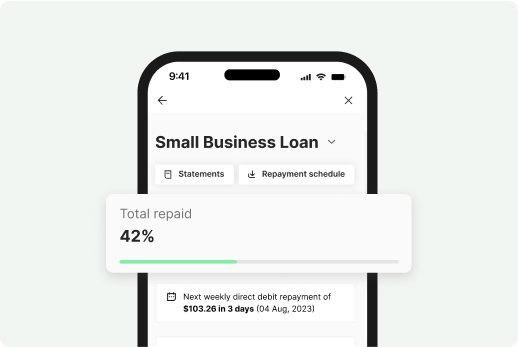

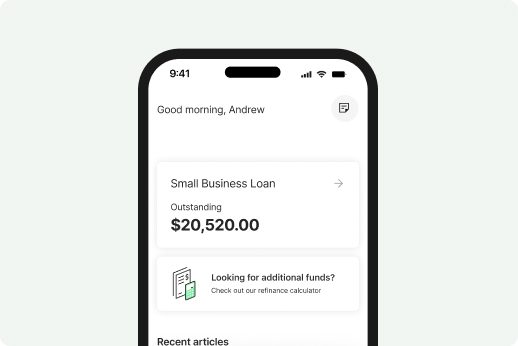

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

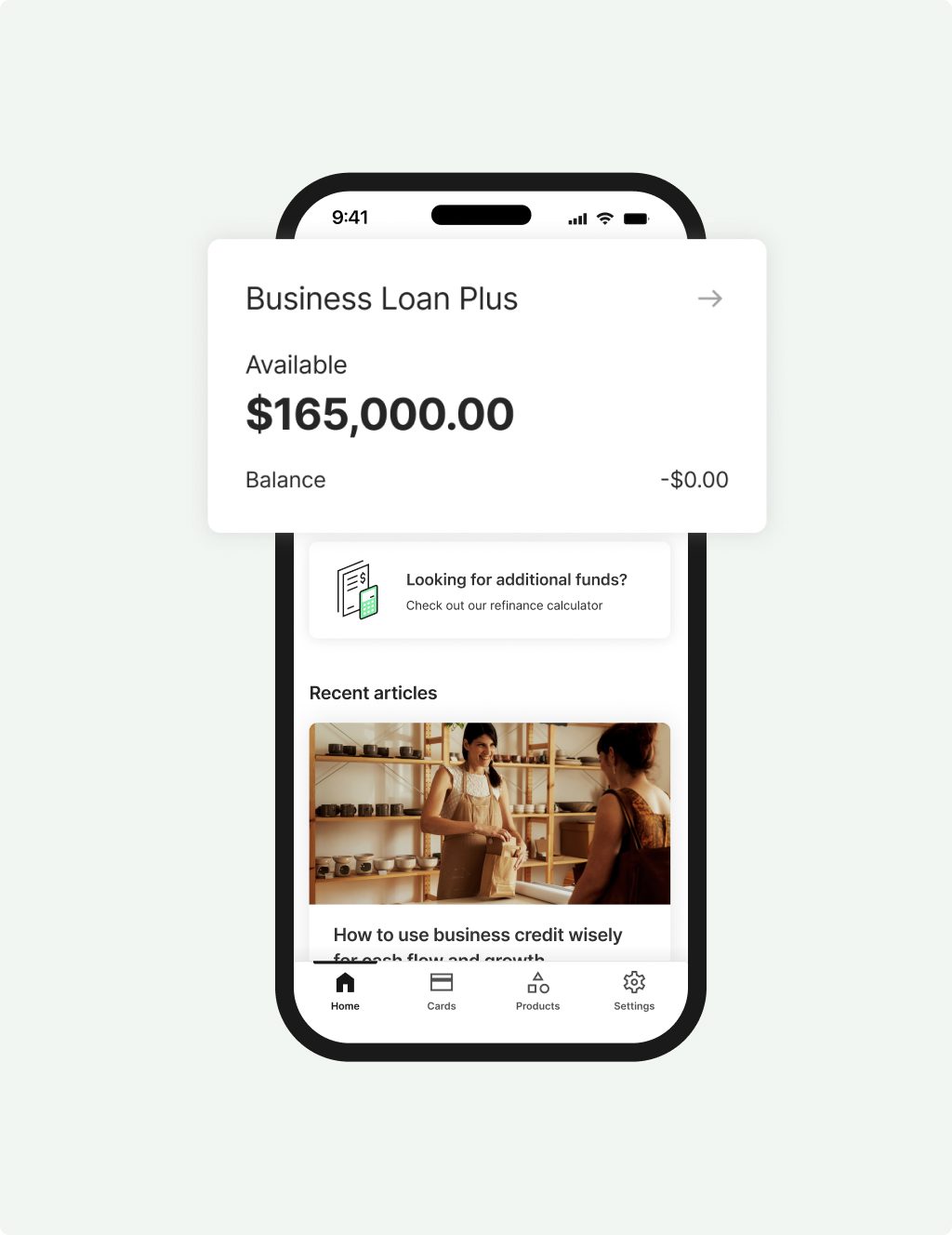

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

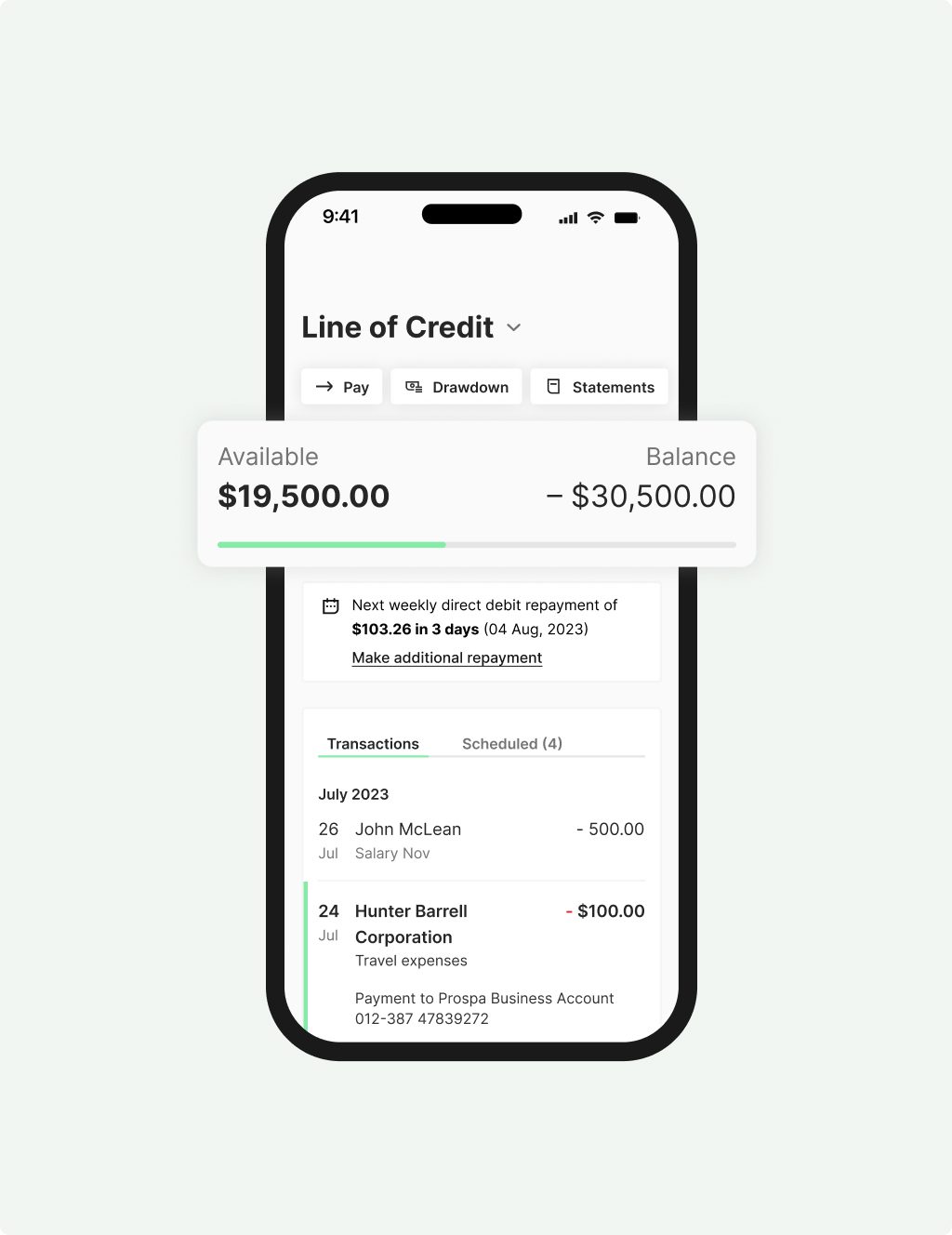

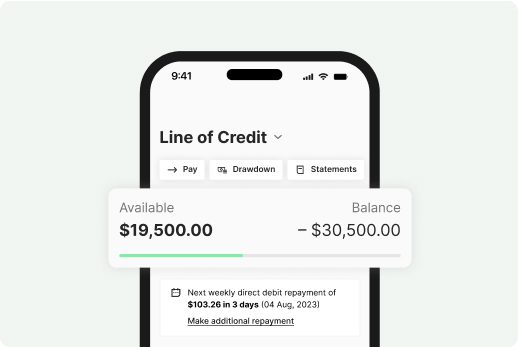

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Easy funding for small businesses

When you’re looking for a lender, finding the right type of funding can be confusing. It’s a good idea to explore all your possibilities and plan your funding strategy before approaching a lender. Once you know what you’re looking for, you’ll find the process of obtaining small business funding has never been easier.

When you apply for small business funding (e.g., SME business loan) at Prospa, you’ll get flexible repayment terms tailored to your cash flow. Whether you need research and development grants for small businesses, funding for unexpected expenses or to cover staff training, Prospa’s small business loan can help you achieve your goals.

Flexibility

Support

Confidence

Prospa supports small businesses

One of the common challenges of owning a small business is accessing funds. While some people can tap into their savings, liquidate some of their valuable assets, or ask for financial assistance from friends or relatives, not everyone has these options or wants to go down that path. Fortunately, there is another way to finance your growing company – you can apply for business loan online.

When you apply for small business funding at Prospa, you could have funds in no time at all. Thanks to our hassle-free online application process that only takes as little as 10 minutes to complete, you can get a fast decision, and funding is possible in 24 hours. In fact, when you apply for any of our loans before 4:00 p.m. on a business day and get approved, you can usually expect your money on the next business day.

Find out more about small business funding here.

Prospa’s small business funding: A game changer

When couple Jeremy and Ashley launched Stoned Crystals in home decor and design stores in 2015, they did not expect such a significant shift in the retail landscape. Many physical stores closed just two years later as consumers moved to online shopping.

As a business that relied on B2B orders, the changing landscape became challenging. They had to find new ways to reach consumers directly, which required funding to do it. When other lenders turned them away, Prospa made it possible for them to access funds. They were able to use their funding to pay for overseas buying trips, attend trade shows to purchase new inventory, and expand their team to support their growing business.

Today, Stoned Crystals is considered one of the fastest-growing companies in Australia . To learn more about them, read their story here.

Features of Prospa’s small business funding

Prospa makes it possible for small businesses to access funding they can use to expand their business or ward off financial difficulties. If you apply for Prospa’s small business loans, you will receive:

- Funds ranging from $5K to $1M

- Fixed term of between 3 and 60 months

- Flexible daily or weekly repayments

- Simple application process with funding possible within 24 hours

Qualifications for small business funding

If you’ve been asking yourself, ‘Do I qualify for a small business loan?’ check out the eligibility criteria for our small business loans:

- an Australian citizen or permanent resident

- over the age of 18 years

- own an Australian business with a valid ABN/ACN

- minimum trading history applies

For larger amounts, there may be other requirements.

Why do small businesses need funding?

We have found that the most common reasons why small and medium enterprises (SMEs) seek financing are the following:

Working capital. Most startups and small companies need to beef up their working capital at some point during their operation lifetime. In many cases, failure to do so can lead to poor cash flow and the eventual failure of the business. Fortunately, Prospa offers short- and mid-term loans that come with flexible repayment terms and competitive rates, allowing SMEs to grow their business and stay afloat during lean periods.

Major asset purchase. If this is your reason for seeking fresh funding, a business loan makes more sense than a revolving line of credit. But how do business loans work really? If approved, you’ll get a lump sum amount that you pay back at a fixed interest rate with regular payments. At Prospa, you can choose from daily or weekly repayments.

Business expansion. Most entrepreneurs need external financing to expand their company without having to spend too much funds on one aspect of their business or use personal funds to cover the cost.

Limited personal wealth. Business owners who have insufficient personal savings or wealth need external financing to start, run, and grow their companies. Others may just prefer to keep personal and business funds separate for tax reasons.

Customers making it happen with a Prospa loan

Read customer storiesFAQs

FAQs

A Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support business cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more.

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $250K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies