Business Loans to match the needs of SA small businesses

- Funding up to $1M

- Fast decision and funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

Flexible funding solutions for SA’s small business community

Whether it’s the cosmopolitan culture, the stunning eco-tourism, Australia’s best wine regions or the well-loved festivals and events, South Australia has it all. And a key factor in the state’s continued growth and employment are the 143,000 small businesses who contribute more than $35 billion to the state’s economy.

At Prospa, we are proud to support the small business owners of SA with hassle-free access to funding. Feel confident to move fast on your next opportunity with a fast decision on amounts up to $1M and funding possible in 24 hours.

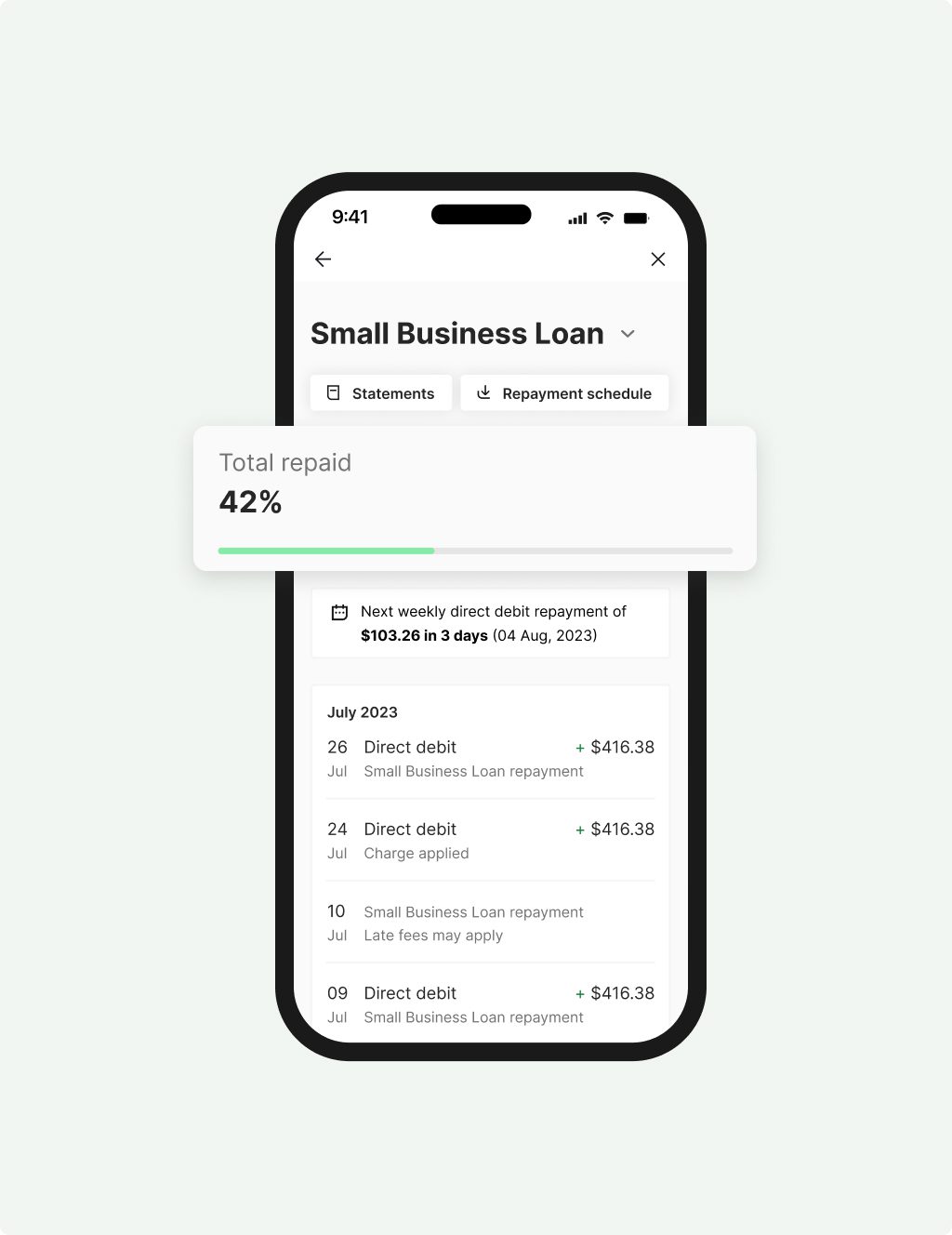

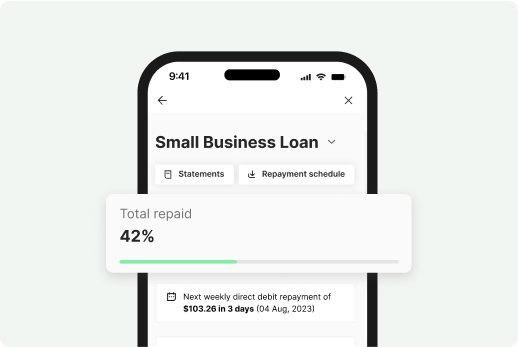

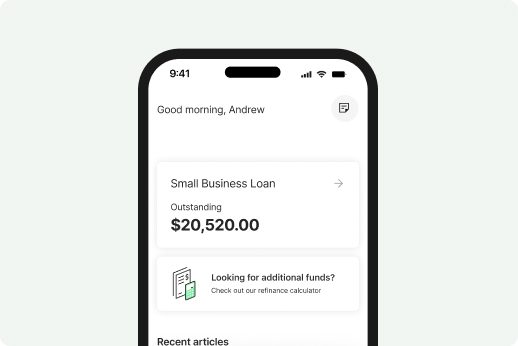

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

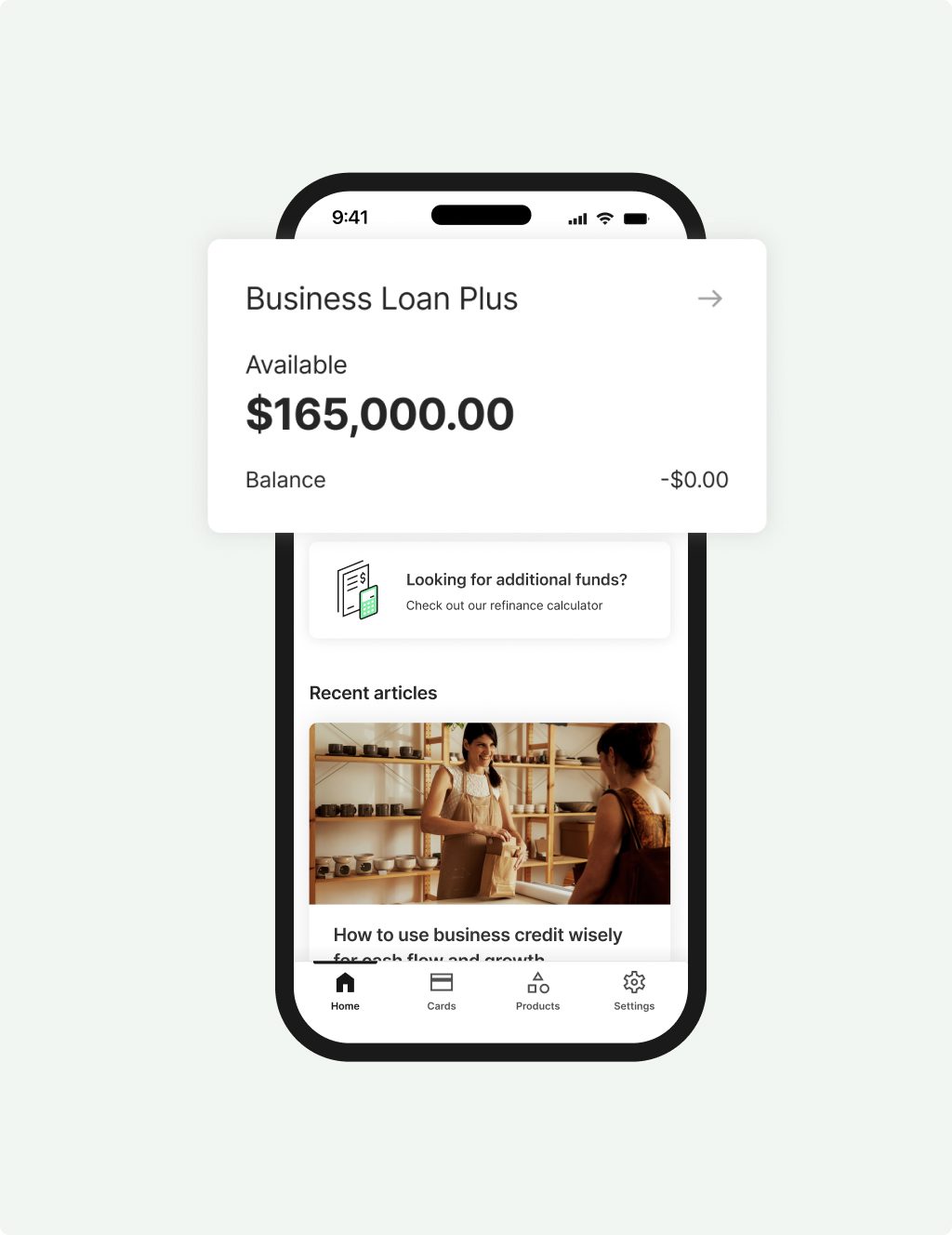

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

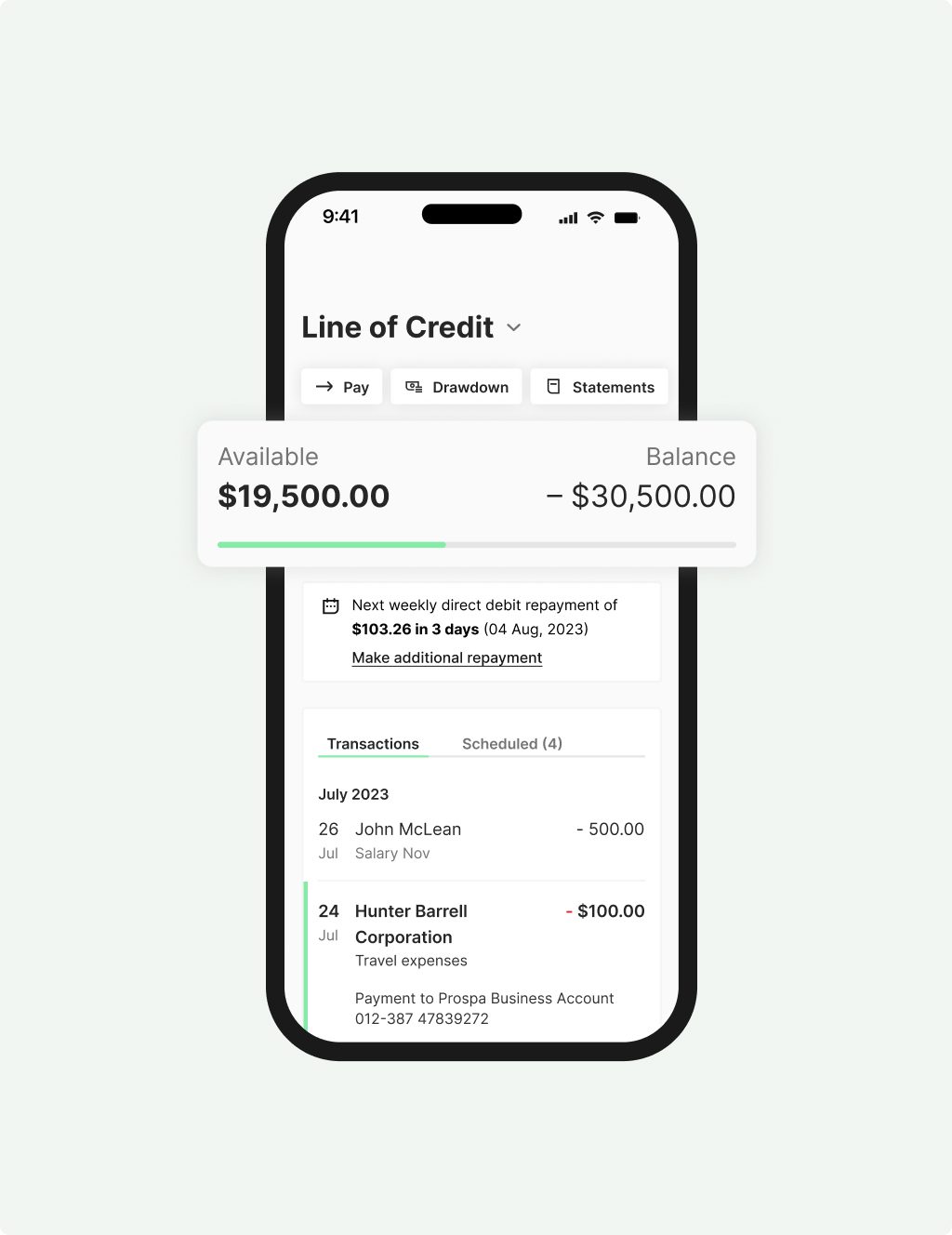

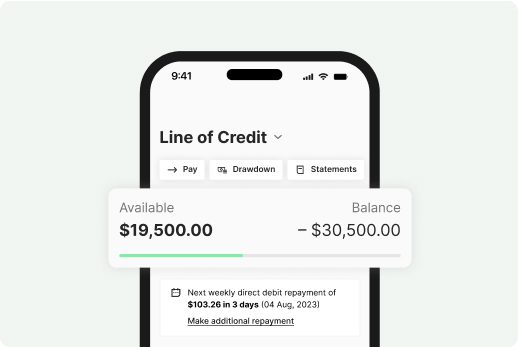

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Customers making it happen with a Prospa loan

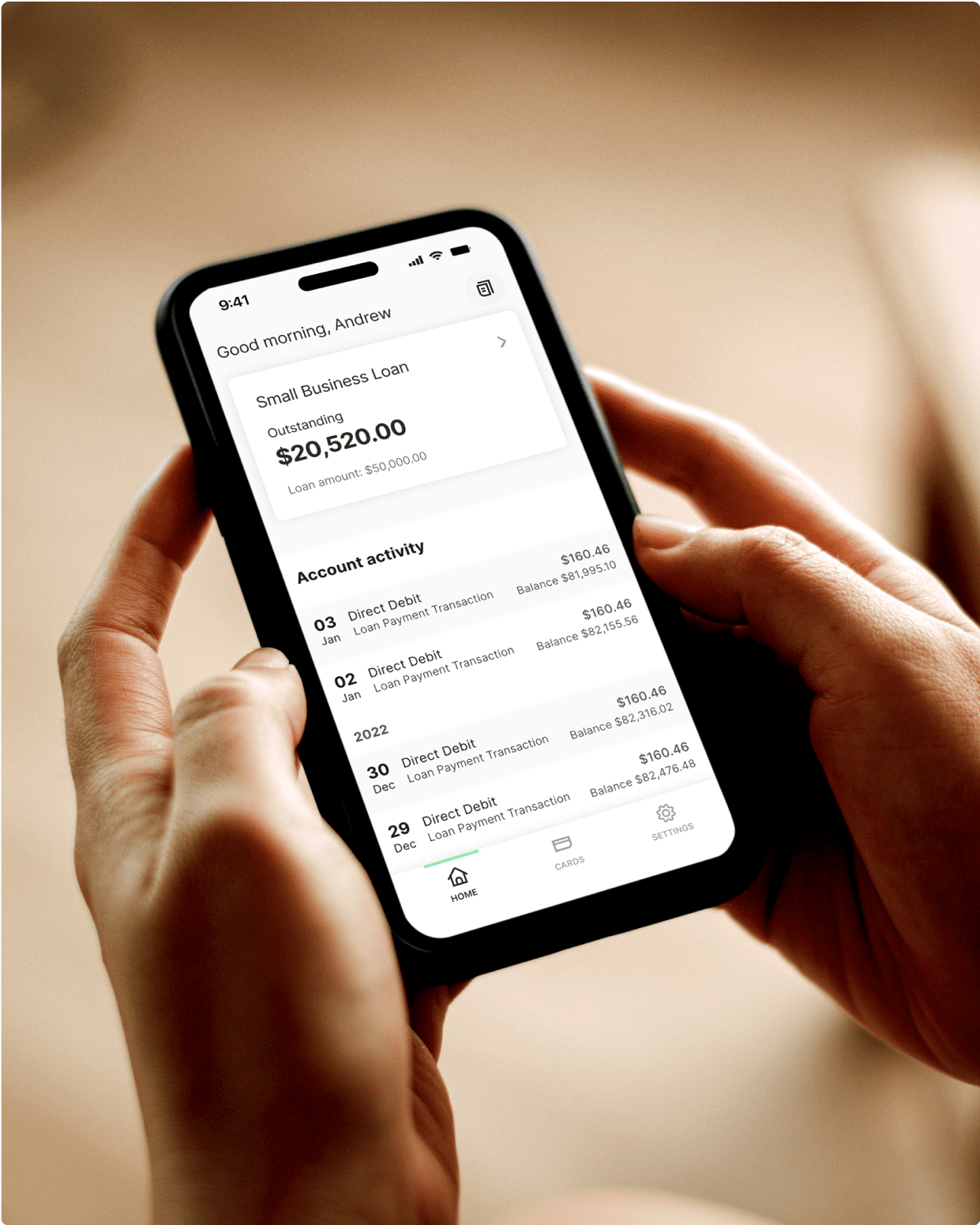

Read customer storiesWhy Prospa? Because we believe in small business.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.