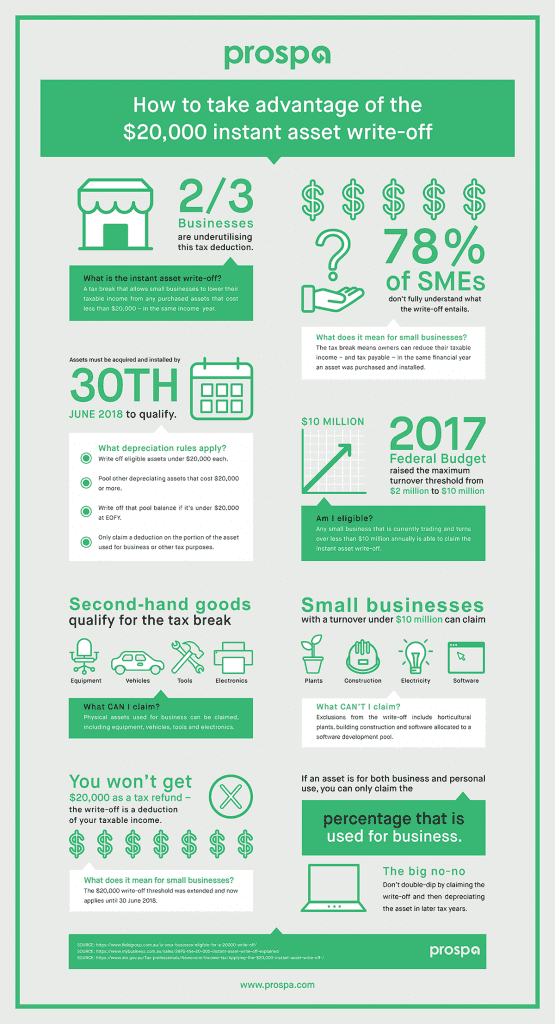

Here we unpack what the instant asset write-off actually means for your small business and what you can and can’t claim.

The small business $20,000 instant asset write-off has been extended to June 30 2019, meaning small business owners with a turnover of under $10 million per year can write off assets costing less than $20,000 each.

What is the instant asset write-off?

A tax break that allows small businesses to lower their taxable income from any purchased assets that cost less than $20,000 – in the same income year.

What does it mean for small businesses?

The tax break means owners can reduce their taxable income – and tax payable – in the same financial year an asset was purchased and installed. Assets must be acquired and installed by 30th June 2018 to qualify.

What depreciation rules apply?

- Write off eligible assets under $20,000 each.

- Pool other depreciating assets that cost $20,000 or more.

- Write off that pool balance if it’s under $20,000 at EOFY.

- Only claim a deduction on the portion of the asset used for business or other tax purposes.

Am I eligible?

Any small business that is currently trading and turns over less than $10 million annually is able to claim the instant asset write-off.

What CAN I claim?

Physical assets used for business can be claimed, including equipment, vehicles, tools and electronics.

Second-hand goods qualify for the tax break

- Equipment

- Vehicles

- Tools

- Electronics

Small businesses with a turnover under $10million can claim

- Plants

- Construction

- Electricity

- Software

What CAN’T I claim?

Exclusions from the write-off include horticultural plants, building construction and software allocated to a software development pool. You won’t get $20,000 as a tax refund – the write-off is a deduction of your taxable income.

What does it mean for small businesses?

The $20,000 write-off threshold was extended and now applies until 30 June 2019. If an asset is for both business and personal use, you can only claim the percentage that is used for business.

The big no-no

Don’t double-dip by claiming the write-off and then depreciating the asset in later tax years.

Thinking about purchasing assets to grow your business? Get the funds you need from Prospa and put your plans into action sooner. Assets purchased before 30 June could be eligible for a $20,000 instant asset write-off.