From final BAS lodgement to potential tax benefits you didn’t know about, use this checklist of key dates to help prepare your small business for EOFY.

Your first order of business will likely be chasing payments – here are our favourite tips from small business owners on how to get those outstanding invoices paid.

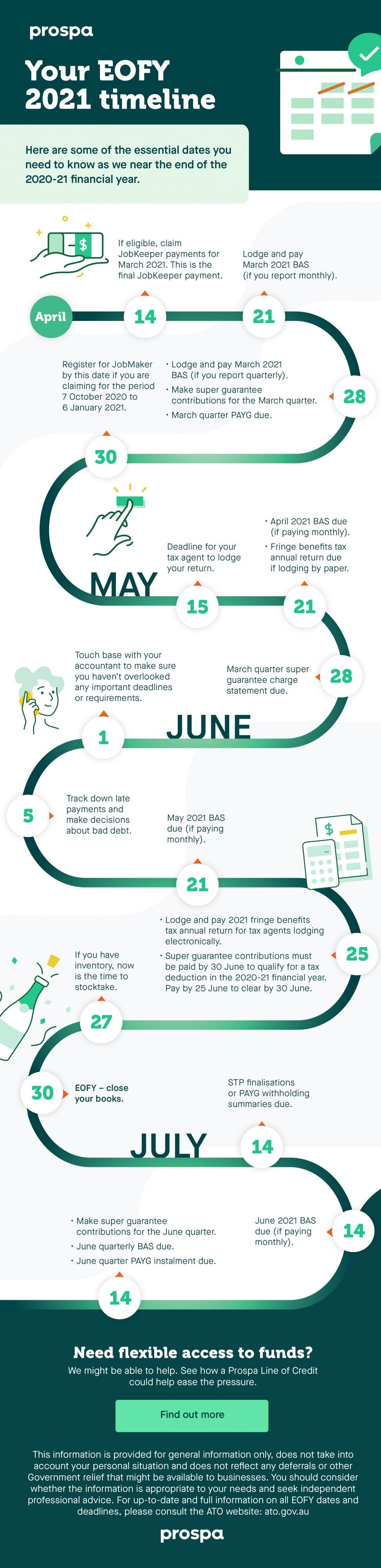

Next, review this checklist for important reminders and key deadlines for small business owners, and add them to your calendar so you don’t miss any important dates in the lead up to the new financial year.

Stimulus and support

Your adviser or accountant will help you get everything in order but there are also a few straightforward things small businesses owners can do to get the most out of tax time.

Davie Mach, Director at Box Advisory Services, suggests small businesses start by prepaying any bills for the next 12 months that they can, as prepayments are tax deductible in the year you paid for them. And he suggests trying to write off any bad debt at EOFY to reduce taxable income for the year.

He also recommends checking to see whether you can take advantage of any government stimulus or support measures.

“You can use the ‘limitless’ asset write-off to instantly claim tax deductions on new assets, for example. And if you’re looking to hire someone, you may be able to claim the JobMaker hiring credit.” And in some other good news for small business: “The 2021 financial year has seen a drop of small business tax rate from 27.5% to 26%. In 2022 it will be dropping to 25%.”

Davie points out that while there’s increased leniency on COVID-impacted businesses regarding their tax time obligations, “there will be an increased number of tax audits and reviews on JobKeeper.” Likewise, with the implementation of single touch payroll (STP), “it’s expected that superannuation audits will be coming.” Good reasons to get in touch with your tax adviser to make sure your payments are up to date and up to scratch.

Stocktake

Take the opportunity of EOFY stocktake not just to count those on-hand items, but to revisit your stock strategy and plan for the coming year.

“You can write off any damaged, lost or obsolete stock as well as establish what may be slow-moving stock,” Davie suggests. This helps with planning going forward so you don’t keep spending on unsuccessful stock and can look at ways to better market the existing slow-moving stock.

EOFY deals and asset write-offs

To decide whether to take advantage of EOFY deals, Davie suggests looking at how your business is tracking.

“If you’re not making a profit, then it’s not ideal,” explains Davie. “EOFY deals are generally designed for businesses that have excess profits and plan to invest anyway. If your business is making a loss, EOFY deals give no benefit as you end up just spending more.”

If your business is profitable, however, “combining EOFY deals with asset write-off incentive is a great way to minimise tax and invest in your business.”

For up-to-date and full information on all EOFY dates and deadlines, please consult the ATO website: ato.gov.au

Need some funds to tide you over ’til the new financial year begins? Talk to one of our small business specialists about how a Prospa Line of Credit could help you start the 2021 financial year with a bang.