At a glance

- With business credit growth on the rise, now is a smart time to apply for business funding.

- Small changes like clarifying your business loan purpose and choosing the right loan type can boost your chances of approval.

- A strong application positions your business to access funding when it matters most.

Many small business owners never apply for a business loan, not because they don’t need funding, but because they assume they won’t be approved. It’s a common hesitation, and often an unnecessary one.

Plenty of loan applications are declined for reasons that have little to do with the financial health of the business. More often than not, it’s avoidable issues like missing documents, vague loan purposes or poor lender fit that get in the way.

And right now, it’s worth getting it right. Business lending is on the rise in Australia. According to the RBA, business credit growth hit 8.9% in early 2025, the fastest pace since mid-2023.

This article is here to help you strengthen your application and take advantage of that momentum.

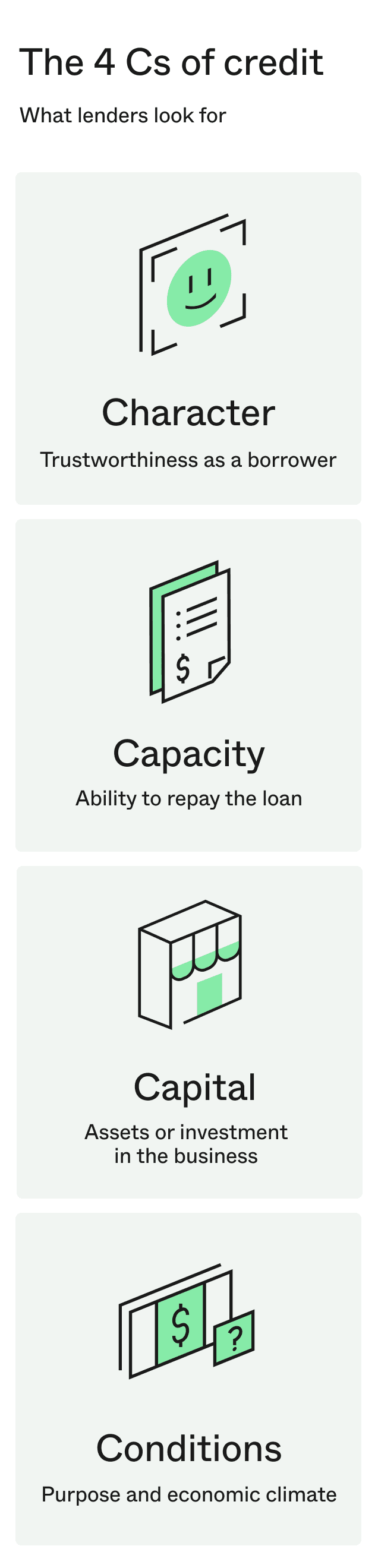

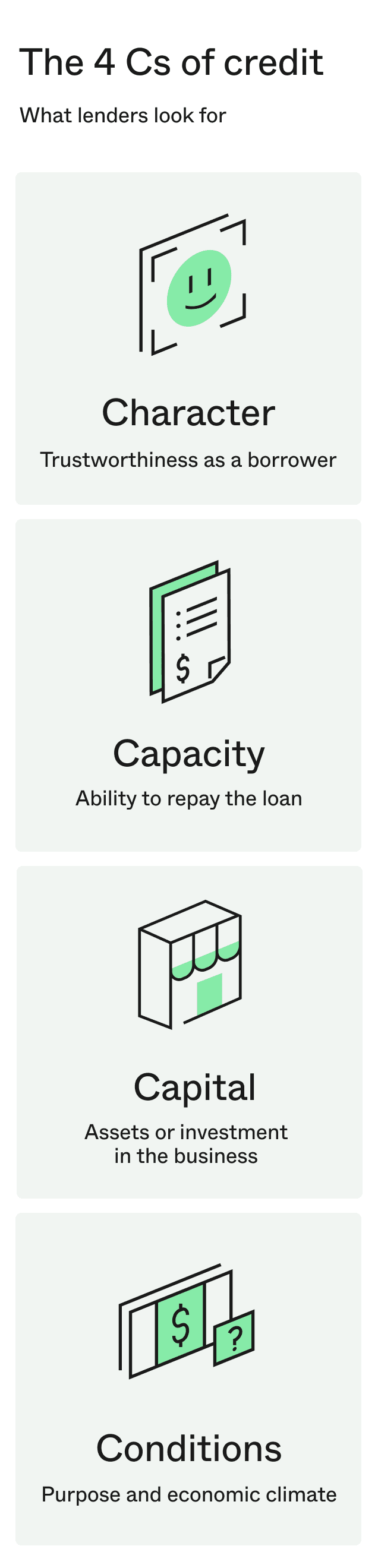

1. Knowing what lenders look for: The four Cs of credit

Before you start filling out a loan application, it helps to understand how lenders think. Most assess applications using a version of the “four Cs of credit”, a framework that gives them a clear picture of your business’s ability to repay the loan.

Here’s what each one means:

Character: This refers to your track record as a borrower. Lenders look at things like your business credit score, trading history, and any past defaults. It’s their way of answering the question, “Can this person be trusted to repay?”

Capacity: This is your ability to repay the loan based on cash flow. Lenders will often look at recent bank statements, outstanding debts, and any liabilities that could affect repayment. They want to know your business can handle regular repayments without stress.

Capital: This includes any assets or funds you’ve invested in the business. A strong capital position shows you’re committed and have a financial stake in the outcome.

Conditions: This relates to the purpose of the loan and the broader economic environment. Lenders want to know how the funding will be used and whether your business is well positioned given current market conditions. For larger loan amounts, they may also consider collateral or security as part of the assessment.

Some lenders will weigh one “C” more heavily than others, depending on their risk appetite. Even if you’re lacking in one area, strengthening another can help improve your overall position.

2. Preparing your financials and documents

If you want to boost your approval odds, start by having your key documents ready. While requirements vary by lender, having your paperwork in order signals professionalism and makes it easier for lenders to assess your application quickly.

Lenders like Prospa often accept minimal paperwork, especially for business loans under $250K, so don’t assume you’ll need complex reports. The goal is to provide the right information to show that your business is structured, stable, and ready to manage repayments.

Here’s typically what you need to prepare:

- Your ABN and proof of business registration

- Identification documents (e.g. driver’s licence)

- Business bank statements: most lenders ask for the last 3 to 6 months

- Information about existing debts or liabilities

- A basic profit and loss statement or summary of income and expenses

The goal isn’t to hand over as much data as possible. It’s to provide the right information to show that your business is structured, stable, and ready to manage repayments.

Understanding and improving your credit profile

Your business credit score is one of the key factors lenders use to assess risk. It reflects how reliably your business has managed debt in the past and whether there are any red flags, like defaults or court judgments.

Even if your business is performing well, a poor or thin credit file can hold back your application. Knowing where you stand gives you the chance to fix issues before you apply.

Start here:

- Check your business credit score. You can request a copy from agencies like Equifax, Illion, or Experian. Some offer free reports or summaries.

- Review the report for errors. Look out for outdated defaults, incorrect listings, or missing information.

- Pay off outstanding debts. Even small overdue amounts can affect your score.

- Avoid unnecessary credit applications. Each one leaves a mark on your file, and too many in a short time can lower your rating.

- Stay on top of bills and repayments. A consistent record of on-time payments builds confidence with lenders.

Think of your credit report as your track record. Make sure it reflects the business you’re running today.

3. Explaining your business loan purpose and business plan

Many business owners assume they’ll need to present a detailed business plan to get approved for a loan, but that’s not always the case. For smaller business loans, lenders like Prospa typically won’t ask for a formal business plan or detailed loan proposal.

That said, it’s still important to be clear on why you’re borrowing. Lenders want to understand how the funds will support your business and whether the amount you’re requesting makes sense for your goals.

Here’s how to get that across without overcomplicating it:

- Be specific about your loan purpose. It could be new tools, extra inventory, a marketing push or bridging a quiet period. Clearly stating the use helps the lender understand the return on investment.

- Link it to your operations. Show how the funding fits into your business activity — for example, buying stock ahead of a seasonal peak or upgrading equipment to meet growing demand.

- Keep it practical. A few clear sentences will often do more than pages of projections.

To find out more about what to have in place before you apply, read this guide to the four essentials of getting a small business loan.

Working out how much to borrow

The two most important things for a lender are the borrowing amount and your capacity to comfortably manage the repayments. Taking the time to work out what’s manageable can improve your chances of getting approved.

Here’s how to work it out:

- Look at your cash flow. What does your average monthly income and expenditure look like over the past 6 to 12 months? Can your business absorb regular repayments without strain?

- Factor in other commitments. Do you already have existing debts or upcoming costs? Lenders want to see you can manage this loan alongside everything else.

- Think about timing. Are you heading into a peak season or a quieter period? Aligning repayments with stronger trading months can ease the pressure.

- Don’t overextend. Borrowing more than you need might seem safer, but it can increase your interest costs and reduce your chance of approval.

Want to go deeper? Here are 5 key questions to ask yourself before applying for a business loan.

4. Choosing the right loan type and lender

Once you’ve decided how much you need, the next step is choosing a loan structure that fits your goals and a lender that aligns with how your business actually operates. The better the fit, the smoother the process and the more likely your application is to succeed.

Finding the right loan type

The type of loan you choose should reflect how and when you plan to use the funds. Here are a few common scenarios and the structures that typically suit them:

Need flexibility over time? A Line of Credit may suit businesses that want to draw down funds as needed. It’s ideal for covering short-term cash flow gaps or managing fluctuating expenses.

Want a lump sum to invest in something specific? A Business Loan with a fixed term works well if you have a defined purpose like purchasing equipment, expanding your premises, or investing in a campaign.

Prefer to repay early if things go well? Look for a loan with no early repayment penalties, so you’re not locked in if cash flow improves.

Tip: Match the loan structure to how your business earns and spends money so that repayments feel like a natural part of operations.

Choosing a good fit lender

Just as important as the loan type is the lender itself. Not all lenders cater to small businesses, and some may require more documentation than your business can easily provide.

Here’s what to weigh up:

- Application process. Does the lender require full financials and a business plan, or offer a hassle-free option with minimal paperwork?

- Approval speed. If timing is critical, check whether the lender offers same-day or next-day decisions.

- Support. Can you speak to someone if needed? Will you get support that reflects the realities of running a small business?

Tip: Don’t just compare rates. The right lender makes the process easier, and that can be just as valuable as the funding itself.

5. Why more small businesses are choosing Prospa

When it comes to applying for finance, many business owners want speed, simplicity, and a partner who understands their needs. That’s why thousands of small businesses choose Prospa.

Here’s what makes Prospa Australia’s #1 online lender to small businesses:

- Fast, online application that can be completed in minutes.

- Minimal paperwork for business loans under $250K. No business plan or complex reports needed.

- Securely connect your bank account to pull statements automatically, saving you the hassle of downloading or printing documents.

- No upfront security required upfront. Access up to $150K without putting up an asset.

- No upfront credit checks. Check your eligibility with zero impact on your credit score.

- Funding from $5K to $1M. Suitable for day-to-day cash flow or larger investments.

- Same-day decisions and fast funding so you can act quickly.

- Business Lending Specialists who get to know your business and offer tailored support.

Want a straighter path to funding? Talk to a Prospa specialist to see how we can support your next move.