At a glance

- Rising costs and unpredictable sales patterns are putting pressure on hospitality cash flow in 2025.

- Small operational changes, such as adjusting rosters and tracking sales in real time, can free up working capital.

- Staying on top of cash flow with the right strategies and tools creates room to grow without overextending.

Managing a hospitality business today means balancing more than great service and memorable experiences. With rising costs, shifting customer patterns, and ongoing staffing pressures, keeping cash flow healthy has become more important than ever.

Hospitality businesses need a steady flow of cash to keep the lights on, invest in new opportunities, and weather seasonal fluctuations. Without it, even a busy venue can struggle to stay ahead.

In this article, we break down practical strategies to help hospitality businesses strengthen their cash flow and lay the groundwork for sustainable growth.

Top cash flow pressures for hospitality businesses in 2025

Australian hospitality businesses are feeling the squeeze from every direction in 2025. Rent and energy bills continue to rise, putting extra strain on fixed costs. At the same time, the cost of food and beverage supplies has climbed sharply, forcing many businesses to rethink menus, portion sizes, and pricing strategies.

Staffing remains one of the toughest challenges. To attract and retain talent, many hospitality owners are paying higher hourly rates or offering incentives, further increasing weekly expenses without always seeing a direct uplift in revenue. Temporary and casual staff, often essential for peak periods, can also create unpredictable spikes in payroll.

Even with customers returning to restaurants, cafés, and venues more regularly, profitability remains tight. Major events, public holidays, and tourist seasons can drive revenue spikes, but quieter months often expose cash flow gaps when there is no buffer in place.

How to stay on top of cash flow day-to-day

Managing cash flow in a hospitality business is about making small, regular adjustments that protect your margins and keep operations stable.

Track your cash flow weekly

Shorter cash flow cycles help identify issues early, especially in a business with daily sales and fluctuating demand. Look for spending patterns, flag irregularities, and adjust purchasing or rostering before problems escalate.

Some small venues schedule a weekly 15-minute check-in to review bank balances, incoming payments, and upcoming bills. It’s a simple routine that improves visibility without adding extra admin.

Fine-tune stock ordering

Over-ordering perishables can tie up cash and lead to waste. Sync your inventory with POS data to maintain just the right amount of stock, especially during seasonal shifts or unpredictable lulls.

To stay nimble, White Rabbit café runs on a just-in-time inventory system, tracking stock and staffing needs on a seven-day rolling schedule to reduce holding costs and respond quickly to changes in demand.

Secure upfront payments

For catering, functions, or large bookings, ask for a deposit to lock in revenue and reduce the risk of cancellations or late payments.

Many cafés and event-based businesses take a 50% deposit at the time of booking. This gives them enough runway to cover staffing and ingredient costs in advance.

Make it easier for customers to pay

Use mobile, contactless, or digital payment tools to speed up transactions and reduce time-to-cash. Offering flexible options at the point of sale can also improve customer experience and reduce friction.

Many venues now use portable EFTPOS machines or QR code payments to streamline the process and improve table turnover. Both can help keep cash moving consistently.

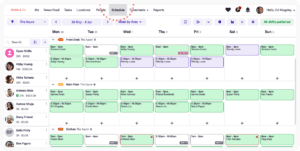

Adjust rosters based on real data

To avoid overstaffing during quiet shifts or under-resourcing busy ones, use historical sales data and forecasts to shape your weekly roster, rather than relying on gut feel.

Some businesses use POS-integrated scheduling tools that flag low-revenue periods. This helps reduce unnecessary casual hours before they start to impact your weekly margins.

Unlocking growth opportunities without overextending

Growth doesn’t have to mean major renovations or launching a second location. For small hospitality businesses, the most sustainable growth often comes from low-risk ideas that fit within existing operations.

Extend your service without expanding your footprint

Look at your quiet times. Could you trial a brunch service, happy hour, or late-night menu using the space and staff you already have? Many businesses find that a few extra service hours each week can lift revenue without requiring major investment.

A beachside café in Newcastle extended its kitchen hours by just 90 minutes on Thursday nights, adding a limited tapas menu. Without bringing on extra staff, they drew steady after-work foot traffic and built a new local following during what was once a quiet shift.

Offer new experiences that draw customers in

Consider running cooking classes, themed dinners, or chef’s table nights. These events can bring in new revenue and make use of your space during quieter periods.

Kitanda café, a Brazilian restaurant in Sydney, hosts a regular calendar of samba performances, DJ sets, and live Brazilian music, turning quiet evenings into consistent crowd-pullers and building a strong community following.

Build partnerships to share the load and increase exposure

Teaming up with a local roaster, florist, or craft brewer can help expand your offering and attract new audiences. White Rabbit café, for example, partnered with a next door pizzeria, Arte Bianca, to share seating space and cross-promote to their respective customer bases. Partnerships like these can boost growth without increasing overheads.

Use loyalty programs to encourage repeat visits

Whether it’s a free coffee after five visits or discounts on off-peak days, loyalty systems help keep your business top of mind without a big marketing budget.

One creative approach is to offer a dessert passport. Guests who try five different sweets receive a free take-home treat. It’s a low-pressure way to introduce people to more of your menu and give them a reason to return.

If you run regular events, consider giving return guests early-access bookings or reserved seating. These low-cost perks reward loyalty without relying on discounts and help turn casual visitors into long-term supporters.

Test ideas on a small scale before going all in

Before committing to a full menu change or equipment purchase, run a short trial. Offer a limited-time special or host a one-off event, then measure interest and sales. This approach helps you grow with confidence and reduces your risk when implementing new initiatives.

Tools to forecast and manage hospitality cash flow

The right tools can give hospitality owners a clearer view of where money is going, what’s coming in, and how to plan for quieter periods.

1. Track inventory and sales in real time.

Platforms like Lightspeed and Square sync daily sales with stock and customer data. This helps you manage ordering, monitor margins, and adjust rostering based on expected demand.

2. Plan short-term cash flow with simple calculators

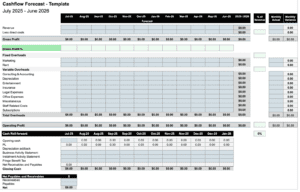

The Prospa Cash Flow Forecast Calculator lets you map out income and expenses week by week. It’s a practical way to test how seasonal shifts, staffing changes, or upcoming events might affect your ability to cover key costs.

3. Forecast seasonal cash flow changes

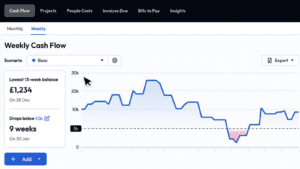

Advanced tools like Float, Fathom, and Spotlight Reporting offer real-time visibility over cash flow, performance insights, and integrated three-way forecasting. These tools are particularly useful for businesses looking to scale or seeking funding.

4. Manage expenses and payments in one place

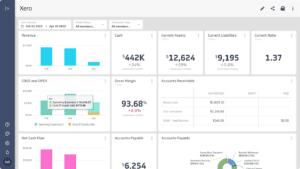

Xero and QuickBooks bring banking, bills, and payroll into one dashboard. This makes it easier to spot overdue invoices, monitor expenses, and stay ahead of payment cycles.

5. Build rosters that reflect sales patterns

With tools like Deputy, you can create staff schedules based on past sales and expected revenue. If a night is consistently quiet, the platform helps you reduce unnecessary hours and protect margins.

Funding solutions to keep your business moving

Whether you’re planning something new or managing a quiet patch, there are a range of funding options for hospitality business owners, each designed to support different cash flow needs.

Need to upgrade or create new revenue streams?

Adding an outdoor seating area, refreshing your fit-out, or launching a new menu can all lift revenue, but most of these ideas require upfront investment.

A Prospa Business Loan gives you access to between $5,000 and $1,000,000, with fixed repayments and terms up to 36 months. It’s a practical way to make improvements now, while spreading the cost over time.

Need flexible cash to cover short-term gaps?

Hospitality businesses often feel the pinch when supplier bills arrive just before the weekend rush or a quiet midweek stretch.

A Prospa Line of Credit gives you flexible access to funds when you need them. Draw down only what’s needed, and pay interest on what you use. It’s well suited for covering wage runs, restocking before peak periods, or bridging the gap between paying suppliers and getting paid.

Need a clearer view of daily spending?

Mixing business and personal expenses, or relying on multiple payment accounts, can make it harder to track what’s going out.

The Prospa Business Account is built to keep things simple. It has no monthly fees, includes built-in spend insights, and lets you send instant payments to other Prospa accounts. It’s an easy way to manage daily business expenses and maintain visibility over available cash.

Not sure which option suits your business? Talk to a Prospa specialist to explore what’s possible.