Company Lending

Looking for a loan for your company? Prospa’s business lending specialists can help you apply for the funding you need. Our loan products support small Aussie businesses across just about every industry to access funding for their company and achieve their business goals.

Our approach to business borrowing is faster and easier. With quick online applications requiring minimal documentation and funding possible in 24 hours, we’re making sure our money works for you – not the other way around.

Whether your business is trying to survive or you’re ready to expand and thrive, Prospa offers a range of flexible business lending products to help you finance your business’s future.

To learn more about how a Prospa small business loan could help your business, talk to a business lending specialist today.

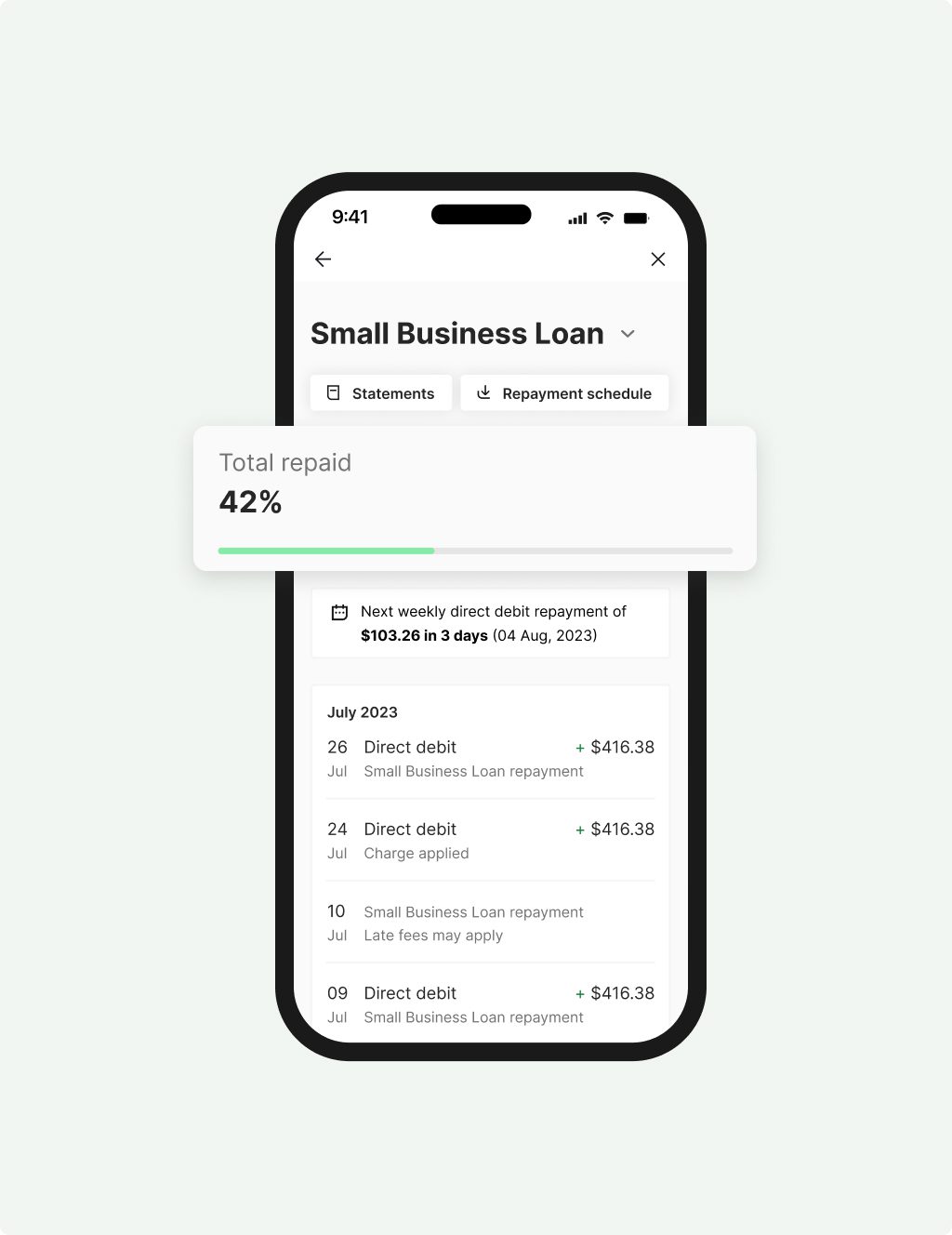

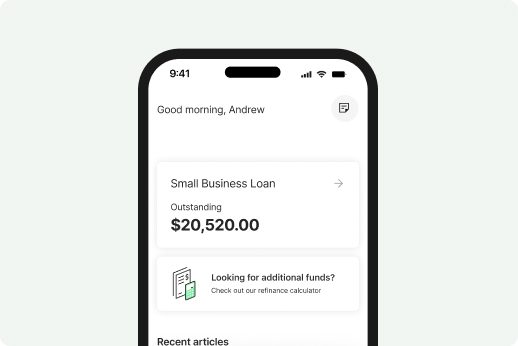

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

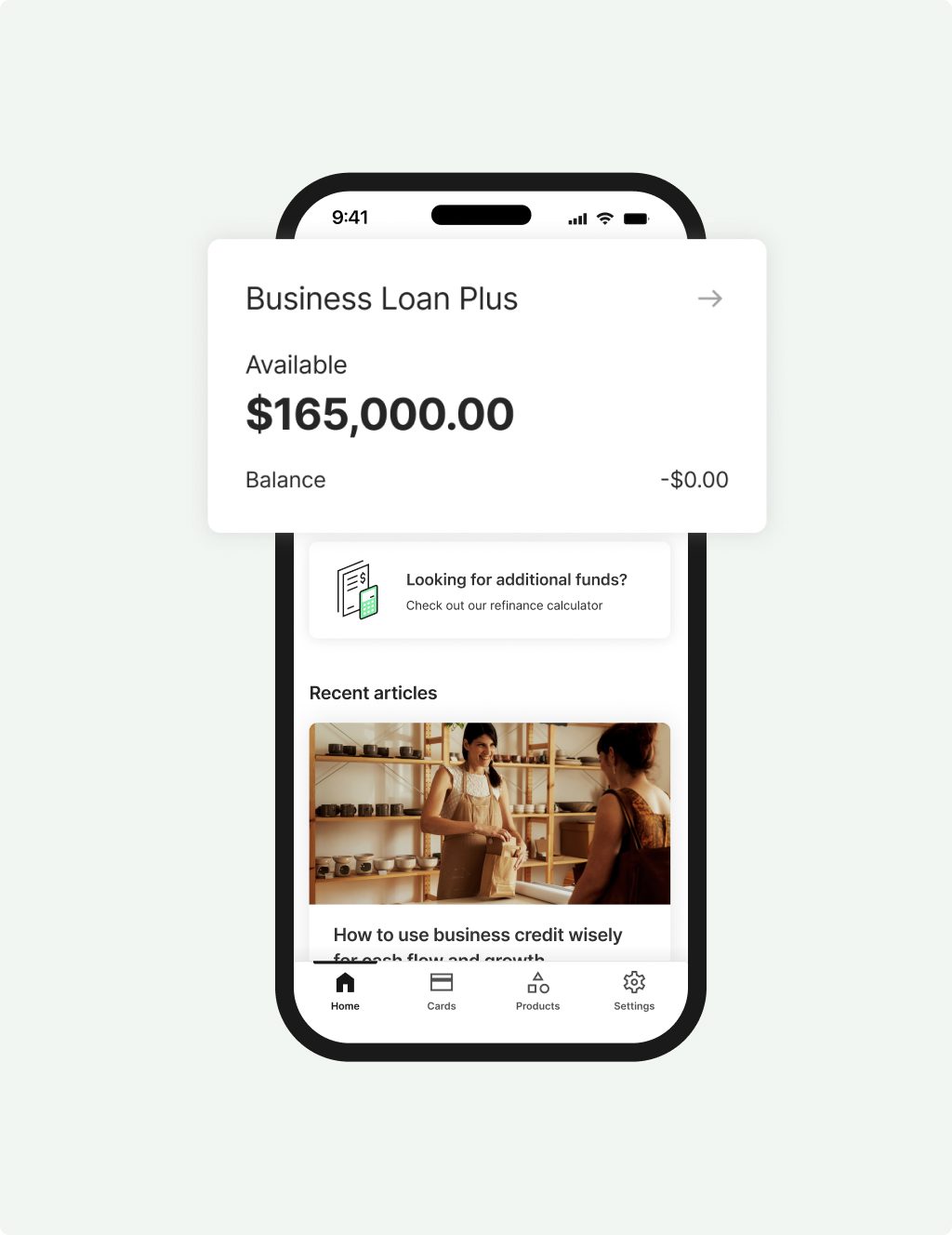

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

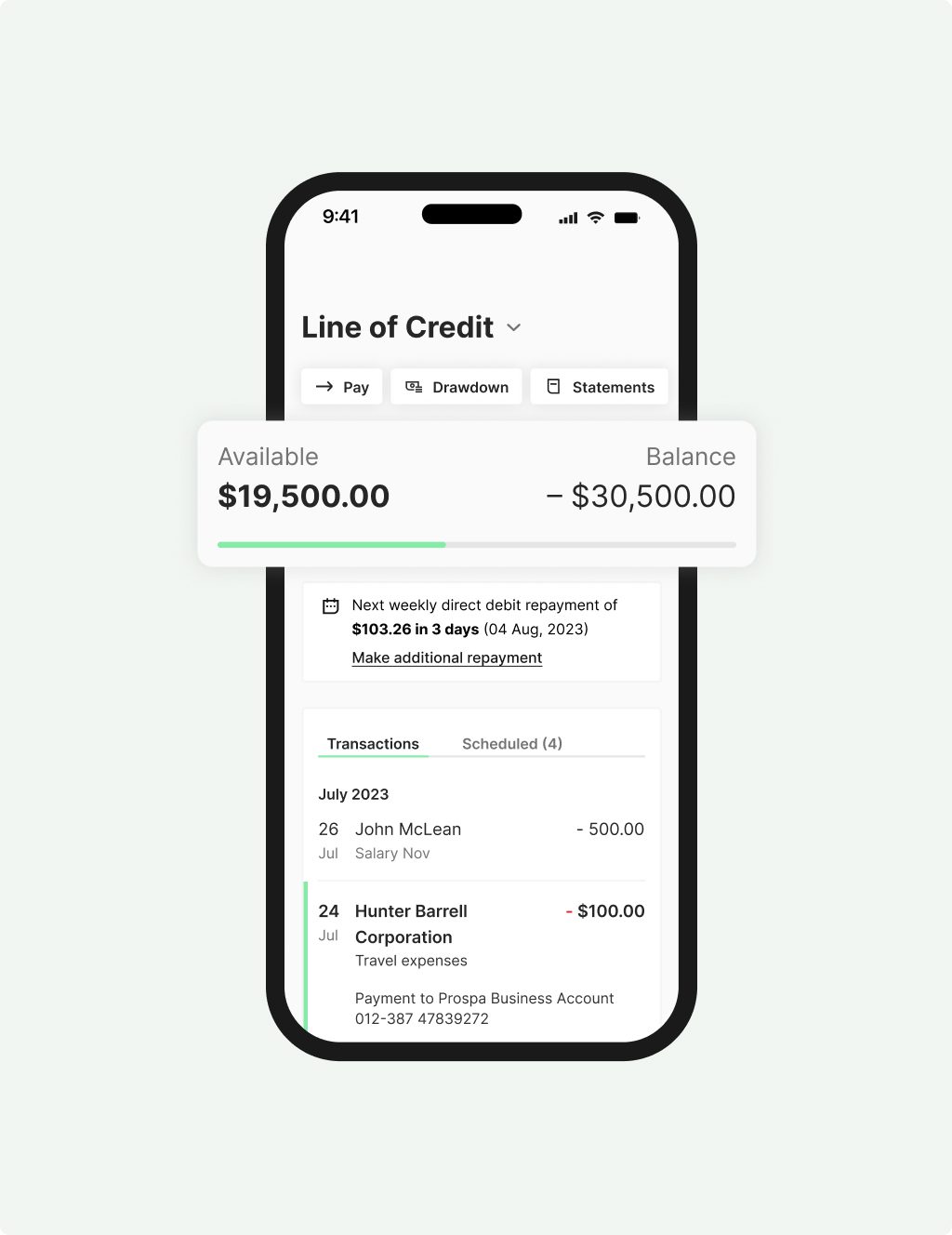

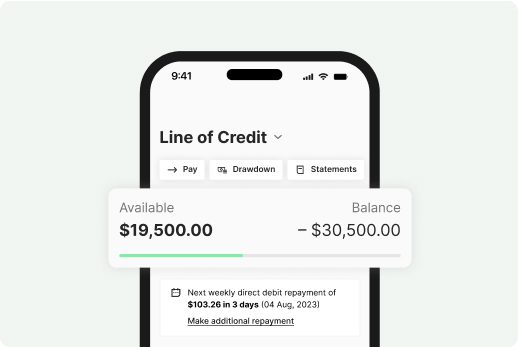

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Why Prospa

With countless finance awards and an average 4.8 out of 5 star rating from over 6,600 verified reviews by satisfied business owners, the better question is: why not?

Every customer is different and their loans should reflect that. We assess each application individually and find the most suitable business borrowing solutions for your needs. Our quick applications and fast delivery of funds save business owners valuable time, while our flexible repayment schedules and early payout discounts offer precious savings.

Our customised business solutions bring our customers back time and time again. We’ve been privileged to watch many businesses grow using our funding to support their different stages of development.

To find out how our company lending solutions can help your business, talk to a member of our team. Or you can apply for business loan today.

The sweet taste of success

Just a few years after purchasing Hyde Park’s Fish out of Water, Adelaide owners Kate and Chris are racking up the awards and tasting the rewards of their commitment to local produce and people.

Recently voted first place (tied) for South Australia’s best fish ’n’ chip shop, they’ve also turned what started as a sweet little side hustle selling homemade desserts from a small space in their shop cabinet into a full-blown dessert bar in its own venue.

At the recommendation of their financial broker, Kate and Chris secured a Prospa small business loan to fund the first commercial kitchen fit-out and hire four new staff for their new business. They’ve since grown to a team of 11 and are running two additional pop-up stores with another standalone shop front on the way.

Read more about Cupkates Desserts success story here.

Our loans work hard so you don't have to

When we designed our award-winning Prospa Small Business Loan, we listened and considered the needs of our customers instead of trying to create a one-size-fits-all company lending solution.

Our quick application process is perfect for businesses short on time and in need of cash flow access fast. Once approved, you won’t need to wait on hold during business hours, you can manage your money on the move with 24/7 access to funds and support through our mobile app and customer portal.

We’ve also worked to make the process of applying for business loans easier , offering the following instead:

- Small business loans between $5K and $500K – no upfront security required to access Prospa funding up to $150K

- Easy application with funding possible in 24 hours

- Loan terms between 3 months and 5 years

- Flexible payment conditions and early payout discounts

- Business loan interest rates calculated based on your business circumstances

- 24/7 access to your account via the Prospa mobile app and customer portal

To get business booming try our business funding options, apply now.

Expected or unexpected expenses? We’ve got you covered.

We recognise that the needs of every business are different. That’s why we tailor our business lending solutions to each company.

A Prospa commercial loan can be applied to a wide range of business-related activities, including:

- marketing and organisational strategy development

- supporting working capital

- increasing capacity of workforce or office space

- office refurbishments and equipment repairs

Whatever your company lending needs, we’ve got you covered. Apply today and you could have funds tomorrow with Prospa.

Flexibility

Support

Confidence

FAQs

FAQs

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

For all Prospa funding:

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Small Business Loan up to $500K, you must also have:

- From 6 months trading history

- Monthly turnover of $6K

For a Business Line of Credit up to $500K, you must also have:

- Minimum 6+ months trading history

- Monthly turnover of $6K

- Property or asset ownership

For a Business Loan Plus from $500K up to $1M, you must also have:

- Minimum 3 years trading history

- Annual turnover of $2M

- Property or asset ownership

To apply for a Small Business Loan:

For amounts up to $250K we require:

- 6 months bank statements

- ATO Tax Portal access (For amounts >$100K)

For amounts above $250K we require:

- 12 months bank statements

- ATO Tax Portal access

- Financial statements

Use our loan calculator to see how much you can afford to borrow.