Prospa (ASX: PGL) (“Prospa” or “Company” or “Group”) will today hold its Investor Day, during which the Company will announce its plans to launch the nation’s first All-in-One business account to grow its online lending platform for small businesses.

Prospa’s strategy for its next phase of growth includes introducing a range of new and exciting digital solutions to further address the leading challenges experienced by Small and Medium Enterprises (SMEs) throughout Australia and New Zealand. These future solutions include:

- All-in-One business transaction account, with a built-in overdraft facility of up to $100,000

- Invoicing features to create, send and track invoices

- Bill management solutions to make payments and manage bills

- Option to consolidate accounts onto one platform to monitor cashflow

- Small Business Loans, offering up to $1,000,000 secured lending to larger business

- Line of credit facility to be launched in New Zealand

Today’s briefing will include details on the Group’s product development and investment in its technology capability to broaden existing lending products and introduce new digital solutions to make Prospa increasingly more embedded with SMEs. Prospa is focused on evolving and improving its product propositions to connect its capital solutions with an integrated suite of innovative cashflow management products and tools, all available on one platform to enable seamless management of business cashflow. This will enable Prospa to play an even greater role in supporting its customers with day-to-day payments, and transactions and support their growth ambitions.

Enhanced online lending platform – scaling lending

With a significant proportion of small businesses’ day to day financial needs still not being met by banks and financial providers, Prospa is focused on capturing additional market share by scaling its existing lending solutions. Core to this is the introduction of two enhanced credit offerings: (1) Small Business Loans of up to $1,000,000, and (2) New Zealand Line of Credit.

Small Business Loans will be offered for up to $1,000,000 to customers for an increased term of 60 months. Prospa also plans to launch its line of credit product in New Zealand, leveraging existing distribution channels and building on the Group’s successful lending platform in the region.

A first for Australian small businesses

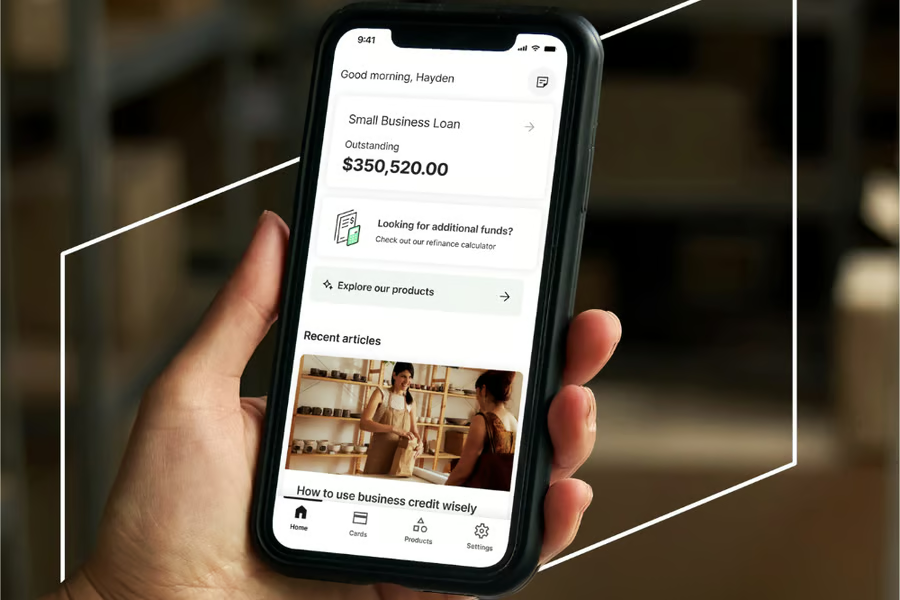

Early next year, Prospa will launch the business transaction account, with its integrated Visa business card, enhanced invoicing features, bill payment solutions, and an overdraft facility of up to $100,000. The business account will be initially launched in Australia.

Prospa’s strategic plan is to attract and engage with a wider market of potential customers through this enhanced range of digital solutions. Through long-term engagement with customers, further data insights will be obtained and leveraged to create more opportunities for cross-selling of lending products to accelerate Prospa’s customer base and engagement, to generate further growth.

Greg Moshal, Co-Founder and Chief Executive Officer, Prospa, said:

“We are excited to provide a strategy update to our investors detailing our transformative product vision with the All-in-One business account. Our core objective from day one has been to understand and create solutions that address the biggest pain points experienced by SMEs.

“At Prospa, we are devoted to keeping businesses moving by providing the tools they need to grow, run and pay all in the one place. We continue to experience growth from existing products and believe the new product strategy will increase customer engagement and lifetime value.”

ENDS

For further information contact:

Company Secretary

Nicole Johnschwager

General Counsel and Company Secretary

e: [email protected]

Media & Investor Relations

Sharon Chang

Corporate Communications Manager

e: [email protected]

About Prospa

Prospa Group Limited (ASX: PGL) is a financial technology company and a leading provider of cash flow products and services that help small businesses to grow and prosper. Headquartered in Sydney, the Company operates across Australia and New Zealand and employs more than 230 people.

Prospa builds cashflow products and services that allow small businesses to grow and run their businesses and help them pay for goods and services though a single app.

Through Prospa’s unique, purpose-built credit decision engine, it quickly assess small business credit applications using proprietary technology and analytics to deliver fast and informed credit decisions and approvals, with high levels of risk controls in place.

As of 30 June 2021, Prospa provided more than $2.1 billion dollars of funding, has 11,900 loyal and active customers. Prospa’s net promoter score increased in 2021 and now exceeds 80, demonstrating the team’s commitment to servicing its customers.

The Company has been recognised as the MFAA National Fintech Lender of the Year four years in a row. Prospa was also recertified as one of Australia’s Great Places to Work in 2021.