- FY20 loan originations of $450.9 million, impacted by the challenging economic conditions resulting from the COVID-19 pandemic (FY19: $501.7 million)

- FY20 total revenue of $142.1 million up 4.2% on the prior year (FY19: $136.4 million), with solid revenue growth of 12.1% recorded in the period leading into the COVID-19 pandemic

- The forward looking additional provision of $18 million for potential credit losses to take into account the impact of COVID-19 is lower than reported on 31 July 2020, as customer repayments since 30 June 2020 have been better than expected

- The COVID-19 provision has resulted in an EBITDA loss of $19.5 million (FY19: loss of $0.8 million). EBITDA excluding the COVID-19 provision and a one-off loan receivable adjustment of $5.5 million was $4.0 million

- Total unique customers in Australia and New Zealand continue to increase, up 43.5% over 30 June 2019 and Prospa has now delivered more than $1.6 billion in lending to more than 28,750 customers since inception[1]

- Average Gross Loans of $433.3 million at 30 June 2020, up 35.7% on the prior year (FY19: $319.4 million)

- Prospa’s balance sheet remains strong with $55.3 million in unrestricted cash (FY19: $29.0 million)

- Prospa continues to have the support of its funding partners and at 30 June 2020 had $114.1 million of available facilities[2] (total third-party facilities of $9 million); and as of 6 August 2020 has allocated $63 million of the AOFM’s $90 million maximum investment amount

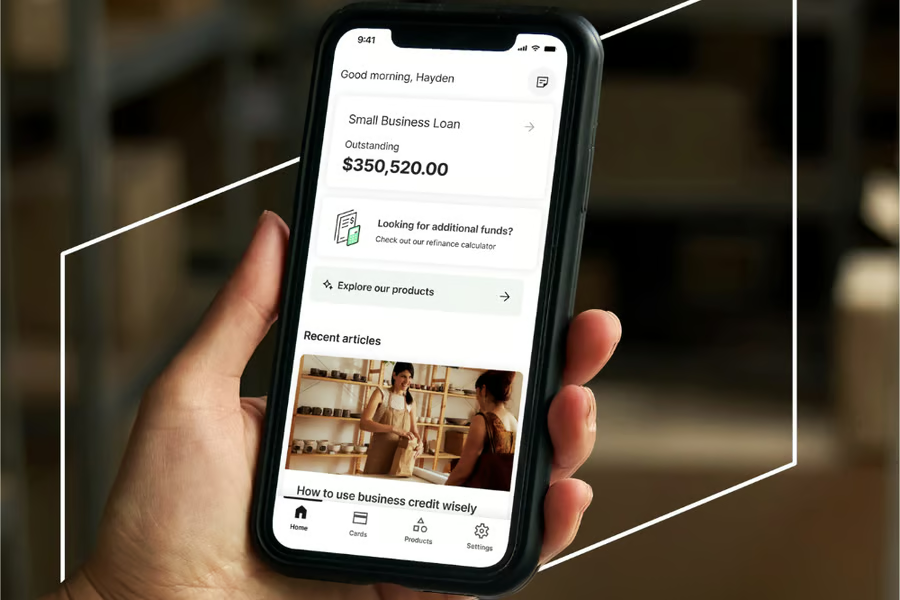

- Proactive measures to continue building a stronger finance and technology platform and accelerate recovery, with investment in its digital customer experience, enhanced liquidity and additional funding

- Prospa’s Net Promoter Score for FY20 remained in excess of 77[3] and Prospa is ranked #1 in the Non-bank Financial Services category in Australia and in New Zealand on independent review site TrustPilot[4]

- Prospa named MFAA[5] Fintech Lender of the Year for the third consecutive year at MFAA National Excellence Awards 2020

Prospa Group Limited (ASX:PGL) (“Prospa” or “the Company”), is pleased to announce its results for the twelve months ended 30 June 2020 (FY20).

Greg Moshal, Chief Executive Officer said: “Prospa has successfully navigated market conditions which have presented unprecedented challenges. The full year result reflects the strength and resilience of our business model, and our ability to quickly adapt to the changing environment.

“Early on, we took swift, decisive action to mitigate the impact of COVID-19 on our business and put in place measures to support our people and our customers. We’re very proud of how the team has performed under these difficult circumstances.

“We will continue to leverage our industry leading knowledge of the small business economy, and we’re confident the actions taken over the last twelve months have positioned Prospa well to support the recovery in this sector.”

Gail Pemberton, Prospa Chair said: “Management have taken steps to ensure Prospa has the right foundations to manage the impact of COVID-19, and the business is well positioned as a result. While momentum in FY20 slowed due to the impact of COVID-19 in the final quarter, we believe it will be restored as the economy and the small business sector recovers. We continue to remain confident of the long-term potential growth opportunity for Prospa in markets which have long been under-served.

Solid results despite a challenging business environment

Strong growth in the first three quarters of the year saw originations increase to $429.0 million for the nine months to 31 March 2020, an increase of 31.6% on the prior corresponding period. This growth was offset by a deliberately restrained risk appetite, with $21.9 million originated in Q4, a decline of 88% compared to the corresponding three month period in FY19. This resulted in total loan originations for FY20 of $450.9 million, down 10.1% on the prior year (FY19: $501.7 million).

Improving customer demand, an adjusted risk appetite, and the full roll out of products supported by the Federal Government’s Coronavirus SME Loan Guarantee Scheme (“Scheme”) saw a recovery in loan originations in the month of June 2020 of $12.8 million, up from $6.2 million in May and $2.9 million in April. COVID-19 has continued to challenge the small business economy, with additional lockdowns in Victoria and New Zealand during August 2020 impacting consumer and business sentiment. Prospa continues to proactively monitor conditions for potential impacts on its risk appetite and customer demand.

Momentum from the solid growth in loan originations in the first three quarters led to total revenue growing to $113.0 million for the nine months to March 2020, a 12.1% increase on the prior corresponding nine month period to 31 March 2019. Growth in Q4 was offset by lower revenue resulting from lower originations and extended repayment terms for COVID-19 affected customers. This resulted in an overall increase in Group total revenue to $142.1 million for FY20, an increase of 4.2% on the prior year (FY19: $136.4 million).

Average Gross Loans grew to $433.3 million, an increase of 35.7% on the prior corresponding period (FY19: $319.4 million). The increase was driven by the strong origination growth at the end of FY19 and the first three quarters of FY20 including the successful launch of its Line of Credit product and full launch in New Zealand.

Realised portfolio yield, which measures reported total revenue as a percentage of Average Gross Loans, was 32.8% for the twelve months to June 2020, a decline of 9.9% on FY19. There was a marginal decline in yield in Q4 as a result of extended repayment terms due to COVID-19 and Scheme supported products. Prospa continues to actively manage yield across the portfolio relative to credit risk and repayment terms.

The Company reviewed expenses in the fourth quarter and achieved a reduction of 32%[6] compared to the prior quarter. Included in this reduction were one off cost savings, but also on-going cost reductions from restructuring the business. The Company continues to optimise operating expenses as conditions evolve.

Statutory EBITDA was ($19.5) million. Prospa has been prudent in its approach to financial management and set aside $18.0 million as a forward-looking provision to take into account the potential impact of the COVID-19 pandemic. This is lower than the $20 million provision noted in the Company’s preliminary results (“Preliminary Results”) announced to the ASX on 31 July 2020 as customer repayments since 30 June 2020 have been better than expected. The total allowance for expected credit losses as a percentage of receivables was increased to 11.1% at 30 June 2020 (30 June 2019: 6.1%; 31 December 2019: 5.9%). This additional provisioning together with a $5.5 million adjustment in loan receivables contributed to the reported EBITDA. Prior to these adjustments, EBITDA was $4.0 million.

Net loss after tax was $24.9 million, 0.8% lower than the prior year.

Unique, scalable and data driven operating platform

The development of Prospa’s product suite during the year has been underpinned by the Company’s deep knowledge of the small business market. This depth of understanding of small business allows the company to precisely identify risk and provide fast credit decision capability at scale through its proprietary Credit Decision Engine (“CDE”).

The Prospa Small Business Loan (SBL) allows small businesses to access lump sum finance of between $5,000 and $300,000 to take advantage of opportunities to invest in and grow their businesses. Prospa’s short term cash flow product appeals to a broad range of customer profiles. Premium risk grades[7], which have historically had significantly lower write-offs, now represent 46.1% of the loan book portfolio as at June 2020 (June 2019: 39%).

In October 2019, Prospa launched its enhanced Line of Credit product, increasing the maximum line size to $100,000 and distributing the product to a broader array of customers. In FY20, Prospa originated $56.5 million of Line of Credit facilities (FY19: $2.8 million), with an average drawn balance of $21,000 and an average utilisation rate of 56%[8].

ProspaPay facilitates trade transactions by spreading the payment of invoices over a short term for a small one-off upfront fee. Despite promising early signs, further development of this product was paused until H2 FY21 as resources were diverted to help support our customers due to the impact of COVID-19.

Prospa continues to make progress in New Zealand, originating NZ$46.6 million of loans in FY20. Originations in the month of February 2020 reached over $7.4 million before the impact of COVID-19. The company has a TrustPilot rating in New Zealand of 4.9 out of 5 and ranks first in the non-bank finance category which positions it well to respond as demand recovers in this market.

Prospa continues to extend its distribution partner network. During the period, leading aggregators FAST and PLAN each announced they would add Prospa to their lender panels. These partnerships with Prospa provide their brokers with a wider range of products and services to support their small business clients.

In August 2020, Prospa was named Fintech Lender of the Year for the third year in a row at the MFAA National Excellence Awards 2020. This follows the announcement in June 2020 that Prospa had achieved a clean sweep at the MFAA State Excellence Awards three years running, receiving the Fintech Lender of the Year Award in every state and territory in Australia.

Customer data shows green shoots

As noted in the Company’s preliminary results (“Preliminary Results”) announced to the ASX on 31 July 2020, Prospa’s data is showing signs of recovery by small businesses.

In particular, the building and trade, professional services and retail sectors are showing demand for funding to support recovery. Geographies showing demand for funding to support recovery are New South Wales, Queensland, Western Australia, and until recently Victoria; and New Zealand albeit to a lesser extent.

Total originations for FY20 were materially impacted in Q4 by COVID-19 related pressures on small businesses, but Prospa saw a gradual increase in originations over the Q4 period and then into July 2020. Prospa is focused on helping its customers through to recovery, and is prepared for a range of economic scenarios, including lower originations growth, and continues to closely monitor its portfolio and risk appetite as the future unfolds.

The Group has also used its data and insights to proactively support customers who are experiencing difficulties. Prospa has provided COVID-19 related relief packages, typically full deferrals of 6 weeks’ duration or partial deferrals of 50% of the typical repayment, with interest on the outstanding principal during the full or partial deferral periods being capitalised.

Despite ongoing movement restrictions in some geographies, an improvement in market conditions has resulted in more customers having been able to resume full or partial repayments. As at 20 August 2020, a total of 1,769 customers in Australia are on full deferral or partial deferral arrangements which compares to 4,701 at the peak, and 3,904 at 30 June 2020, and 1,899 at 31 July 2020, indicating a significant downward trend in customers needing support.

Prospa is able to analyse current business transaction information for a majority of its small business customers, providing real time insight into the impact the crisis is having on their businesses. The Company has and will continue to undertake economic modelling driven by analysing its customers’ capacity to make repayments under various scenarios.

Well-funded to support SME recovery

Prospa remains well funded to support its activities, with a strong balance sheet and committed funding lines from a diverse range of domestic and international senior and junior funders. As at 30 June 2020, the Group had $442.9 million in available third-party facilities including unused facilities of $114.1 million with a lower weighted average funding rate of 5.7% compared to 7.5% in FY19.

In August 2019, Prospa established its first warehouse facility specifically to fund New Zealand Small Business Loans. The three year facility with a credit limit of up to NZ$45 million is designed to scale with its funding needs over time.

Since the COVID-19 pandemic started in March, Prospa has been actively engaged with its funding partners to secure flexibility to provide customers with appropriate COVID-19 relief, including reduced payments, revised payment schedules and deferrals. On 23 July 2020, the Group announced amendments to the warehouse facilities that fund the Group’s small business loans and lines of credit. This has enhanced the Group’s ability to provide its customers with appropriate assistance during the impact of COVID-19.

On 20 July 2020, the Federal Treasurer announced that the Federal Government’s SME Loan Guarantee Scheme would be enhanced and extended to 30 June 2021 to support continued small business recovery. While the final terms of the extension are yet to be announced, the Group anticipates it will apply to be a Participating Lender under the extended Scheme. Prospa received an allocation of up to $223 million when the Scheme was initially introduced.

Funding activity has been supported by Federal Government initiatives. On 6 August 2020, Prospa allocated $63 million of the AOFM’s $90 million maximum investment amount to support the growth in its Line of Credit, Back to Business Small Business Loan and Back to Business Line of Credit products, with the remainder to be allocated over FY21.

Following the period end, Moody’s confirmed its ratings of Class A, Class B and Class C Notes issued by Prospa Trust Series 2018-1[9], with Prospa remaining the only unsecured small business lender to have a rated Trust in Australia.

Cash and cash equivalents[10] grew to $110.3 million at 30 June 2020 (FY19: $69.8 million), an increase of 58.0% from the prior year. This includes unrestricted cash of $55.3 million (FY19: $29.0 million), an increase of $26.3 million or 90.7% on prior year; and ensures Prospa is in a solid position to continue to support its small business customers, and to leverage future growth opportunities going into FY21.

Supporting our people

The health, safety and wellbeing of our people is paramount during these challenging times.

Prospa activated its Business Continuity Plan in early March 2020, and staff have been working remotely since then without operational interruptions to the business.

Prospa has a phased voluntary return to office program in place, guided by employee feedback and Government restrictions, with the flexibility to respond to changing scenarios.

Employee engagement has remained high and was 86% during the Q4 period[11]. Prospa was recognised as a Great Place to Work Australia in September 2019[12].

Outlook

Greg said: “We will continue using our strengths in technology, data and customer service to proactively engage with our customers to support their recovery.

“Although there is uncertainty ahead, we know what a sound small business looks like. We have an intimate understanding of how our customers trade during periods of supressed economic activity. Coupled with financial scale this allows us to quickly pivot to support the recovery across Australia and New Zealand.

“We continue to manage the business prudently given the current uncertain environment, and we face the future with some great strengths. We are well funded, have a strong balance sheet and we have the flexibility to respond quickly to challenges. ”

The business intends to update the market on a quarterly basis from the end of Q1 FY21. Due to ongoing uncertainty, no guidance is provided and this position will be reviewed in February 2021.

Prospa will hold an analyst and investor presentation at 11.00am AEST on Thursday 27th August.

To pre-register for the webcast please click here.

Approved for release by the Board.

[1] Total unique customers ever active across Australia and New Zealand as at 30 June 2020. Total active customers as at 30 June 2020 was 13,342.

[2] Includes warehouse facilities that are partially utilised but which permit drawdown and repayment under the committed limits at any time during the Availability Period, as explained in our Response to ASX Query letter dated 23 April 2020. This applies to all references to available third party facilities in this release.

[3] Average for the period 1 July 2019 to 30 June 2020.

[4] Prospa is ranked #1 in Australia in the Non-bank Financial Services category on independent review site TrustPilot with a TrustScore of 4.9 and over 5,434 reviews as at 12 August 2020. Prospa is ranked #1 in New Zealand in the Non-bank Financial Services category on independent review site TrustPilot with a TrustScore of 4.9 and over 546 reviews as at 12 August 2020.

[5] Mortgage and Finance Association of Australia.

[6] Excluding insurance costs and accounting treatments.

[7] Premium risk grades are the top three risk grades (in terms of credit quality) which were introduced into the business in May 2017.

[8] Utilisation rate is the active utilisation rate, which is the life to date amount used as a proportion of the active life to date total facility limit.

[9] Moody’s Rating Action (“Report”) dated 30 July 2020, which confirms current ratings on Prospa Trust Series 2018-1 will remain unchanged, does not cover PGL’s entire portfolio of loans (including those that reside in other warehouse funding arrangements or in New Zealand or on PGL’s balance sheet). At the time of the Report, this Trust comprises only a small part of PGL’s Australian Warehouse Facilities and only a small part of PGL’s Australian customer numbers, and in PGL’s view, changes like those described in the Report are immaterial at a company level.

[10] Includes cash and cash equivalents as reflected in our consolidated balance sheet in accordance with applicable accounting standards, and includes cash held in securitisation trusts, as explained in our Response to ASX Query letter dated 23 April 2020. This applies to all references to cash and cash equivalents in this document.

[11] Internal Pulse survey, 86% percent of Prospa people would recommend Prospa as a place to work.

[12] Recognised by global business management consultancy Great Place to Work Australia Pty Ltd.

ENDS

For further information contact:

Company Secretary

Nicole Johnschwager

General Counsel and Company Secretary

e: [email protected]

Investor Relations

Anna Fitzgerald

Group Head of Corporate Relations

e: [email protected]

Media

Roger Newby

Domestique Consulting

e: [email protected]

+61 401 278 906

About Prospa

Prospa is a financial technology company that provides cash flow products and services to help small businesses to grow and prosper. At 30 June 2020, Prospa had originated over $1.6 billion in loans and served more than 28,750 small business customers across Australia and New Zealand since inception. Prospa has a history of industry leadership and innovation and is a founding member of the AFIA Online Small Business Lender Code of Lending Practice. Prospa has a Net Promoter Score in excess of 77, is ranked #1 in the Non-bank Financial Services category in Australia and New Zealand on TrustPilot, and is recognised as a 2019 Great Place to Work.