Prospa Group Limited (ASX: PGL) (“Prospa” or “Company” or “Group”), is pleased to provide a trading update for the quarter ended 30 September 2020 (1Q21).

Group Highlights[1]

- Total originations of $80 million in 1Q21, up 265% on 4Q20 (4Q20 $21.9 million) and 38.5% lower than prior corresponding period (1Q20: $130. million).

- Originations excluding loans originated under the Government’s Guarantee Scheme[2] (“GGS”) in 1Q21 were up 107% on 4Q20 demonstrating improving small business sentiment and demand

- Uptake in non-GGS originated loans in 1Q21 has continued in the first three weeks of October

- Annual portfolio yield of 31.5% maintained notwithstanding the deliberately restrained risk appetite at the height of the COVID-19 pandemic in 4Q20

- Continued strong discipline on cost management with lower operating costs from the previous quarter maintained

- Significantly reduced loan deferrals with 1,681 accounts in Australia and New Zealand on full or partial deferral, down from 5,555 at the peak on 15 May 2020, a reduction of almost 70%

- Strong balance sheet and liquidity with $422.1[3] million in available third-party facilities ($174.8m in unused facilities) and $111.1 million of cash (of which $54.4 million is unrestricted) to support growth as conditions improve

- Prospa’s Net Promoter Score remains more than 77[4], and Prospa is ranked #1 in the Non-bank Financial Services category in Australia and New Zealand on independent review site TrustPilot[5]

Greg Moshal, Chief Executive Officer, said:

“Challenging COVID-19 operating conditions continued in 1Q21; however, it has been encouraging to see signs of a steady, yet modest increase in confidence amongst our small business customers. Within this environment, I am proud of the Prospa team’s continued professionalism and their commitment to ensuring our customers are well supported.

“Our 1Q21 performance reflects our focus on writing profitable business as well as our deliberately restrained risk appetite in 4Q20 in response to the COVID-19 pandemic. We saw improvement in our originations in 1Q21 compared to 4Q20 on a total basis and after excluding loans originated under the GGS, and this improvement has continued in the first three weeks of October despite the GGS ending on 30 September 2020.

“Our liquidity remains strong, and as Australia’s largest online small business lender, we stand ready to support our customers as business conditions continue to improve.”

Loan originations of $80.0 million were up 265% on the prior quarter (4Q20: $21.9 million) demonstrating signs of improving demand in the small business sector. Monthly originations steadily increased from the lows in April, May and June with increased month on month growth over the quarter, and with September, in particular, benefiting from the end of the first phase of the Government’s Guarantee Scheme.

Nonetheless, originations remained constrained versus the prior corresponding period (pcp) down 38.5% (1Q20: $130.0 million), noting that this quarter’s result had a significantly lower contribution from Victoria due to the lockdown.

Prospa originated $57.0 million of loans and lines of credit in 1Q21 under the GGS compared to $10.8 million of loans originated under the GGS in 4Q20. Prospa originated $23.0 million of non-GGS loans in 1Q21, an increase of 107.1% on the prior quarter (4Q20: $11.1 million). Following the conclusion of the GGS on 30 September 2020, the Company has seen encouraging signs of continued momentum.

Total revenue before transaction costs of $28.1 million was down 27.8% on pcp (1Q20 $38.9 million), reflecting lower originations in 4Q20 due to the Company’s deliberate decision to restrain risk appetite as well as weaker customer demand during the height of the pandemic.

Management’s tight focus on cost management has resulted in lower operating expenses from the prior quarter.

Average Gross Loans of $353.2 million for 1Q21 were down 15.8% on pcp (1Q20: $419.4 million). This reduction is from lower originations during 4Q20 due to the deliberately restrained risk appetite at the height of the pandemic.

Loan impairment expense for the period improved to $3.8 million during the quarter, representing a decrease of 57.8% on the prior corresponding period (1Q20: $9.0 million). This reduction reflects the decline in receivables over the period, with the provision rate maintained at 11.1%.

Quarterly key metrics

Supporting our customers

Prospa continues to analyse current business transaction information for a majority of its small business customers, providing real-time insights into the impact the pandemic is having on their businesses. Pleasingly, Prospa continues to see more small businesses looking for growth capital as the economic recovery continues and as they prepare for the traditionally busy holiday season.

Prospa has continued to provide support for its customers experiencing hardship through COVID-19 related relief packages. These typically are either full deferrals of 6 weeks duration or partial deferrals of 50% of the typical repayment, with interest on the outstanding principal during the full or partial deferral periods being capitalised.

As at 30 September 2020, 1,516 accounts in Australia are on full deferral or partial deferral arrangements which compares to 4,877 at the peak on 15 May 2020 and 3,904 at 30 June 2020, indicating a significant downward trend in customers needing support. Of the 1,516 remaining accounts, 628 are Victoria based accounts, down from a peak on 15 May 2020 of 1,371.

In New Zealand, 165 accounts are on full deferral or partial deferral arrangements which compares to 678 at the peak on 15 May 2020, and 392 at 30 June 2020.

Pro-active risk assessment and management

The Group continues to proactively manage credit risk on new lending, leveraging data, industry insights, and its purpose-built credit decision engine to lend within the Board’s mandated 4-6% stable static loss rate tolerance.

Loss indicators on the existing portfolio including COVID-19 affected customers are reviewed daily. From 30 June 2020 no additional loss provisioning overlay has been provided as at 30 September 2020.

Net bad debt expense for the quarter (excluding provision expense) was $7.6 million and in line with management’s expectations. At the same time, stable static loss rates on half-yearly loan cohorts have not exceeded the Board mandated loss tolerance rate of 6%.

As at 30 September 2020, the total coverage for expected credit losses as a percentage of receivables is 11.1% (30 June 2020: 11.1%) with a total provision of $37.6 million.

Funding remains strong to support small business recovery

Prospa remains well funded to support its activities, with a strong balance sheet and committed funding lines from a diverse range of domestic and international senior and junior funders. As at 30 September 2020, the Group had $422.1 million in available third-party facilities including unused facilities of $174.8 million with a lower weighted average funding rate of 5.4% compared to 5.9% in 1Q20.

Federal Government initiatives have supported funding activity. On 6 August 2020, Prospa allocated $63 million of the AOFM’s $90 million maximum investment amount to support the growth in its Line of Credit, Back to Business Small Business Loan and Back to Business Line of Credit products, with the remainder to be allocated over FY21.

During the quarter, and as previously announced, Moody’s confirmed its ratings of Class A, Class B and Class C Notes issued by Prospa Trust Series 2018-1, with Prospa remaining the only unsecured small business lender to have a rated Trust in Australia.

Cash and cash equivalents grew to $111.1 million at 30 September 2020, an increase of 0.8% from the prior period (4Q20: $110.3 million). This includes unrestricted cash of $54.4 million (4Q20: $55.3 million) and ensures Prospa is in a solid position to continue to support its small business customers and to leverage future growth opportunities.

Outlook and strategic opportunities

Greg Moshal added:

“We’re pleased to see the Government prioritising support for small business through the significant business tax relief initiatives and investment incentives. These are precisely the kind of measures that will give confidence to small businesses to start planning, investing, and hiring for the future. Despite the positive tailwinds in the sector, we remain cautious about the extent and speed of recovery and will continue to be prudent in lending to our small business customers.

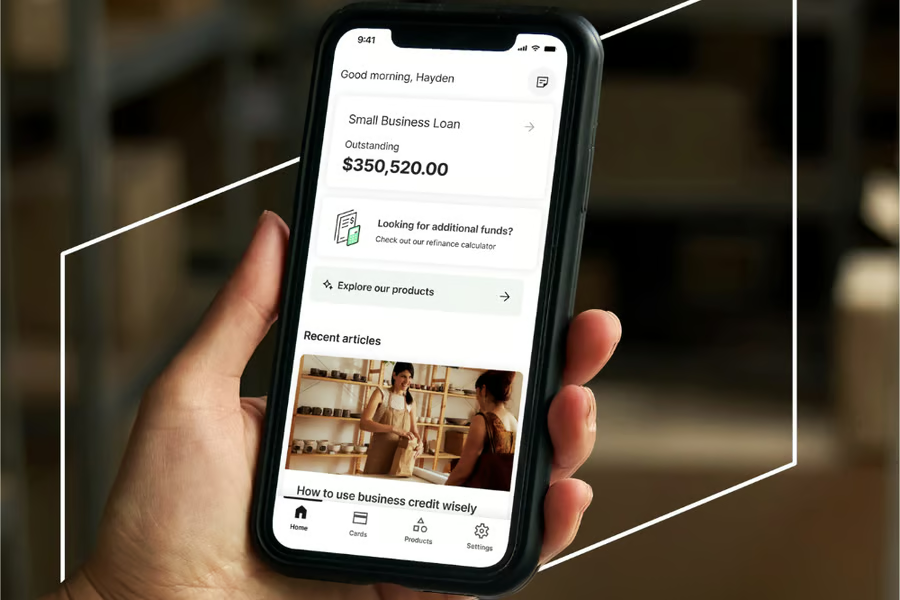

“Whilst COVID-19 has posed many challenges, it has also given rise to opportunities within the small business lending market. Small businesses remain amongst the most dissatisfied customer segment with traditional bank offerings, yet a majority still use their bank account for business banking. The data we’ve gathered over the last 8 years – particularly during COVID-19 – places Prospa in a unique position to expand the role we play in helping small businesses manage cash flow. We will continue to invest in our people, our business and our technology to leverage our brand and our market-leading position to realise these opportunities.”

Prospa will provide the market with regular quarterly reporting on an ongoing basis.

Prospa will hold its Annual General Meeting virtually on 24 November 2020.

This announcement has been authorised for release by the Board.

About Prospa

Prospa is a financial technology company that provides cash flow products and services to help small businesses to grow and prosper. At 30 September 2020, Prospa had originated over $1.65 billion in loans and served more than 29.4 thousand small business customers across Australia and New Zealand since inception. Prospa has a history of industry leadership and innovation and is a founding member of the AFIA Online Small Business Lender Code of Lending Practice. Prospa has a Net Promoter Score over 77, is ranked #1 in the Non-bank Financial Services category in Australia and New Zealand on TrustPilot and is recognised as a 2019 Great Place to Work.

[1] Note all figures in AUD unless otherwise specified.

[2] This refers to the Australian Federal Government’s Coronavirus SME Guarantee Scheme.

[3] NZD converted at RBA exchange rate 0.9258 as at 30 September 2020.

[4] Average for the period April 2020 to September 2020.

[5] Prospa is ranked #1 in Australia in the Non-bank Financial Services category on independent review site TrustPilot with a TrustScore of 4.9 and over 3,682 reviews as at 14 October 2020. Prospa is ranked #1 in New Zealand in the Non-bank Financial Services category on independent review site TrustPilot with a TrustScore of 4.9 and over 588 reviews as at 14 October 2020.

For the Appendix, please view the full announcement on www.prospa.com/investors.

Company

Nicole Johnschwager

General Counsel and Company Secretary

[email protected]

Investor Relations

Stephanie Hansen

Public Relations Manager

[email protected]

Media

Roger Newby

Domestique Consulting

Mob: 0401 278 906

[email protected]