Prospa Group Limited (ASX: PGL) (“Prospa” or “Company” or “Group”) is pleased to provide a trading update for the quarter ended 30 June 2021 (4Q21), with the results driven by continued economic recovery, improved technology capabilities, and strong repeat customer originations.

Group Highlights[1]

- Record originations of $182.7 million in 4Q21, up a significant 51% on the prior quarter (3Q21: $120.9 million) and eight times the prior corresponding period (“pcp”) (4Q20: $20.3 million, COVID-19 affected).

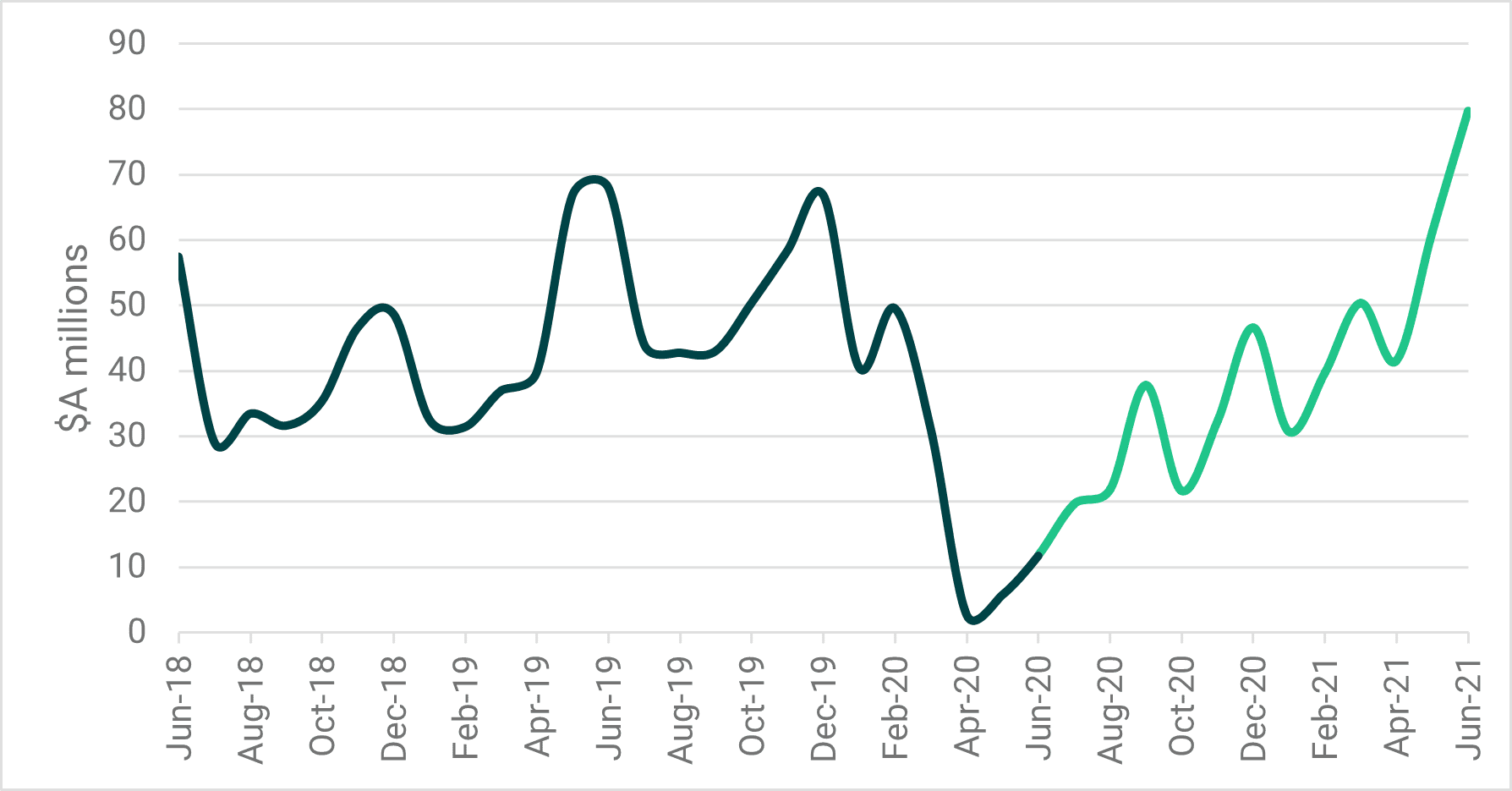

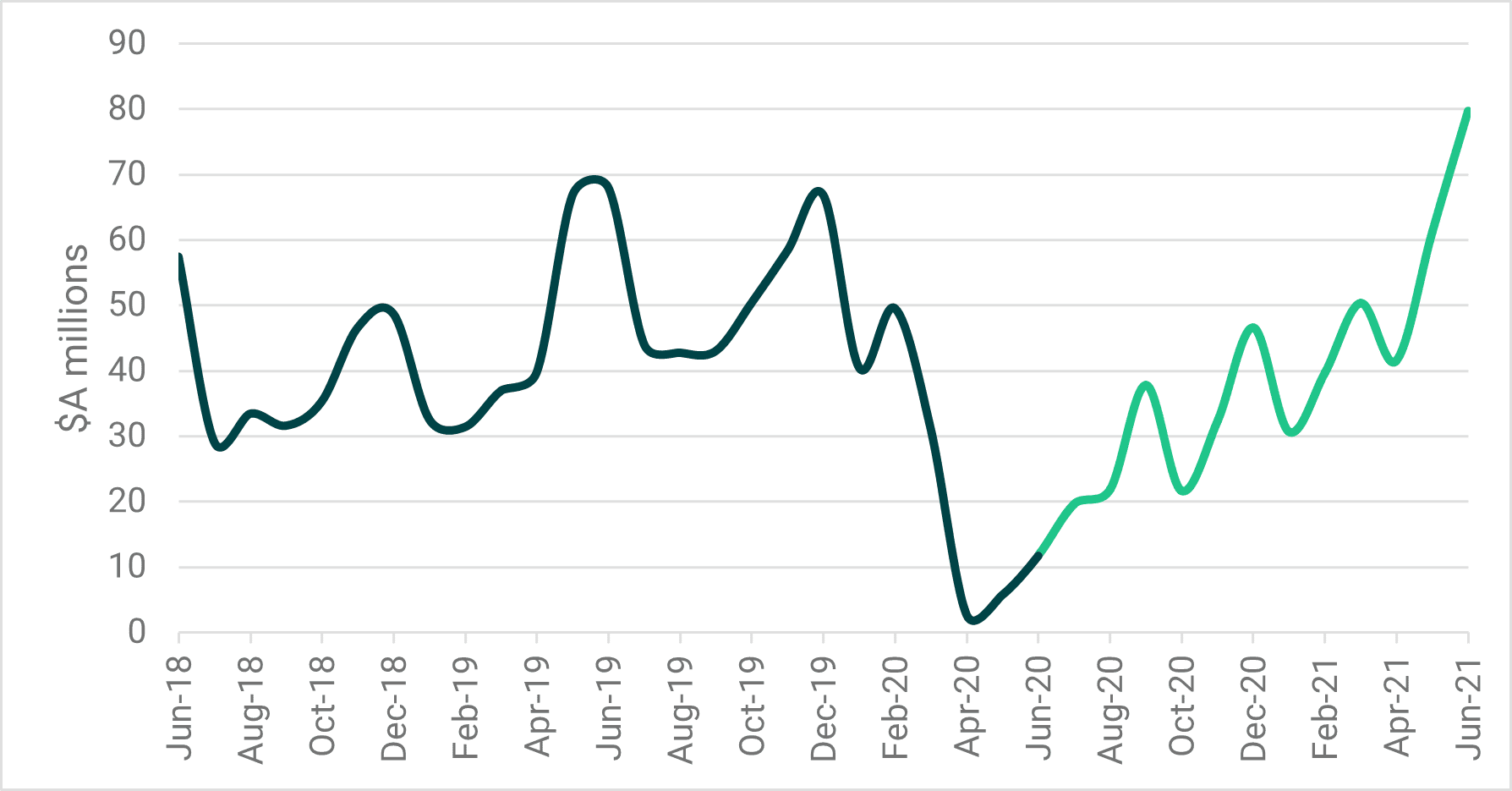

- Prospa recorded its highest ever quarterly originations and its highest ever month, with $79.8 million originations in June, increasing from $61.4 million in May and $41.5 million in April, continuing an accelerating growth trend.

- Of the total originations for the quarter, 74% were from Prospa’s Small Business Loan, and 26% were from the Company’s recently enhanced Line of Credit product.

- The New Zealand business continues to see strong growth in originations with $34.3 million in the quarter, a 72% increase on 3Q21 ($19.9 million). Loans originated under the New Zealand Business Finance Guarantee Scheme accounted for 46% ($15.7 million) of these originations.

- Reflecting the solid economic recovery and improved portfolio performance, credit provisioning for future bad debts has been materially reduced from 10.4% to 7.9% of total loans.

- The acceleration in originations has been strongly supported by Prospa’s improved technology capability, which has streamlined the customer experience and approval process, enabling Prospa to assist more customers with a similar operational team size.

- Prospa continues to demonstrate a loyal customer base with repeat and returning customers accounting for 50% ($91.6 million) of total originations. Importantly, this is at a materially lower cost of acquisition than customers new to Prospa.

- Long term relationships are essential to growth with the Company’s customer-centric approach resulting in Prospa’s Net Promoter Score in excess of 80[2] and positive customer sentiment remaining an important driver of originations growth.

- Closing Gross Loans of $427.1 million surged to within 10% of the all-time high reached just before the onset of COVID-19 in February 2020 ($475.4 million), and active customers of 11,900 continue to grow and are the highest they have been in 2021.

- Average Gross Loans increased to $393.5 million during the quarter, with the annualised yield for the financial year remaining stable at 32.7% (FY20: 32.8%) despite the significant increase in originations.

- Importantly, total revenue before transaction costs for the quarter was $33.4 million, up a significant 17% on the prior quarter (3Q21: $28.5 million).

- Prospa’s growth is underpinned by its strong balance sheet and funding platform, with $458.6 million[3] in available third-party facilities ($97.2 million in available undrawn facilities[4]) and $80.4 million of cash (of which $39.8 million is unrestricted).

Greg Moshal, Chief Executive Officer, said:

“Prospa is now benefiting from the rapid recovery in the Australian, New Zealand and global economies. This quarter, Prospa surpassed many of our all-time record results. They include the highest levels of originations achieved in any quarter; June delivering the greatest number of originations for any month; New Zealand achieving another unbroken monthly increase in originations; and the number of active customers climbing to 11,900.

“The key drivers for this strong performance were recovering SME business confidence, the growing popularity of Prospa’s award-winning Small Business Loan and enhanced Line of Credit products, and the strong repeat and returning customer numbers, which accounted for more than 50% of total originations for the quarter.

“Prospa’s success and identity is built on the power of technology. It enables us to efficiently and rapidly service the financial needs of SMEs both within Australia and New Zealand, particularly as many are now reinvesting in the growth of their businesses. We have further increased our investment in technology this quarter to support our strategy to provide a broader suite of cashflow management products meeting the needs of our customers.”

“Whilst we are all too aware of the challenges currently faced by small businesses in the Greater Sydney metropolitan region, Victoria and South Australia, the SME sector generally has been on a solid recovery path this past financial year. Research undertaken on our behalf by RFi Consulting in May 2021 shows that one in four SME business owners expect their FY21 turnover to increase. This compares with just 7% who expect it to decrease for the period.”

“This research also reveals that, for SMEs, access to credit remains a fundamental problem. Over the past 12 months, SMEs were declined $23.9 billion in credit. The rebound now being witnessed among SMEs has seen the appetite to invest in their future increase further. Prospa has created service technologies and products developed specifically to make managing the capital requirements of a small business more straightforward and less time-consuming.”

4Q21 Financial Performance

Loan originations of $182.7 million were up 51.2% on the prior quarter (3Q21: $120.9 million), an all-time record. Demand for Prospa’s Small Business Loan drove 74.2% of this volume, while the recently enhanced Line of Credit saw a record 25.8% of total originations ($47.1 million). Particularly pleasing is the high rate of repeat or returning customers making up 50% ($91.6 million) of the $182.7 million originations during the quarter.

The New Zealand business experienced continued growth contributing originations of A$34.3 million to the total, representing an increase of 72.1% on the prior quarter (3Q21: A$19.9 million) and a significant increase on pcp (4Q20: A$0.8 million). This was aided by the participation in the Business Finance Guarantee Scheme, with originations of A$15.7 million. Prospa continues to set record monthly originations in New Zealand, and this strong growth validates the Group’s decision to expand its product offering to this market.

Monthly originations trend[5]:

Total revenue before transaction costs was $33.4 million, up 17.4% on the prior quarter (3Q21: $28.5 million), with the higher originations and stable margins contributing strongly to revenue. Total revenue for 4Q21 reflects an increase of 14.9% on pcp (4Q20: $29.1 million). The business is on track to return to pre-COVID-19 revenue levels as growth in originations continues.

Following a period of prudent expense management, Prospa increased its investment in 4Q21 across technology, product, sales and marketing. This expected increase was previously flagged to the market, and as a result, operating expenses of $20.9 million were up 17.4% on the prior quarter (3Q21: $17.8 million).

Average Gross Loans of $393.5 million increased by 11.2% on the prior quarter (3Q21: $354.0 million), driven by the record originations in the quarter and is expected to continue to increase into FY22. Closing gross loans for the year ended on $427.1 million, only 10% lower than the highest gross loans balance reached in February 2020 ($475.4 million).

Quarterly key metrics

| Financial and operational performance (A$m)1 |

3Q20 Results |

4Q20 Results |

1Q21 Results |

2Q21 Results |

3Q21 Results |

4Q21 Results |

% Change from prior quarter |

% Change on 4Q20 |

| Total originations (Aus & NZ)2 |

121.3 |

20.3 |

79.4 |

100.7 |

120.9 |

182.7 |

51.2% |

798.0% |

| Originations excluding AU Government Guarantee Scheme (GGS) and NZ Business Finance Guarantee Scheme (BFGS) |

121.3 |

9.5 |

22.4 |

98.6 |

120.9 |

167.0 |

38.2% |

1649.9% |

| Active Customers (000s)3 |

14.5 |

13.3 |

11.8 |

11.3 |

11.0 |

11.9 |

8.2% |

(10.5%) |

| Average Gross Loans |

466.3 |

422.7 |

353.2 |

332.8 |

354.0 |

393.5 |

11.2% |

(6.9%) |

| Revenue4 |

37.4 |

29.1 |

28.1 |

27.7 |

28.5 |

33.4 |

17.4% |

14.9% |

| Transaction Costs |

2.7 |

2.0 |

1.8 |

1.9 |

1.6 |

2.0 |

23.7% |

(1.0%) |

| Loan Impairment Expense |

8.8 |

30.0 |

3.8 |

7.1 |

6.7 |

9.7 |

45.2% |

(67.6%) |

| Funding Costs |

5.7 |

5.2 |

4.2 |

4.0 |

4.0 |

4.6 |

16.1% |

(10.7%) |

| Other Operating Expenses5 |

20.6 |

15.2 |

14.8 |

17.2 |

17.8 |

20.9 |

17.4% |

37.5% |

[1] Unaudited management accounts. Quarterly totals may not add up precisely due to rounding.

[2] Originations from 29 April to 6 October 2020 include lending under the GGS, which ended in September 2020. Originations from 1 April 2021 include lending under the BFGS, which ended on 30 June 2021. Small retrospective changes in origination figures may occur due to backdated cancellations or modifications to support customer outcomes.

[3] Total active customers at the end of each reported period.

[4] Revenue is total revenue before transaction costs.

[5] Other operating expenses includes share-based payment expenses.

Technology enhancements driving customer originations

As noted, Prospa increased its investment in technology, product, sales, and marketing in 4Q21. This includes investment in research and development and technology capabilities to build and trial new payments solutions in market to accelerate customer engagement.

A key highlight relating to Prospa’s technology has been introducing the customer digital qualification journey that has automated thousands of customer interactions, resulting in a significant reduction of call volumes. In addition, a revised discretion approach has streamlined the credit escalation process and systemised controls, which has further enhanced and accelerated Prospa’s credit approval process. This has resulted in Prospa assisting many more customers, underpinning growth in originations during the quarter.

With enhanced functionality including pay anyone capability, Prospa experienced increased drawdowns under its Line of Credit product as customers take advantage of the flexibility and features offered. As at 30 June 2021, average utilisation for the product was 51.0% (1H21: 48.8%).

Credit risk assessment and management

As at 30 June 2021, the total coverage required for expected credit losses as a percentage of receivables has decreased to 7.9% (3Q21: 10.4%), a total provision of $33.7 million. The reduction is due to the improving business conditions and the Group’s proactive management of credit risk on new lending using the purpose-built credit decision engine (“CDE”) and leveraging its extensive data and industry insights.

While management remains confident in the economic recovery nationally, potential future losses remain adequately covered within Prospa’s provisions for expected credit losses.

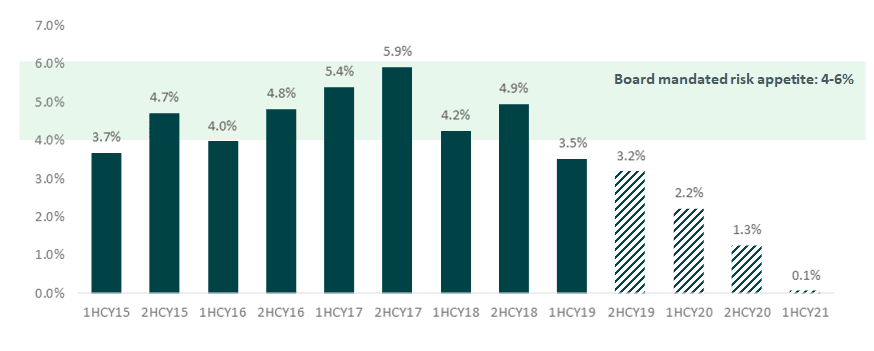

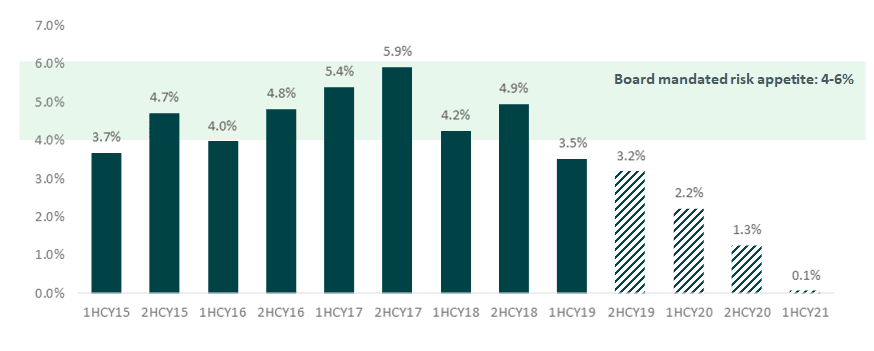

Static loss rates remain within the Board mandated 4% – 6% tolerance range supported by the Group’s proprietary Credit Decision Engine.

As previously announced, the loan deferral period offered to Prospa’s customers during the height of COVID-19 concluded in December 2020. Included in the closing gross loans of $427.1 million at 30 June 2021 is $29.0 million related to COVID-19 loans previously deferred. Of that, $18.5 million are performing, with just $10.5 million showing increased deterioration in credit risk. Prospa continues to work with those remaining customers on a case-by-case basis through the Company’s standard collections process and believes it has adequate credit provisions to support these loans.

In response to the recent lockdowns, Prospa has adopted its standard hardship program offering up to 4 weeks of 50% payment or no repayments. As of 20 July 2021, the company has received 187 requests for support (1.5% of active customers). The company will continue to monitor the situation and respond to customer requests accordingly.

The loan impairment expense for the quarter was $9.7 million, representing a decrease of $20.3 million on pcp (4Q20: $30.0 million). The loan impairment expense consists of a $4.6 million net provision release and $14.3 million net bad debt expense. Loan write-offs related to the impact of COVID-19 remain lower than initially expected.

Funding platform remains solid to support business growth

Prospa boasts a strong balance sheet and funding platform, which positions the Group well to support business growth momentum. Prospa has no corporate debt and has committed funding lines from diverse domestic and international senior and mezzanine funders.

As at 30 June 2021, the Group had $458.6 million in available third-party facilities, including available undrawn facilities of $97.2 million with a weighted average funding rate of 5.7% (3Q21: 5.4%), mainly due to higher average undrawn lines over the period.

On 15 June 2021, Prospa cancelled $63 million of the allocated AOFM funding lines, offsetting these cancelled limits with a $91.3 million increase in limits across its two largest warehouse facilities. During the quarter, Prospa also extended the PROSPArity Trust warehouse facility to May 2024 to provide for future growth. The Group has a well spread maturity profile for its various funding facilities.

Total cash and cash equivalents have decreased 13.8% over the quarter to $80.4 million at 30 June 2021 (3Q21: $93.2 million), of which $39.8 million is unrestricted. This reduction resulted from funding required for the surge in originations and higher cash operating expenses during the quarter with investment in technology, product, sales, and marketing.

Prospa remains well positioned to support the increasing demand for capital from its small business customers and leverage future growth opportunities.

Outlook and strategic opportunities

With an ongoing focus on continuing to build a loyal customer base and enhancing the customers’ online experience, Prospa is particularly pleased that this has resulted in significant growth in new and repeat customers. These customers are looking to invest further in their business to leverage the solid economic rebound.

As an exciting next step in the growth path for Prospa this quarter, the Group has continued to invest in product development and enhanced technology capability to build and trial new payments solutions.

Prospa’s long term plan is to continue to evolve and improve its product propositions connecting its capital solutions with an integrated suite of cashflow management products. This will enable us to play an even greater role in the day-to-day payments and transactions within our customers’ businesses and support their growth ambitions.

Greg Moshal added:

“We are pleased with the new records set in the 4Q21 showing the business is on a solid growth trajectory. Importantly, total revenue growth is robust across our two products in Australia and New Zealand, and it has been achieved without materially changing our risk settings. Our robust balance sheet and funding platform enables us to pursue a range of strategic growth options, including further product development and enhancing Prospa’s tech capability.

“Prospa has achieved substantial growth in a year that was impacted by the COVID-19 pandemic. We acknowledge the challenges faced by many today with restrictions in the Greater Sydney Metropolitan region, across Victoria and South Australia. We are confident that our business is in the best shape to support our customers through these short-term economic restrictions, particularly given the strong results we have achieved in the past year.

“Prospa is well placed to move forward and significantly boost its support of small businesses with a broader range of online financial products and services. I look forward to sharing further details of our strategic growth plans as they continue to be developed over the next few months.”

Prospa will hold its Full Year results presentation on 23 August 2021.

Prospa expects to provide an update on its growth strategy later in the year.

This announcement has been authorised for release by the Board.

For further information contact:

Company Secretary

Nicole Johnschwager

General Counsel and Company Secretary

e: [email protected]

Investor Relations

Kylie Ramsden

GRACosway

e: [email protected]

p: 0412 340 850

Media

Tracy Lee

e: [email protected]

t: 0414 887 129

About Prospa

Prospa Group Limited (ASX: PGL) is a financial technology company and a leading provider of cash flow products and services that help small businesses to grow and prosper. Headquartered in Sydney, the Company operates across Australia and New Zealand and employs over 230 people. The Company has been recognised as the MFAA National Fintech Lender of the Year three years in a row and received the Excellence in Business Lending Award at the FinTech Australia Finnie Awards 2020. Prospa was also certified as one of Australia’s Great Place’s to Work in 2021.

Appendix

Cash & Cash Equivalents:

| Cash & Cash Equivalents (A$m) |

Current Quarter |

Prior Quarter |

Movement |

| Unrestricted Cash |

39.8 |

46.0 |

(13.6%) |

| Restricted Cash |

40.6 |

47.2 |

(13.9%) |

| Total Cash & Cash Equivalents |

80.4 |

93.2 |

(13.8%) |

Trust facilities (as at 30 June 2021):

| Facility (A$m) |

Facility Limit |

Drawn |

Maturity |

| Propela Trust (AU Warehouse) |

27.0 |

27.0 |

Sep-21 |

Prospa Trust 2015-1

(Warehouse facility) |

95.0 |

59.2 |

Dec-21 |

PROSPArity Trust

(Warehouse Facility) |

135.0 |

114.3 |

May-24 |

Pioneer Trust

(Warehouse Facility) |

138.8 |

106.4 |

Feb-23 |

| Kea Trust 2019-1 (NZ) |

32.6 |

24.2 |

Aug-23 |

| Kea Trust 2021-1 (NZ) |

30.2 |

30.2 |

Sep-24 |

Stable static loss rates by cohort at 30 June 2021:

Represents static loss rates net of recoveries at 30 June 2021 for the Australian small business loan and Government Guarantee Scheme loan products (previously excluded). Banded columns reflect cohorts that are still seasoning.

[1] Note all figures in AUD unless otherwise specified.

[2] Average for the period 1 April 2021 to 30 June 2021.

[3] NZD converted at RBA exchange rate 0.930 as at 30 June 2021.

[4] Previously referred to as “unused facilities.”

[5] Fresh originations from all products and geographies as at 30 June 2021.