Prospa Group Limited (ASX: PGL) (“Prospa” or “Company” or “Group”), is pleased to provide a trading update for the quarter ended 31 December 2020 (2Q21).

Group Highlights[1]

- Total originations of $100.7 million in 2Q21, up 25.9% on prior quarter (1Q21: $80.0 million) and 43.0% lower than prior corresponding period (“pcp”) (2Q20: $176.8 million).

- The Company experienced strong month on month growth in originations during the quarter. $98.6 million (97.9%) of the $100.7 million total originations were on standard products[2], with $19.6 million originated in October, $32.4 million in November and $46.6 million in December.

- Significant growth in New Zealand with originations of A$18.0 million, up 200% on prior quarter (1Q21: A$6.0 million), up 25.0% on pcp (2Q20: A$14.4 million).

- Annual portfolio yield maintained despite the impact of COVID-19 with the annual yield for the 12 months to December 2020 of 31.0% only marginally lower than the 12 months to September 2020 (31.5%).

- Stable static loss rates have remained within the Board mandated loss tolerance rate of 4-6%, demonstrating the effectiveness of Prospa’s purpose-built credit decision engine.

- Continued tight management of operating costs at $17.2 million in 2Q21, down 18.9% on pcp (2Q20: $21.2 million).

- Total coverage for expected credit losses declining as a percentage of receivables is 10.4% (1Q21: 11.1%) with a total provision of $35.5 million (1Q21: $37.6 million).

- Strong balance sheet and liquidity with $420.3[3] million in available third-party facilities ($120.6 million in available undrawn facilities[4]) and $110.9 million of cash (of which $47.0 million is unrestricted) to continue to support growth as conditions improve.

- Prospa’s Net Promoter Score remains more than 77[5], and Prospa is ranked #1 in the Non-bank Financial Services category in Australia and New Zealand on independent review site TrustPilot.[6]

Greg Moshal, Chief Executive Officer, said:

“We are pleased to report strong quarterly growth in originations as we see small business demand for capital increasing faster than we had previously expected. It is particularly significant that demand for our products has grown following the conclusion of the Government Guarantee Scheme at the end of September. Our New Zealand operations continue to go from strength to strength, having our busiest ever month in December, benefitting from the country’s earlier recovery from the impact of COVID.

“We took a proactive role as a responsible lender for the SME sector during the pandemic and adjusted our credit risk assessment accordingly to ensure we are now in the strongest position possible to support small businesses as demand for capital returns. This deliberately restrained risk appetite at the height of the pandemic (particularly during the fourth quarter of FY20) had resulted in a reduction of Average Gross Loans for the first half of FY21. In light of the current low-COVID trading environment, we expect our balance sheet will return to growth in the second half of the year as originations continue to improve.”

2Q21 Financial Performance

Loan originations of $100.7 million were up 25.9% on the prior quarter (1Q21: $80.0 million) demonstrating continued improving demand in the small business sector for Prospa’s core Small Business Loan and Line of Credit products, whilst still down -43.0% on pcp (2Q20: $176.8 million).

New Zealand performed very strongly with originations of A$18.0 million, up 200% on the prior quarter (1Q21: A$6.0 million) and up 25.0% on pcp (2Q20: A$14.4 million), a result of the ongoing robust performance of the economy post lockdown. Prospa recorded its highest monthly originations in New Zealand to date in December as small businesses prepared for the traditionally busy holiday season.

Total revenue before transaction costs was $27.7 million, down 1.4% on the prior period (1Q21: $28.1 million) and down 24.5% on pcp (2Q20 $36.7 million), reflecting the flow on impact of lower originations in 4Q20 and 1Q21 due to the Company’s deliberate decision to restrain risk appetite.

Management’s tight focus on costs has resulted in lower operating expenses from pcp, down 18.9% (2Q20: $21.2 million). This is up 16.1% on the previous quarter as a result of increased investment in sales and marketing in line with the increase in demand from small businesses for capital.

Average Gross Loans of $332.8 million for 2Q21 were down 23.8% on pcp (2Q20: $436.8 million), a result of lower originations at the height of the pandemic (March until July). The Company expects the loan book to expand as economic conditions continue to improve.

Active customers of 11,300 down marginally on the prior quarter (1Q21: 11,800) in line with Average Gross Loans, a result of lower customer acquisition at the height of the pandemic and customers with outstanding loans finishing their repayments.

Quarterly key metrics

COVID-19 pro-active risk assessment and management

The Group continues to proactively manage credit risk on new lending, leveraging data, industry insights and its purpose-built credit decision engine to lend within the Board’s mandated 4-6% stable static loss rate tolerance. Loss indicators on the existing portfolio including COVID-19 affected customers are reviewed daily.

As a result of improving economic and trading conditions, Prospa’s COVID-19 deferral period for customers has now concluded. The remaining customers have either resumed payment or are now being worked with on a case by case basis through Prospa’s standard collections process. As at 31 December 2020, any expected losses from this group are adequately covered within Prospa’s provisions for expected credit losses.

As at 31 December 2020, the total coverage for expected credit losses as a percentage of receivables is 10.4% (30 June 2020: 11.1%) with a total provision of $35.5 million.

Loan impairment expense for the period was $7.1 million during the quarter, representing an increase of $2.0 million on the prior corresponding period (2Q20: $5.1 million). A decline in receivables and a reduction in the provision rate to 10.4% (1Q21: 11.1%) was offset by increased write-offs in the quarter of $1.6 million (2Q21: $9.2 million vs $7.6 million in Q1), a result of a non-recurring write-off of certain loans that had a specific provision attached to them at 30 June 2020. At the same time, stable static loss rates on half-yearly loan cohorts continue to be within the Board mandated loss tolerance rate of 4-6%.

Funding remains strong to support continued small business recovery

Prospa remains well funded to support its activities, with a strong balance sheet and committed funding lines from a diverse range of domestic and international senior and junior funders. As at 31 December 2020, the Group had $420.3 million in available third-party facilities including available undrawn facilities of $120.6 million with a slightly higher weighted average funding rate of 5.5% (1Q21: 5.4%), mainly due to higher unused facility fees.

On 3 December 2020, Prospa allocated $27 million of the remaining AOFM’s $90 million maximum investment amount in a new warehouse to support the growth in its Line of Credit and Small Business Loan products. During the quarter, all rated notes held by external investors in the Moody’s rated Prospa Trust Series 2018-1 were repaid with Prospa exercising its call option.

Cash and cash equivalents were maintained during the quarter, with $110.9 million at 31 December 2020, flat on the prior period (1Q21: $111.1 million). This includes unrestricted cash of $47.0 million (1Q21: 54.4 million) and ensures Prospa is in a solid position to support its small business customers’ demand for capital and to leverage future growth opportunities.

Outlook and strategic opportunities

Greg Moshal added:

“Today’s results demonstrate that the greenshoots of improved confidence within the SME sector that we saw in first quarter have now planted deeper roots and are beginning to take hold. Whilst demand remains lower than pre-COVID levels, we believe that the extent and speed of recovery within the SME sector has accelerated faster than anticipated and we are well placed to support its return to growth.

“As economic conditions continue to strengthen in Australia and New Zealand, we believe now is the right time to invest in our short and long term growth by increasing investment in research and development, and sales and marketing. Our vision is to further enhance Prospa’s award-winning product set to include an integrated suite of solutions that bring us into more frequent contact with our customers, ingraining ourselves in the payments and transactions that make up their business.”

Prospa will hold its Half Year results presentation on Thursday 25th February 2020.

This announcement has been authorised for release by the Board.

Please view full ASX release witih Appendix here.

For further information contact:

Company Secretary

Nicole Johnschwager

General Counsel and Company Secretary

e: [email protected]

Investor Relations

Stephanie Hansen

Corporate Communications Manager

e: [email protected]

Media

Roger Newby

Domestique Consulting

e: [email protected]

t: +61 401 278 906

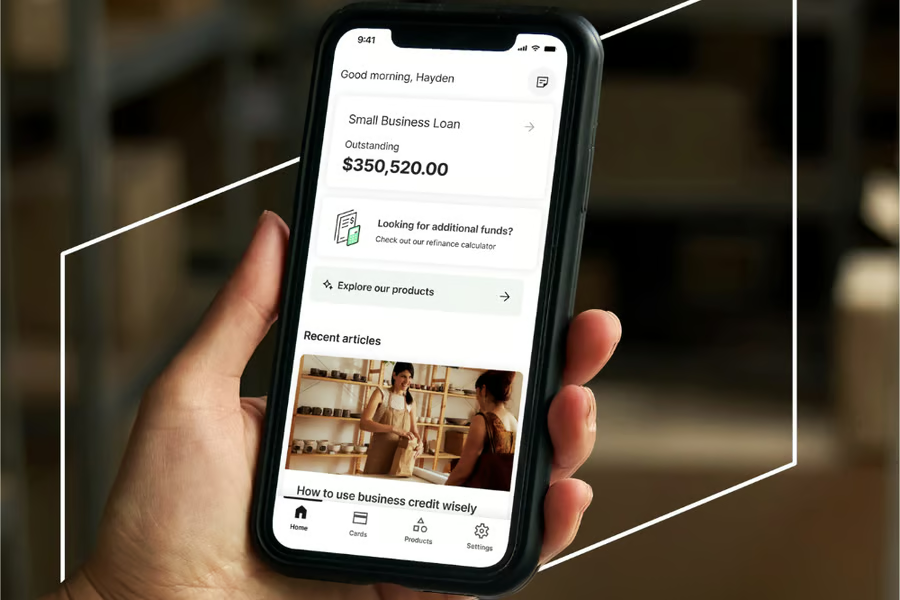

About Prospa

Prospa Group Limited (ASX: PGL) is a financial technology company and a leading provider of cash flow products and services that help small businesses to grow and prosper. Headquartered in Sydney, the company operates across Australia and New Zealand and employs over 200 people. Prospa has a Net Promoter Score over 77 and is ranked #1 in the Non-bank Financial Services category in Australia and New Zealand on TrustPilot. The company has been recognised as the MFAA National Fintech Lender of the Year three years in a row and received the Excellence in Business Lending Award at the FinTech Australia Finnie Awards 2020.

[1] Note all figures in AUD unless otherwise specified.

[2] Standard products refers to Prospa’s non-Government Guarantee Scheme products.

[3] NZD converted at RBA exchange rate 0.9376 as at 31 December 2020.

[4] Previously referred to as “unused facilities.”

[5] Average for the period October 2020 to December 2020.

[6] Prospa is ranked #1 in Australia in the Non-bank Financial Services category on independent review site TrustPilot with a TrustScore of 4.9 and over 6,091 reviews as at 15 January 2021. Prospa is ranked #1 in New Zealand in the Non-bank Financial Services category on independent review site TrustPilot with a TrustScore of 4.9 and over 747 reviews as at 15 January 2021.