Discover the best cash flow management software for small businesses. Compare forecasting tools like Float, Fathom, and Spotlight Reporting, and learn how to choose the right one to plan ahead and stay on top of cash flow.

At a glance

- Cashflow forecasting tools give small business owners visibility over their cash position, helping them plan ahead, and make proactive decisions about day to day operations and growth opportunities.

- Options range from simple spreadsheet templates to connected software like Float, Fathom, Spotlight Reporting, and Futrli, each with different levels of automation, cost, and insight.

- The right choice depends on your business size, accounting setup, and how much control or integration you need to manage cash flow effectively.

Running a small business means constantly balancing what’s coming in and going out. From covering wages and rent to paying suppliers and taxes, cash flow is what keeps your business moving. But staying on top of it can be a challenge, especially when revenue doesn’t land on time or expenses fluctuate month to month.

That’s where the right cash flow management software can make all the difference. These tools help you track, forecast, and plan your cash position so you can make informed decisions about when to restock, hire, or invest in growth.

In this guide, we’ll look at how cash flow forecasting tools can simplify financial planning, the benefits of using them, and which options might best suit your business.

Why cash flow forecasting tools matter for small businesses

Knowing your cash flow is one thing; staying ahead of it is another. Forecasting tools turn what’s often a manual, time-consuming task into a clearer, more consistent part of running your business.

The right tool helps you see what’s really happening with your cash, week by week or month by month. You can plan for quieter periods, prepare for large expenses, and make better decisions about when to spend or save. Many business owners also find that forecasting tools make conversations with lenders or investors easier because the numbers are accurate and up to date.

When forecasting is left to guesswork or outdated spreadsheets, small issues can quickly grow. A late payment, an unexpected bill, or a tax deadline can create pressure that ripples through your entire operation, from paying staff to ordering stock. Cashflow tools help you spot those shortfalls early and adjust before they become problems.

If your forecast shows a gap between cash in and cash out, flexible funding can help bridge it. In these instances, an unsecured business loan can support your cash flow and growth plans.

How cash flow tools differ from accounting software

Most accounting platforms, including Xero, MYOB, and QuickBooks Online, now offer some level of cash flow forecasting, though the features vary by plan tier. These built-in tools can give you a short-term view of your finances, which is often enough for day-to-day monitoring.

Cash forecasting software takes it further. It lets you test different scenarios, model future growth, and see how changes in your business could affect your cash position over time. When comparing tools, check which accounting systems they integrate with. A strong integration keeps your forecasts updated automatically, saving hours of manual work and reducing the risk of errors.

Cashflow management tools

No two businesses manage cash flow in quite the same way. Some owners prefer the flexibility of building their own spreadsheets, while others want software that connects directly to their accounting system and updates automatically. Fortunately, there is a tool to suit every approach, from simple templates that give you complete control to smart platforms that turn your financial data into real-time insights.

Finding the right software can be time-consuming, so we’ve done the heavy lifting for you. Below, we’ve analysed five leading cash flow management tools, comparing them on the features that matter most: flexibility, automation, accounting integrations, and price. This will help you find the perfect fit, whether you’re a hands-on spreadsheet expert or looking for a ‘set it and forget it’ platform.

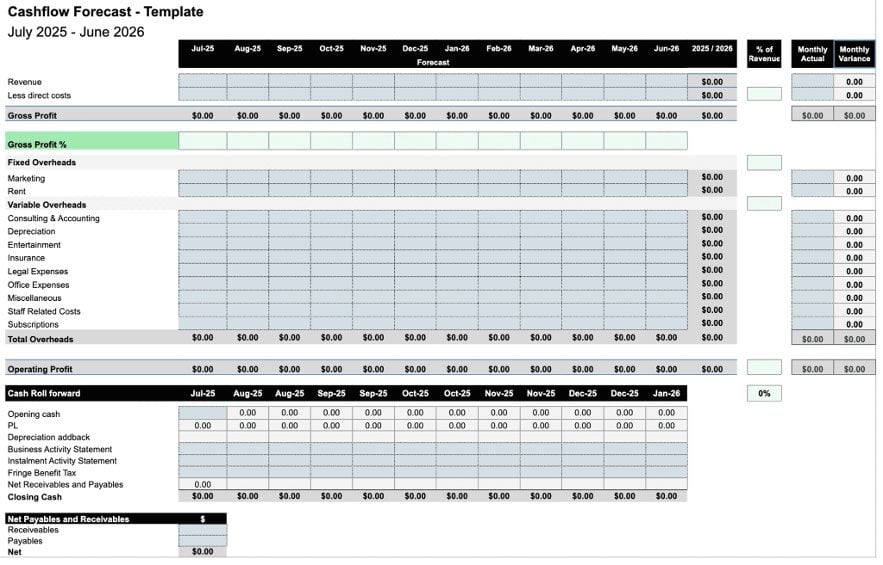

Spreadsheet templates (Google Sheets / Microsoft Excel)

If you’re comfortable working with numbers and spreadsheets, Microsoft Excel or Google Sheets are among the most flexible and cost-effective ways to forecast cash flow. They give you full control over how your data is organised and make it easy to adjust for your business’s unique income and expense patterns.

Many small businesses start here because it’s simple, familiar, and often free, especially if you already use Google Workspace or have Microsoft Office. Spreadsheets let you see the direct impact of changes like new hires, pricing adjustments, or supplier costs without relying on external software.

They do require manual updates, but that hands-on approach can help you understand exactly where your money is going and how each line item affects your cash position. For many owners, it’s the most practical way to build financial awareness before moving to automated tools.

Free cash flow forecast templateProspa partnered with Chartered Accountants JD Scott + Co to create a free cash flow forecast template based on the same structure accountants use with their small business clients. It helps you track revenue, expenses, and tax obligations across a 12-month period. Download the free Excel template and follow the step-by-step guide in our companion article on how to forecast cash flow for your small business. |

|---|

- Best for: Those who prefer to manage their own finances and want full control and flexibility.

- Ease of use: Easy

- Integrations: None (manual entry)

- Multi-Currency: Manual

- Typical cost: Google Sheets – Free; Microsoft 365 Business Basic from $6.60/month

- Free Trial: 30 days

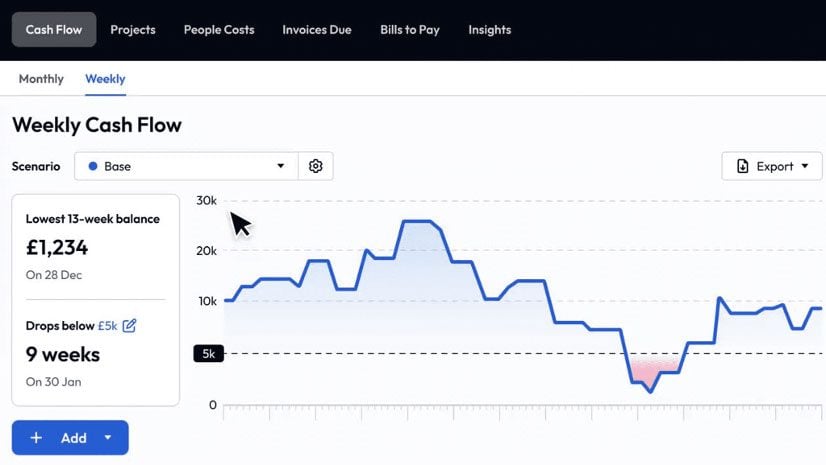

Float

Float is a cloud-based cash flow tool that connects directly to your accounting software to give you real-time visibility over your business finances. Once set up, it automatically imports your real financial data and updates your forecast as those numbers change.

It’s designed to be simple to use, with clear charts and scenario planning tools that let you test changes before they happen. You can see a live projection of your cash position and easily test “what if” scenarios.

- Best for: Automatic forecasting and simple visual reports

- Ease of use: Easy

- Integrations: Xero, QuickBooks, FreeAgent

- Multi-Currency: No

- Typical cost: From $39/month

- Free Trial: 14 days

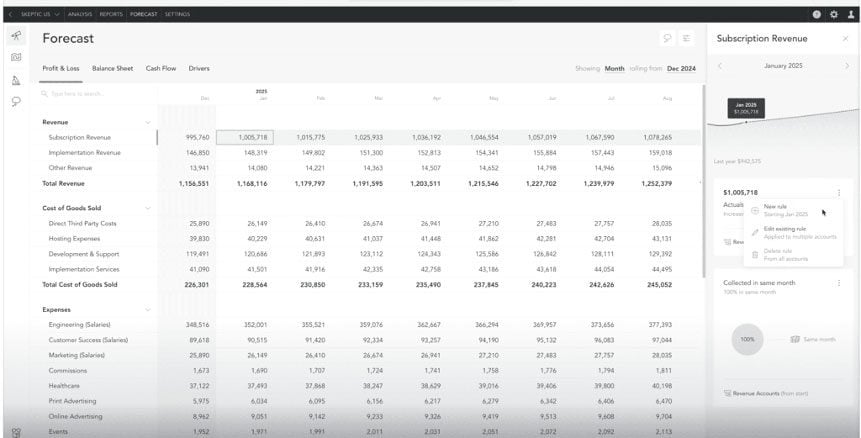

Fathom

Fathom goes beyond forecasting to help you understand your business performance in detail. It combines forecasting, KPI tracking, and visual reporting in one platform.

The platform connects with your accounting software and automatically imports your data to build a three-way forecast that links P&L, balance sheet, and cash flow.

- Best for: Deeper analysis and long-term planning

- Ease of use: Moderate

- Integrations: Xero, QuickBooks, MYOB, Excel, Google Sheets

- Multi-Currency: Yes

- Typical cost: From $65/month

- Free Trial: 14 days

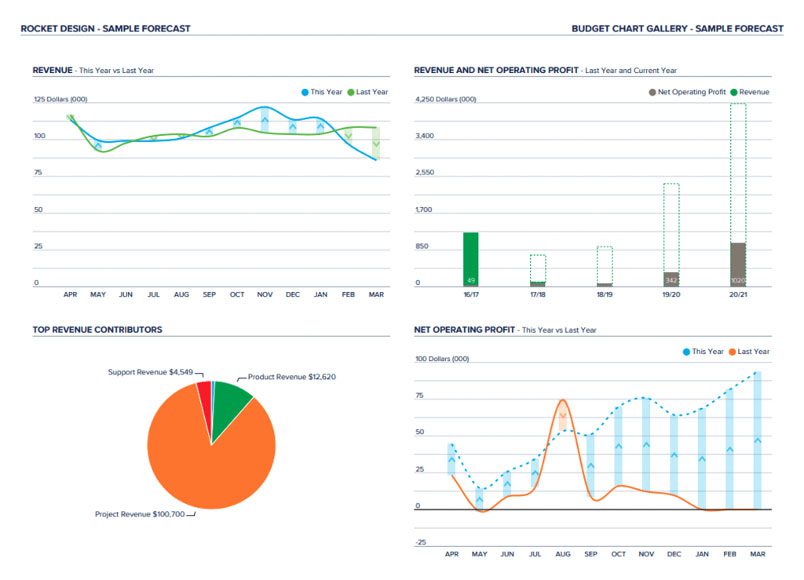

Spotlight Reporting

Spotlight Reporting is designed for producing formal, board-ready financial reports and dashboards. It also supports three-way forecasting and complex consolidations across multiple entities.

- Best for: Consolidated reporting and working with accountants/advisors

- Ease of use: Moderate to high

- Integrations: Xero, QuickBooks, MYOB, Karbon, Excel, Google Sheets, Google Analytics

- Multi-Currency: Yes

- Typical cost: From $65/month

- Free Trial: 14 days

Futrli by Sage

Futrli by Sage gives business owners a clear view of their performance and cash flow. It supports long-range forecasting, multi-entity consolidation, HR modelling, and multi-currency capabilities.

- Best for: Detailed forecasting with high flexibility

- Ease of use: Moderate

- Integrations: Sage, Xero, QuickBooks, Excel

- Multi-Currency: Yes

- Typical cost: From $55/month

- Free Trial: 14 days

Cash Flow Forecasting Tools Comparison

| Tool | Best for | Ease of use | Integrations | Multi-Currency | Typical Cost | Free trial |

|---|---|---|---|---|---|---|

| Google Sheets / Microsoft Excel | Managing own finances

Control and flexibility |

Easy | None

(manual entry) |

Manual | Google – Free

Excel – from $6.60pm |

30 days |

| Float | Automatic forecasting

Simple visual reports |

Easy | Xero, QuickBooks, FreeAgent | No | From $39 pm | 14 days |

| Fathom | Deeper analysis

Visual reports Long-term planning |

Moderate | Xero, QuickBooks, MYOB, Excel | Yes | From $65 pm | 14 days |

| Spotlight Reporting | Consolidated reporting

Working with accountants/advisors |

Moderate

to high |

Xero, QuickBooks, MYOB, Karbon, Excel, Google Sheets, Google Analytics | Yes | From $65 pm | 14 days |

| Futrli by Sage | Advanced scenario planning

Detailed long-range forecasting Flexible reporting |

Moderate | Sage, Xero, QuickBooks, Excel | Yes | From $55 pm | 14 days |

Keeping your cash flow in check

Every small business manages cash flow differently, but the goal is always the same: to plan ahead and stay in control. Whether you prefer the structure of a spreadsheet or the automation of connected software, using a cash flow management tool can give you a clearer view of your money and how it moves through your business.

Once you have visibility over your cash position, it becomes easier to make proactive decisions, from restocking inventory to seizing new opportunities. And when you need extra flexibility to smooth out cash flow, Prospa’s business finance solutions are here to help.

Learn more about how a Prospa Business Line of Credit can help you keep cash flow moving.