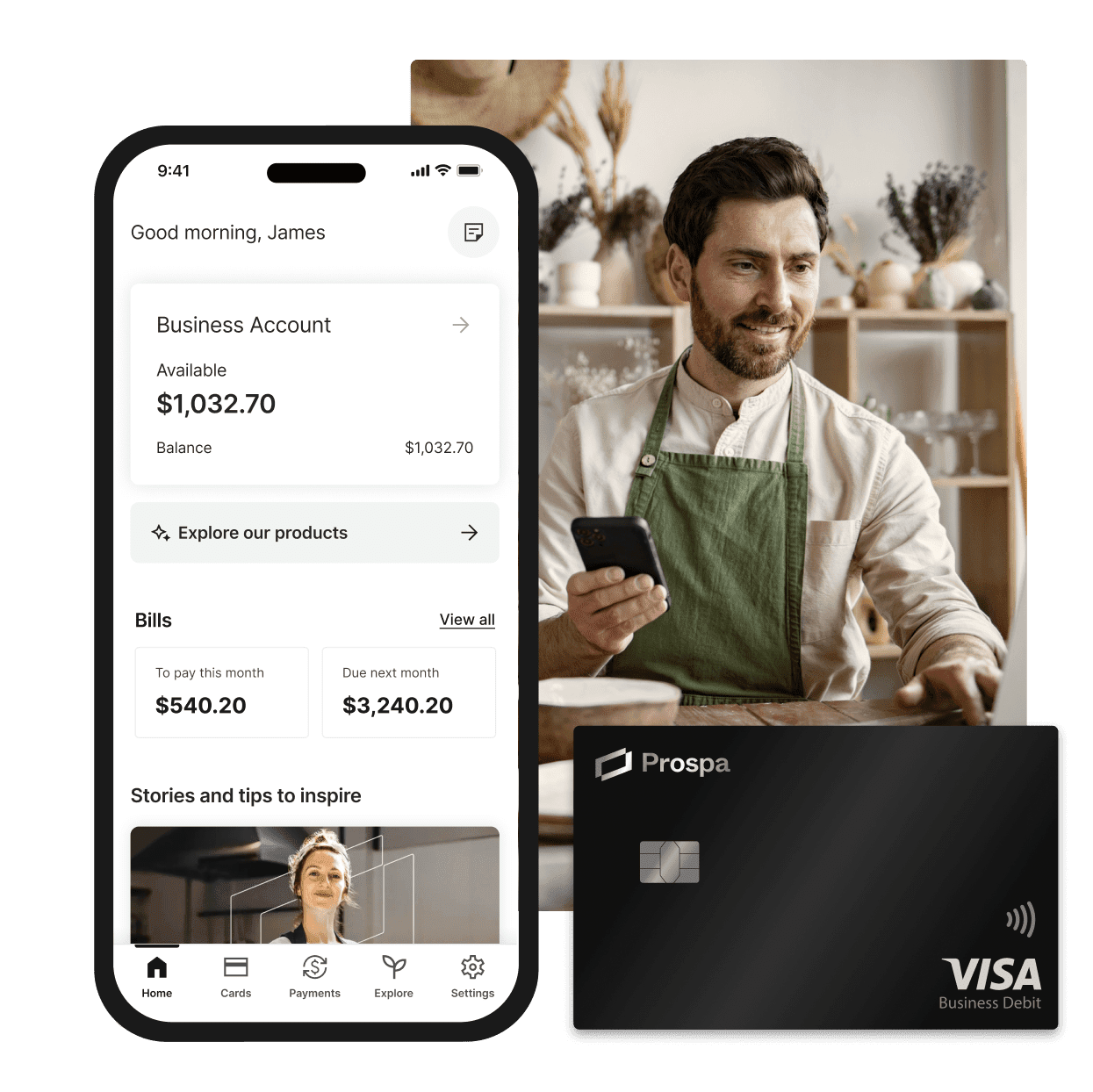

Prospa Business Account For simpler cash flow

Ready to fit into the way you work.

No matter where you’re starting from or where you’re headed, our Prospa Business Account will help to simplify your cash flow.

No hidden costs

Simple tools

Made to move

Made to fit your business

Simplify your spending

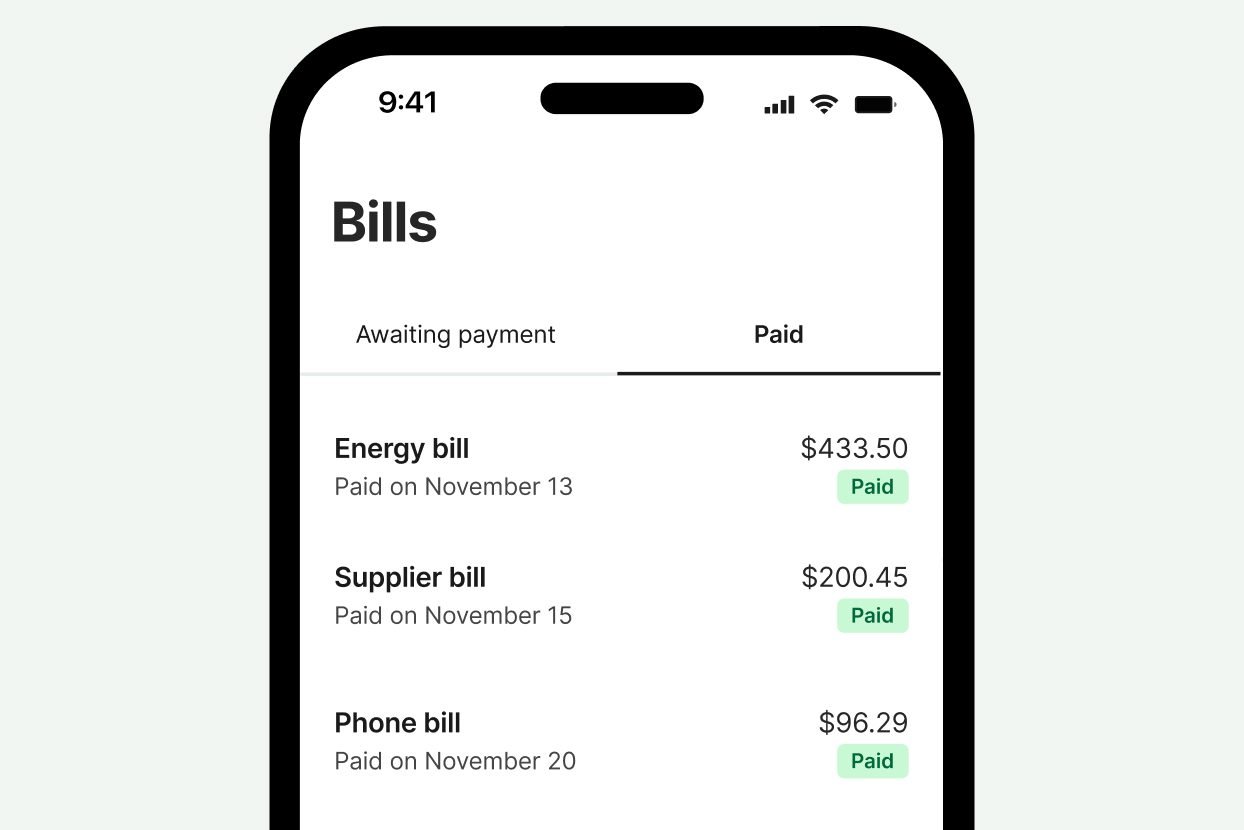

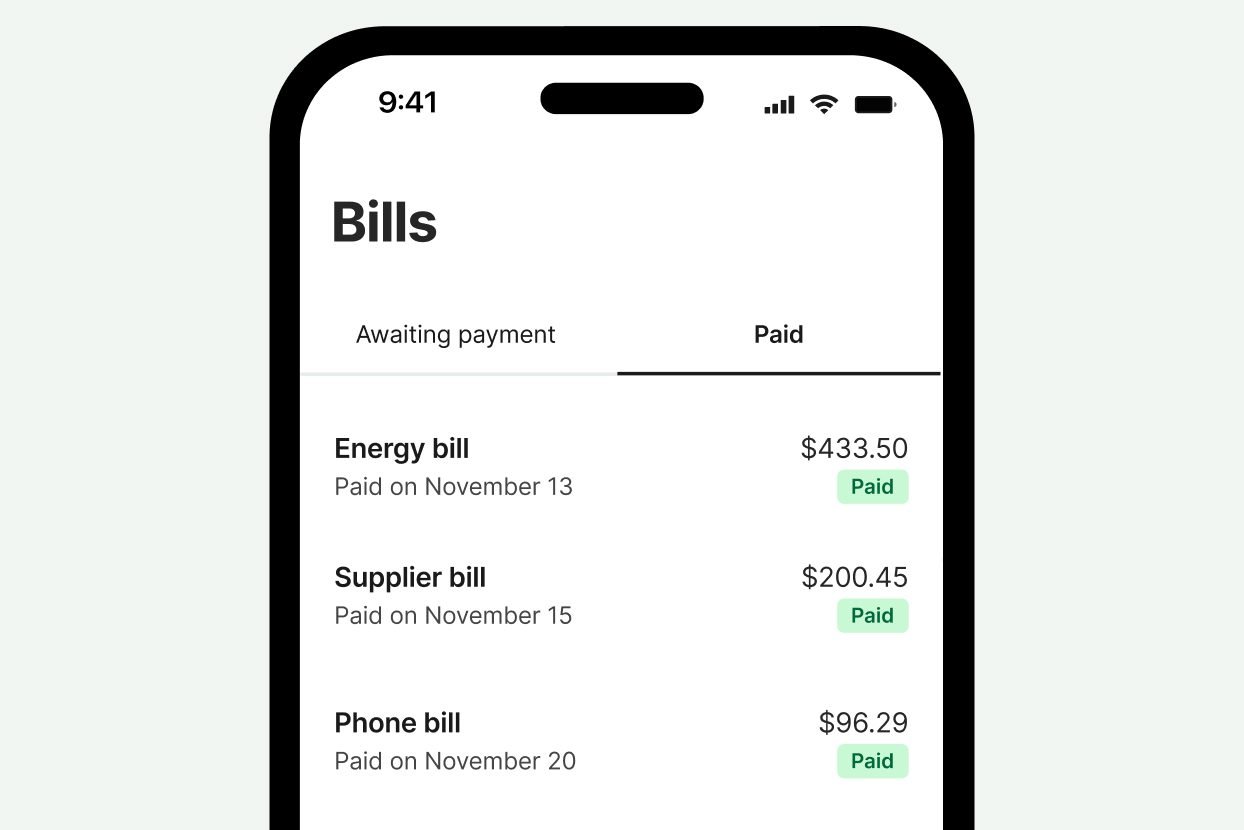

Manage and pay bills easily

Accept payments with Tap to Pay

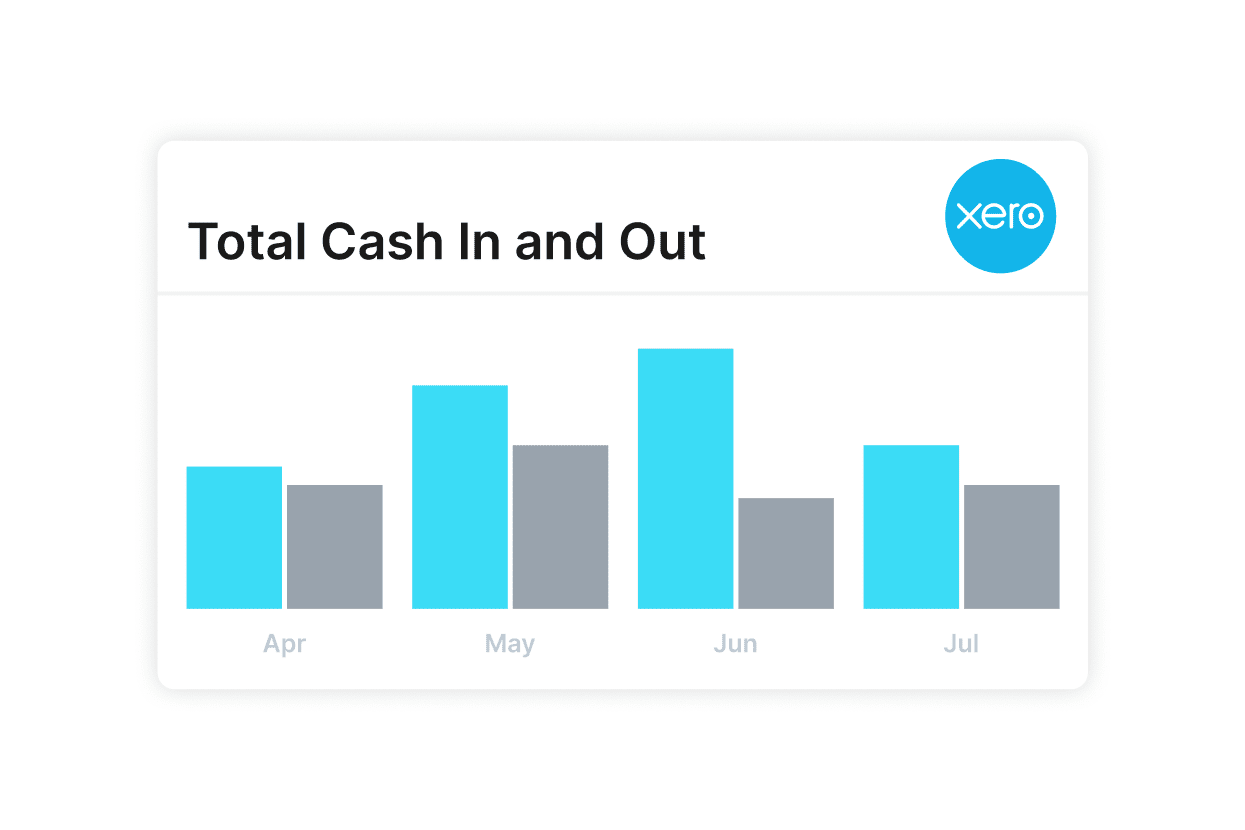

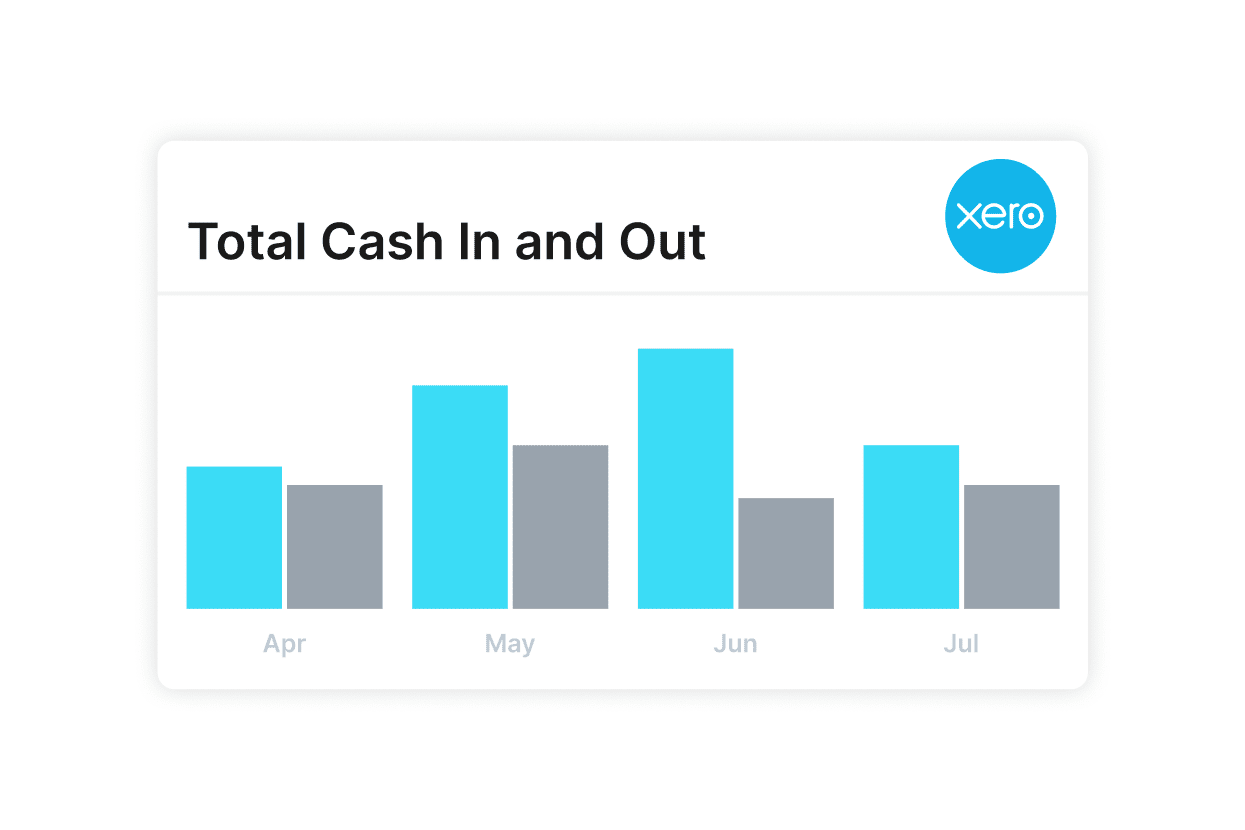

Let Xero do the heavy lifting

Simplify your spending

Accept payments with Tap to Pay

Manage and pay bills easily

Let Xero do the heavy lifting

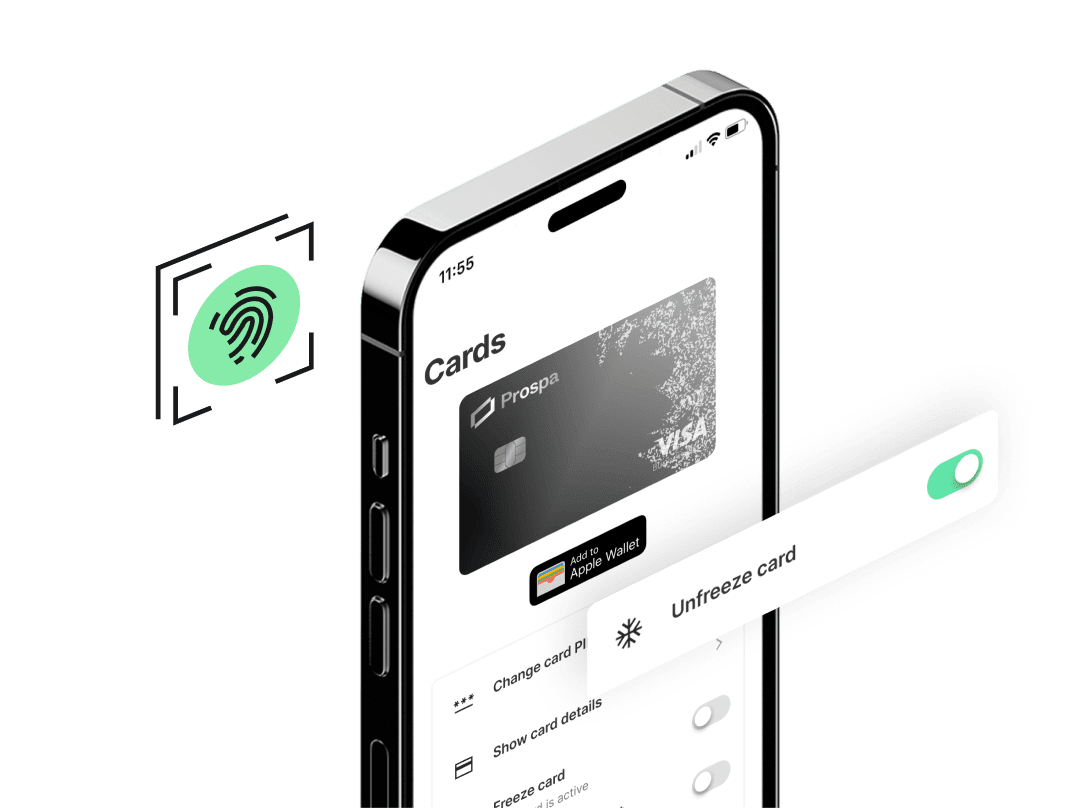

Security controls

Funding at your fingertips

Open an account in minutes

To apply all you need is your ABN and a valid driver’s licence handy.

FAQs

Common questions answered

What are the key features of the Prospa Business Account?

The Prospa Business Account is simple, free and easy to use. Available on both web and mobile, it comes with no monthly fees and a range of handy features (with more coming soon).

• Deposit funds: With your BSB/Account Number.

• Make payments: Real time payments to other bank accounts, BPAY, and card payments.

• Prospa Business Visa Debit Card: Pay for goods in person and online with your Prospa Card.

• Manage your account 24/7 online: Access your account whenever and wherever it suits you.

• One view: Access your business cash flow all in one place

• Reporting: Download statements in PDF and CSV format.

And this is just to start! We’re working hard to deliver a range of additional features to help make running your business easier. Keep an eye out for new releases, and make sure to update your Prospa App when prompted to ensure you’re getting the best experience.

How do I access the Prospa Business Account?

You will first need to apply for and set up a Prospa Business Account. It only takes a few minutes, and you just need a valid ABN and Australian driver’s licence to apply.

Once your Prospa Business Account is created, you can access it via Prospa Online or on the Prospa App, which you can download via Google Play and the Apple App Store.

Your username and password to access your Prospa Business Account is the same for both Prospa Online and the Prospa App – it will be the email address and password you entered when setting up your account.

When you log into the Prospa App, you’ll need your email again and there will be a two-factor authentication for added security.

How do I add funds to my Prospa Business Account?

You can transfer funds to your Prospa Business Account using your account BSB and account number. Under your available balance on the Dashboard select Add funds and you will be able to copy your account details to your clipboard for easy funds transfers from other accounts.

How do I download my statements?

To download your statements via Prospa Online:

1. Log into your account on Prospa Online

2. Head to the Dashboard section

3. Click on Statements

4. Click the download button on the automatically generated statements in the Past statements section, OR

5. Input dates under the Create summary section to generate a custom statement, and select PDF or CSV to download accordingly

To download your statements via the Prospa App:

1. Log into your account on the Prospa App

2. Head to the Dashboard

3. Click on the Statements icon in the top right hand side of the dashboard

4. In Statements, select Business Account from the drop-down list of products next to account name

5. Click on the download button next to the automatically generated monthly statement you’d like to download or create and download a custom statement by clicking Create summary

How do I update my account information?

Updating your account information can be done on Prospa Online.

Go to Settings to change your Personal details. If you need to change your business details, please contact our Support Team on [email protected] or 1300 714 530 (9am to 6pm Mon-Fri AEST).

How much does the Prospa Business Account cost?

The Prospa Business Account is free to set up and use, with no monthly fees or minimum deposits. We will be introducing low-fee foreign exchange bank transfers as an optional service in the near future.

Is the Prospa Business Account available outside of Australia?

No. To apply for a Prospa Business Account, your business must be registered in Australia with a valid ABN, and you must be an Australian Citizen or Permanent Resident.

How do I close my Prospa Business Account?

Please get in touch with our Support Team for assistance with closing your account. You can reach them on [email protected] or 1300 714 530 (9am to 6pm Mon-Fri AEST).

How do I connect my Prospa Business Account to Xero?

You can connect your Business Account to Xero via your Prospa login.

Follow these simple steps to connect:

1. Log into Prospa Online or the Prospa App

2. Head to the settings page

3. Click the ‘Connect to Xero’ button

4. Sign into Xero and select the business to connect

5. Follow the prompts to connect in minutes

You can tell whether you’ve successfully connected to Xero by checking the connection status in the settings page of Prospa Online or the Prospa App.

Once you connect your Business Account to Xero, the transaction data will be sent on every business day. Easy!

How do I disconnect my Prospa Business Account from Xero?

To disconnect your Business Account from Xero:

1. Log into your account on Prospa Online or the Prospa App

2. Head to the settings page

3. Click ‘Manage connections’

4. Untick the account to disconnect and click update

You can tell whether you’ve successfully disconnected Xero by checking the connection status in the settings page of Prospa Online or the Prospa App. Note that it can take up to 24 hours for the connection status to update.

How long will it take for my Prospa Business Account transactions to sync to Xero?

The transaction data will be sent on every business day. Please allow for up to 24 hours for new transactions from your Prospa Account to appear in Xero.

When I connect to Xero, how will my data be protected?

You can have peace of mind knowing your data is safeguarded with our safe and secure login. Plus, we have an encrypted connection.

Can I connect my Prospa Business Account to Xero on both Prospa Online and the Prospa App?

Yes, you can manage your connection to Xero via the Prospa App and Prospa Online.

What should I do if I get an error when connecting?

You can try to connect to Xero again or visit the Help Centre to troubleshoot.

If I don’t use Xero, what are my options?

If you use another accounting platform you can still export transactions by downloading your statements in CSV or PDF format and upload into other accounting software or provide to your accountant.

If I don’t have a Prospa Business Account, and instead have a Prospa lending product, can I connect my account to Xero?

This feature is not yet available for Prospa lending products but keep an eye out for when this becomes available. If you sign up to a Business Account and your loan repayments come out of this account, your transactions will sync to Xero.

What types of payments can I make from my Prospa Business Account?

Currently, you can make electronic deposits directly and make payments using BPAY, plus you can schedule payments in advance. However, there are more payment options coming soon!

How do I make a payment?

1. Navigate to the dashboard

2. Select Pay anyone

3. Select the payment type – we currently support direct bank transfers and BPAY payments.

4. Select a payee to pay from your address book or create a new payee

5. Enter the transaction details such as the payment description and amount

6. Confirm payment

How do I make a scheduled payment?

Log into your account on the Prospa Online or Prospa App.

1. Head to the Dashboard

2. Select Pay anyone

3. Select a payee from your existing contacts or add a new payee by clicking on + New payee

4. After payee selection, you will have the option to make a one-off payment by selecting the Pay Later tab or make a recurring payment by selecting Recurring tab

Pay Later: Enter amount, description and a Scheduled date to make a one-off payment. Confirm payment

Recurring: Enter amount, description, payment Frequency, Start Date, and Duration. Confirm payment

How do I cancel a scheduled payment?

Currently you can cancel a scheduled payment using Prospa Online. Soon this feature will also be available in the Prospa App. You can cancel a scheduled payment by following the steps below.

To cancel a scheduled payment:

1. Go to the Dashboard

2. Navigate to the Scheduled transactions tab

3. Select a scheduled payment that you’d like to cancel

4. Click on the Cancel button to cancel that scheduled payment

How do I save a new payee?

You can save a new payee by following the steps below.

To save a new payee via Prospa Online:

1. Under Pay anyone, in the Select an account or add new payee section, create a new payee by clicking + New payee.

2. After entering the new payee’s details, ensure that the Save to address book check box is selected so that a green tick appears.

3. Once a payment to the new payee has been confirmed, your contact will be saved and you will receive a Prospa email indicating that your contact list has been updated!

To save a new payee via the Prospa App:

Whenever a new payee is created and paid through mobile, the new payee will be saved. Once your payment has been confirmed, you will receive an email indicating that your address book has been updated.

How do I edit a payee’s details from my payees list?

We’re working on it! For now, you can create a new payee with the amended details under Pay anyone and, in Prospa Online, you can delete the outdated contact by hovering over the contact you wish to delete and clicking on the trash can to the right.

How do I see my transaction history and scheduled transaction list?

Via Prospa Online:

To see transaction history and scheduled transactions click on the Transactions or Scheduled tab on the Dashboard. You will be directed to a full list of either your transaction history or scheduled transactions.

Via the Prospa App:

To see transaction history and scheduled transactions click on the Business Account tile on your Dashboard. You will be directed to a full list of your transactions and you can shift between viewing your transaction history or scheduled transactions by clicking on the Transactions or Scheduled tab respectively.

How do I know my payment has been sent?

After confirming and reviewing a payment, you should see the recent transaction on your Dashboard under Transactions or in your transactions list immediately.

How do I activate my Prospa Visa Business Debit Card?

It’s easy to activate your Prospa Card via the Prospa App or Prospa Online.

Here’s how:

Activating your Prospa Card via Prospa Online:

1. Head to the Cards section of Prospa Online

2. Click on Activate card

3. Enter the last 4 digits of your card

4. Create your card PIN

Activating your Prospa Card via the Prospa App:

1. Head to the Cards section of Prospa Online.

2. Enter the last 4 digits of your card

3. Create your card PIN

How do I change the PIN for my Prospa Visa Business Debit Card?

Once your Prospa Card is activated you can change your PIN at any time in the Cards section of Prospa Online or on the Prospa App simply by clicking Change card PIN.

How do I lock/freeze my Prospa Visa Business Debit Card?

When you choose to freeze your Prospa Card, it will temporarily lock your card so no purchases can be made using the card both online and in person.

You can freeze your card on Prospa Online and Prospa App in the Cards section by clicking on the Freeze card toggle. When the toggle is turned from grey to green, your card will be locked and you will not be able to make any purchases.

How do I enable or disable contactless payment for my Prospa Business Account?

You can control contactless payment on your Prospa Visa Business Debit Card via Prospa Online and Prospa App. You can control contactless payment by heading to the Cards dashboard and clicking on the Contactless payment toggle. When the toggle is turned on (from grey to green), you will be able to make contactless payments with your card. When the toggle is turned off (from green to grey), contactless payments will be disabled on your card until you turn it back on.

Will my Prospa Visa Business Debit Card work at an ATM?

You can withdraw cash from an ATM. Prospa does not charge ATM fees, however a fee may be charged by the ATM operator.

What do I do if I’ve lost my Prospa Visa Business Debit Card, or it has been stolen?

Don’t stress! Open Prospa Online or the Prospa App, go to Cards, and then Lost, stolen or damaged and order a replacement card. Your current Prospa Card will be locked immediately and no further purchases can be made on your card. You will need to activate your replacement card once you receive it and update your card details with any merchants or suppliers.

If you have any questions or concerns, please reach out to our Support Team on [email protected] or 1300 714 530(9am to 6pm Mon-Fri AEST). If you are calling from overseas please use +612 91388740.

I am having trouble logging into my Prospa Business Account. How can I log back into my account?

If you’re having trouble accessing your account, please contact our Support Team on [email protected] or 1300 714 530 (9am to 6pm Mon-Fri).

I forgot my Prospa password, how do I reset it?

You can reset your password on Prospa Online. On the Sign in page, click Forgot password and follow the steps required to reset your password. If you have forgotten your email address, please contact our Support Team on [email protected] or 1300 714 530 (9am to 6pm Mon-Fri).

I forgot my Prospa App passcode, how do I reset it?

You can reset your Prospa App passcode by clicking Forgot passcode? at the bottom of the Login page, and you will be prompted to enter your Prospa email and verify your phone number. Then, you can create a new passcode and you will be ready for action!

Do I need to enter my Prospa account password to use the Prospa App?

No. Your Prospa password is not needed in Prospa App. Once you verify your phone number and a Prospa registered email address you will be prompted to create a login passcode. This passcode will act as your password throughout the Prospa App – including login.

How do I change my Prospa App passcode?

You can change your Prospa App passcode by navigating to Settings and clicking Change passcode.

Is my Prospa App passcode the same as my Prospa Visa Business Debit Card PIN?

No. They are different and they do not need to match! Your passcode is used to login to the Prospa App, while your card PIN enables purchases and cash withdrawals with your Prospa Card.

How do I manage login biometrics on the Prospa App?

1. Go to Settings

2. Under the Security section you can toggle on and off the biometrics functionality that your device supports

Why do I need a business account?

If you’re operating a business in Australia, it is recommended to have a dedicated business account for all your business-related financial transactions. (If you have a company, it is a requirement.) Prospa’s online business account helps SMEs keep track of their business finances and monitor cash reserves at any time. With some financial institutions, small business accounts can include high monthly fees, which can be a hurdle for new or established small businesses, especially those with low transactions. At Prospa, our Business Account comes with no monthly fee to suit the needs small businesses.

What is a business account?

A business account can provide support and solutions to help with cash flow. Any small business that accepts or spends money should have a dedicated business account. One way to determine if you have the best business account for your business is if it offers you an easy way to keep track of your income and expenses in an easy-to-understand format. If you use an account for your business that includes other transactions (such as a personal account), it can be hard to separate your business from your personal expenses.

Your business account should allow you to grow alongside it, offer good value, and provide trust. Prospa’s no monthly fee business account is an excellent fit for most small businesses. It includes a Prospa Visa Business Debit Card you can use to access your funds (similar to a business credit card) is accepted anywhere that takes Visa. More payment options coming soon.

What are the benefits of a business account?

Any small business that accepts or spends money should have a dedicated business account. At Prospa, we have our basic business account that has no monthly fees or a minimum balance. In our years of experience specialising in small business loans, we understand that most small business owners look for convenience in their business-related financial transactions. As our business accounts are available 24/7, you can do your transactions at any time that suits you.

When you open an account with Prospa, you’ll be provided a Prospa Visa Business Debit Card (similar to a business credit card) that is accepted anywhere that takes Visa, with more payment options coming soon. This Prospa Card is a debit card that uses your existing available funds, and there are no foreign exchange fees applied when you shop online with a different currency or in an overseas location.

If you’re looking for a corporate account that aligns with your business objectives by allowing you to minimise your fees and charges, you can open a business account online with Prospa. Eligible Australian businesses can open an account within a few minutes. We can also support approved businesses with access to funding through a small business loan or line of credit.

How to create a business account?

One of the many benefits of working with Prospa for your business needs is that our accounts can be set up quickly. When you need to open a business account, the application should be completed by the directors or the owner, and you’ll need a valid ABN. You will need to supply identification documents when applying such as your driver’s licence. If you need some assistance opening your account, our team of specialists is only a phone call away, and they can help you with your application.

Setting up a business account means you’ll need to fill out our online form, which takes just a few minutes. We’ll let you know if any particular documents are required, and you can submit these digitally. Most applications can be completed 100% online.

It is highly recommended you spend some time after your account is opened to get used to how Prospa Online or the Prospa App work. You can call our team if you need some guidance or explore all the functions and capabilities yourself. If you have regular income, you can update any direct debits and update your payment details to your Prospa Business Account details on your outgoing invoices. You can also set up regular repayments for monthly expenses to help ensure you never miss any.

Open a Prospa Business Account and take your business to a whole new level.

Other questions?

All information provided on this page is provided by Prospa Innovations Pty Ltd (ABN 98 609 580 734) – a wholly owned subsidiary of Prospa Advance Pty Ltd (ABN 47 154 775 667) and a corporate authorised representative (AFS representative number 1313363) of Hay Limited (ABN 34 629 037 403 & AFSL 515459) that is the issuer of Prospa Business Account. Hay is not a bank or authorised deposit taking institution. All customer funds held in a Prospa Account are held with an authorised deposit-taking institution (ADI). All information is factual in nature and should not be considered as financial product advice. Please make sure to read the Financial Services Guide, Target Market Determination, Product Disclosure Statement and the Card and Account terms and conditions prior to deciding whether these products are appropriate for you. Eligibility criteria, fees, terms and conditions apply.