Business Account

At Prospa, we’ve made opening a business account online as easy as possible. All the information about what we can provide for your business is laid out, and we’re dedicated to providing you with the best service and features in a business account. We have many years working with small businesses and providing loans to help them grow. We have developed our business account to offer the most common benefits sought after by new businesses and mature small businesses.

The owners or directors can apply and open up a business account with Prospa, and as it is being used primarily for business purposes, a valid, registered ABN will be required to get started. After entering these details, we’ll need some personal information such as your driver’s licence details. We’ll open your account and send you the details when these are supplied. From then, you can log in to your accounts, make your first deposits, and set up any regular transfers or payments.

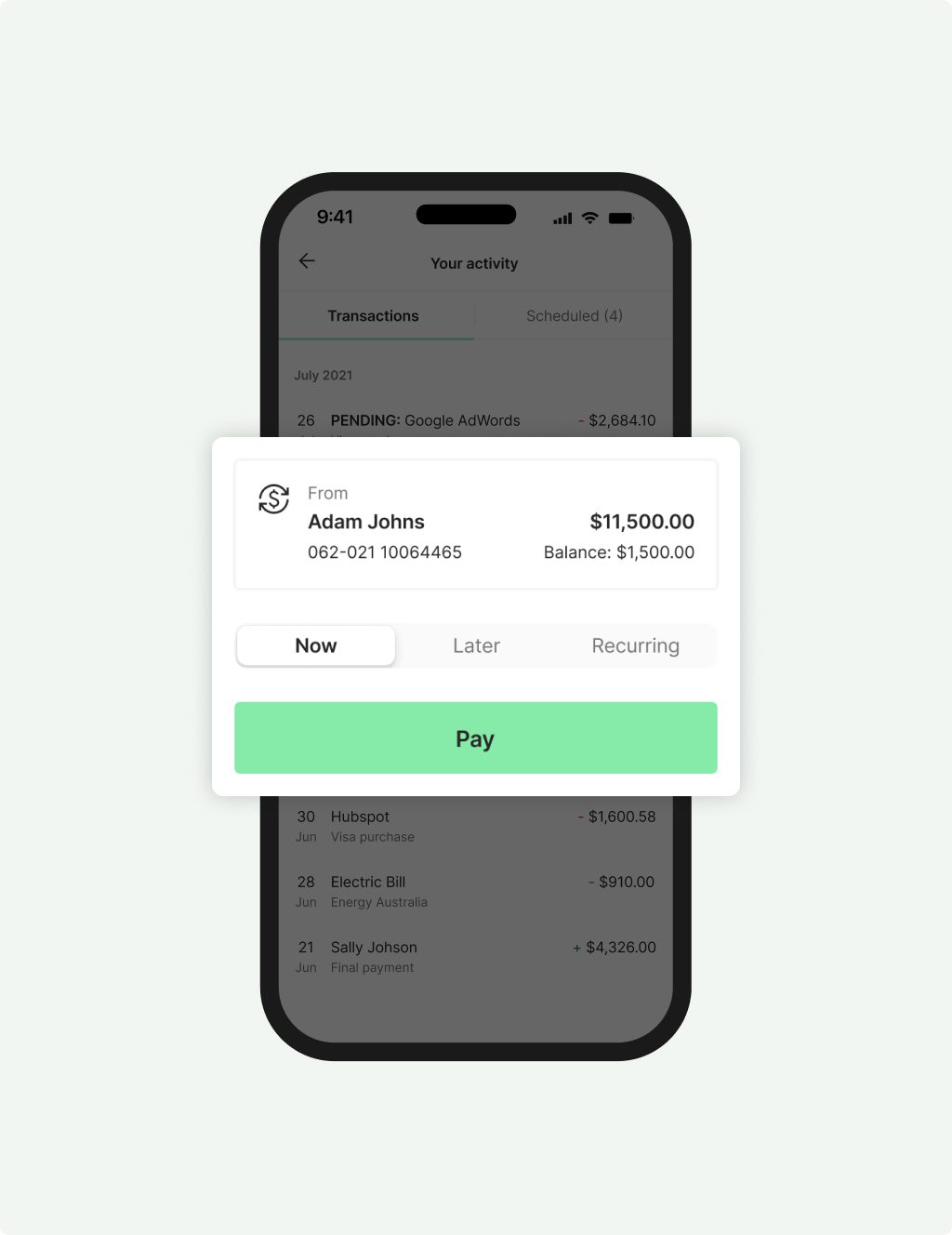

Make payments instantly

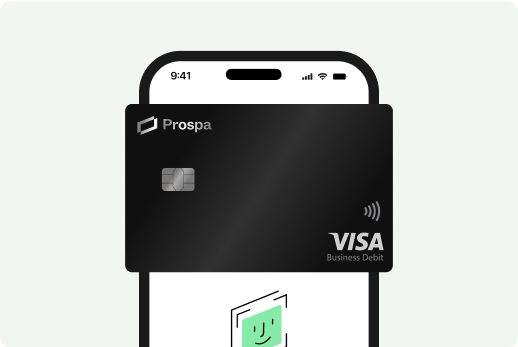

Send and receive funds, make payments with BPAY or schedule future payments and pay using your Prospa Visa Business Debit Card.

Flexible spending

Use your Prospa Visa Business Debit Card to pay wherever Visa is accepted, including overseas. Plus, withdraw cash from the ATM.

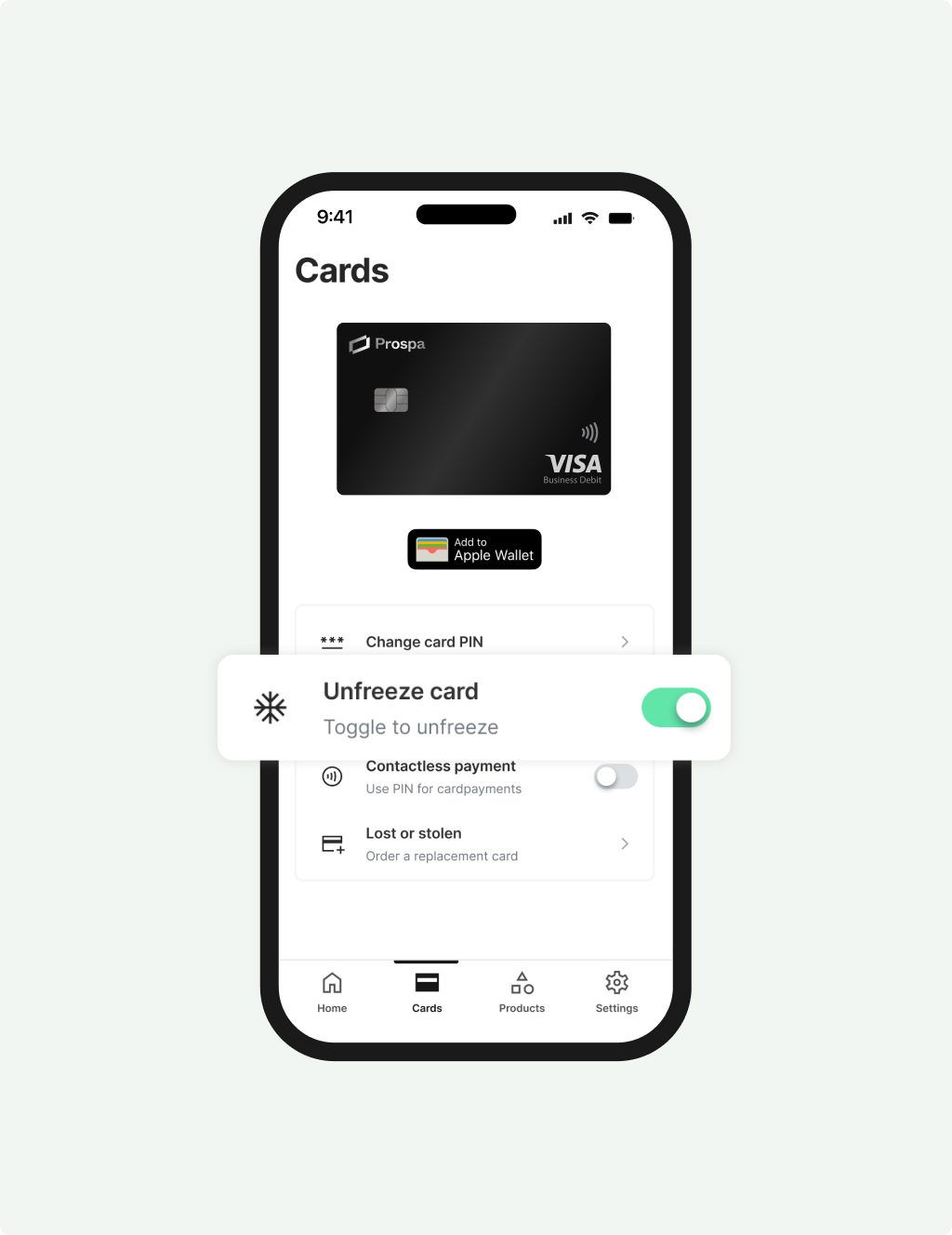

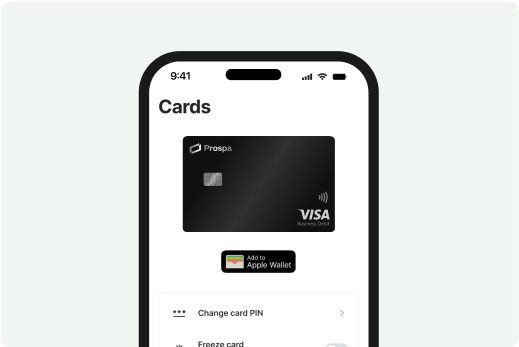

Apple Pay & Google Pay

Link your Prospa Visa Business Debit Card to Apple Pay or Google Pay to start making payments even before your card arrives in the mail.

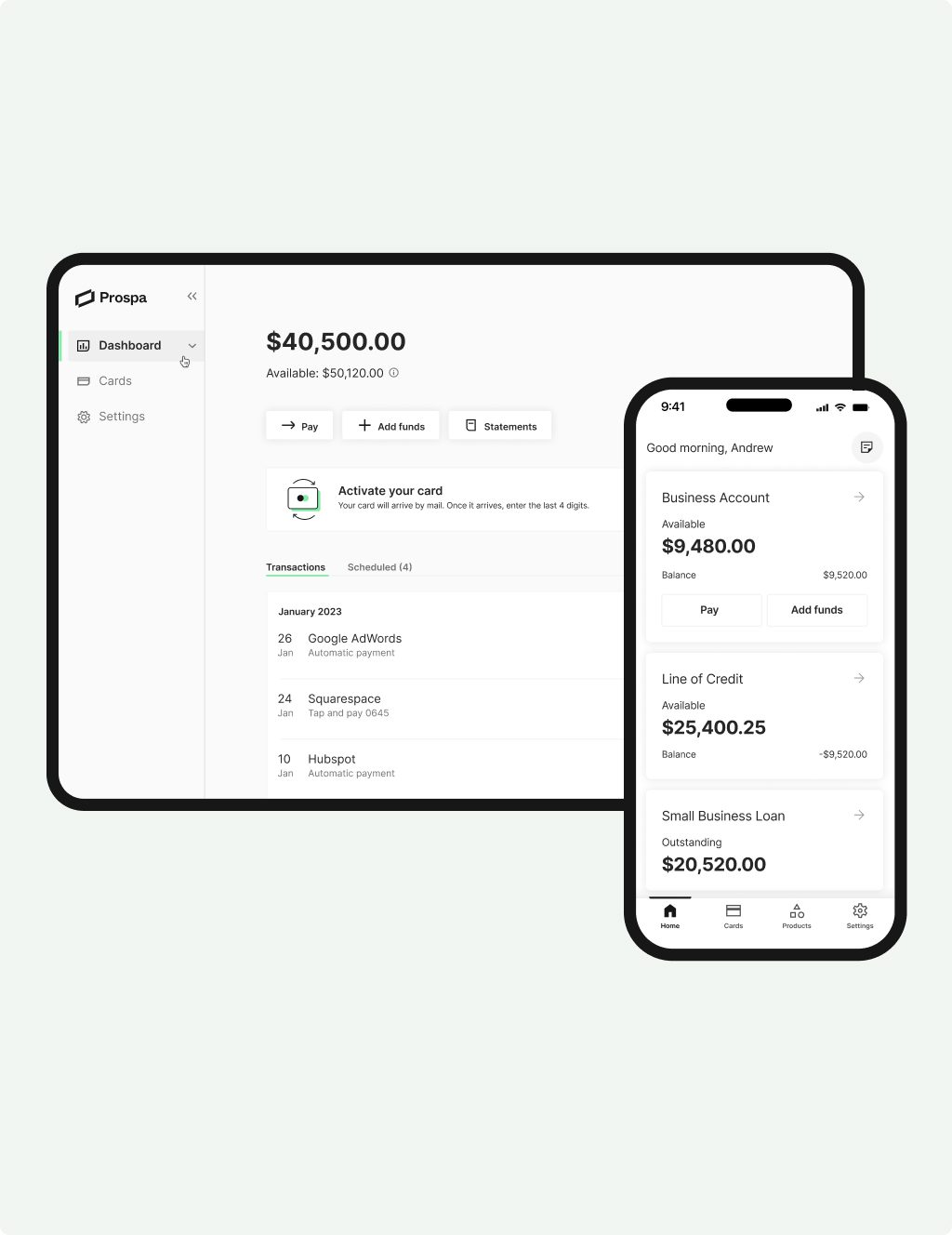

Made to move

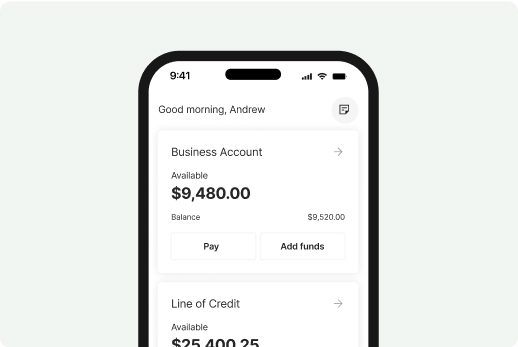

Whether you’re using the Prospa App or Prospa Online, you’ll have the same great account experience, 24/7.

What are the different types of business accounts?

When you’re looking to open a business account online, you’ll find a variety of different accounts to choose from. It can be challenging to find the one that best suits your business, but if you narrow down your choices to four or five, you can examine these in more detail. Try to find the best business account that offers your business the most benefits.

If you’re after an online business account to get started because you’re operating a new venture, you may prefer a business account that has no monthly fees and no minimum balance. At Prospa, our online business account has been tailored to suit many small businesses and newly established ones. We have removed many of the costly obstacles you’ll find with some traditional business accounts. When you open a business account online with Prospa, you’ll receive 24/7 access to your account and have our customer service team on call whenever you need them.

When looking at all the available options, you may see many different types of accounts available. Some business accounts will have high annual or monthly fees, but these accounts are usually limited to businesses that complete many transactions in a month. These accounts are commonly known as corporate accounts, and you’ll usually need a minimum balance to open them. For a basic business account, you usually won’t make use of a lot of the services offered by these types of accounts, for example, if you don’t regularly deposit cash or need branch assistance for your deposits and withdrawals.

At Prospa, our small business account can provide you with all the necessary features to help you keep track of your finances so you can focus on growth. You lower your risk when you transact online because all transactions are handled in a secure, electronic environment. Our customer service team can take you through all the functions and benefits of your new account if you need help.

What should you look for in a business account?

Whenever you’re planning to open a business account online, you should find a business product that provides you with what you need and has room for your company to grow. With the Prospa online business account, you’ll receive the Prospa card; and this can be used at any location where Visa is accepted, with Apple Pay, and Google Pay coming soon. The Prospa card also offers no foreign exchange fees. Suppose you regularly make purchases in a country outside of Australia or buy products online in a different currency, our card can save you substantial amounts on foreign exchange fees.

What are the advantages of a business account?

When you open a business account online, one of the main benefits is that you’re keeping your personal and business accounts separate. If you’re new to operating a business, you may think that it doesn’t matter if you use the same account, but it is easier to see where your finances are at a glance by having a separate business account.

Having a business account will also make completing your tax accounts simpler. If you use one account for your business and personal life, it can be challenging to remember what purchase was for what at tax time. You’ll also find that any fees or interest charges applied to your business account could be tax-deductible (speak to your accountant about this). With an online small business account, you can download all your financial transactions at the end of the year and provide these directly to your tax agent, which will save you (and them) time.

If you’d like to apply for small business loans, then having a business account is often a requirement, and it can help you understand your current financial position. Your business account and any loans can be linked, and this way, you’ll never miss any repayments. With separate accounts, you’ll find that your finances are easier to manage, and that includes any credit cards or other income.

For additional advice on how to open a business account online, you can speak to our customer service team and discuss your needs.

Talk to Australia’s #1 online lender to small business

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

Information about the Prospa Business Account is provided by Hay Limited (ABN 34 629 037 403 & AFSL 515459), the issuer of the Prospa Business Account and Prospa Visa Business Debit Card. Prospa Innovations Pty Ltd (ABN 98 609 580 734), a wholly owned subsidiary of Prospa Advance Pty Ltd (ABN 47 154 775 667), is a corporate authorised representative (AFS representative number 1313363) of Hay Limited. All information is factual and should not be considered as financial product advice. Please make sure to read the Financial Services Guide, Target Market Determination, Product Disclosure Statement and the Card and Account terms before making decisions about the product. Eligibility criteria, fees, terms and conditions apply.