Business Finance

Thinking about getting finance for your business? Whether you’re buying equipment or looking to support your cash flow, Prospa offers fast business finance solutions to match your needs.

- Borrow from $5K to $500K

- 3 months - 5 year loan terms

- Funding possible in 24 hours

- No upfront security required to access

Prospa funding up to $150K

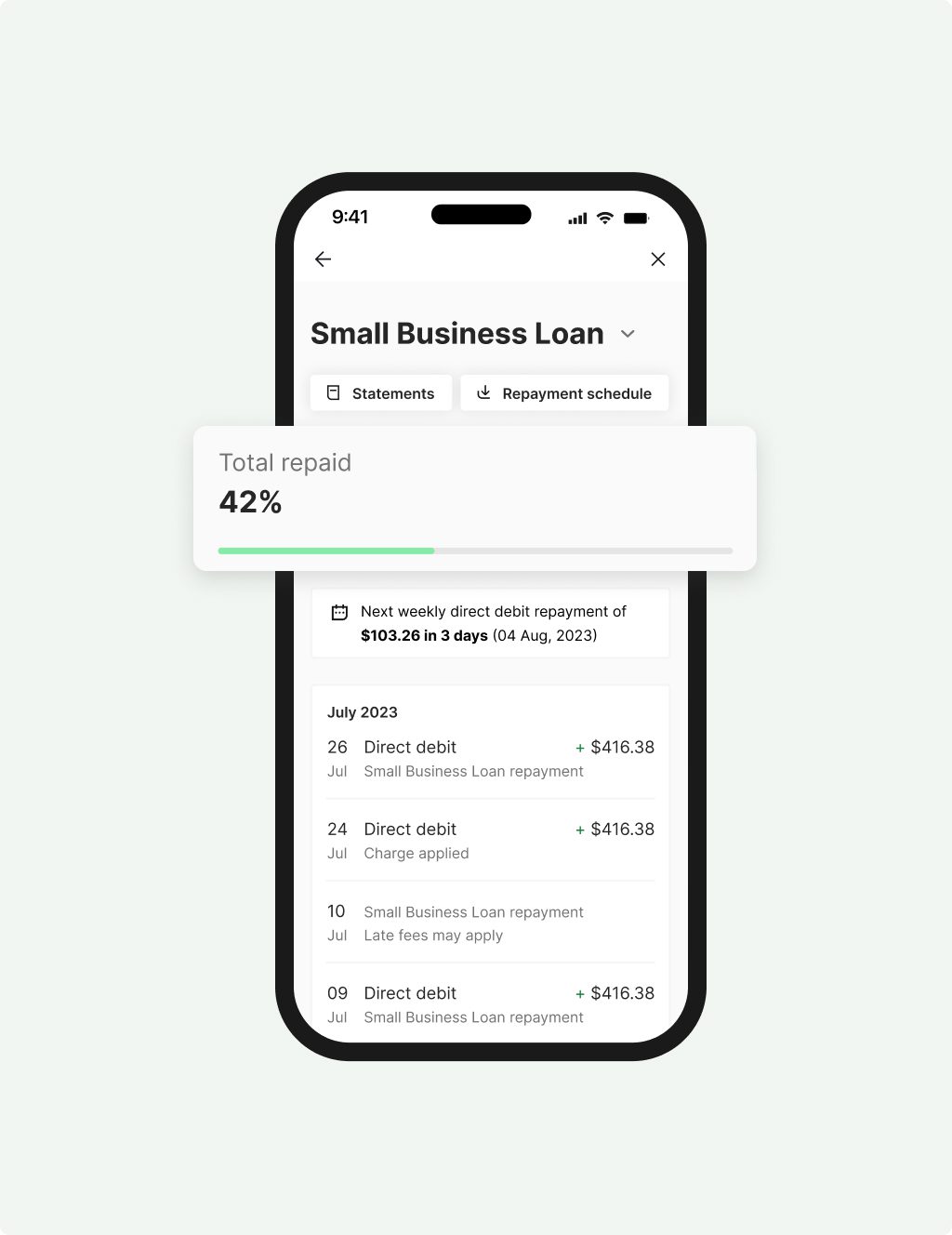

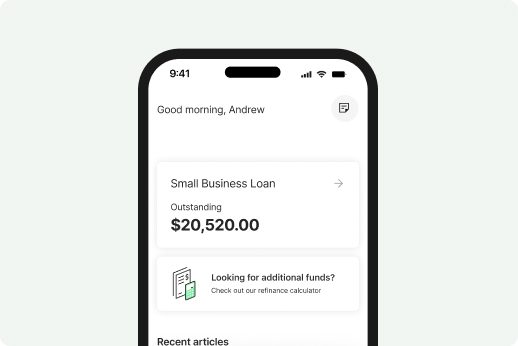

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

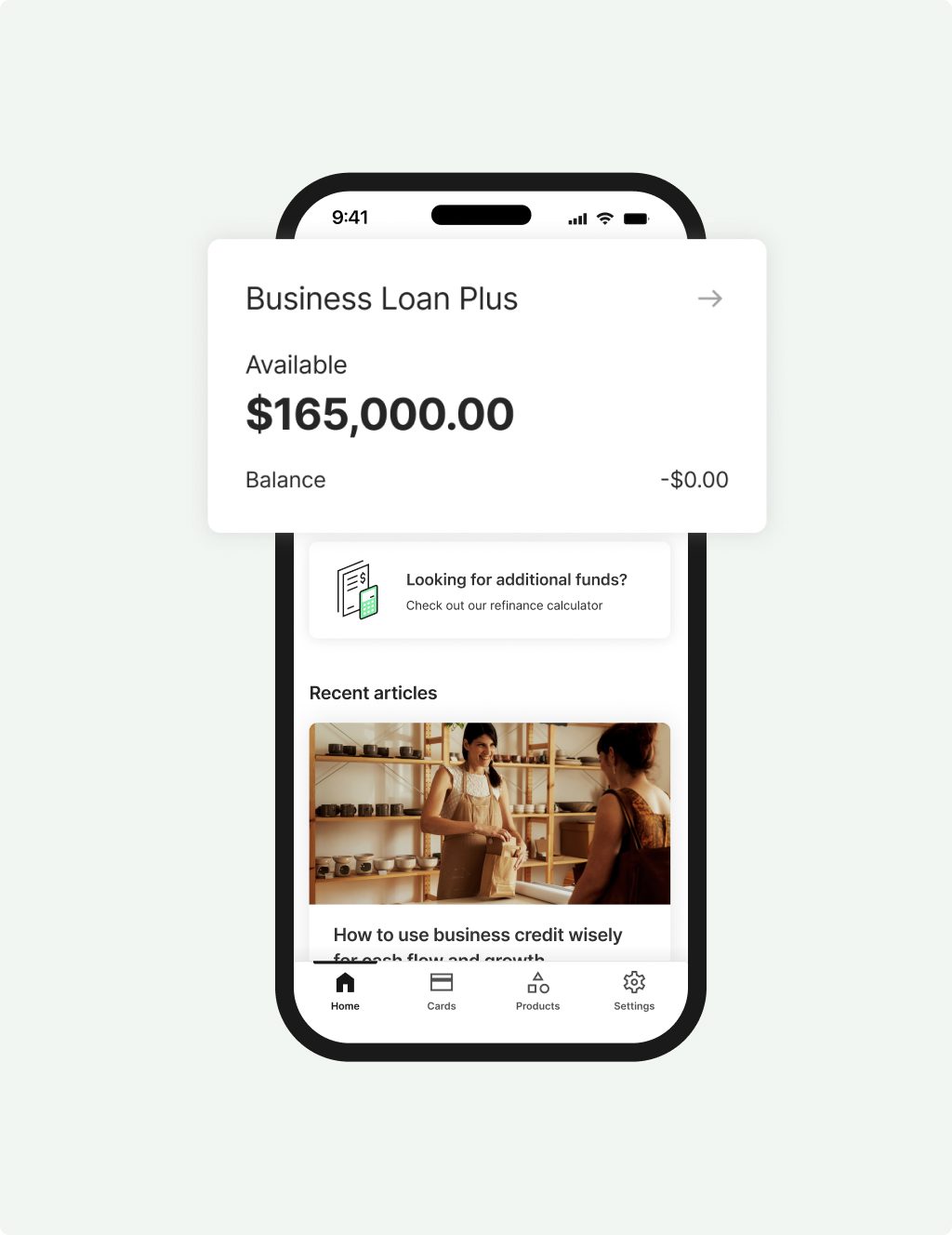

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

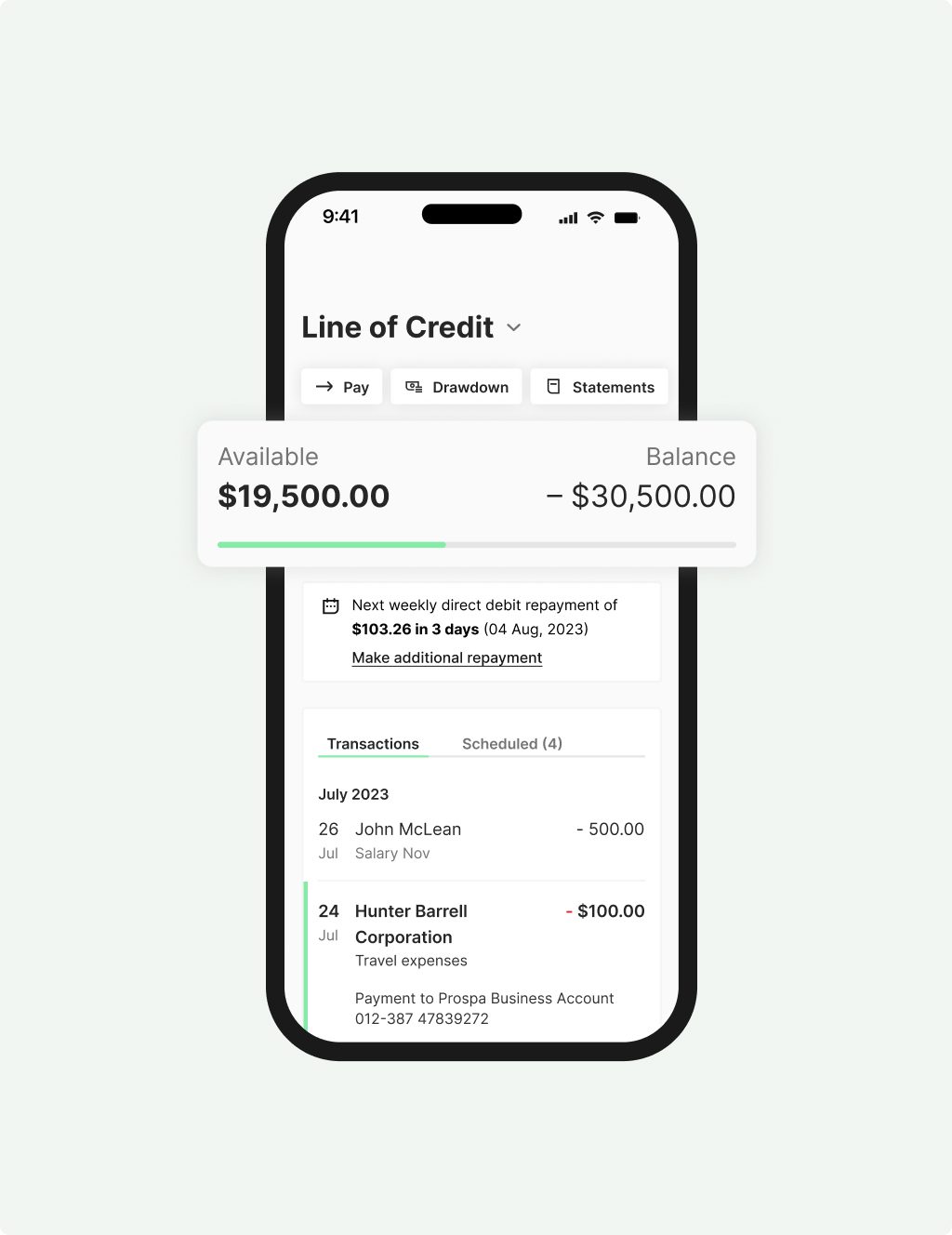

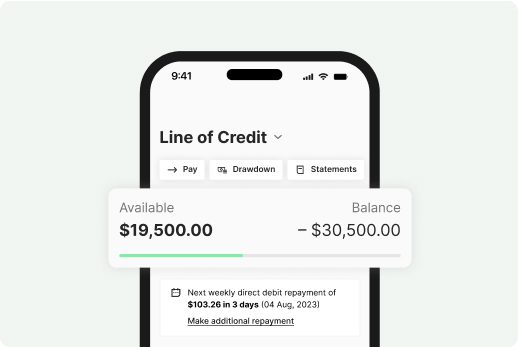

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Need finance for your business? Talk to Prospa

How do I obtain finance for a small business? It’s a question many business owners ask themselves when they are starting out or when they want to take their business further along the growth and expansion pathway. Unfortunately, it isn’t always easy – especially if the business doesn’t have any equity or doesn’t have several years of trading history.

With Prospa, we offer business finance options that are especially designed with small businesses in mind – to help them grow and to get them through tough spots. As Australia’s #1 online lender to small business we have helped more than 29,400 clients with over $1.65 billion in short term business finance.

Why Prospa?

It’s today’s way to borrow. No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $1M with 10 minute application, fast decision and funding possible in 24 hours.

Support

Talk to real people. Business Lending Specialists who are focused on getting you what you need, sooner.

Confidence

Thousands of small businesses have borrowed from Prospa so far.

You could benefit too.

What could you do with business finance?

Being able to raise finance may be a key part of a business’s plan for strategic growth. A business may need a lump sum to invest in an expansion, or easy and continuous access to funds to support working capital.

Prospa has a small business finance solution for both these scenarios – so talk to us today. What could your business do with some additional finance?

Business finance can help with

- Renovations

- New equipment

- Advertising and marketing

- Buying stock in bulk

- Paying wages

- Covering invoice gaps

- Upgrading IT equipment

- Much more

Customers making it happen with a Prospa loan

Read Customer StoriesFAQs

Business Finance FAQs

We are Australia’s #1 online lender to small business and we can help. Our dedicated customer support team will understand your business and find a finance solution to suit your needs. We work with Australian small business owners from NSW to QLD, Victoria to WA and everywhere in between.

Unlike traditional lenders, we don’t require the usual pages of reports, financial statements and business plans when you apply. Instead, we offer a quick online application with a fast decision and funding possible in 24 hours. Minimum trading history applies, your ABN and a drivers licence to get started.

If you’re concerned about being baffled by banking jargon, we’ve simplified our loan application process so there’s no more complex terminology around cash flow, low interest loans, fixed rate loans versus variable rates, the loan term, terms and conditions and whether you are in a position to refinance in the future. It’s simple and easy to understand.

With Prospa, you’ll have a clear understanding of what’s expected, how much your weekly repayments will be and when they’ll be due.

Call 1300 882 867 to get started on your business loan application today.

To apply for a Small Business Loan:

For amounts up to $250K we require:

- 6 months bank statements

- ATO Tax Portal access (For amounts >$100K)

For amounts above $250K we require:

- 12 months bank statements

- ATO Tax Portal access

- Financial statements

Use our loan calculator to see how much you can afford to borrow.

Some commercial loans require a deposit. And while you don’t need a deposit to apply for funding with us, however it is a good idea to have a clear understanding of all of your finances before you apply.

It’s OK if you don’t have pages and pages of financial analysis to reference. We understand that small business operators are up against it and often struggle to keep up with the paperwork.

Other questions?

Awards, thanks to your support

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |