Prospa Group Limited (”Prospa” or “the Company”), Australia’s number one online lender to small business, makes the following update to its 2019 calendar year Prospectus forecast (CY19).

The company expects CY19 originations to be above Prospectus forecast at $574.5 million, up 32% on pcp and up 2.7% ahead of Prospectus forecast. Revenue is expected to be $12.6 million lower at $143.8 million, up 16% on pcp and down 8% on Prospectus forecast. This variance is largely due to the premiumisation strategy exceeding our forecast. While we continue to grow our lending to all credit grades, we are seeing increased appetite for our solutions from premium credit quality customers who pay lower interest rates over longer terms.

At the contribution margin level, the revenue shortfall is expected to be largely offset by reductions in loan impairment expense and funding costs, such that the CY19 net interest margin after losses is forecast to reduce by $2.3 million on Prospectus levels[1]. We expect to see further reductions in net impairments as our premium loan book seasons. Historically, we have observed a lag of 12-18 months between the origination of a loan and loss outcomes.

The earnings before interest, tax, depreciation and amortisation (EBITDA) variance relates to a combination of: a) acceleration of growth investment; b) a number of one-off expenditures; and c) some cost over-run which we currently addressing. This is outlined in this table and explained in more detail in this pack. Management expects the resulting EBITDA to be $4 million for CY19.

Greg Moshal, co-founder and joint CEO of Prospa, said: “Our business continues to grow and evolve. While we are experiencing some short term impacts on our forecasts, we’re confident we have the right growth strategies to deliver long term shareholder value and solve the funding challenges of small business owners across Australia and New Zealand. Originations are growing. Portfolio premiumisation means a higher quality loan book and lower rates and longer average terms for our customers. Early loss indicators continue to improve and we expect to continue to invest in new products, sales and marketing.”

Originations Growth

The introduction of Prospa’s new rate card for its flagship small business loan product, continued growth in the New Zealand market and the contribution from new products have delivered strong growth in originations across the business.

At 31 October 2019, Prospa’s originations for the first four months of the financial year were $181.2 million, up 40% on the prior corresponding period in 2018 and a strong base from which to finish the year. Since founding the business in 2012, Prospa has originated $1.35 billion in small business loans.

In the four months to 31 October 2019, Prospa has grown customer numbers to 24,000.

The company expects total originations for FY20 to be in the range of $626 million to $640 million, an increase in the range of 25% to 28% on FY19, and revenue to be at least $150 million.

Impact of Premiumisation

Prospa’s strategy to optimise its cost of funding has facililated lower rates for customers and broadened Prospa’s customer base and appeal – allowing the company to tap more of the $20 billion addressable market.

The introduction of a new rate card in early April was more successful than anticipated, with approximately 43% of Prospa’s portfolio now represented by premium customers[3]. The evolution in book composition towards premium grades has led to a short term impact on revenue, despite the positive impact premiumisation has had on market penetration, operating leverage, funding diversity and portfolio resilience.

Lending rates to premium customers are lower than the average book rate and loan duration is longer. In the four months to 31 October 2019, the average simple interest rate on Prospa’s book has adjusted to 18.5% (Prospectus forecast at 18.9%) and average loan term has increased to 14.6 months (Prospectus at 14 months).

Early indications are that the static loss rates in the growing premium section of our loan book are well below 4%, which is the bottom of the risk appetite range.

Early Loss Indicators in the Australian Small Business Loan

Prospa’s early loss indicators continue to exhibit improving trends. This is due to the impact of premiumisation and also the Credit Decision Engine’s ability to better predict customer credit quality across the company’s entire portfolio.

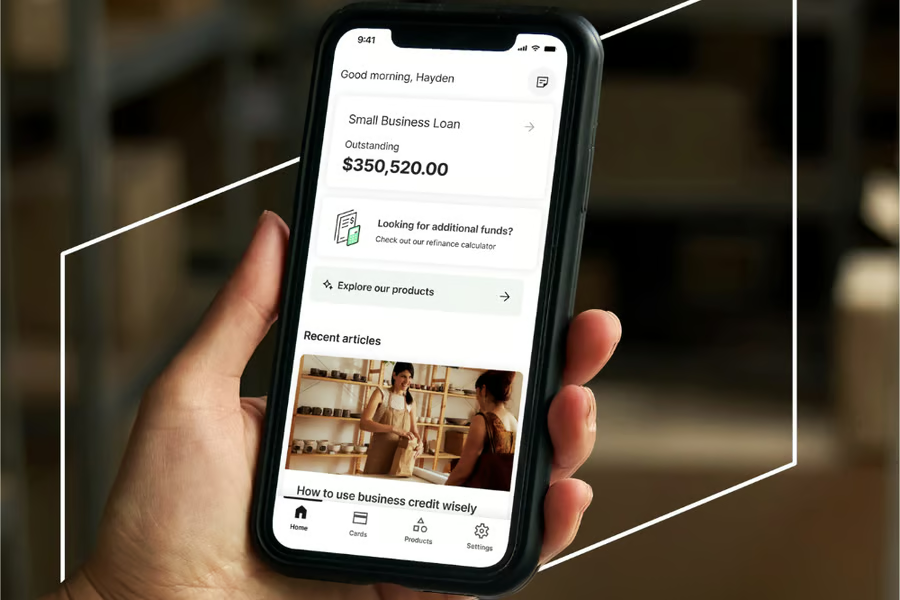

Line of Credit

Prospa’s Line of Credit product has undergone extensive product development. This 12-month development program involved a relatively small number of customers and was designed to ensure the product delivered the features and performance to meet the needs of our customers.

Management undertook a full launch of the product in October 2019 and has been delighted with the customer response to date, with originations of over $10 million in October. Since launch, Line of Credit has delivered an extremely strong performance and originations growth is expected to continue. Management expects seasonality for this product may be similar to the Small Business Loan.

Beau Bertoli, co-founder and joint CEO of Prospa, said: “We’re incredibly pleased with the take up of our Line of Credit Product and believe it will continue to grow strongly. It is a complementary product to our Small Business Loan, improving our touch points with small business customers. The market for small business funding in Australia is $20 billion and Prospa is well positioned to fund these businesses with fit-for-purpose funding solutions.”

Operating expenses

Prospa’s operating expenses for CY19F are expected to be $130 million compared to Prospectus at $136.4 million ($6.4 million or 4.7% lower than Prospectus). The benefits of premiumisation flowing through in funding costs and loan impairment have been partially offset by higher expenses in sales & marketing and general & administration. Predicted expenses for CY19 versus Prospectus are outlined below.

- Funding costs lower: $18.8 million vs Prospectus at $21.2 million ($2.4 million or 11.4% lower than Prospectus). We expect to continue to see the benefits of lower base rates and additional tier 1 bank senior funding positively impacting profitability.

- Sales & marketing higher: $30 million vs $29.3 million ($0.7 million or 2.5% higher than Prospectus) as a result of deliberate investment in growth in Australia and New Zealand during H1 CY19.

- Product development slightly higher: $11 million vs $10.9 million ($0.1 million or 0.6% higher than Prospectus). We expect to continue to increase our investment to support future growth in our loan product, the Line of Credit and ProspaPay.

- General & Administration higher: $39.1 million vs $35.6 million ($3.5 million or 9.8% higher than Prospectus). Key drivers were:

- share based payments higher than expected ($1.3 million);

- cost of establishing new funding structures ($0.4 million);

- higher legal and consulting costs associated with accelerating our product and funding growth plans ($0.6 million);

- increased investment in technology licences and services to support growth ($0.8 million); and

- other expenses ($0.4 million).

- Loan impairment lower: $31 million vs $39.3 million ($8.3 million or 21.1% lower than Prospectus). Key drivers for this forecast result include:

- provision rate improvement forecast, consistent with our early loss indicators and the lower loss rates we are seeing on the growing premium segment of our portfolio (6.1% to 5.7%, $2.0 million impact);

- overall loan impairment improvement in line with our premiumisation strategy ($2.6 million); and

- proceeds from our first debt sale, which had the effect of accelerating our loss recovery on written off loans ($3.7 million).

ENDS

For further information contact:

Company Secretary

Nicole Johnschwager

General Counsel and Company Secretary

e: [email protected]

Investor Relations

Anna Fitzgerald

Group Head of Corporate Relations

e: [email protected]

Media

Lauren Thompson

Domestique Consulting

e: lauren@ domestiqueconsulting.com.au

+61 438 954 729

Roger Newby

e: [email protected]

+61 401 278 906

About Prospa

- Prospa provides cash flow products and services that allow small businesses to prosper.

- Prospa has originated over $1.35 billion in loans to date across Australia and New Zealand

- Prospa has over 24,000 small business customers

- Prospa was awarded AON Hewitt Employer of Choice in 2017 and 2018

- Prospa’s Net Promoter Score is in excess of +77

- In 2018 and 2019 Prospa won Australian Fintech Lender of the Year, and achieved a clean sweep of the MFAA Excellence awards in all five States

[1] Refer page 8 of accompanying pack for net interest margin after losses bridge.

[2] Annualised to be consistent with Prospectus forecasts

[3] As At 31 October 2019