- Prospa in full compliance with Code that sets industry-best practice

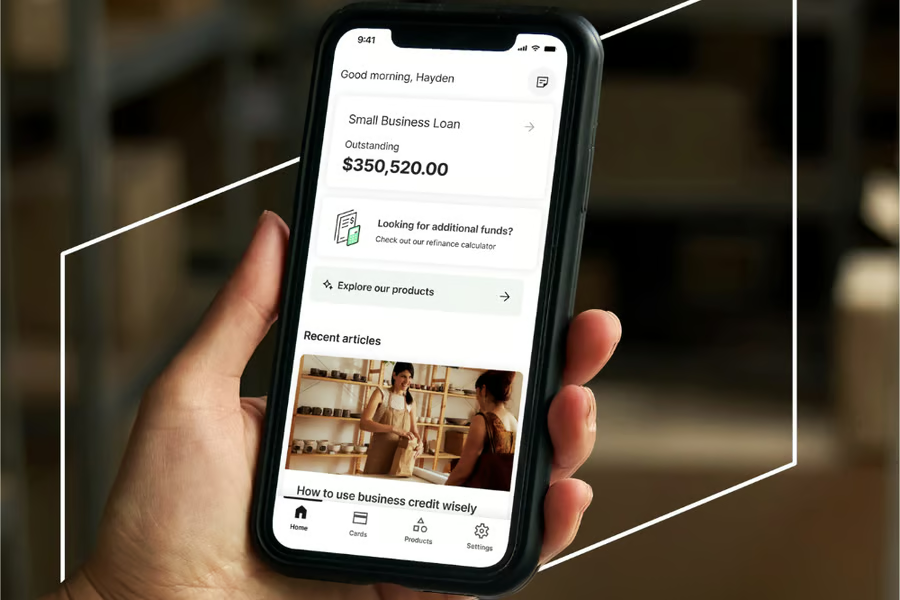

- Prospa introduces SMART Box to its online small business loan product

- SMART Box allows customers to easily compare online lenders’ small business loan product pricing

Prospa, Australia’s number one online lender to small business, is pleased to announce that from 1 January it will be operating in compliance with the Code of Lending Practice.

Prospa has been instrumental in developing the new Code and is reaffirming its commitment to increased transparency so that small business owners can clearly assess if a loan is right for their needs, how much it is going to cost, and if it is the best solution available to them.

Prospa has a history of industry leadership and innovation, having funded its first loan in 2012, implemented same day loan approval capability in 2013 and implemented the first Australian small business loan securitisation in 2015. While traditional banks have been pulling back from SME lending, Prospa has invested significantly in customer experience and customer success teams who seek to offer personalised support to small business owners when it matters most.

On September 7 2018, Prospa was also the first online small business lender to have undertaken a full review of its loan terms after consultation with ASIC.

Introduction of SMART Box

As part of the new Code of Lending Practice, Prospa customers will now receive a SMART Box with their loan contract, which provides a clear and concise loan summary before a loan is accepted. This will allow customers to see the key features of Prospa’s product and provides a standard way to deliver key information and pricing metrics. As part of Prospa’s commitment to transparency and regulation, it will help customers better understand and assess the cost of their finance and compare offers from other lenders.

Each SMART Box will contain metrics with different values, based on the specific loan amount, term, risk grade and therefore pricing for each customer. Importantly, this will include the Loan Amount, Disbursement Amount, Total Repayment amount and Term.

Beau Bertoli, co-founder and joint CEO of Prospa, said:

“Prospa has consistently been committed to helping lift transparency across the industry and transform the way small business owners experience finance. Our focus has always been on putting customers at the heart of our business and doing the right thing by them. The introduction of SMART Box to all of our loans will make it even easier for small businesses across Australia to review and compare unsecured small business loans to support their business.

“We continue to encourage other small business lenders in the industry to engage with AFIA and sign up to the Code of Lending Practice.”

Prospa’s customer satisfaction remains consistently high with an annual average Net Promoter Score in excess of +77. Prospa also scores 9.8/10 on independent review platform TrustPilot, making Prospa the #1 Money company in Australia ranked by TrustScore.

For more information on the SMART Box metrics and what they mean, please visit: prospa.com/small-business-loan/cost-of-borrowing

For further information contact:

Anna Fitzgerald +61 410 447 922

Roger Newby +61 401 278 906

About Prospa

- Prospa has originated over $850 million in loans to date

- Prospa has over 15,000 unique small business customers

- These customers have a strong track record of repeatability (approximately 69% of eligible customers take a repeat loan)

- Prospa’s distribution channel includes 10,000+ partner firms

- Prospa is an AON Hewitt Employer of Choice in 2017 and 2018

- Prospa’s Net Promoter Score is +77

- Prospa recently achieved a clean sweep of the MFAA Excellence awards for Fintech Lender of the Year, winning the award in all five States in Australia